On Monday, July 29, at night in the west and north, during the day in the east, south, most of the central regions and the northern part of the country in some places short-term rain, thunderstorms; in the rest of the country without precipitation.

The wind is westerly, north-westerly, 7-12 m/s, with gusts of 15-20 m/s in the western and northern regions.

The temperature at night 14-19°, in the south of the country up to 23°, in the western regions 11-16°; in the afternoon 21-26°, in the central regions in some places 28-30°, in the eastern regions and southern part 29-34°.

In Kiev on Monday, July 29, there will be short-term rain at night and no precipitation during the day.

The wind is predominantly north-westerly, 7-12 m/s, gusts of 15-20 m/s. The temperature will be 15-17° at night and 23-25° during the day.

According to the Central Geophysical Observatory named after Boris Sreznevsky. Borys Sreznevsky in Kiev on July 29, the highest daytime temperature was 38.0° in 1936, the lowest nighttime temperature was 10.1° in 1923.

Tuesday, July 30, in Ukraine will be dry, only in the northeastern part and in the northern, at night also in most eastern regions in some places short-term rains, thunderstorms.

The wind is north-westerly, 7-12 m/s, in some places gusts of 15-20 m/s. Temperatures will be 11-16° at night and 21-26° during the day; in the south of the country it will be 15-20° at night and 25-30° during the day.

In Kiev on July 30, short-term rain and thunderstorms are expected in places. The wind is north-western, 7-12 m/s, in some places gusts of 15-20 m/s. The temperature will be 14-16° at night and 23-25° during the day.

Agrarians in all regions of Ukraine have already harvested 22.325 million tons of new crops from 5.872 million hectares, the press service of the Ministry of Agrarian Policy and Food reported on Friday.

According to the report, more than 19 million tons of grains and more than 3 million tons of oilseeds have already been harvested.

It is specified that 14.7 million tons of wheat have been harvested from 3.502 million hectares at a yield of 42 c/ha, 3.8 million tons of barley from 1020.2 thousand hectares at a yield of 37.9 c/ha, 416.3 thousand tons of peas from 189.8 thousand hectares at a yield of 21.9 c/ha.

Ukraine also continues harvesting oilseeds. In particular, more than 3 mln tons of rapeseed have been harvested from 1086.3 thou hectares with a yield of 28.3 c/ha and 0.3 thou tons of soybeans from 0.2 thou hectares with a yield of 19.3 c/ha.

Also, the top three in terms of grain harvesting are farmers of Odesa region – 733.3 thou hectares, Dnipropetrovska – 630.7 thou hectares, Mykolaivska – 536.5 thou hectares. Khmelnytsky region is the leader in terms of yield with 64 c/ha.

Farmers in Poltava region have completed harvesting early grains and pulses.

The Ukrainian Sea Corridor has transported 60 million tons of cargo in 11 months of operation, the Ukrainian Sea Ports Authority (USPA) reported on Facebook.

“60 million tons – the cargo turnover of the ports of Greater Odesa for 11 months of the Ukrainian Corridor,” the USPA said in a statement on Friday.

It is noted that 40.6 million tons of this volume are grain cargoes. They were exported to 46 countries.

“The bulk carrier Manta Hacer with 25.2 thousand tons of Ukrainian humanitarian wheat is moving through the Ukrainian corridor to Yemen. This is another vessel chartered by the UN World Food Program,” the USPA said.

The Administration emphasized that despite the war and the enemy’s insidious shelling of port infrastructure, including hangars for storing agricultural products, Ukraine remains a key player in the issue of global food security. This is especially true for grain exports to Asia and Africa.

Earlier it was reported that during the 10 months of operation of the Ukrainian Sea Corridor, cargo exports reached a record high of 55 million tons. In mid-July, it reached 57.55 million tons.

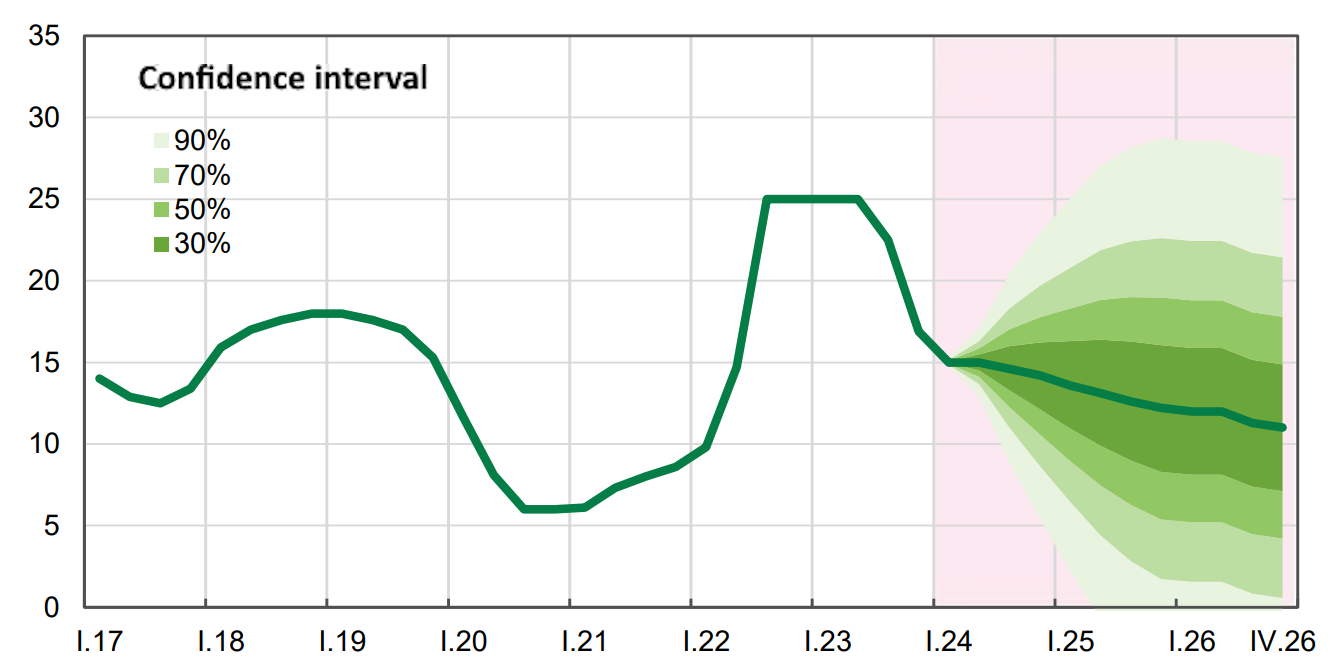

Forecast of changes in discount rate of National bank of Ukraine, %

Source: Open4Business.com.ua

Since the beginning of the year, Uglepromtrans LLC, a member of Metinvest Group, has transported 2 million tons of coking coal and coal concentrate within the framework of Metinvest Pokrovskugol, which manages the enterprises of Pokrovsk Coal Group (Pokrovskoye).

According to the company, Vuglepromtrans trains are responsible for delivering premium concentrate to customers. Despite the war, the railroaders are working in a stable mode, increasing their speed and shunting operations.

In addition, it is reported that locomotive crews at Shakhtnaya station are providing railcars for loading coal concentrate to their main customers, Pokrovskoye Mine Administration and Svyato-Varvarinskaya Concentrator.

Currently, the rolling stock service employs 63 people, and one in four of them is a diesel locomotive driver.

As reported, in 2023, Vuhlepromtrans railroaders built 68 meters of track and three turnouts. The plans for this year are to lay another turnout and 60 meters of track, which will facilitate access to the diesel locomotive garage.

Nikolay Vishnevsky, Director of Vuglepromtrans, noted that in the face of a full-scale invasion, Metinvest transformed its business in a timely manner and set up logistics to maintain key production facilities and, most importantly, retained its staff.

“Metinvest created Metinvest Pokrovskugol, which manages the Pokrovske Coal Group’s enterprises. It includes, among others, Pokrovske Mine Administration and Svyato-Varvarinskaya Concentrator.

Svyato-Varvarinskaya Enrichment Plant is a premium coal concentrate producer in Ukraine. Its production capacity is about 8 million tons of raw coking coal per year with the ability to enrich five different classes of coal.

Pokrovskoye (formerly Chervonoarmeyskaya-Zapadnaya No. 1) is Ukraine’s largest coking coal producer.

The major shareholders of Metinvest B.V. are SCM Group (71.24%) and Smart Holding Group (23.76%), which jointly manage the company. Metinvest Holding LLC is the management company of Metinvest Group.

On July 23, 2024, Ambassador Extraordinary and Plenipotentiary of the Arab Republic of Egypt to Ukraine Ayman Elgammal held a diplomatic reception on the occasion of the 72nd anniversary of the Revolution of July 23, 1952.

On July 23, Egypt celebrates a public holiday – the Day of the Revolution of 1952, which resulted in the overthrow of the feudal monarchical regime of King Farouk and the establishment of a republic.

In 1953, Egypt was proclaimed a republic. Since 1971, the official name of the country is the Arab Republic of Egypt.

The solemn event on the occasion of the holiday was attended by honored guests: heads of diplomatic missions of foreign countries accredited in Ukraine, representatives of the leadership of state authorities, including Special Representative of Ukraine for the Middle East and Africa Maksym Subkh, Islamic religious figures, members of the Egyptian diaspora, educators and cultural figures.

At the beginning of his speech, Ambassador of Egypt to Ukraine Ayman Elgammal congratulated all those present on an important date in the history of the Arab Republic of Egypt, highlighted the main stages of Egypt’s formation as a sovereign country and economic achievements over the past 10 years – during the revolution that took place on June 30, 2013 and the establishment of the third Egyptian Republic in 2014.

In his speech, Mr. Ambassador emphasized that our countries have established close friendly relations in political, economic, commercial and investment spheres.

“The trade balance between Egypt and Ukraine before the coronavirus pandemic and the current war was $2.1 billion, and in 2023 it amounted to about $1.3 billion. Egypt is still the main trading partner for Ukraine in Africa and the Middle East and the seventh trading partner in the world, and the beginning of this year shows progress in returning the trade balance to pre-war levels,” the diplomat said.

He also emphasized that Egypt and Ukraine have a long history of cooperation in the space sector, and the first Egyptian satellite was designed and built in Ukraine with the participation of Egyptian experts.

In his speech, the Head of the Diplomatic Mission elaborated on the recent history of Egypt after the 1952 revolution, when his country witnessed the wars of 1956, 1967 and 1973, where more than 30% of the country, namely the Sinai Peninsula, was occupied for 6 years and, like Ukraine, underwent severe trials.

However, Egypt managed to liberate all of its lands not only through military force, but mainly through diplomacy, applying to the International Court of Justice to return the last disputed territory, the Egyptian city of Taba, even 16 years after the end of hostilities in 1973.

Drawing on this page of history, the Ambassador emphasized his country’s unwavering position in support of Ukraine’s territorial integrity and sovereignty, as these principles have defined Egypt’s position on all conflicts, including Ukraine, since 2014.

“In addition, Egypt believes that no conflict can be resolved by military means alone, as diplomacy plays a primary role in resolving any conflict, so we participated in the Arab Ministerial Liaison Committee on the Ukrainian Crisis, which was established by the Arab League and at the initiative of African presidents after the outbreak of full-scale armed aggression against Ukraine. During the OAS Summit27 , President Al-Sisi called on world leaders to work toward a peaceful resolution of the war in Ukraine. In addition, Egypt supports all efforts of the parties to resolve the conflict peacefully,” the diplomat said.

On behalf of the Ukrainian government, the Special Representative of Ukraine for the Middle East and Africa, Ukrainian diplomat and historian Maksym Subkh expressed congratulations on the occasion.