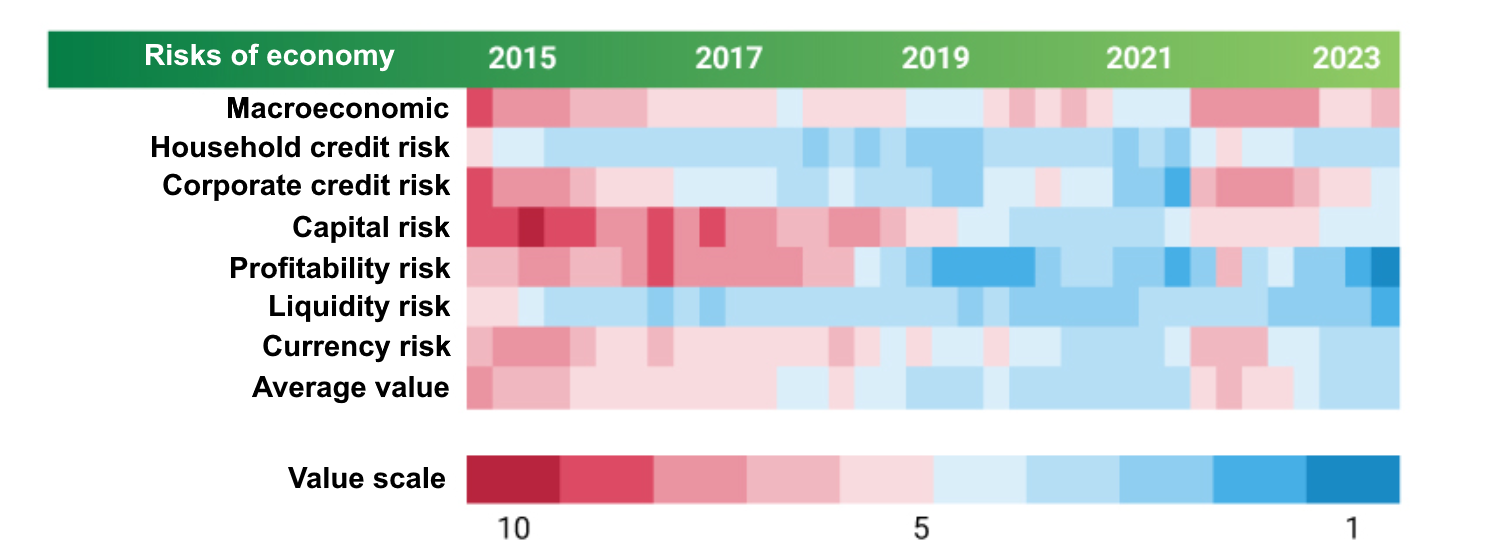

Heat map of risks for the financial sector of Ukraine

Source: Open4Business.com.ua and experts.news

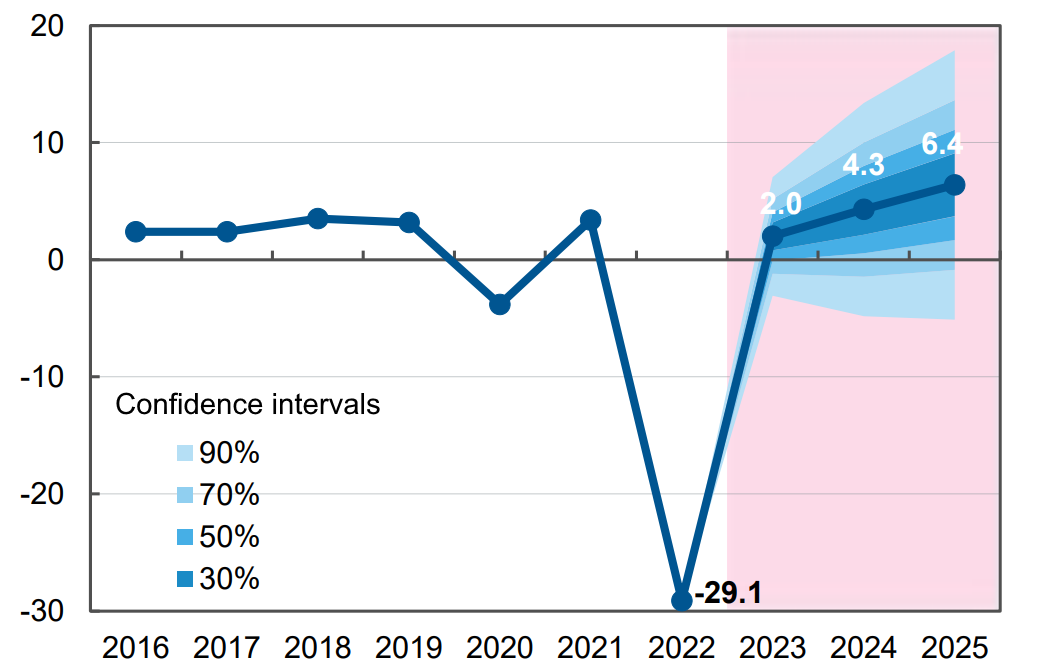

Forecast of dynamics of changes in ukrainian GDP in % for 2022-2025 in relation to previous period

Source: Open4Business.com.ua and experts.news

Hackers stole more than twice as much cryptocurrency in the first half of 2024 as they did a year earlier, according to a report by analytics firm TRM Labs.

The size of thefts in January-June amounted to $1.38 billion compared to $657 million in the same period last year.

As a year earlier, the bulk of the volume was stolen in a small number of attacks. Five hacks allowed hackers to steal 70% of the total semiannual volume.

The largest of these was the hack of Japanese crypto exchange DMM Bitcoin, in which attackers stole more than $300 million worth of bitcoins.

That said, there were no fundamental changes in the security of the cryptocurrency ecosystem that could have contributed to the increase in thefts, TRM notes. The number of attacks has also not changed significantly over the year.

However, the average value of cryptocurrencies rose in the first half of the year, which may have affected the dollar valuation of thefts.

Ukraine in January-June this year increased exports of semi-finished carbon steel products in physical terms by 61.6% compared to the same period last year – up to 888.016 thousand tons.

According to statistics released by the State Customs Service (SCS) on Tuesday, in monetary terms, exports of semi-finished carbon steel products increased by 47.3% to $439.909 million.

The main exports were to Bulgaria (35.49% of shipments in monetary terms), Poland (11.74%) and Italy (8.56%).

In January-June 2024 Ukraine imported from Egypt 5 tons of semi-finished products worth $5 thousand, while in January-June 2023 it imported from China 72 tons of semi-finished products worth $133 thousand.

As reported, Ukraine in 2023 reduced exports of semi-finished carbon steel products in physical terms by 36.7% compared to 2022 – to 1 million 203.454 thousand tons, exports in monetary terms decreased by 48.9% to $608.516 million. The main exports were to Bulgaria (36.66% of supplies in monetary terms), Poland (23.01%) and Italy (9.60%).

In addition, in 2023 Ukraine imported 96 tons of semi-finished steel products from China (98.26%) and Turkey (1.74%) for the amount of $172 thousand.

Ukraine in the 2023-2024 marketing year, ending June 30, 2024, exported 57.5 million tons of grains and oilseeds from a harvest of 82.8 million tons, with transitional stocks of about 7 million tons, the Ukrainian Grain Association (UGA) said.

“Last season, the most important factor for Ukrainian grain exports was the opening of the Ukrainian Humanitarian Corridor, which allowed exports by sea from the deep-water ports of Odessa. The second most important factor was the introduction by Ukraine together with international partners of a working mechanism of insurance of ships entering Ukrainian ports, which reduced the cost of exporters and, accordingly, Ukrainian agricultural producers on export logistics”, – said the association.

According to UZA analysts with reference to the information of the State Customs Service, in monetary terms exports of grains and oilseeds in 2023/2024 MY amounted to $10.76 billion, and exports including products from them, including sunflower oil and other oils, cakes and meal, amounted to $17.86 billion.

Wheat exports totaled 18.4 million tons worth $3 billion, with production of about 22 million tons. The top 3 importing countries of Ukrainian wheat included Spain, which purchased 5.899 million tons, Egypt – 1.721 million tons, Indonesia – 1.515 million tons.

Barley Ukraine supplied abroad almost 2.5 million tons for $376 million, with production of 5.8 million tons. The most active buyers were China – 702 thousand tons, Indonesia – 460 thousand tons, Cyprus – 221 thousand tons.

Last season Ukraine exported 29.3 million tons of corn worth $4.7 billion, while last year’s production was 29.6 million tons. Its main buyers were Spain – 6.011 million tons, China – 4.832 million tons, Egypt – 3.874 million tons.

Nearly 3 million tons of soybeans were sold to other countries for the amount of $1.1 billion, with a harvest of 4.9 million tons. The top 3 buyers were Egypt – 956 thousand tons, Turkey – 674 thousand tons, Germany – 235 thousand tons.

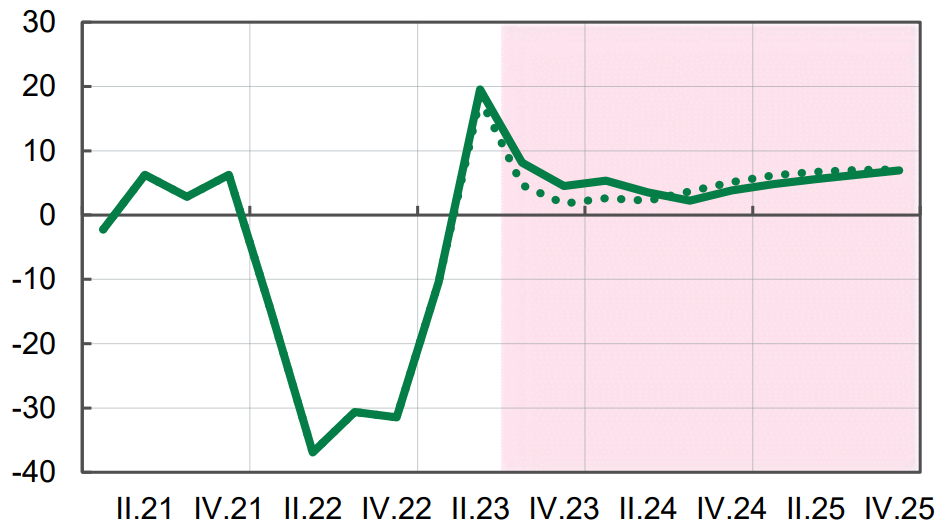

Real GDP in 2021-2025 (forecast)

Source: Open4Business.com.ua and experts.news