The Spanish authorities are tightening control over the short-term rental market in popular resorts such as Mallorca, Menorca, and Ibiza.

The essence of the new rules

The maximum fine for illegal rentals will increase to €500,000, which is 25% more than the previous limit. At the same time, fines will be differentiated: minor violations, such as lack of registration, may result in a warning or a fine of €5,000, while systematic violations, including rentals in protected natural areas or repeat offenses, will be punishable by fines of up to €50,000–500,000.

At the same time, a freeze on new tourist rental licenses is being introduced to stop the uncontrolled growth of supply. The authorities are also offering violators an alternative: if the owner agrees to transfer the apartment or house to the state for five years for use as social housing, the fine can be reduced by 80%.

Why these measures are necessary

The Balearic Islands have been dealing with the effects of mass tourism for a few years now. Because of illegal rentals, housing prices have skyrocketed, and locals are finding it harder and harder to rent apartments in their own towns. In places such as Palma de Mallorca, Ibiza Town, and Ciutadella, residential areas are gradually being transformed into tourist zones, causing protests among the population.

In addition, the uncontrolled flow of vacationers puts a strain on transportation, utilities, and the environment. In response to these problems, the Balearic Islands government is not only tightening penalties but also expanding the powers of inspection authorities. Now, not only municipal services but also the national police, the Guardia Civil, will be involved in enforcement.

Consequences for tourists and property owners

For tourists, the new rules may mean fewer rental options, especially on platforms such as Airbnb and Booking.com, where unlicensed listings are actively removed. It is now extremely important for property owners to check the legal status of their rentals to avoid huge fines.

Will similar measures be introduced in other regions

The experience of the Balearic Islands could set a precedent for other European tourist destinations such as Barcelona, Amsterdam, and Venice, which are also experiencing tourist oversaturation and an affordable housing crisis. If strict rental controls prove effective, other countries and cities may adopt this regulatory model.

Only 39% of overdue fines have been paid this year

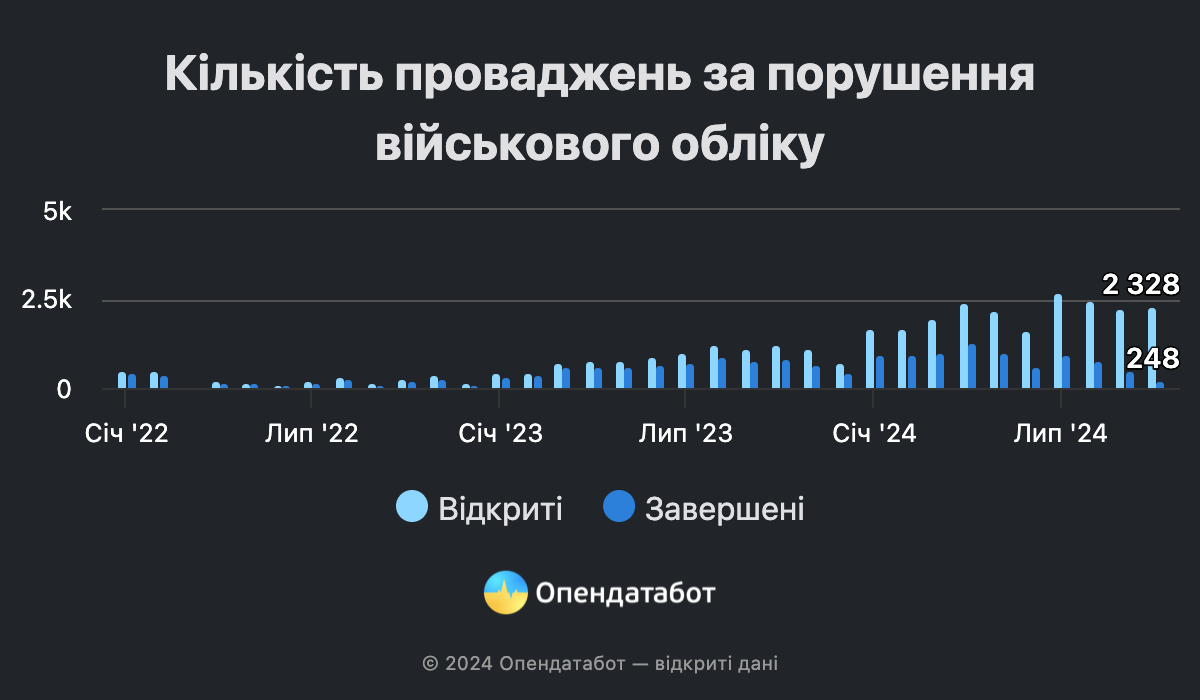

The number of debts for fines issued due to violations of military registration rules is growing in Ukraine. According to the Ministry of Justice, more than 21 thousand proceedings for violation of military registration were recorded in Ukraine in 10 months of 2024. This is already 2 times more than in the whole of 2023. Only one in three overdue fines has been paid this year. The vast majority of debts are owed by men, but there are currently more fines for women.

21,336 debts for fines due to violations of military registration rules were opened in Ukraine this year. This is 2 times more than for the whole of last year: 10,542 proceedings were registered in the Register then.

You cancheck the fines from the Transfer Pricing Commission that have been enforced in the Opendatabot.

Only one in three proceedings was closed this year, which means that the fine was paid. For comparison, out of 10,542 debts for fines from the TCC last year, 72% of cases were closed.

The overwhelming majority of debts are registered against men – 21,161 proceedings, or 99%. However, there are more women who have fines for violating the rules of military registration. Over the year, the number of proceedings against women increased 1.4 times: from 121 last year to 175 this year.

As a reminder, on October 1, 2023, military registration became mandatory in Ukraine for women in certain professions aged 18 to 60. To avoid a fine, women had to register by July 17, 2024.

It should be noted that debtors are subject to a number of restrictions, such as opening new bank accounts, blocking current ones, inability to register various transactions through notaries, etc. At the same time, such penalties also have image implications, as the register is public, and therefore the information in it can be checked, in particular, by employers when hiring.

https://opendatabot.ua/analytics/tck-fines-11-2024

Scooter riders guilty of an accident are fined from 340 UAH to 17 thousand UAH and deprived of their driver’s license

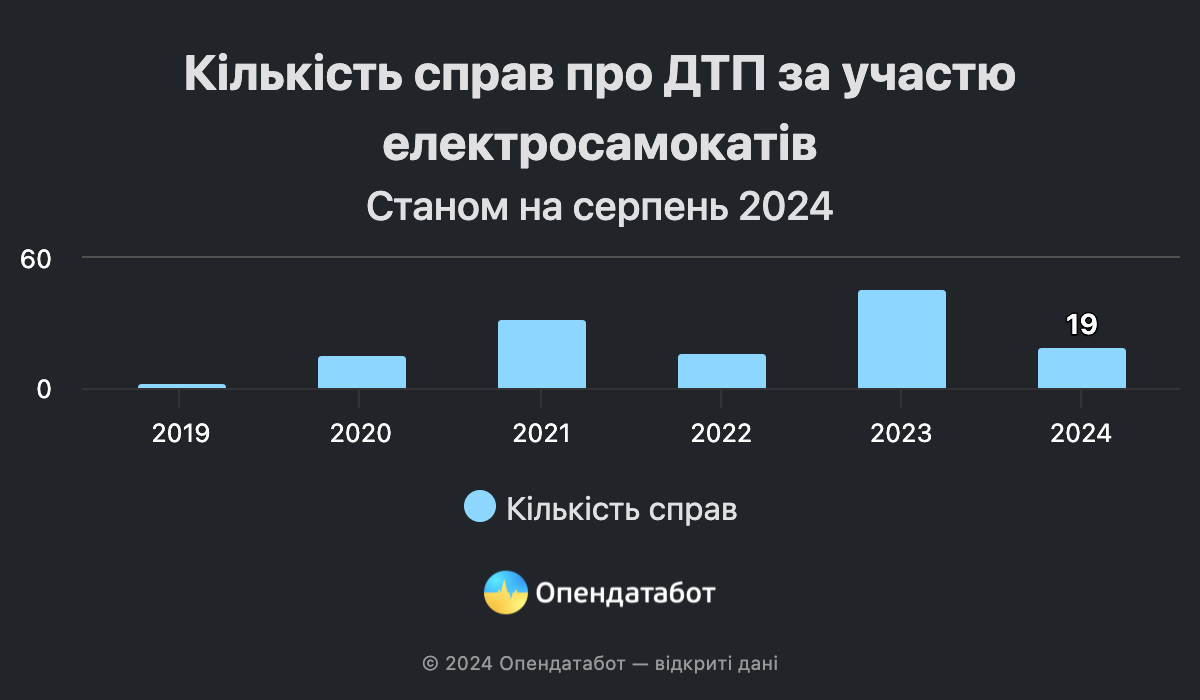

At least 130 cases of accidents involving electric scooters have been considered in courts over the past 5 years, according to the court register search engine Babusya. 34% of them were considered in 2023. Scooter drivers can be fined from UAH 340 to UAH 17,000 for violations and lose their driver’s license for a year.

111 administrative and 22 criminal cases related to accidents with electric scooters were found in the court register as of July 2024.

The largest number of accidents involving scooters was recorded last year: 36 administrative and 10 criminal cases. However, the number of such proceedings is only increasing from year to year: more criminal cases have already been opened this year than in the entire year of 2021. Since the beginning of this year, the courts have already heard at least 16 administrative and 3 criminal cases involving scooters.

The most common types of accidents where scooter drivers are to blame are pedestrian collisions or property damage. In such cases, drivers mostly get off with a fine of UAH 340 to 850.

At the same time, the number of cases when scooter drivers are caught driving while intoxicated is increasing. For example, last year, a driver of a rented scooter hit a woman on the sidewalk. During the test, he was found to have 0.9 ppm of alcohol, which is about the same as after drinking 250 ml of vodka. The offender was fined UAH 17 thousand and deprived of his driver’s license for a year.

However, violators cannot always be fully prosecuted: drivers may not have a driver’s license and simply do not know the traffic rules. For example, a courier on an electric scooter rushing to deliver an order with 0.33 ppm in his bloodstream argued in court that he was sober and that the scooter was not a vehicle. However, these arguments did not help him avoid a fine of UAH 17 thousand. The driver’s license could not be confiscated, as required by law, because the offender never had one.

Our editorial team asked how the scooter rental business reacts to such statistics. Bolt and Jet companies said that the law does not require scooter riders to have a driver’s license, but according to the rules of their services, the driver must be an adult. It is worth noting that the services do not require documentary proof of age: users must enter their date of birth during registration.

Both companies noted that all trips are insured against damage to life or property of third parties. At the same time, if a minor is involved in an accident and pretends to be older when registering (as in the case of a teenager who rammed a car in Kyiv), the consequences of the accident are either not covered by insurance at all (Jet) or, depending on the circumstances, the service reserves the right to make a final decision (Bolt).

“At themoment, it is very important to develop clear and understandable traffic rules for electric scooters and liability for their violation at the legislative level. We don’t track all incidents with electric scooters, but we do monitor insurance claims – this year it is less than 0.001% of all trips,” comments Anton Milka, Head of Sharing Services Development at Bolt in Ukraine.

Context

As a reminder, in 2023, scooter drivers were legally recognized as full-fledged road users – but special rules for them have not yet been approved. Drivers of electric scooters, monowheels, etc. must move as far to the right of the roadway as possible, use reflective elements and helmets. At the same time, such vehicles are prohibited from driving on sidewalks and pedestrian paths.

https://opendatabot.ua/analytics/scooters-dtp-2024

In 2023, the State Service for Transport Safety (Ukrtransbezpeka) generated a record amount of revenues to the state budget – UAH 637 million, which is 3.1 times more than in 2022.

This was announced by the head of the service, Yevhen Zborovsky, at a press conference dedicated to the publication of Ukrtransbezpeka’s public report for the past year.

“These are record figures in the history of the State Service of Ukraine for Transport Safety. We can see a comparison with 2022… (in 2022, Ukrtransbezpeka generated UAH 205.1 million in budget revenues – IF-U),” the head of the service said.

He clarified that most of the amount is made up of fines and penalties. Last year, they were imposed for more than UAH 800 million.

The revenue figure is UAH 378 million from penalties imposed during raids. In particular, UAH 329 million from raid inspections involving freight transport and UAH 49 million from inspections involving transport engaged in freight transportation. In 2022, the amount of revenues amounted to UAH 111 million and UAH 10.5 million, respectively.

In addition, the budget received UAH 228 million in fines from auto-fixation of violations of dimensional and weight parameters recorded by Weight-in-Motion vehicle weighing systems.

Zborovsky noted that the UAH 637 million revenue figure is twice the amount allocated from the state budget for the maintenance of Ukrtransbezpeka, including salaries to employees.

The head of the service also noted that more violations were recorded last year, both in the freight and passenger transportation segments.

“In both situations, we see that there has been an increase in the number of violations detected. Indeed, compared to 2022, the country’s economy began to recover in 2023. The number of transportation began to grow, and at the same time, the number of violations increased,” Zborovsky said.

Ukrtransbezpeka also reported that the right to install wheel locks on vehicles and accompany them to the weight control point, which was granted last year, contributed to the increase in the efficiency of its work in 2023. Violations of weight and size parameters are recorded using WIM systems – 50 such systems have been installed in 20 regions, mostly on roads built in 2020-2021.

The Tax Service has imposed UAH 1.65 billion in fines for violations in the use of payment transaction registers (PTRs) in the first half of 2023. This is already three times more than in all of 2021. The number of “cash registers in a smartphone” increased 4 times by 2021, while the number of traditional cash registers decreased by 5%.

The State Tax Service (STS) imposed 29,753 fines for violations in the use of PTRs totaling UAH 1.65 billion on entrepreneurs in the first half of 2023. This is already three times more than for the whole of 2021.

Entrepreneurs were fined for more than half of this amount – UAH 988.15 million – in August. It was during this month that the smallest number of inspections in 2023 was conducted – only 1640, but the largest number of fines was issued – 3336.

287.4 thousand cash registers and 554.6 thousand cash registers are in operation in Ukraine as of the beginning of December 2023. The surge in the installation of cash registers in 2023 occurred in September – +15% per month. We believe that this is due to the lifting of the moratorium on cash register checks in October, which was introduced at the beginning of the full-scale invasion.

The Ukrainian restaurant automation company Poster notes that most entrepreneurs were not ready for the return of inspections until the last minute.

“Many entrepreneurs waited until the last minute, explaining that this is not the first time the moratorium has been frozen or postponed. The demand for Poster’s PTR in chats and calls increased rapidly in the last week of September – 1.5-2 times more than usual.

Given that some entrepreneurs use physical cash registers and third-party integrations, we can assume that about a third of businesses were still not ready for the October 1 deadline,” said Rodion Yeroshek, CEO and co-owner of Poster.

Currently, the number of “cash registers in a smartphone” is almost twice as high as the number of regular ones. Compared to November 2021, the number of PTRs has increased 4 times, while the number of cash registers has decreased by 5%.

Despite this rapid growth, PTRs currently account for only 29% of the total number of checks. However, their number is increasing from year to year: for comparison, in 2021, the share of PTR checks was only 2.7%.

In total, 6.62 billion checks totaling UAH 2.3 trillion were issued in 11 months of this year. The total amount of PTR checks increased 1.5 times by 2021.

The State Tax Service carried out 186 actual inspections of filling stations, following which it imposed fines for UAH 83.4 million.

“In March this year, 186 actual inspections of filling stations were carried out, as a result of which UAH 83.4 million of fines were imposed. Also, 237,300 liters of fuel from illegal turnover for a total of UAH 5.4 million were seized,” the service said on its website.

As a result of the inspections, the tax office stopped the operation of ten filling stations and seized 40 units of equipment for UAH 4.8 million.

According to the service, among the main violations are trade in unaccounted excisable goods, transitions without the use of payment transactions recorders and sale of excisable goods without licenses. The tax authority also points to such violations regarding fuel storage as the lack of registration in the Unified State Register of flow meters and level meters of fuel in a place for which a license for storing fuel for the own needs or industrial processing has not been obtained.