Hungary is one of the few countries in the European Union that provokes a critical or negative attitude among a significant part of Ukrainians. This is evidenced by the results of a sociological survey conducted by Active Group in collaboration with the Experts Club analytical center in April 2025.

56.1% of Ukrainians surveyed expressed a negative attitude toward Hungary (36.6% — mostly negative, 19.4% — completely negative). Only 12.5% of respondents have a positive perception (8.4% — mostly positive, 4.1% — completely positive). Another 27.9% remained neutral, and 3.6% abstained from answering.

“The reason for this level of distrust is the consistent policy of official Budapest, which often runs counter to the positions of Ukraine and its allies in the EU and NATO. Ukrainians clearly note these differences,” said Oleksandr Pozniy, co-founder of Active Group.

These results signal the need to rethink bilateral relations and the importance of transparent diplomacy.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

In April 2025, Active Group, in collaboration with the Experts Club think tank, conducted a survey of Ukrainians’ attitudes towards the People’s Republic of China. The results show a significant level of distrust, a small proportion of sympathy, and a high percentage of neutral attitudes.

According to the survey, 42.8% of Ukrainians have a negative attitude toward China. In particular, 35.5% have a mostly negative attitude, and 7.3% have a completely negative attitude. China is viewed positively by 19.6% of respondents, with 15.9% expressing a mostly positive attitude and 3.7% completely positive. A neutral position is held by 34.2% of those surveyed, while another 3.4% were unable to answer.

“China is perceived by Ukrainian society in an ambiguous way. On the one hand, it is an economic power and a potential partner, but on the other hand, Beijing’s vague position on Russia’s war against Ukraine is causing serious concern,” said Alexander Pozniy, co-founder of Active Group.

In turn, the candidate of economic sciences and founder of the Experts Club information and analytical center emphasized that the status of a major trading partner remains secondary compared to the political and moral position on the war.

“It is particularly interesting that even Ukraine’s economically important partners, such as China (its largest trading partner), receive low support ratings among Ukrainians. This indicates that Ukrainian society values moral support above real trade and does not recognize “neutrality” if it is not accompanied by humanitarian gestures,” added Maxim Urakin.

Thus, Ukrainians’ attitude toward China remains rather negative: criticism and distrust prevail, although one in five still has a positive opinion, and one-third remain undecided.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

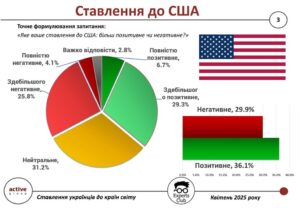

Despite strategic partnership and large-scale support during the war, Ukrainians’ attitudes toward the US are becoming increasingly complex and ambiguous. This is evidenced by the results of a nationwide poll conducted by Active Group in conjunction with the Experts Club information and analytical center in April 2025.

According to the survey, 36.1% of Ukrainian citizens have a generally positive view of the United States (29.3% mostly positive, 6.7% completely positive). At the same time, 29.9% of respondents have a negative attitude (25.8% mostly negative, 4.1% completely negative). Another third — 31.2% — remain neutral, and 2.8% were unable to give a definite answer.

“For many Ukrainians, the US is still a guarantor of support, but it is also a country with an ambivalent role in global conflicts, which can cause mixed reactions in society,” said Experts Club founder Maxim Urakin.

“These data show that Ukrainians recognize the important role of the US in supporting our country during the war, but at the same time remain critical of Washington’s current actions in global politics,” said Alexander Pozniy, co-founder of Active Group.

The poll was part of a broader study examining Ukrainians’ international sympathies and antipathies in the context of contemporary geopolitics.

The study can be found at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

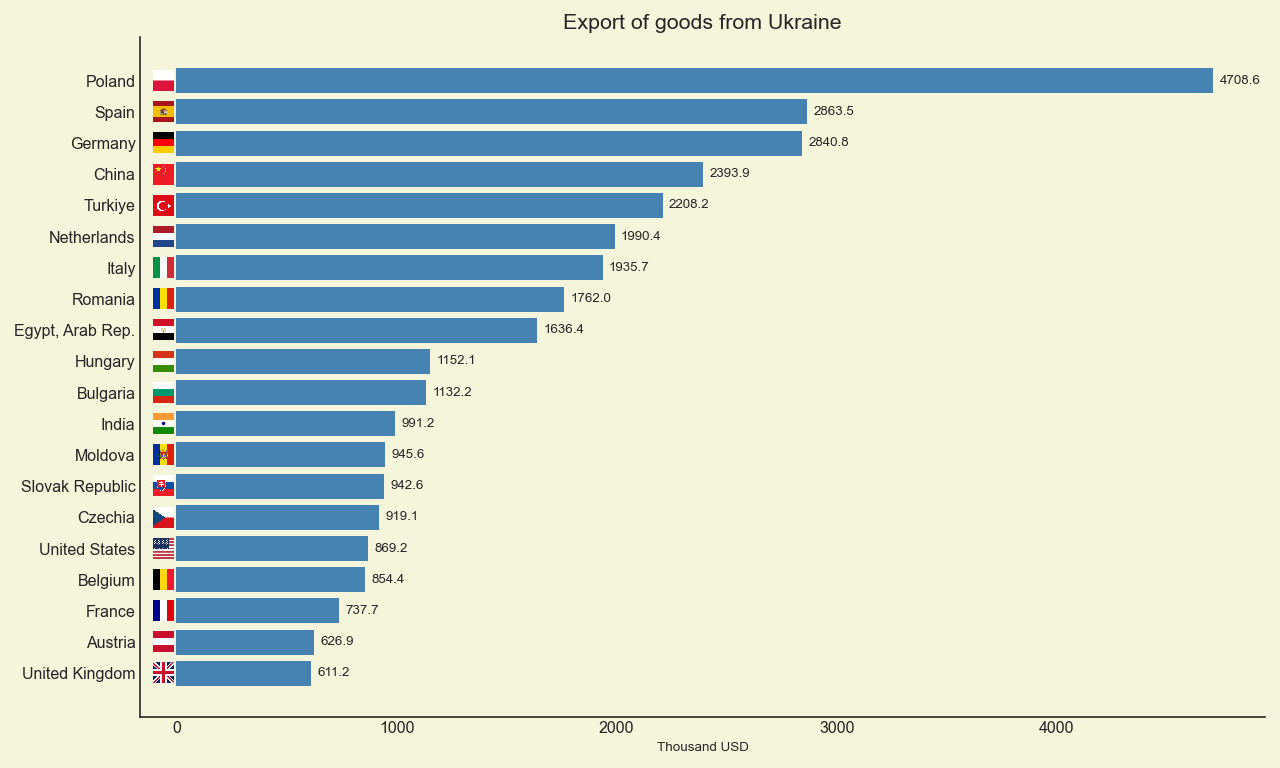

Geographical structure of Ukraine’s foreign trade (exports) January-December 2024, million USD

On May 9, Kyiv will host Svoe.IT 2025, an event that will bring together over 50 Ukrainian developers and more than 2,000 visitors from across the country. This is not just a conference, it is a demonstration of how Ukrainian IT solutions work, scale, and replace foreign analogues, including Russian products.

At Svoe.IT 2025, each participant will not only learn about new products, but also test them in person. This year, the focus is on national technological independence and support for Ukrainian business. Svoe.IT is not just an event, it is a movement towards our own IT code, tailored to the needs of Ukrainian enterprises.

IT Ukraine Association and UKRSIBBANK BNP Paribas Group are the general partners of Svoe.IT 2025 for the second time.

This year, Svoe.IT participants will present innovative solutions for business, including:

Bukkeeper SaaS, Vchasno, Diya, DP “INFOTECH,” InfoPlus, Kyivstar, Legal Tech Solutions, LOGISTIKON, SoftPro-Global, AI FINTECH, BJet, Checkbox, ConnectiveOne, Coworker Crew, DUXIT, GigaTrans, IT Specialist, IT-Enterprise, Konica Minolta Ukraine, LBS Cloud, Lenovo, Liga Zakon, Linkos Group, Macpaw, MASTER, MK legal, MODUS X, NetHunt, Self-ERP, Shop-Express, SmartTender, Smiddle, ToDo, Unitalk, VoIPTime, YouControl. Supported by InWeb, 23Merch, and the State University of Trade and Economics.

The focus of Svoe.IT 2025 will be on movement to the regions. Software solutions from Ukrainian developers should be available in Kyiv, Khmelnytskyi, Poltava, Kryvyi Rih, Chernivtsi, and other cities. Therefore, the event will feature participants from all corners of Ukraine, and the program will include real-life case studies for small and medium-sized businesses.

What can you expect at Svoe.IT 2025?

● 50+ Ukrainian IT products: CRM, ERP, automation, cybersecurity, cloud solutions, accounting and management accounting, document management, logistics, e-commerce, health tech, and more.

● Speech zone: success stories of Ukrainian teams that create and scale their products.

● Panel discussions: topics include abandoning Russian software, cyber security, and local digital resilience.

● Tech Ecosystem Stage — a thematic platform dedicated to the evolution of innovation: from student startups to large technology businesses.

● Meetpoint zones for networking and real-life connections.

● Open area for relaxation and food court.

Svoe.IT 2025 is a space where technological independence becomes a reality. If you are looking for new solutions or alternatives to BAS or Tilda, this event is for you. If you are creating your own software product, we want the whole country to see you.

When: May 9, 2025

Where: Kyiv (address will be sent after registration)

Registration: svoe.it. Admission is free for visitors.

Svoe.IT 2025 — where Ukrainian software meets Ukrainian business. Finally.

______________________________________________________________

Solutions from Svoe.IT partners by category:

Payment services, POS systems, software cash registers

● SOTA Kasa browser-based cash register

● Checkbox POS system

● Multifunctional service Cashalot

● PRRO No. 1 Checkbox

IT services

● IT as a Service from the DUXIT team

● Electronic services in the Tviy Chas store network

Accounting/management accounting

● Online accounting Bookkeeper

● MASTER Online – cloud accounting

● MASTER accounting automation solution: Accounting

● “New Era” – no code/low code software platform for creating accounting systems

● Self-ERP – a modern accounting solution that takes into account the needs of residents of Dія.Сіті

Reporting and document flow

● ASKOD is designed for effective management of corporate information resources

● ASKOD Online – a service that provides instant legally valid exchange of documents in electronic form

● Vchasno – reliable exchange of electronic documents

● Zvit Korporatsiya – a service for automating, receiving, and processing reports from accountable organizations.

● MIA: Document Management is a tool for effective document management

● PTAH is a platform that brings together all participants in document exchange.

● SOTA is a web service for small and medium-sized businesses, electronic document management, and online reporting.

● SOTA CRS – a web service for creating, verifying, signing, and sending CRS reports to the tax service

● SOTA Driver – a mobile application that allows you to work with electronic documents for transportation

● SOTA E-TTN – a cloud solution that allows everyone involved in transportation to access the necessary documents

● CSC “Ukraine” – the largest commercial provider of electronic trust services in Ukraine

● CloudKey – a reliable cloud-based electronic signature

● DEEP HR – document management

● Dubidoc – fast document signing and exchange

● M-Files – a document management system

● M.E.Doc is a program for e-document management and e-reporting

● Signy is an electronic document management service

AI solutions

● AI assistants from IT-Enterprise

● SmartCheck AI is a tool for participating in public auctions

Telecom, telephony, and software for call centers

● ConnectiveOne omnichannel platform

● Telecom services from GigaTrans

● Smiddle Voice Bot – voice bot with artificial intelligence

● VoIPTime Contact Center omnichannel platform

● VoIPTime AI QA – a service that allows you to automate quality assessment for 100% of calls

● Voice robot from VoIPTime

ERP

● Canteen on your phone – a platform for managing school canteens.

● Self-ERP – a solution based on Odoo and real business practices in Ukraine

● Universal 9 – a resource management and business process automation system

● Bjet – accounting and process automation based on Odoo Community

● ISpro – World-class complex for accounting and management automation

● IT-Enterprise – complete replacement for 1C

● LBS Cloud – cloud ERP platform

● ToDo – Odoo-based solution for small and medium business automation

● SUPiK: Product and Kitchen Management System

CRM

● NetHunt – reliable CRM system for the entire team

● VoIPTime – CRM for e-commerce

Risk monitoring and cyber security solutions

● Protection against DDoS attacks from GigaTrans

● Comprehensive risk monitoring Liga 360

● Next-Gen Security Solutions from IT Enterprise

● Analytical system for compliance and market analysis YouControl

Other

● Online government services – Diya app

● Warehouse and logistics management systems LOGISTICON WMS and LOGISTICON YARD

● M.E.Doc SAF-T UA electronic audit service

● Shop-Express website builder

● Smart Procurement commercial procurement platform

● YC.Market market intelligence platform

● Ysoft SafeQ Cloud print expense management system

Interfax-Ukraine is the information partner of the event

Against the backdrop of growing tensions between India and Pakistan, a sociological survey conducted by Active Group in collaboration with Experts Club highlights Ukrainians’ views on how they see our country’s diplomatic position in the event of an escalation of the conflict between these two nuclear powers.

According to the poll, the vast majority of Ukrainians — 90.3% — are in favor of Ukraine taking a neutral position in the event of a full-scale Indo-Pakistani war. This shows that people want diplomatic restraint on issues that don’t directly affect national interests.

Only 8% of respondents expressed support for some form of support for India (4.7% — full support, 3.3% — partial support). As for Pakistan, only 1.6% supported this country (0.3% — partial support, 1.3% — full support for Pakistan’s position).

These results echo Ukrainians’ broader perceptions of these two countries. According to separate surveys

26.7% of Ukrainians have a positive attitude toward India, while 55.3% are neutral.

26.7% have a positive attitude toward Pakistan, while 55.3% are neutral.

“The predominance of neutrality in the choice of diplomatic course towards India and Pakistan indicates a low level of inclusion of the topic in Ukraine’s information space. At the same time, this is a sign of a mature approach to foreign policy in the eyes of citizens,” notes Maxim Urakin, PhD in Economics and founder of Experts Club.

Despite the fact that some respondents show moderate sympathy for India, the vast majority of Ukrainian citizens adhere to a position of non-interference. This may indicate a high level of awareness of armed conflicts outside their own region.