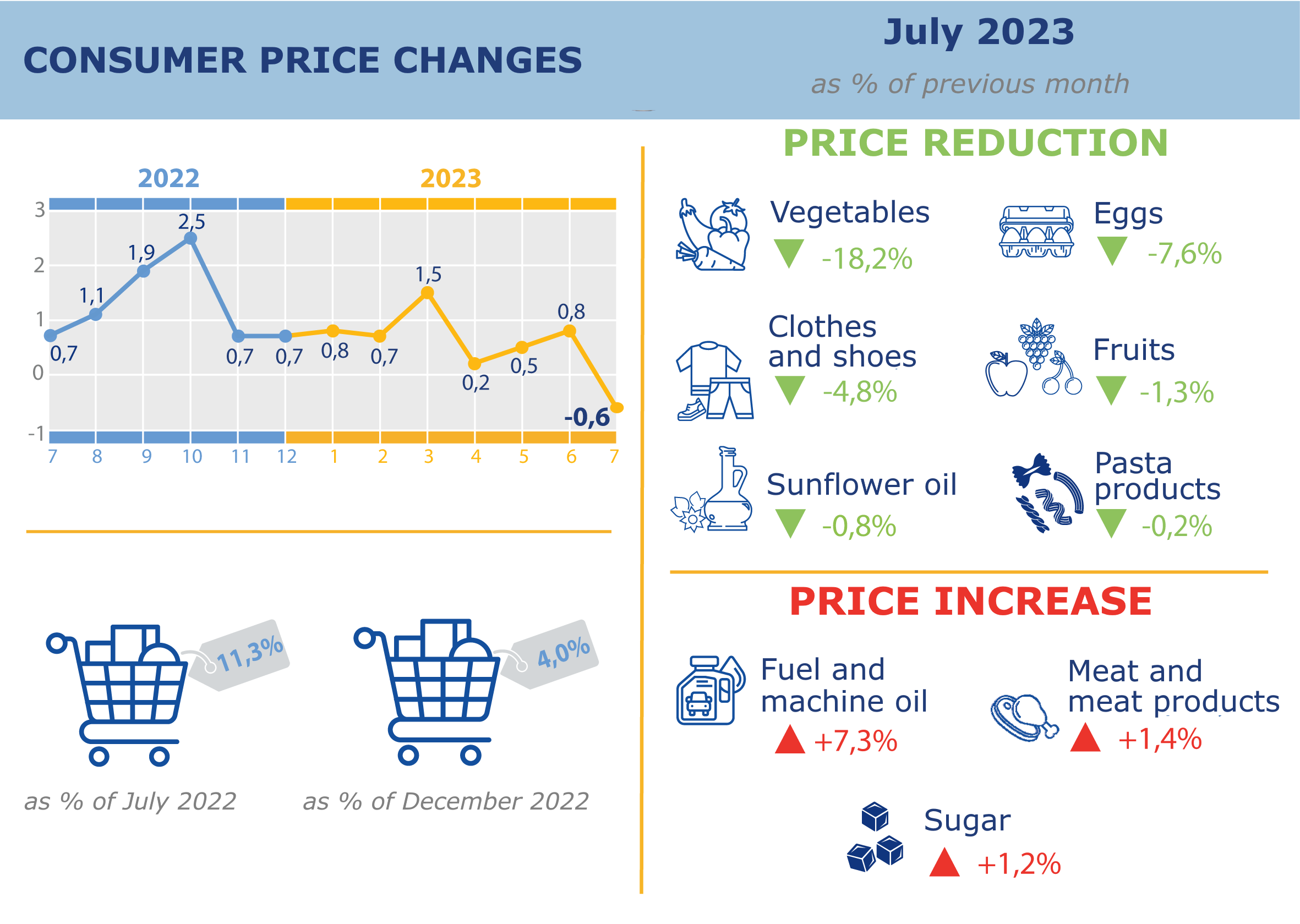

Change in consumer prices in July 2023

Source: Open4Business.com.ua and experts.news

Passengers have bought 183,500 bags of Gemini tea worth over UAH 3.6 million on Ukrzaliznytsia (UZ) trains, of which UAH 1 million will be used to purchase Ukrainian FPV drones Hrom, Minister of Digital Transformation Mykhailo Fedorov said on his Telegram account.

“Everyone who travels by train can help the Defense Forces. To do this, you need to buy Gemini tea. Part of the funds from each bag will be used to buy drones for the military,” the minister emphasized.

UZ noted that such tea can be ordered in the app, chatbot, or on the website, as well as directly on the train (except for Intercity+). The cost of the drink is UAH 20, of which UAH 5.5 from each bag goes to raise funds that will be transferred through the UNITED24 platform for the purchase of Ukrainian-made FPV copters “Thunder”. The cost of one such drone is UAH 21 thousand.

Farmers with more than 1,500 hectares of winter crops can insure their crops against war risks with a limit of indemnity from UAH 500 thousand to UAH 2 million in INGO Insurance Company until December 15, the company said in a statement.

“In the world practice, war risks are always included in the list of standard exclusions, and losses are not compensated,” the press release quotes INGO’s Director of Corporate Insurance Serhiy Krivosheev as saying. – “However, now in Ukraine we are ready to revise the rules to create more opportunities for farmers. We understand that not only the economic condition of the agricultural sector, but also many others depend on their success.”

Thus, INGO Insurance Company has expanded its standard winter crops insurance program, which provides protection against negative weather factors (extremely low temperature, ice crust, damping, drought, etc.), to include coverage of crop damage risks resulting from events that were a direct or indirect consequence of military operations.

The company assumes that this will “help agricultural enterprises maintain financial stability.”

It is noted that only winter crops of more than 1500 hectares, which are grown industrially and are located in the unoccupied territory or no closer than 50 km from the combat zone or the state border with Belarus and Russia, can be insured against military risks.

In the event of an insured event, INGO will compensate for the costs of sowing and growing crops damaged or destroyed as a result of military operations, including maneuvers, movement of equipment, construction of defensive structures, and demining costs.

“The company assumes reimbursement of such costs depending on the volume of insured crops with a limit of UAH 500 to 2 million,” the statement said.

According to it, the settlement of insured events for further compensation is carried out according to the standard procedure within 15 days from the date of submission of the necessary documents. A document confirming the fact of occurrence of such an event under military risks should be obtained from the military-civilian administration, the State Emergency Service or the National Police.

INGO Insurance Company has 30 years of experience in the market. Since 2017, the company’s main shareholder has been the Ukrainian business group DCH of Alexander Yaroslavsky.

The company holds 29 licenses for various types of compulsory and voluntary insurance, provides insurance services to corporate and retail clients, and is a full member of the Motor (Transport) Insurance Bureau of Ukraine (MTIBU).

According to the National Bank, as of the middle of this year, INGO Insurance Company was the eighth largest in the market in terms of assets (UAH 3.28 billion). Its net earned insurance premiums for the first half of the year amounted to UAH 971.4 million, insurance payments and reimbursements – UAH 545.6 million, net profit – UAH 152.0 million.

Croatian Prime Minister Andrej Plenkovic said he does not intend to allow Ukrainian grain to enter the country’s domestic market, Politico reported on Tuesday.

“Croatia’s position and desire is that we are a transit country, not a country that will receive a huge amount of Ukrainian grain, which is cheaper than ours,” Plenkovic said.

According to him, imports of such products would lead to the fact that “our farmers would be in trouble.”

On September 15, the European Commission announced the termination of restrictive measures on the export of Ukrainian grain and other food products to the EU. Later, the authorities of Poland, Hungary, and Slovakia announced their own bans.

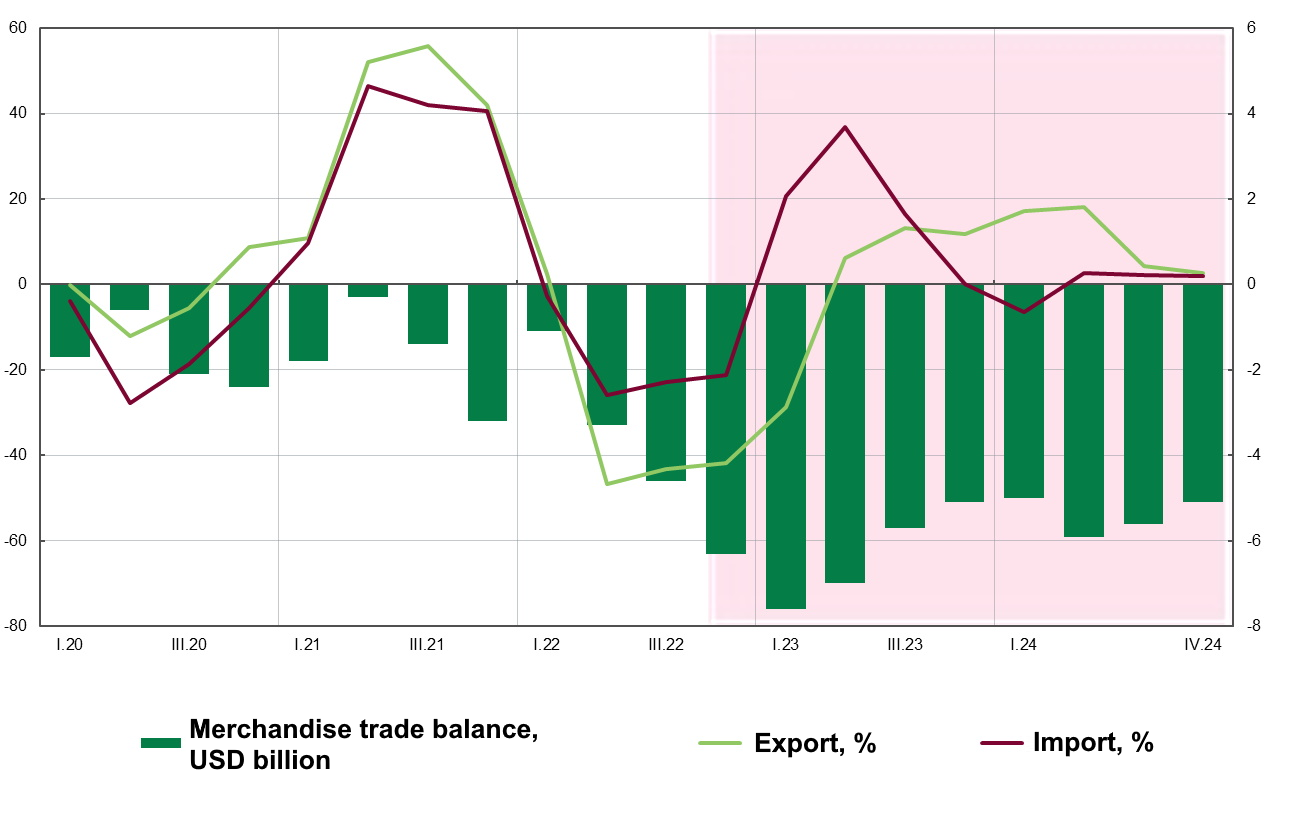

2022-2024 goods trade balance forecast (USD bln)

Source: Open4Business.com.ua and experts.news

South Korea will send two K600 Rhino mine-clearing vehicles of its own production to Ukraine, the Korean daily Chosun Ilbo reported on Friday.

“The Rhino is a domestic minesweeper that either clears the rear or clears paths through a minefield on the front line. Although it is not a lethal weapon, it is the most military equipment that South Korea has sent to Ukraine so far,” the statement said.

During a bilateral meeting at the G7 summit in Hiroshima, Japan, in May, South Korean President Yun Sook-yeol promised Ukrainian President Volodymyr Zelenskyy to send non-lethal equipment and provide assistance in post-war reconstruction. During a visit to Ukraine in July, Yun reiterated his promise to send more mine detectors and land minesweepers.

“Recently, the government decided to send two minesweepers to Ukraine as soon as possible, in addition to the previously delivered batch of used minesweepers… This follows an urgent request and promise from President Yun Seok-yol to support Ukraine,” a government source told the newspaper on Sunday.

The government made the decision after North Korean leader Kim Jong Un met with Russian President Vladimir Putin, during which the two sides are believed to have signed arms deals.

At the same time, fearing Russia’s reaction, the South Korean government will ask Ukraine to use the vehicles only for humanitarian operations, the report said.