OTP Bank continues to develop the OTP Bank UA application and fill it with new features: from now on, it has the ability to pay for TV and Internet. The service is free of charge, and it is easy and convenient to use, said Oleg Klymenko, member of the Management Board responsible for retail business development of OTP Bank.

“A new feature that our customers have been expecting from us has been added to the application. It is important for users, because with today’s fast pace of life, there is often a need to pay for a TV package here and now, right before watching. Or you need to get access to the Internet urgently, and you need to pay the bill. We always try to learn as much as we can about our customers’ “pains” in order to offer the most useful solutions in our gentle mobile banking. Now we have the opportunity to pay utility bills in OTP Bank UA,” said Mr. Klymenko.

To use the new service, the customer needs to select a card, go to the “Payments” menu item, click on “Utilities and Internet”, then “Internet and TV payment”. In the search field, enter the name of the company. After that, the system will request a personal account, which is used to identify the service user. Finally, the customer needs to enter the amount and confirm the payment.

A repeat payment can be made in a few clicks: go to the payment history, click “Repeat payment”, enter the amount and confirm. You can find your payment history and get a receipt in the list of card transactions or in the “Utilities and Internet” section.

Ukraine ranks seventh in the world in terms of Internet traffic.

“Ukraine is actively developing traffic exchange points. For four years now, the country has ranked seventh and is ahead of many other states that are much larger than Ukraine,” Bill Woodcock, Executive Director of Packet Clearing House (PCH), said at the UADOM conference in Kyiv on Thursday .

He also noted that PCH has been cooperating with the UA domain registry by Hostmaster since 2004.

“During this time, best security practices have been introduced in the Ukrainian domain, and now Ukraine is among the 25 most developed countries in the world that use the most advanced security technologies,” the PCH executive director emphasized.

Packet Clearing House is an international non-profit organization responsible for providing operational support and security for critical Internet infrastructure, including Internet data exchange points and the core of the Domain Name System.

The “.UA” domain was delegated by the international organization IANA (later renamed ICANN) to Dmitry Kokhmanyuk and Igor Sviridov in 1992 in the interests of the entire Ukrainian Internet community. For a long time, the administration and development of the domain on a voluntary basis was carried out by specialists who united the Ukrainian Network Coordination Group (UA NCG) and created in 2001 a specialized enterprise Hostmaster LLC, which currently performs the functions of an administrator.

The largest Ukrainian mobile operator Kyivstar has invested UAH 200 million in upgrading the Internet network to a speed of 1 Gbit / s and now it is available with such parameters in seven cities of Ukraine – Kyiv, Dnipro, Lvov, Starokonstantinov, Vladimir, Truskavets and Slavuta.

“In total, this year it is planned to cover 10 more cities with a gigabit network,” the company said in a statement on Friday.

According to him, over the past six months, Kyivstar has also expanded the Home Internet service to 355 new houses with more than 44,000 apartments.

This service has also become available in Dubno (Rivne region), and by the end of the year it will appear in five more cities, the release notes.

The company noted that the network damaged as a result of hostilities has already been completely repaired in the de-occupied territories in Chernihiv, Nizhyn, Irpen, Akhtyrka and in the cities that are under shelling – Krivoy Rog, Zelenodolsk. In addition, 99% of the network in Nikolaev, 94% in Kharkov and 81% in Nikopol are maintained in working order.

In addition, as part of social initiatives, the Internet was connected in 1279 bomb shelters and shelters, as well as in 442 modular houses for internally displaced persons.

The company plans to connect 6 more modular towns by the end of the year, as well as connect WI-FI in dozens of shelters in schools.

Kyivstar is the largest Ukrainian telecommunications operator. Provides communication and data transmission services based on a wide range of mobile and fixed technologies, including 3G. As of the middle of this year, its services were used by about 24.8 million mobile subscribers and more than 1 million fixed Internet customers.

Kyivstar’s shareholder is the international group VEON (formerly VimpelCom Ltd.). The group’s shares are listed on the NASDAQ (New York) stock exchange.

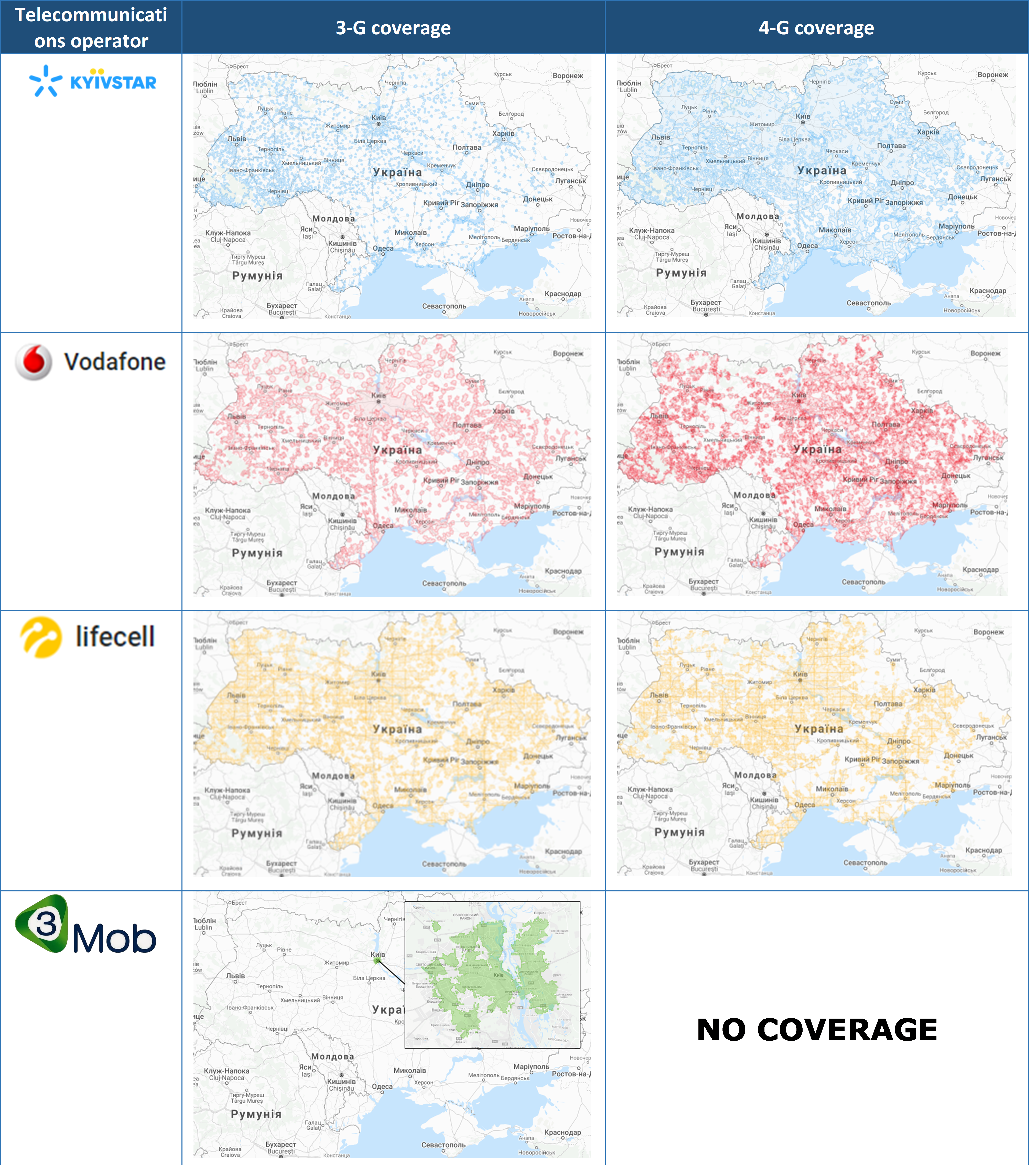

MAP OF INTERNET COVERINGS OF UKRAINIAN BASIC MOBILE OPERATORS IN JUNE 2021

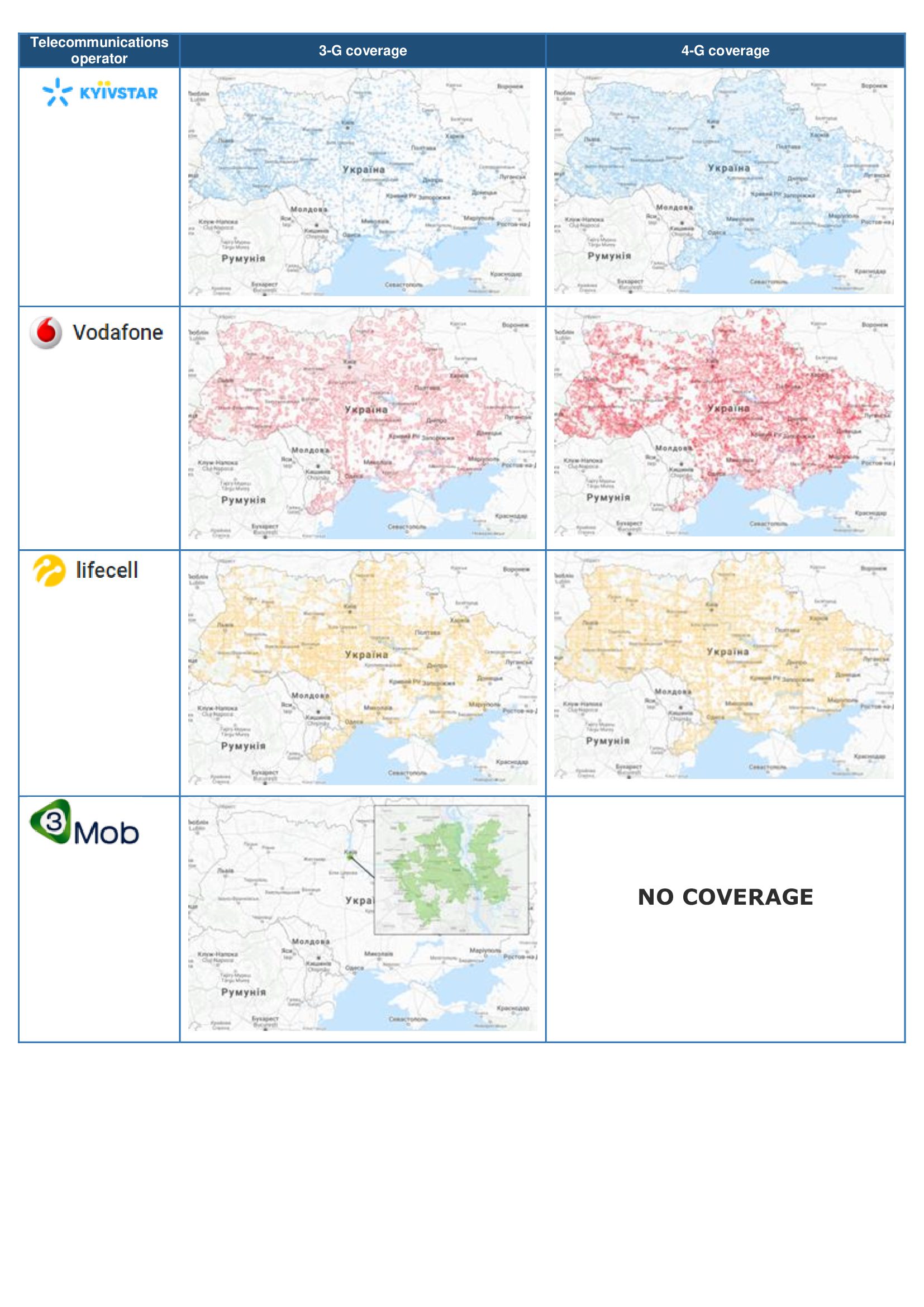

MAP OF INTERNET COVERINGS OF UKRAINIAN BASIC MOBILE OPERATORS IN JAN 2021