Budshlyakhmash has begun construction of a new 3,000 sq. m production complex in Brovary (Kyiv region), which will be used to manufacture vehicle frames, allowing the company to increase the localization of municipal and special equipment it produces from the current 40-60% to 75%, according to Dmytro Kysilevsky, deputy chairman of the Verkhovna Rada Committee on Economic Development.

“The start of production of vehicle frames is scheduled for mid-2026,” he wrote on Facebook on Tuesday.

According to him, this indicator (40-60% localization) was achieved thanks to licensed SKD assembly of equipment based on Daewoo and JAC chassis with the right to use its own VIN code.

“The contract with these companies provides for permission to replace imported components with Ukrainian ones,” Kysilevsky said.

The MP noted that after the launch of frame production, Budshlyakhmach plans to establish the production of wheel axles, as well as order tires, fuel tanks, and plastic components from other Ukrainian manufacturers.

“Next spring, Budshlyakhmach plans to start developing a new production site on the outskirts of Brovary to create an industrial park with a machine-building cluster. Forty thousand square meters of industrial buildings will be built on an area of 11 hectares. The total investment in this project is about $40 million,” Kysilevsky said.

According to him, investment in new production facilities is stimulated by localization legislation. This year, it requires a mandatory Ukrainian component of at least 25% in public procurement of equipment, and in 2026, the minimum localization level will increase to 30%.

Budshlyakhmash manufactures dump trucks, garbage trucks, truck cranes, sand spreaders and watering machines, tow trucks, and other equipment. In 2025, production volumes will be about 70 units per month.

According to opendatabot, in 2024, the Spetsbudmash plant in Brovary, where Budshlyakhmash Group’s automotive equipment is manufactured, earned UAH 4.2 billion in revenue and UAH 298.5 million in net profit, and in the first nine months of this year, UAH 3.3 billion and UAH 265 million, respectively.

The ultimate beneficiaries are Myroslav and Oleksandr Guiwan.

The Budshlyakhmash group of companies is the official representative in Ukraine of domestic and foreign manufacturers of special, road, and municipal equipment (JAC, Scania, Renault, MAN, Pronar, Daewoo, and Spetsbudmash brands).

Last year, Budshlyakhmash Trading House LLC received UAH 2.18 billion in revenue and UAH 22.9 million in net profit, and in January-September 2025, UAH 138.7 million and UAH 1.9 million, respectively.

The ultimate beneficiary is Myroslav Guiwan.

Budshlyakhmash, EQUIPMENT, FACTORY, frame, Kysilevsky, PRODUCTION

In Ukraine, in January-October 2025, the volume of cattle slaughter for beef in farms of all categories amounted to 286.2 thousand tons, which is 8% less than in the same period of 2024, according to the Association of Milk Producers (AMP).

The industry association specified that cattle slaughter volumes at agricultural enterprises decreased to 106.9 thousand tons (-3%), and at private farms – to 179.3 thousand tons (-11%) compared to January-October 2024.

The largest share (57%) of cattle slaughtered at agricultural enterprises was in the Kyiv (15.41 thousand tons), Poltava (13.33 thousand tons), Cherkasy (11.72 thousand tons), Vinnytsia (9.73 thousand tons), and Chernihiv (9.36 thousand tons) regions, according to the AVM.

The forestry agencies of the state-owned enterprise “Forests of Ukraine” have started selling Christmas trees, with about 10,000 trees already sold, according to the press service of the state-owned enterprise.

“Forests of Ukraine” noted that they plan to sell about 140,000 coniferous trees, which is the same amount that was sold last year. Forestry farms currently grow 7.8 million Christmas trees on 2,700 hectares of “Christmas tree” land. If necessary, harvesting can also be carried out during forest formation and restoration logging. In case of higher demand, the state-owned enterprise has promised to harvest additional quantities.

“Prices for New Year’s coniferous trees are affordable and have remained almost unchanged compared to last year – from 210 to 250 UAH. Spruce/fir trees cost between 240 and 280 hryvnia,“ according to ”Forests of Ukraine.“

In addition, some branches of the state-owned enterprise ”Forests of Ukraine” offer New Year’s trees in containers. Prices start at 500 hryvnia, depending on size.

Christmas trees sold by the State Enterprise “Forests of Ukraine” are required to be marked with barcode tags or self-adhesive labels, which confirm their legality and safety.

Christmas trees can be purchased directly from the State Enterprise “Forests of Ukraine” without any extra charges. Branches of the state enterprise traditionally organize retail sales at forestry trading platforms, fairs, and markets in populated areas.

On December 11–12, Bucharest will host the forum “Rebuilding Ukraine: Security, Opportunities, Investments,” organized by the Center for New Strategies under the patronage of the Romanian Ministry of Foreign Affairs and the Ukrainian Ministry of Foreign Affairs. This event, which is being held for the second time, brings together officials, representatives of international organizations, the private sector, international financial institutions, and experts from various fields, such as defense, finance and banking, energy, infrastructure, digitalization, cybersecurity, and agriculture. The conference will be attended by numerous representatives of Ukrainian regional authorities who are directly involved in the planning and implementation of recovery projects.

Participants will gain a deeper understanding of Romania’s role in the recovery process in Ukraine, especially in the southern regions of the country located near Romania, as well as in issues related to connectivity, energy, and cross-border cooperation projects that have a positive economic impact on communities in both Romania and Ukraine. Over the course of two days, the event will feature more than 30 panel discussions and parallel sessions with guests from Europe, North America, and Asia. The discussions will address key elements of Ukraine’s reconstruction: security and defense, infrastructure, communications, financing and investment, green transition, energy security, digitalization, human capital, agriculture, and cross-border cooperation.

The panel discussions will address important topics such as:

● Regional security architecture and possible diplomatic developments;

● Lessons learned from the war in Ukraine and how they can be applied by Ukraine’s allies;

● Cooperation for the development of projects in the defense industry;

● Connectivity projects between Romania, Ukraine, and the Republic of Moldova;

● Financial instruments, guarantees, investments, and the role of the private sector;

● The strategic role of the Danube in Ukraine’s reconstruction;

● Black Sea ports;

● Energy sustainability, rare minerals, and the future of the green transition;

● Cloud infrastructure, advanced digitalization, and cybersecurity;

● Reintegration of displaced persons, veterans, and community recovery;

● Ukraine’s integration into the EU and necessary reforms;

● The role of local communities and minorities in cross-border cooperation.

The conference provides a unique platform for establishing links between decision-makers and the business community, financial institutions, local authorities, and experts from various fields, facilitating the creation of concrete partnerships and sustainable solutions for Ukraine’s recovery. Simultaneous interpretation in Romanian, Ukrainian, and English will be provided during the conference, as well as online streaming.

Media partner of the forum: Interfax-Ukraine news agency

Event website: https://reconstruct-ukraine.ro/

The tenth annual meeting of the Ukraine-EU Association Committee in Trade (ACTA) was held in Brussels, where issues related to Ukraine’s export duties on soybeans and rapeseed, as well as temporary restrictions on the export of unprocessed timber, were discussed, according to the Ministry of Economy, Environment, and Agriculture.

Ukraine informed its partners that a 10% export duty on soybeans and rapeseed was introduced in 2025 to support the development of agricultural processing within the country. At the same time, agricultural producers who export their own products are completely exempt from paying duties. Therefore, the mechanism introduced does not create additional financial costs for them.

“It is precisely through the proceeds from export duties on soybeans and rapeseed that the state will fill a special budget fund, from which programs to support agricultural producers are financed. First and foremost, these are programs for frontline territories, as well as grants for processing, greenhouses, orchards, compensation for agricultural equipment, insurance against military risks, and other key instruments. This allows us to maintain support for farmers even in wartime,” emphasized Deputy Minister of Economy, Environment, and Agriculture Taras Vysotsky.

The meeting participants also discussed decisions on regulating timber exports, including a temporary ban on the export of unprocessed timber (except pine) and the establishment of zero quotas until the end of 2025.

The Ukrainian side stressed that these measures are aimed at meeting the needs of defense and critical infrastructure, as well as reducing risks to the environment in wartime. At the same time, these measures prevent a shortage of raw materials on the domestic market.

It was separately noted that the Verkhovna Rada of Ukraine is considering draft laws on the formation of an updated timber market model, taking into account security challenges.

The Ukrainian side stressed the importance of continuing an open dialogue with the EU on all temporary measures that the state is applying during the period of martial law. At the same time, maintaining access for Ukrainian products to the European market remains one of the key factors for economic stability and support for national production.

The Ukraine-EU Association Committee in Trade Composition (ACTC) was established in accordance with Article 465 (4) of the Association Agreement between Ukraine and the EU to consider issues related to Section IV “Trade and Trade-Related Matters” of the Association Agreement. The CATS operates in accordance with the rules of procedure approved by Decision No. 1/2014 of the Association Council between Ukraine and the EU of 15 December 2014 “On the adoption of the rules of procedure of the Association Council, the Association Committee and its subcommittees”.

The Trade Committee meets annually and includes representatives from Ukraine and the European Commission.

As reported, a 10% export duty on soybeans and rapeseed for traders has been in effect in Ukraine since September 4, 2025. Agricultural producers who export their own products, or agricultural cooperatives that export the products of their members, are exempt from this duty, provided that the origin of the goods is documented. Until 2030, the duty will be reduced by 1% each year until it reaches 5%.

The Cabinet of Ministers has temporarily banned the export of unprocessed wood (except pine) until December 31, 2025, setting a zero quota for its export. This is done to provide the domestic market with raw materials, support Ukrainian woodworking enterprises, and stabilize the industry.

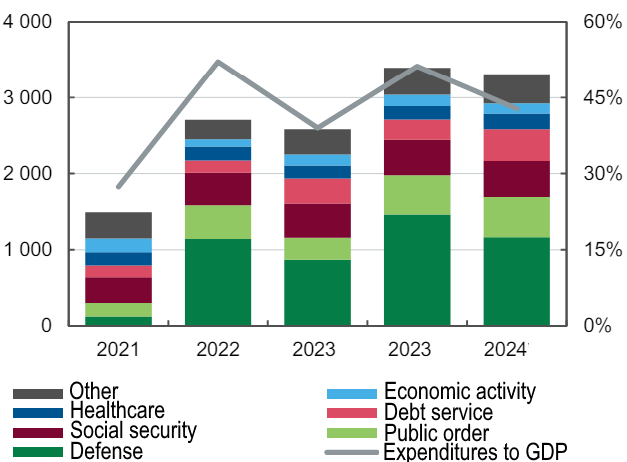

Components of state budget expenditures in 2021-2024, UAH billion

Source: Open4Business.com.ua