According to the Statistics Agency of Uzbekistan, as of June 15, 2024, the country’s resident population reached almost 37.1 million people.

For comparison, as of April 1, the number of residents of the republic was less than 37 million, indicating a population increase of almost 133 thousand people over the past 2.5 months.

Statistics also show that the number of men in Uzbekistan exceeds the number of women. In particular, there are 18.6 million men in the country, while there are 18.4 million women.

State Enterprise “Chernobyl NPP” June 25 announced a tender for compulsory civil liability insurance of owners of land vehicles (CMTPL).

As reported in the system of electronic public procurement Prozorro, the expected cost of the purchase of insurance services is 103.8 thousand UAH.

Documents for participation in the tender are accepted until July 3.

The EU says that the negotiations on Ukraine’s accession to the European Union will be rigorous and demanding, and that it will be up to EU member states to decide whether all the conditions for completion have been met.

“The accession negotiations that we are starting today will be rigorous and demanding. Thanks to your determination and commitment, we are confident in your ability to bring this process to a successful conclusion. We will support you in your efforts, and we look forward to welcoming you as a fully-fledged member of the European Union,” said Hajia Labib, Minister of Foreign Affairs of Belgium, which holds the EU presidency, at the opening of the Intergovernmental Conference in Luxembourg on Tuesday, marking the start of official negotiations on Ukraine’s accession to the EU.

She clarified that it is the EU member states that will decide whether the conditions for completing the negotiations have been met, taking into account changes in EU legislation since the opening of the negotiations and Ukraine’s readiness for membership.

Presenting the approved framework for the negotiations, the Minister said that it is based on “taking into account the experience of past enlargements and ongoing accession negotiations, as well as EU legislation, and properly reflects Ukraine’s advantages and characteristics.” “The negotiations are aimed at ensuring that Ukraine fully adopts EU norms and ensures their full implementation and compliance. The negotiations also include a revised enlargement methodology, which ensures an even greater focus on fundamental reforms in the accession negotiations. Therefore, Ukraine will need to fully adopt and continue to implement reforms in the areas of rule of law and fundamental freedoms, strengthening democratic institutions and public administration reforms, as well as economic criteria,” the Minister elaborated.

In addition, Ukraine will need to pay special attention to judicial reform, the fight against corruption, and the protection and non-discriminatory treatment of persons belonging to national minorities. “To ensure that progress in these areas is irreversible and fully and effectively implemented, progress will be closely monitored by the Commission, which will report regularly to the Council,” Labib said.

According to her, “the progress in the implementation of the fundamental cluster (the cluster on fundamental values) will be crucial throughout the process of these reforms, which will determine the overall pace of the negotiations.” “This will give enough time to create the necessary legislation, institutions, and a solid track record of implementation before the end of the negotiations. The screening reports to be prepared by the Commission will contain substantial recommendations, in particular on the tasks to be addressed in the roadmaps adopted by the Ukrainian authorities,” the minister added.

At the same time, Labib expressed the expectation that Ukraine, as a future member state, will adhere to EU values, “namely, respect for human dignity, freedoms, democracy, equality, the rule of law, the rule of law and respect for human rights, including the rights of individuals to belong to minorities.” “In addition, accession to the EU provides for the timely and effective implementation of all EU legislation or the EU acquis as it existed at the time of accession. In accordance with the revised enlargement methodology, the development of sufficient administrative and judicial capacity, as part of the fundamental cluster, is key to fulfilling all the obligations arising from membership. Good neighborly relations with EU member states and other enlargement partners remain important,” she said.

The minister said that the EU welcomes “Ukraine’s strategic commitment to its EU path and its high coherence with the EU’s common foreign and security policy and its restrictive measures”. “We encourage Ukraine to continue this positive trend towards full coherence, in line with respect for the principles of sovereignty and territorial integrity, including for EU members. Coherence with the EU’s foreign and security policy is a key aspect of the EU integration process and a clear expression of a strategic choice.”

In addition, according to Labib, in parallel to the accession negotiations, the Union and Ukraine will continue their dialogue with civil society and cultural cooperation in order to “bring people closer together and ensure that citizens support the accession process.” “We expect Ukraine to continue to strategically communicate the benefits and commitments of the accession process and EU membership to its public, including by combating disinformation,” she said.

Pivdennyi GOK (Northern Mining and Processing Plant, Kryvyi Rih, Dnipro Oblast), a part of Metinvest Group, reported a net profit of UAH 866.090 million in 2023, compared to a net loss of UAH 2 billion 972.333 million in 2022.

According to the decision of the sole shareholder, Metinvest B.V. (Netherlands), which owns 100% of the shares in Pivnichnyi GOK, at its meeting on April 30, 2024, the profit for 2023 was left undistributed.

Another shareholder’s decision – at the meeting of May 14, 2024 – changed the company’s management structure to a one-tier one with the corresponding amendments to the charter. At the same time, after the registration of the updated charter, the supervisory board was liquidated and a four-member board of directors was created. It includes Metinvest CEO Yuriy Ryzhenkov, Metinvest CFO Yulia Dankova and Metinvest Legal Director Svetlana Romanova as non-executive directors for three years, as well as Igor Tonev as executive director, whose position as CEO is being eliminated.

Earlier, based on the shareholder’s decision of March 28, 2024, Andrey Skachkov’s powers as CEO were terminated by agreement of the parties, and Tonev was appointed CEO.

On May 24, 2024, the state registration of the new version of Northern GOK’s charter took place. On May 25 this year, at a meeting of the Board of Directors of Northern GOK, Metinvest’s CFO Yulia Dankova was elected Chairman of the Board of Directors for a term from May 25, 2024 to May 24, 2027 inclusive. Igor Tonev was elected Chief Executive Officer with a term of office from May 25, 2024 to April 2, 2025 inclusive. And it was determined that in accordance with clause 7.8 of the Charter of Northern GOK, the chief executive officer is referred to as the general director in the company’s activities in general, organizational structure, staffing and document flow.

By the decision of the shareholder of June 13, 2024, at its meeting, the net profit of UAH 580.409 million received in January-March of this year is allocated to pay dividends for 2024. At the same time, UAH 0.25 of dividends are paid per ordinary share.

The Board of Directors of the company (Minutes No. 3 dated June 14, 2024) decided to establish the date of compiling the list of persons entitled to receive dividends, the procedure and term for their payment. The start date of dividend payment is July 1, 2024, and the end date of dividend payment is December 13, 2024 inclusive.

As reported, for 9M2023, Northern Mining earned a net profit of UAH 681.867 million, while it ended the same period in 2022 with a net loss of UAH 2 billion 227.488 million. Retained earnings as of the end of September 2023 amounted to UAH 10 billion 727.921 million.

The company ended 2022 with a net loss of UAH 2 billion 972.333 million, while in 2021 it made a net profit of UAH 25 billion 293.042 million.

It was also reported that in April this year, Metinvest introduced a new model for the operation of Kryvyi Rih mining enterprises, uniting mining and processing plants in Kryvyi Rih under a single management. Central, Ingulets and Northern GOKs are managed by a single administrative and management center. For this purpose, a mining department was set up within the group’s operating directorate. The department is headed by Igor Tonev, who has also been appointed as the sole CEO of the three GOKs. Prior to this position, he was the head of Metinvest-SMC’s sales company since 2019 and has been with Metinvest since 2011.

The plant specializes in the extraction, processing and sale of iron ore.

Metinvest B.V. owns 100% of the shares in Northern GOK.

Northern GOK is part of Metinvest Group, whose major shareholders are System Capital Management (SCM, Donetsk) (71.24%) and Smart Holding Group (23.76%). Metinvest Holding LLC is the management company of Metinvest Group.

The authorized capital of Yenakiieve Mining is UAH 579.707 million.

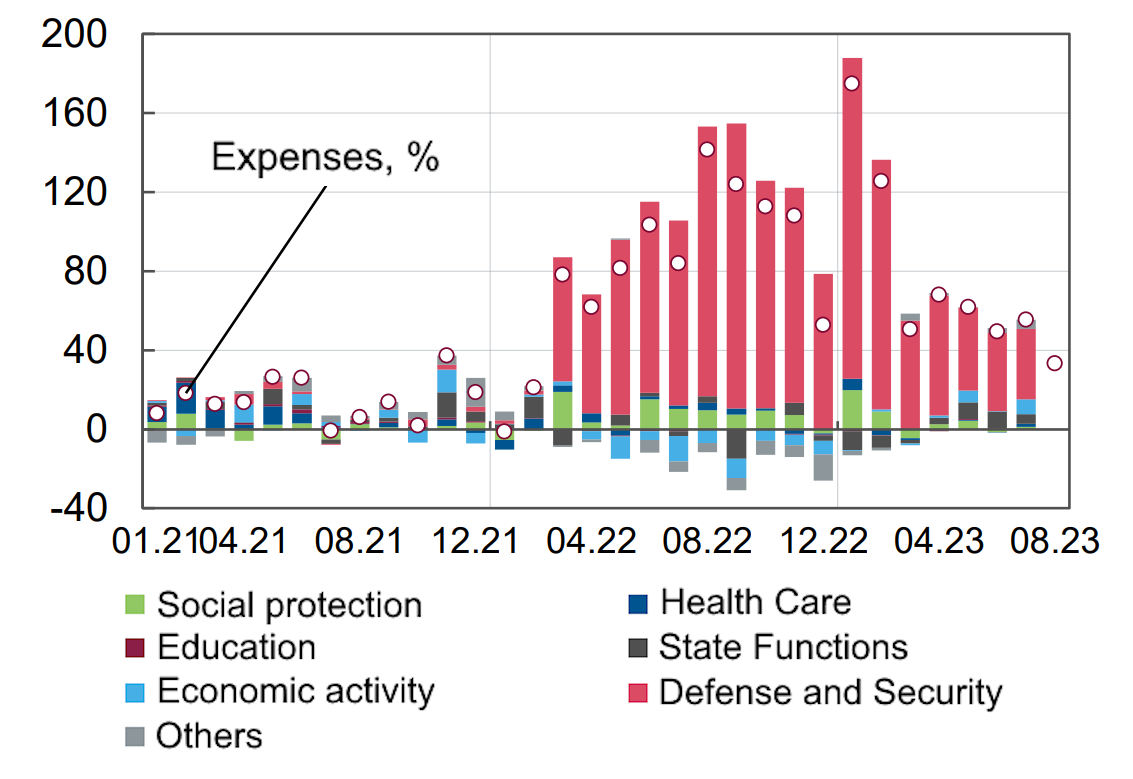

Changes in consolidated budget expenditures in 2021-2023 (%)

Source: Open4Business.com.ua and experts.news

The membership negotiations began on Tuesday, a landmark move aimed in particular at signaling a vote of confidence in Ukraine’s future.

The European Union launched accession negotiations with Ukraine and Moldova on Tuesday, June 25, setting the fragile ex-Soviet states on a long path towards membership that Russia has tried to block. The landmark move is aimed in particular at signaling a vote of confidence in Ukraine’s future as Moscow has momentum on the battlefield almost two and a half years into the Kremlin’s invasion.

Ukraine’s President Volodymyr Zelensky called it a “historic day” ahead of the start of talks between officials from Kyiv and the EU’s 27 member states in Luxembourg. “We will never be derailed from our path to a united Europe and to our common home of all European nations,” the Ukrainian leader wrote on social media.

Ukraine and later its neighbour Moldova lodged their bids to join the EU in the immediate aftermath of Russia’s all-out assault in February 2022. The start of the talks marks just the beginning of a protracted process of reforms strewn with political obstacles that will likely take many years — and may never lead to membership.

Read more Subscribers only European Union approves opening of formal accession negotiations with Ukraine

Standing in the way along that journey will be not just Russia’s efforts at destabilisation but reticence from doubters inside the EU, most notably Hungary. But European Commission chief Ursula von der Leyen called the opening of talks “very good news for the people of Ukraine, Moldova, and the entire European Union. The path ahead will be challenging but full of opportunities,” she wrote on X on Tuesday.

So far, Ukraine – represented at the talks by Deputy Prime Minister Olga Stefanishyna – has won plaudits for kickstarting a raft of reforms on curbing graft and political interference, even as war rages. “Today is a historic day for Ukraine and Moldova, but also for the EU,” said Germany’s Europe minister Anna Luehrmann. “Both countries have made enormous progress in the area of the rule of law, the fight against corruption and freedom of the press.”

Complex process

Russia’s war in Ukraine has reinvigorated a push in the EU to take on new members, after years in which countries particularly in the Western Balkans made little progress on their hopes to join. The EU in December 2023 also granted candidate status to another of Russia’s former Soviet neighbours, Georgia. It likewise approved accession negotiations with Bosnia and has talks ongoing with Serbia, Montenegro, Albania and North Macedonia.

The meetings with Ukraine and Moldova on Tuesday will set off a process of screening of how far laws in the countries already comply with EU standards and how much more work lies ahead. Once that is done the EU then has to begin laying out conditions for negotiations on 35 subjects – from taxation to environmental policy.

It appears unlikely that there will be progress onto the next step in the coming six months, when Hungary – the friendliest country to Russia in the bloc – holds the EU’s rotating presidency. “It’s very difficult to say at what stage Ukraine is,” said Hungary’s Europe minister Janos Boka. “From what I see here as we speak, they are very far from meeting the accession criteria.”

The start of the talks resonates powerfully in Ukraine as it was a desire for closer ties with the EU that sparked protests back in 2014 that eventually spiralled into the full-blown crisis with Russia. The talks also come at a tense time in Moldova after the United States, Britain and Canada warned of a Russian “plot” to influence the country’s presidential elections coming up in October.

Wedged between war-torn Ukraine and EU member Romania, Moldova’s pro-Western authorities frequently accuse the Kremlin of interfering in its internal affairs. President Maia Sandu has accused Moscow – which has troops stationed in a breakaway region of the country – of aiming to destabilise Moldova ahead of the vote. “Our future is within the European family,” Sandu wrote on X. “We are stronger together.”

Le Monde with AFP