As part of his official visit to France, Ukrainian President Volodymyr Zelenskyy met with the heads of leading French companies in the energy, engineering and electrical equipment, telecommunications, construction, and financial and banking sectors, the President’s website reported on Friday.

“Even in the difficult conditions of war, the Ukrainian economy is finding ways to develop and grow, adapting to new circumstances. Ukraine is a profitable market for French investment, and new projects can be launched right now,” the head of state emphasized.

Zelenskyy also reaffirmed Ukraine’s commitment to working with the French government to create favorable conditions for investors, in particular through a system of state guarantees, lending and investment insurance mechanisms.

Vilnius will allocate 300 thousand euros for the reconstruction of the Taras Shevchenko National Theater in Dnipro, which will result in the theater becoming a modern inclusive art space with opportunities for exhibitions, concerts, and master classes, said the head of the regional military administration Serhiy Lysak.

“300 thousand euros for the Taras Shevchenko National Theater in Dnipro. This amount will be allocated by Vilnius for reconstruction. The money is from the Ukraine Assistance Fund,” he wrote on his Telegram channel on Friday.

Lysak said that the money will be used to restore a large machine room, which is currently not in operation. “However, it is planned to turn it into a real artistic hub. It will be used for exhibitions, concerts and master classes. A reliable and comfortable shelter will be created there,” added Lysak.

According to him, the reconstruction will involve the dismantling of everything outdated. “To make the space barrier-free, an additional entrance will be arranged. And also the stage. Major repairs, installation of ventilation.”

“I am grateful to our international partners for supporting the region.

I thank the mayor of the capital of Lithuania, Valdas Benkunskas, for this decision. And the Ministry of Culture for promoting this important initiative,” Lysak summarized.

Source: https://en.interfax.com.ua/news/diplomats/992150.html

Traffic at the Shehyni-Medica checkpoint may be blocked from the Polish side in the coming days, according to the State Border Guard Service of Ukraine.

“According to available information, Polish farmers may block traffic in the direction of the Medyka checkpoint, which is opposite the Ukrainian Shehyni checkpoint. The blocking may begin on June 9 at 10:00 a.m. and will last until the end of September,” the message on the telegram channel reads.

It will be announced later which categories of vehicles will be affected.

U.S. House Speaker Mike Johnson and his supporters are pushing for a vote on a bill to end political persecution aimed at demonstrating loyalty to former President Donald Trump, Axios reports.

“According to two lawmakers and two other GOP sources familiar with the situation, Johnson’s leadership team is calling for support for the End Political Persecution Act,” the report says.

It emphasizes that this is a direct response to the verdict of a jury in New York, which found Trump guilty of falsifying documents on all 34 counts.

The portal writes that bringing the bill to a vote is a demonstration of “how eager the Republican leadership in the House of Representatives is to support Trump.” According to Republican leaders, the former president has become the victim of a sham trial aimed at reducing his chances of re-election.

Axios believes that even if the bill is approved by the House of Representatives, it has no chance of being considered in the Senate, which is controlled by Democrats.

As explained in the publication, the head of state can only pardon federally convicted persons. Thus, even if Trump becomes president again, he will not be able to overturn the verdict of the New York court. The bill, if approved, could allow Trump to transfer the charges to a federal court with the possibility of further pardon in the event of a guilty verdict.

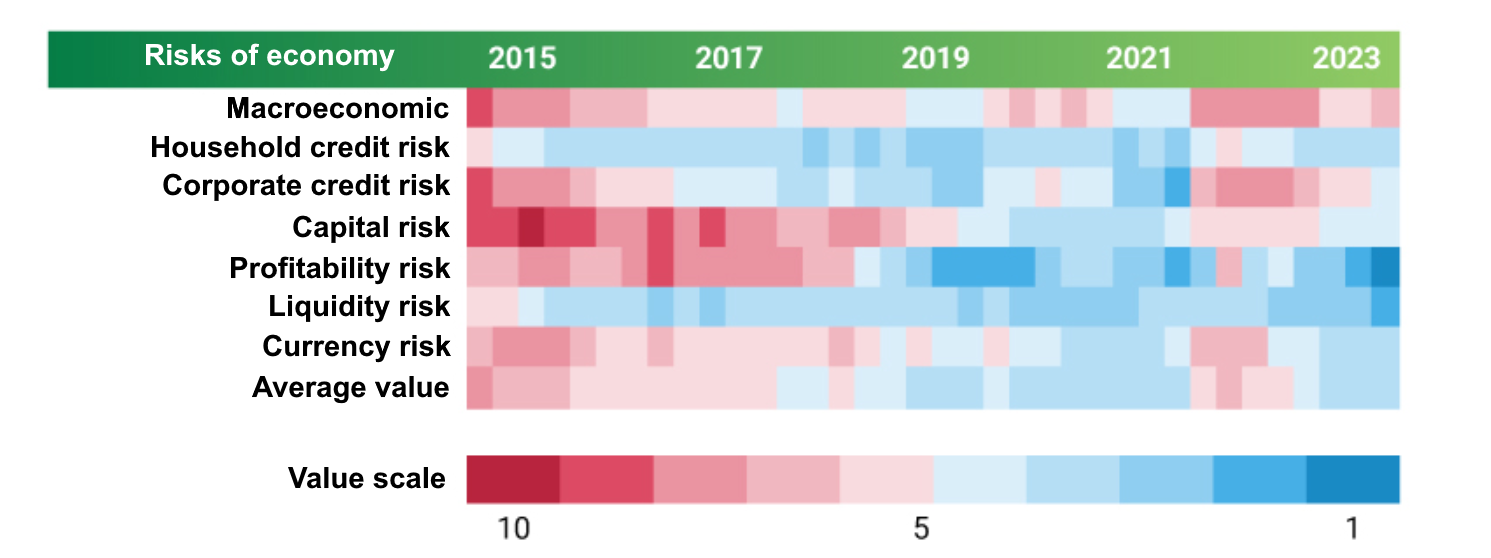

Heat map of risks for the financial sector of Ukraine

Source: Open4Business.com.ua and experts.news

One of the largest grain market operators in Ukraine, JV Nibulon LLC, and Pravex Bank, part of the Intesa Sanpaolo group, have entered into a bilateral agreement to extend the restructuring of a $5.5 million loan for six years with preferential interest rates and a grace period for debt repayment, the grain trader’s press service reported on its Facebook page.

“PRAVEX Bank approaches each case of debt restructuring individually, taking into account the specifics of the business and the needs of its clients. This approach allows us to provide the most effective financial solutions and maintain stable partnerships,” commented Yuriy Lytvynenko, Director of the bank’s Loan Management Department.

Nibulon noted that the loan restructuring will help it optimize its financial flows and focus on implementing strategic projects aimed at strengthening and developing the agricultural sector of Ukraine.

“We are confident that this step will be an important incentive for the company’s further growth and prosperity, strengthening our market position and contributing to the country’s economic development,” said Nibulon’s CFO Irina Levkovskaya.

As reported earlier, Nibulon Group has more than 25 Ukrainian and foreign creditors, with the vast majority of whom have already signed restructuring agreements.

Nibulon JV LLC was established in 1991. Prior to the Russian military invasion, the grain trader had 27 transshipment terminals and crop reception complexes, capacity to store 2.25 million tons of agricultural products at a time, a fleet of 83 vessels (including 23 tugs), and owned the Mykolaiv Shipyard.

“Before the war, Nibulon cultivated 82 thousand hectares of land in 12 regions of Ukraine and exported agricultural products to more than 70 countries. In 2021, the grain trader exported the highest ever volume of 5.64 million tons of agricultural products, reaching record volumes of supplies to foreign markets in August – 0.7 million tons, in the fourth quarter – 1.88 million tons, and in the second half of the year – 3.71 million tons.

Nibulon’s losses due to Russia’s full-scale military invasion in 2022 exceeded $416 million.

Currently, the grain trader is operating at 32% of capacity, has created a special unit to clear agricultural land of mines, and was forced to move its headquarters from Mykolaiv to Kyiv.