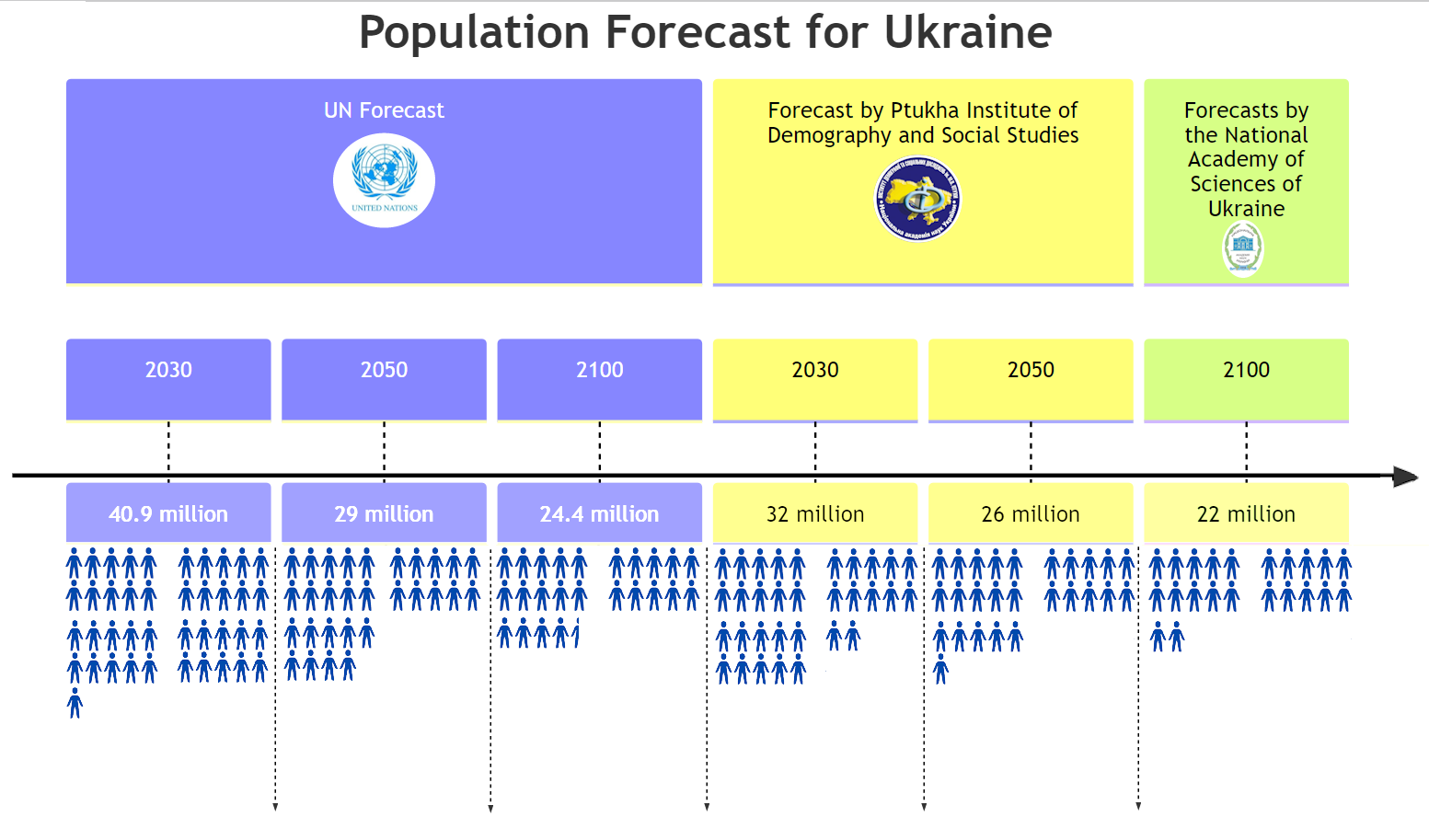

Population forecast for Ukraine in 2030-2100

Source: Open4Business.com.ua

The State Property Fund (SPF) of Ukraine has announced an auction for the privatization of the Ukraina Hotel with a starting price of UAH 1 billion 47.6 million. According to the SPFU press service, applications for participation in the auction scheduled for September 18 will be accepted until September 17. The guarantee fee is UAH 52.3 million.

The lot includes 14 registered units of real estate and infrastructure, including a hotel building; two security buildings; two non-residential buildings; two parking lots, etc. The total area is 26.3 thousand square meters.

According to the results of January-March 2024, the net loss of SE Hotel Ukraine amounted to UAH 3.1 million. In addition, as of March 31, it had wage arrears (UAH 3.8 million), overdue accounts payable (UAH 21 million), and budgetary debts, namely personal income tax (UAH 4.7 million), tourist tax (UAH 1.4 million), and land tax (UAH 4.5 million).

The privatization terms stipulate that the company’s core business (hotel operations) will be maintained for five years, that wage and budget debts will be paid within six months of the transfer of ownership, that social guarantees will be provided to employees in accordance with the law and that they will not be dismissed within six months, and that environmental legislation will be complied with.

As reported, in April, the Cabinet of Ministers of Ukraine included Hotel Ukraina in the list of large-scale privatization objects. In May, the auction commission set the starting price for the privatization of the Ukraina Hotel at UAH 1 billion 47 million 637 thousand 152.

The Ukraine Hotel is a state-owned enterprise managed by the SPFU. The 14-story, 4-star hotel has 363 rooms, six conference halls and meeting rooms. There is a parking lot for 80 cars and a shelter with a separate auditorium for 50 people. The total area of the building is 22.4 thousand square meters.

In the second quarter of 2024, the number of agricultural land sale and purchase transactions in Ukraine amounted to 27.3 thousand with a total area of 60.8 thousand hectares, which is 6.3% more than in the first quarter in terms of the number of transactions and 3.3% more than in terms of the area of land in circulation.

These are the results of a study conducted by the Kyiv School of Economics (KSE), commissioned by the USAID program.

“The main factor behind the growth of indicators in the second quarter was a record increase in the volume of the land market in April 2024, when 10.3 thousand purchase and sale transactions were concluded with a total area of 22.5 thousand hectares. After that, the market volumes declined in May (9.0 thousand transactions with a total area of 19.8 thousand hectares) and in June (8.0 thousand transactions with a total area of 18.5 thousand hectares),” analysts stated.

In their opinion, this decline is due to the limited liquidity of farmers, as the sowing campaign has already been completed in May-June, while the harvest has not yet begun, which limited their financial resources. In addition, amid rising land prices after the opening of the land market to legal entities, landowners may wait to sell. Analysts also suggest that there is seasonality in the farmland sales market.

According to KSE experts, in general, the volume of the land market has been recovering since the start of Russia’s full-scale invasion, but has not reached pre-war levels. The average monthly sales of agricultural land for six months of 2024 amounted to 19.9 thousand hectares, which is 38% lower than the pre-war figures. At the same time, the area of agricultural land transactions due to the occupation and hostilities has decreased by more than 20% since February 2022.

If we extrapolate the figures for the first half of 2024 to the whole year and do not take into account the areas where the land market is hampered by hostilities, then this year 0.8% of the total amount of agricultural land will be in circulation, which is almost in line with the figures of countries with developed land markets. (…) Given the trends of monthly sales growth until February 2022, it can be argued that if not for the full-scale war, the average monthly volume of land in circulation would be much higher than 32.2 thousand hectares. Thus, the land market has the potential to grow in the short term, according to the KSE study “Land of Endurance”.

Corporate bonds of NovaPay, a non-bank financial institution that is part of the Nova Group, have been purchased by about 2,000 Ukrainians for UAH 365.5 million through the company’s app in the four months since their placement, the company’s press service said on Thursday.

“Under the agreements that have already expired, customers have already been paid UAH 255.1 million. Most often, clients prefer medium-term bonds. 56% of clients invest in bonds repeatedly,” CFO Igor Prikhodko said in a release on Thursday.

As reported, on February 20, NovaPay announced the start of bond sales. It was noted that they can be purchased for a period of 1 to 12 months for the amount of UAH 1000. The interest rate for investments for one, two and three months was 16% per annum, six months – 17% per annum and 12 months – 18% per annum. The issuer stated that it intends to actively use the bonds in repurchase agreements for a period of one month to one year, creating a convenient alternative to deposits, and to launch their secondary market.

According to NovaPay’s latest release, 75% of bond investors are men, 25% are women, the average age is 37, and the oldest investor was 75. The average check for transactions through the app is UAH 41 thousand.

Currently, the investment rate for a month has been reduced to 13% per annum, for 2 months – to 14%, for 3 months – to 16%, for 6 and 12 months – to 16.5% per annum.

In 2023, NovaPay registered three public issues of interest-bearing bonds of series A, B, and C for UAH 100 million each. In 2024, the company issued three more issues of such securities – series D, E and F. The rating agency Standard-Rating assigned them a credit rating of uaAA.

Founded in 2001, NovaPay is an international financial service that is part of the Nova group and provides online and offline financial services at Nova Poshta offices. According to its website, the company employs about 13 thousand people in more than 3.6 thousand Nova Poshta offices across Ukraine. According to the National Bank of Ukraine, the company accounts for 35% of the total volume of domestic money transfers.

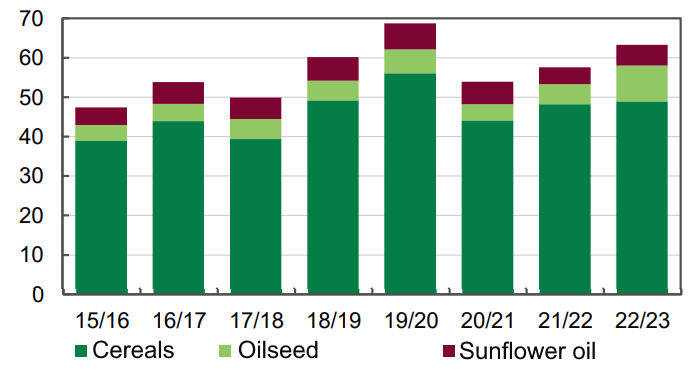

Export of agricultural products during marketing year, mln tons

Source: Open4Business.com.ua

Bosnia and Herzegovina has opened its market for imports of Ukrainian poultry meat products of mechanical deboning, the press service of the State Service of Ukraine for Food Safety and Consumer Protection (Gosprodpotrebsluzhba) has reported.

“It is very important during the war to support Ukrainian exporters, to create new opportunities for them, because this is support for the economy of our state. Therefore, the Ministry of Foreign Affairs together with Gosprodpotrebbsluzhba constantly negotiate with foreign partners and step by step open new foreign markets for Ukrainian producers “, – said the Minister of Foreign Affairs of Ukraine Dmytro Kuleba.

“Ukrainian entrepreneur needs any support from the state, which is very important during the war. And the State Consumer Service together with the team of the Ministry of Foreign Affairs continue to open the international trade arena for our manufacturer. There are still about 63 countries in the work in almost 200 directions”, – emphasized the head of the department Serhiy Tkachuk.

The agreed form of veterinary certificate of the specified category of products is published on the official web portal of the State Consumer Service of Ukraine in the section “International Cooperation” – “Veterinary and Safety” – “Certificates for export from Ukraine”.

The agency reminded that the first step for exporting Ukrainian products of animal origin is a request of the market operator to the territorial body of the State Food and Consumer Service at the place of location.

Since the beginning of the full-scale invasion agreed 41 forms of international veterinary certificates for the export of objects of state veterinary and sanitary control and supervision from Ukraine, that is, 41 markets are open for the export of Ukrainian products, said the State Food and Consumer Service.