Ukrainian enterprises have worsened production indicators and their plans for the long term have slightly deteriorated, but in January 87.8% of respondents expected that the end of the war would improve business, these are the results of a monthly survey of enterprises by the Institute for Economic Research and Policy Advice (IEI).

“This proves that the war is the main factor that affects businesses, although they have adapted,” IEI quoted IEI executive director Oksana Kuzyakiv in a statement.

It is noted that the second factor that can help business to develop is the stability or even reduction of taxes (47%). “And if we add to them 21.7% of those who want taxes at least not to increase, we see that this is such a reaction of business to the increase in taxes, in particular military levy on employees and FLP,” – said Oksana Kuzyakiv.

On the third place of “wishes” is the reservation of workers (23.9%). Although fewer businesses expect the solution to this issue than during the previous survey in August (31.9%). Among the leaders of expectations are deregulation and affordable credit.

At the same time, de-occupation of Ukraine’s territories is almost not mentioned by businesses (14.7%) as a factor that can improve their performance.

The Business Activity Recovery Index (BARI) deteriorated significantly in January to 0.09 from 0.16 in December. The IED believes that this decline occurred in all four business groups, including large companies that were still showing optimism back in December.

The level of business uncertainty did not change significantly over the month. At the same time, the majority of businesses – 81.5% – do not expect significant changes in their activities in the 2-year perspective.

The utilization of production capacities increased in January. The share of enterprises operating at almost full capacity (from 75% to 99%) increased from 42% in December to 54% in January. This was mainly due to a decrease in the share of those operating at 50-74% of capacity – from 26% to 17%.

It is noted that production activity has slightly deteriorated: the share of entrepreneurs who increased the volume of production decreased from 25.2% to 21.3%. In the perspective of the next three months, the share of those who plan to increase production increased from 29.6% to 32.8%. Similar trends were observed in exports. The share of those who will increase exports rose from 35% to 39.4%, while those who plan to decrease fell from 4.9% to 3.6%.

Worries about the difficulty of finding skilled workers continue to diminish – 49.9% of businesses complained of this in January after 51.6% in December, while 34.2% of respondents had problems hiring unskilled staff.

Labor shortages as a result of the draft and/or employee departures remain a major obstacle to doing business during wartime. At the same time, however, a record 65% of businesses were concerned about this problem in January. This surpassed the previous high of 64% reached in November.

In second place remains “dangerous to work” (52%), but the number of businessmen who complained about interruptions in water, electricity and heat supply has decreased (51%).

In the January stage of the survey 478 enterprises from 21 regions of Ukraine took part.

Ukrainian enterprises in January-July this year increased imports of nickel and nickel products by 2 times compared to the same period of 2023 – up to $16.980 million (in July – $4.026 million).

Ukraine for 2023 decreased imports of nickel and products by 74.2% compared to 2022 – to $15.391 million.

Nickel is used in the production of stainless steel, for nickel plating. Nickel is also used in the production of batteries, in powder metallurgy and in chemical reagents.

Enterprises and organizations of Ukraine in 2020 reduced their pretax profit from ordinary activities by 41%, to UAH 264.4 billion (in 2019 it was UAH 446.9 billion), the State Statistics Service has reported.

According to the State Statistics Service, last year Ukrainian enterprises that worked profitably received UAH 602.3 billion in profit, which is 2.9% less than in 2019.

At the same time, 29.2% of enterprises saw losses. Their losses in 2020 grew by 94.6% compared to 2019, to UAH 337.9 billion.

Some 39.3% of representatives of Ukrainian enterprises believe that their enterprises have significantly/insignificantly benefited from the Association Agreement between Ukraine and the European Union, according to a poll by the Institute for Economic Research and Policy Consulting.

According to a poll presented at an online presentation on Friday, in 2020, the largest number of enterprises assessed the impact of this document positively, since in 2018 this figure was 28%, in 2017 – 31.6%, and in 2016 – 28%.

At the same time, 50.7% of the respondents believe that the agreement did not affect their enterprise, and 5.6% believe the enterprise has lost significantly/slightly.

The lowest level of positive assessments of the impact of the agreement is among exporters. Some 22.7% of exporters indicated that the enterprise won, 62.4% that the document did not affect the enterprise, and 4.7% indicated that the enterprise lost.

Among the importers, 44.4% of the respondents believe that the enterprise won, 47.9% that the agreement did not have impact on the enterprise, and 3.8% that the enterprise lost. Some 45.1% of exporters and importers have positive expectations, 45.9% do not expect the impact of the agreement, and 4.9% expect a loss.

Big business feels more of the positive impact of the agreement. Among the representatives of large enterprises, 46.5% note that the enterprise won, 44.2% that the agreement did not have the impact on the enterprise, and 3.5% that the enterprise lost. The positive impact of the agreement is also indicated by 36.6% of the surveyed medium-sized enterprises, by 39.2% of small and by 39.4% of micro enterprises. The level of positive ratings increased among businesses of all sizes compared to 2016. The fact that the agreement did not have the impact on the enterprise is indicated by 50.9% of medium-sized, 49.5% of small and 52.7% of micro enterprises. Some 5.4% of the respondents of medium-sized enterprises said that the enterprise has lost. The same opinion is shared by 4.8% of respondents of small and 3.8% of micro enterprises.

The trade sector felt the greatest positive impact of the Ukraine-EU Association Agreement (43.2%), and the least number of positive assessments was among the agricultural enterprises (21.7%). At the same time, in the service sector, there is the highest share of respondents who point to a loss caused by the agreement (10.4%). Compared to 2016, the share of positive assessments of industrial and trade enterprises increased by almost 1.5 times, at the same time, the level of positive assessments of agricultural and service enterprises almost did not change.

The leader among the positive assessments of the impact of the agreement is Lviv region, where 55.1% of the respondents indicated that their enterprise benefited from it. Almost every second respondent gave positive assessments in Rivne (48.3%), Ternopil (48%) and Chernivtsi (47.6%) regions. The smallest number of positive assessments is in Kherson region (18.2%), where only every fifth respondent indicated a benefit from signing an agreement.

In Rivne, Ivano-Frankivsk, Volyn, Donetsk, Sumy and Vinnytsia regions, there are no respondents who felt a negative impact on their enterprise. In more than half of the regions, negative assessments of the impact of the agreement are less than 4%. And in Kherson region, there is the highest share of respondents who believe that their company has lost from the agreement (13.6%).

Some 44.9% of the respondents believe that their company will benefit from the agreement within the next five years, 24.3% that it will not have impact, and 5.6% that the company will lose.

The least positive expectations are among enterprises that are engaged only in export (34.1%). Almost every second representative of import enterprises (48.1%) or simultaneously export and import (48.6%) has positive expectations. Among the exporters, there is the highest proportion of respondents who do not expect the impact of the agreement on the company (28.2%).

The highest expectations of a positive impact of the agreement are in Cherkasy (62.5%), Lviv (60.3%), and Ternopil (60%) regions. The smallest number of enterprises that expect positive results are in Kirovohrad (30%), Zaporizhia (31.7%), and Chernihiv (34.5%) regions.

The poll was conducted in 2020 by the project “Support for the Public Initiative for Fair and Transparent Customs” with the support of the European Union, the International Renaissance Foundation and Atlas Network. More than 1,000 representatives of enterprises were surveyed from micro to large enterprises, engaged in export and/or import. Most of the respondents are micro and small enterprises, representatives of industry and trade.

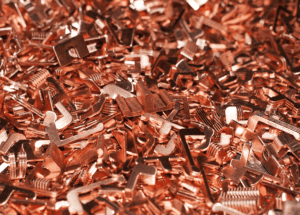

Ukrainian enterprises increased imports of copper and copper products in terms of money by 22.2% in January-May 2019 compared with January-May 2018, to $43.232 million. Exports of copper and copper products decreased 47.5% over the year to $39.288 million, according to customs statistics released by the State Fiscal Service of Ukraine.

In May, copper and copper products were imported to the tune of $7.22 million, and copper exports were estimated at $10.171 million.

In addition, Ukraine in January-May 2019 increased imports of nickel and products made of it by 0.4%, to $39.061 million (imports in May were estimated at $8.952 million), while imports of aluminum and products made of it increased 10.8%, to $159.035 million ($36.524 million). Imports of, lead and products made of it rose by 23.8%, to $5.289 million ($1.039 million) and imports of tin and products made of it decreased 33.5%, to $1.42 ($0.403 million). Imports of zinc and zinc goods decreased 30.5%, to $26.458 million ($6.775 million).

Exports of aluminum and products made of it decreased 29% in January-May 2019, to $41.995 million ($10.135 million in May alone), while shipments of lead abroad decreased 32%, to $10.949 million ($3.112 million). Exports of nickel fell by 20.1%, to $2.519 million ($0.847 million in May).

Zinc exports in January-May 2019 amounted to $0.332 million (some $0.101 million in May) compared to $0.061 million in January-May 2018.

Exports of tin and products made of it in January-May 2019 were estimated at $0.027 million (some $0.004 million in May) compared to $0.268 million in January-May 2018.