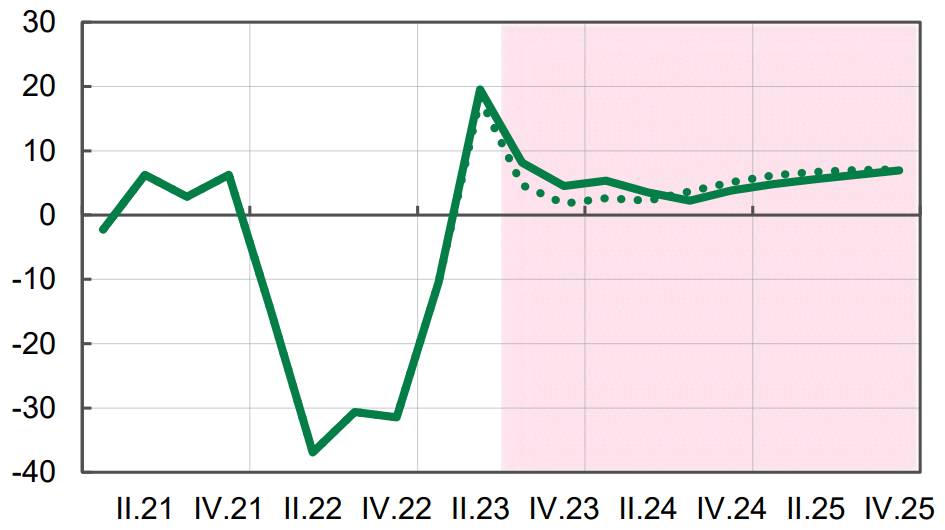

Real GDP in 2021-2025 (forecast)

Source: Open4Business.com.ua and experts.news

On May 21, the Ministry of Foreign Affairs of Ukraine announced a tender for voluntary insurance of motor vehicles and compulsory insurance of civil liability of owners of land vehicles, according to the electronic state procurement system Prozorro.

The expected cost of purchase of services is UAH 342,898 thousand.

The deadline for submission of tender documents is May 29.

AUTO, INSURANCE, MINISTRY OF FOREIGN AFFAIRS, TENDER, UKRAINE

In January-April 2024, TAS Insurance Group (Kyiv) collected UAH 1279.69 million in insurance premiums, which is 47.2% more than in the first four months of last year.

According to the insurer’s website, motor hull insurance premiums amounted to 19.24% of the total or UAH 246.18 million, which is 30.2% higher than the corresponding figure for January-April 2023, MTPL premiums – 30.79% or UAH 393.98 million (+35%), Green Card – 31% or UAH 396.59 million (2.04 times).

In January-April, TAS Group collected UAH 116.7 million in premiums under voluntary health insurance contracts, which is 9.12% of the total premiums and 12.7% higher than the corresponding figure for the same period last year.

In turn, property insurance contracts attracted UAH 28.68 million of insurance premiums, which is 34.7% more than in the same period last year.

Under other insurance contracts for the four months of 2024, the company collected UAH 97.56 million in payments, an increase of 40.4%.

DTEK Energy’s machine builders manufactured and repaired 553 units of mining equipment in January-April this year, including six new tunnelling and shearers.

“Machine builders also provided 355,000 spare parts and components to meet the needs of Ukrainian miners,” the energy holding said in a press release on Tuesday.

According to DTEK Energy CEO Ildar Saleev, the company’s main efforts are currently focused on restoring the damaged and destroyed thermal generation, which suffered the most from Russian attacks on the power grid in the spring of this year.

“The next winter is a real challenge for all power engineers, as the power system has lost more than 8 GW of capacity due to Russia’s recent massive attacks. The volumes are enormous. And despite a significant drop in coal consumption by our thermal power plants, we are doing everything possible to maintain last year’s production volumes,” Saleev said in a press release.

As reported, in 2023, the company’s investments in Ukrainian coal mining amounted to about UAH 7 billion, which is almost twice as much as in 2022.

“DTEK Energy provides a closed cycle of electricity generation from coal. As of January 2022, the company’s installed capacity in thermal generation amounted to 13.3 GW. The company has established a full production cycle in coal mining: coal mining and enrichment, mechanical engineering and maintenance of mine equipment.

Currently, more than 50% of DTEK’s thermal generation capacity has been destroyed as a result of Russian attacks.

A heat wave in Pakistan has triggered temporary school closures and power problems, the Associated Press reported Tuesday.

“The debilitating heat wave will continue this month,” said Zaheer Ahmed Babar, a senior member of Pakistan’s Meteorological Department. Temperatures could exceed the monthly norm by six degrees Celsius, he said. It will exceed 40 degrees Celsius in many parts of the country this week.

In Punjab, the country’s most populous province, all schools will not be open this week because of the heat wave, and about 18 million students will stay at home. Some parts of the country are experiencing hours-long power cuts.

On Monday, it was reported that the abnormal heat wave is also observed in neighboring India. In Delhi and areas adjacent to the Indian capital, temperatures have exceeded the 47 degrees Celsius mark in the last 24 hours. Authorities have declared a red, maximum, level of weather danger in the capital, as well as in the states of Rajasthan, Punjab, Uttar Pradesh and Haryana, where the previous day the temperature ranged from 43 to 46 degrees Celsius.

The heat wave is expected to continue in India for at least five more days.

Kharkiv Regional Council at the session on Tuesday amended the complex program “Development of local self-government in Kharkiv region for 2022-2024”, according to which 60 million UAH will be directed to help the AFU and other Defense Forces.

“Funds previously allocated for community projects within the framework of regional competitions “Effective Medicine in Society” and “Together in the Future” will go to support the security and defense forces of Ukraine”, – wrote the head of the Kharkiv Regional Council Tatyana Egorova-Lutsenko in her Telegram channel.