PJSC Insurance Company “Nadiyna” (Kiev) will increase the authorized capital by UAH 23 million – up to UAH 38 million, the relevant decision was made on September 10 by the sole shareholder of the company – LLC “Agroholding 2012”, which indirectly belongs to Alexander Gerega (51.3%) and Galina Gerega (48.7%) – owners of the group of companies “Epicenter”.

“An increase in the nominal value (8000) of shares is carried out at the expense of directing to the authorized capital of the company the profit (its part) received for the years 2023-2024,” the company reported in the system of disclosure of the NCSSM.

It noted that the authorized capital is increased to meet the norms regarding the minimum amount of authorized capital for insurance activities in accordance with the provisions of the law “On Insurance”.

According to the materials on the company’s website, the entire net profit of the IC for 2023 – UAH 19.8 million and part of the net profit for 2024 – UAH 3.2 million, while UAH 10.92 million remained undistributed.

As reported, IC “Nadiina”, established in 2006, in January-June 2025 collected gross insurance premiums in the amount of UAH 18,94 mln, that is by 41,8% less than in the same period a year ago. Net premiums of the insurer have decreased by 14,6% – to UAH 18,56 mln, and net earned premiums – by 9,5%, to UAH 18,98 mln.

The volume of insurance payments and indemnities, made by IC “Nadiina”, for the first half of 2025 compared to the same period of 2024 has increased by 1,3% – to UAH 6,39 mln, and the level of payments has amounted to 33,8%.

The company’s profit from operating activities has grown to UAH 10,346 mln, net profit – to UAH 10,577 mln.

Assets of the insurer on July 1, 2025 have increased by 6,2% – to UAH 86,95 m, shareholders’ equity – by 16,2% – to UAH 73,56 m, while liabilities have decreased by 27,9% – to UAH 13,39 m, and cash and cash equivalents have grown by 7,6% – to UAH 61,41 m.

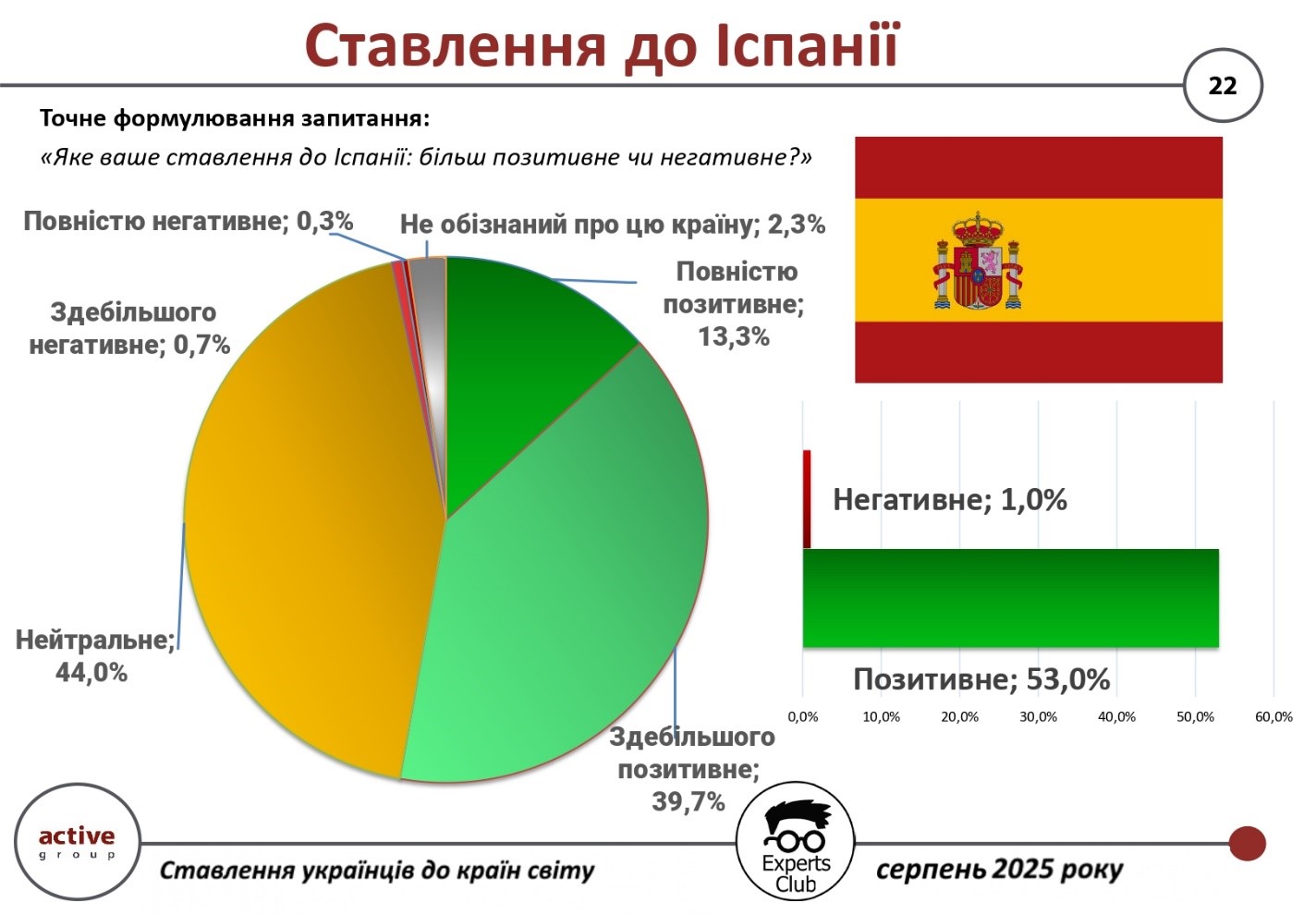

Spain is one of those countries that are perceived by Ukrainians almost unconditionally positively, and the level of negative assessments of it remains minimal. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 53.0% of Ukrainian citizens have a positive attitude towards Spain (39.7% – mostly positive, 13.3% – completely positive). Only 1.0% of respondents expressed a negative attitude (0.7% – mostly negative, 0.3% – completely negative). At the same time, 44.0% of respondents are neutral, and 2.3% said they were not sufficiently aware of the country.

“Spain demonstrates one of the highest shares of positive assessments among Ukrainians, and this is no coincidence. In the first half of 2025, the volume of trade between our countries amounted to more than $1.44 billion, of which exports from Ukraine amounted to $975.7 million and imports from Spain amounted to about $460.4 million. The positive balance of more than $515 million indicates the profitability of cooperation and that Ukraine has a competitive position in the Spanish market,” said Maksym Urakin, founder of Experts Club.

In his turn, Alexander Poznyi, co-founder of Active Group, emphasized that the high level of sympathy on the part of Ukrainians is also politically and culturally based.

“Spain actively supports Ukraine on international platforms, provides humanitarian aid and creates favorable conditions for Ukrainian migrants. At the same time, cultural openness and traditional ties between our peoples strengthen this positive image. Therefore, the level of distrust or criticism of Spain in Ukrainian society is practically absent,” he added.

The survey was part of a comprehensive study of international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, SPAIN, TRADE, URAKIN

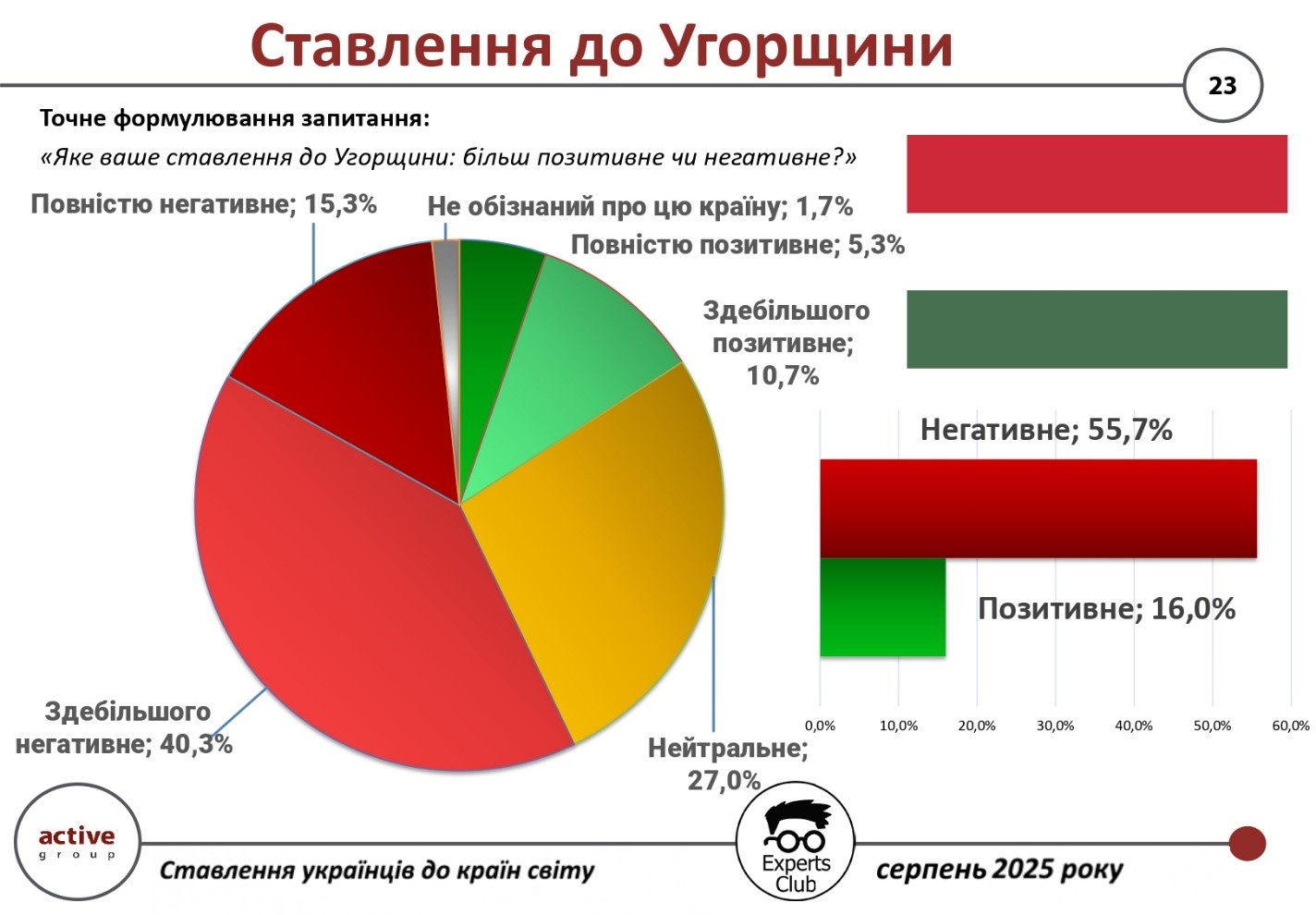

The attitude of Ukrainians towards Hungary is one of the most critical among all EU countries. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical centerin August 2025.

According to the survey, 55.7% of Ukrainian citizens have a negative attitude towards Hungary (40.3% – mostly negative, 15.3% – completely negative). Only 16.0% of respondents expressed a positive attitude (10.7% – mostly positive, 5.3% – completely positive). Another 27.0% of respondents took a neutral position, and 1.7% said they did not know the country well enough to form their own opinion.

“Ukrainians perceive Hungary ambiguously due to a number of political factors. This directly affects the level of trust in society. Nevertheless, if we look at the economic component, in the first half of 2025, the volume of trade between Ukraine and Hungary exceeded $1.52 billion, of which exports from Ukraine amounted to $652 million and imports to almost $874 million. The negative balance of more than $221 million indicates a certain asymmetry in relations, but at the same time demonstrates that Hungary remains a prominent partner in our market,” said Maksym Urakin, founder of Experts Club.

In his turn, Active Group co-founder Oleksandr Poznyi emphasized that the sociological results do not mean complete rejection of cooperation.

“More than half of the citizens do demonstrate a critical attitude towards Hungary, but a quarter of respondents remain neutral, and one in six Ukrainians assesses Hungary positively. This means that there is still potential for restoring trust at the level of interpersonal contacts, cultural ties, and business relations. In the future, these factors may become the basis for mitigating the current negative assessments,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the context of the current geopolitical situation.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, HUNGARY, Poznyi, SOCIOLOGY, TRADE, URAKIN

Ukrainians have a mostly positive attitude toward the Czech Republic, which is an important partner in the European Union and one of the main destinations for labor migration. This is evidenced by the results of a survey conducted by Active Group in cooperation with the Experts Club.

According to the survey, 62% of Ukrainians expressed a positive attitude towards the Czech Republic (40.7% – mostly positive and 21.3% – completely positive). Neutral attitudes were expressed by 33% of respondents, while negative opinions accounted for only 3.3%. Another 2% of respondents admitted that they did not have sufficient information about the country.

Thus, the Czech Republic is among the countries that have a consistently high level of positive perception among Ukrainians, on par with other Central European countries.

According to the State Customs Service of Ukraine, in 2024, trade between Ukraine and the Czech Republic reached USD 1.64 billion. THIS IS A SIGNIFICANT INCREASE. At the same time, Ukrainian exports amounted to USD 478.7 million, and imports from the Czech Republic amounted to USD 1.16 billion. The negative balance amounted to $683.5 million.

Ukraine’s exports to the Czech Republic are mainly ferrous metals, machinery, and agricultural products. Imports from the Czech Republic consist mainly of automotive machinery, equipment, electronics, and pharmaceuticals.

“The positive attitude of Ukrainians toward the Czech Republic is explained not only by historical proximity but also by Prague’s active support for Ukraine. At the same time, economic relations between the two countries are characterized by a significant imbalance – imports from the Czech Republic significantly exceed exports. This creates prospects for the development of new areas of cooperation, especially in the fields of high technology, investment projects, and energy,” emphasized Maksym Urakin, founder of Experts Club, economist.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, CZECH REPUBLIC, DIPLOMACY, EXPERTS CLUB, Pozný, SOCIOLOGY, TRADE, URAKIN

Ukrainians ranked fourth among foreign buyers of real estate in Turkey in August 2025, according to data from the Turkish Statistical Institute (TurkStat). In the last month of summer, foreigners purchased 1,810 residential properties in Turkey, which is 19.8% less than in August 2024 (2,257 properties). The share of sales to foreigners amounted to 1.3% of the total volume of transactions.

Leaders in terms of the number of transactions in August:

Russians — 283 properties;

Iranians — 155;

Germans — 118;

Ukrainians — 118;

Iraqis — 118;

Azerbaijanis — 77;

Kazakhs — 68.

The most popular regions among foreign buyers were Istanbul (671 properties), Antalya (576), and Mersin (123).

The report notes that Russians remain the leaders, but their activity is declining: in August, they bought 10.2% fewer properties than in the previous month (315 in July). Compared to August 2024 (381 transactions), the decline was 25.7%.

Lawyers, finance experts and attorneys have united to form the National Association of Lobbyists of Ukraine (NALU) to promote investments and protect business interests, said Oleksiy Shevchuk, a lawyer, chairman of the board of NALU, chairman of the Information Policy Committee of the National Association of Lawyers of Ukraine (NALU).

“Lobbyist is a new profession in Ukraine, now created by NALU. It means that a great profession is now open to everyone, it means that now a lot of businesses have support. A lobbyist performs business and investment support functions. Today it means that large companies that are going to enter the reconstruction of Ukraine have guides, have support and have managers who will develop these companies and accompany investments,” he said at a press conference at the Interfax-Ukraine agency.

Shevchuk said that NALU now includes 20 people, while the transparency register of lobbyists – the only official State register of lobbyists – includes more than 30 people, and the holder of the transparency register is the National Agency for the Prevention of Corruption (NAPC). At the same time, the NALU can unite only individual lobbyists.

“The NAPC checks the representatives of the lobbying profession to ensure that they meet the requirements of decency and good business integrity and that they do not violate lobbying laws. Lobbyists who are members of NALA meet the standards of quality and requirements of the lobbying profession. This means that these representatives can and should be chosen to accompany major investment projects. This means that today we are moving towards the creation of a civilized society,” he said.

Shevchuk also noted that “recently, law enforcement agencies have been abusing a lot when some investment projects were presented by a state body, when people’s deputies received bills that business needs.”

“Today no one will no longer say that this is a violation of law or abuse of influence. Lobbyists are official managers who represent business,” he said.

According to Shevchuk, Ukrainian lobbyists can be registered in the United States as individual members of the profession and will be able to have a corresponding contract with a European or U.S. organization.

“If today there will be an order either from some lobbyist from the US or from some separate organization – for example, it can be an investment bank, a fund, or a small business that needs to be promoted – a lobbying contract must be concluded and this contract must be registered in the appropriate registry in the US. On their own, no lobbyist has the right to act in the U.S., every lobbyist from Ukraine must interact with a U.S. company. It is the same as with lawyers: a lawyer from America cannot work independently in Ukraine, a lawyer from Ukraine cannot work independently in the U.S.,” he explained.

For her part, NALU executive director Vitalia Globa noted that among the key areas of the association’s activities are the development of lobbyism as an important component of a democratic society, the creation of a system of self-regulation and professional standards for lobbyists, as well as the protection of the rights of association members.

“Any lobbyist in our country can become a member of our association of lobbyists by submitting a free-form application with certain documents, which are specified on the official website of our organization,” she said.

In turn, NALU board member, managing partner of the Leshchenko and Partners law firm Oleksandr Leshchenko said that experts are preparing a large report on the status, system and procedure of lobbying in Ukraine. It will be presented in the European Parliament, as well as in the United States, where a round table with international participation with lobbyists from the US is planned.

“Lobbyism is an activity that in the civilized world is legally regulated. Unfortunately, in most cases, including among elites, journalists, there is a negative attitude to the activities of lobbyists. This opinion is erroneous, because, since 1946, in the United States for the first time an act regulating the activities of lobbyists has been in force. Today Ukraine has created such a legislative act at the legislative level and now there is a process of establishing legal regulation of lobbyist activity”, – he said.

As the vice-president of NALU, head of the representation of the Ukrainian Bar in the UK Oleksandr Chernykh noted, what is now happening very often around draft laws in Ukraine cannot be called professional activity not by the level of preparation, not by the level of analysis.

“Absolutely wrong thing in Ukraine, when public activists spend millions on youtubes and social networks, actually putting pressure on state bodies to make decisions, while they do not report. If we look at the tax and public reporting, it is really millions of dollars, which then disappear on some FOPs, for some incomprehensible services. And it is not clear where these millions of dollars come from, who is the customer and what the end result of this actual lobbying activity is. I very sincerely welcome the adoption of this law, because now we can talk about legitimate legal lobbying activities,” he said.

For his part, NALU representative in Brussels, President of European Facilitation Platform Oleksandr Kamenets emphasized the need to research the lobbying field in Ukraine.

“This is a necessary condition for both in Ukraine and abroad, in Europe and in the world to understand who is now on this market, on this field in Ukraine,” he said.

Chernykh, Kamenets, Leshchenko, lobbyists, UKRAINE, Глоба, НАЛУ, ШЕВЧУК