JSC “Ukrzaliznytsia” (UZ) in January-August transported 10.5% less cargo than in the same period last year – 94.9 million tons, deputy director of the department of commercial work of “UZ” Valery Tkachev said at a meeting of the Export Office on Wednesday.

At the same time in August the volume of transportation amounted to 12.3 million tons, which is 13.8% more than in August last year.

Tkachev noted that the said reduction in the volume of cargo transportation for the first eight months of this year was mainly due to a decrease in the volume of their transportation in the export direction: in January-August it decreased by 14.8% compared to the same period last year, to 34.8 million tons.

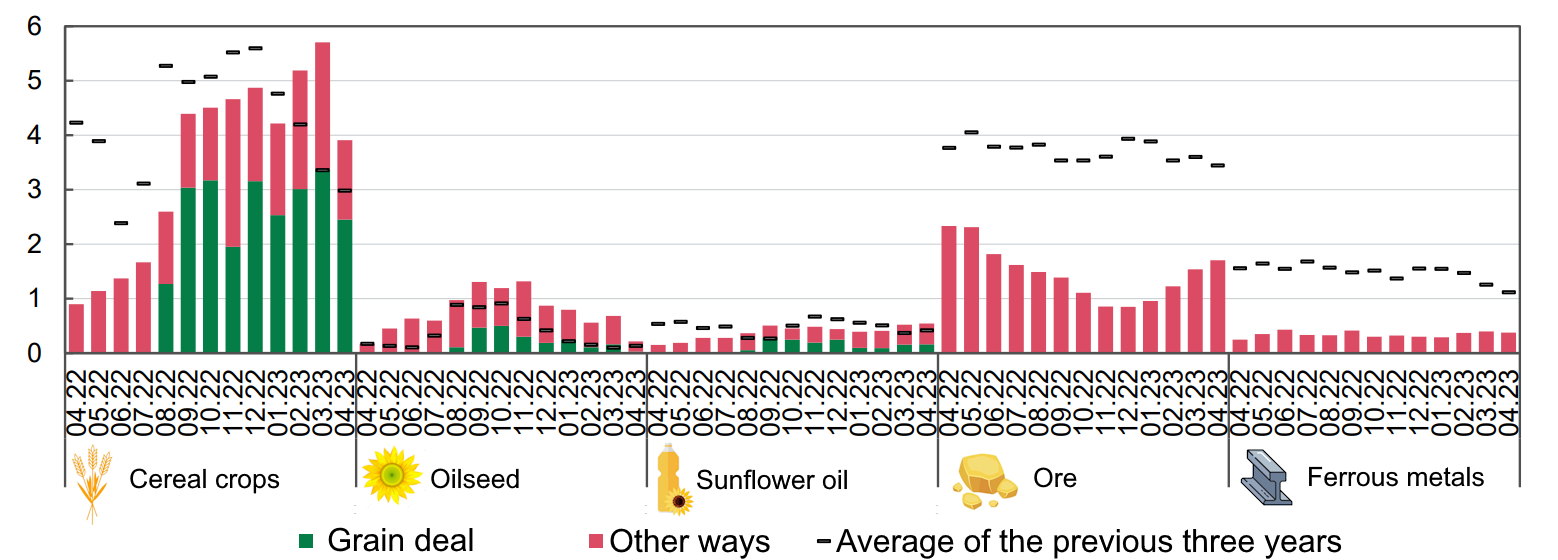

“The situation with transportation in the export direction is not very good. Last month we transported only 3.3 million tons of cargo in export traffic. The reason is the closure of the “grain corridor” and the introduction of restrictions on the western border regarding the acceptance of grain. Therefore, unfortunately, our export transportation has decreased. The best indicator was in September (2022), when we transported 5.2 million tons in export traffic. But now, due to the decline in grain transportation, we have the current indicators,” Tkachev said during the meeting.

According to him, as a result of the decline in grain cargo exports, there have been changes in the structure of transportation – iron ore has taken the first place.

“The first place in transportation in export traffic is occupied by iron and manganese ore – 42% of the total volume. Grain takes the second position – 27%, in the third place ferrous metals – 11%”, – said the deputy director of the department of commercial work of “UZ”.

Thus, in January-August the volume of ore transportation amounted to 11.49 million tons, which is 38.3% less compared to the same period last year. The volume of ferrous metals transportation in export traffic decreased by 29.7%, to 3.03 million tons, oil increased by 21%, to 826 thousand tons, building materials fell by 47.5%, to 1.036 million tons, cement increased by 37.4%, to 791 thousand tons.

The volume of grain cargo exports in August amounted to 876 thousand tons, which is 8.8% more than in July. Of this volume, 358 thousand tons of corn, 225 thousand tons of wheat, 235 thousand tons of industrial seeds and 58 thousand tons of other seeds were transported. In the direction of sea ports 143 thousand tons were transported, through land border crossings 733 thousand tons, which is 8.8% more than in July.

For eight months, the volume of grain transportation amounted to 14.75 million tons, which is 27.6% more compared to the same period last year. “Since June 29, the work of the Grain Corridor has been completely blocked. Massive strikes carried out by the aggressor in July-August on the Odessa region resulted in damage to the infrastructure of international and Ukrainian traders in Odessa and Danube ports. “In addition, since May 2, the European Commission has banned the supply of wheat, corn, rapeseed and sunflower seeds from Ukraine to five countries – Bulgaria, Hungary, Poland, Romania and Slovakia – until September 15, 2023,” UZ points out.

“It is pleasing that the volume of grain transportation in the direction of western land crossings began to grow. Already up to 500 railcars per day we transfer to the western BCPs. Let me remind you that in the best times we used to transfer 680 wagons per day and transported 1 million tons of grain across the western borders per month. After the restrictions, the volumes fell to 370-400 cars and 0.5 million tons of grain. Now the situation is normalizing,” – said Tkachev.

It is noted that the cargo flow through land crossings at the end of August amounted to 2.83 million tons, or 86% of the total export traffic by rail. Mostly cargoes went through Chop – 684 thousand tons, Uzhgorod – 396 thousand tons, Batievo – 241 thousand tons, Vadul-Siret – 206 thousand tons, Yagodin – 163 thousand tons. Seaports handled 476 thousand tons of cargo in August, or 14% of the total volume transported by UZ.

In “UZ” also specified that following the results of August seaports handled 476 thousand tons of cargoes, or 14% of the total volume of transportation by rail in the export direction. Of this volume, only Izmail ICC processed 433 thousand tons of cargo.

As of June this year, the share of illegal tobacco products in the total market in Ukraine amounted to 19.5%, slightly down from 20.2% in February, but the share of Duty Free labeled products even slightly increased to 10.9% from 10.8%, according to the latest study “Monitoring of the Illegal Trade in Tobacco Products in Ukraine” by Kantar Ukraine.

According to Kantar’s preliminary estimates, presented this week at a roundtable organized by the American Chamber of Commerce with the participation of representatives of the US and Japanese embassies, government officials, the Ukrtyutyun Association and business, the losses of the state budget in 2023 from the illegal tobacco market are estimated at more than UAH 21 billion.

It was noted that the share of counterfeit products remained significant in June – 6.9%, while in February it was estimated at 7.9%.

At the roundtable, KPMG also presented its research on the markets for illegal tobacco products in Ukraine, the EU, the UK, Norway, Switzerland and Moldova in 2022. According to the report, Ukraine is the second largest market for the consumption of illegal tobacco products in Europe, and budget losses amounted to almost UAH 26 billion.

The roundtable participants called for intensifying efforts to combat the illegal production and trafficking of tobacco products and establishing coordination between the competent authorities. In particular, as noted in the release of the American Chamber of Commerce, it is important to adopt the necessary amendments to the legislation on criminalization of tobacco smuggling, improve mechanisms for prosecution for actions related to the illegal production and trafficking of cigarettes, and create an effective system of control over the storage and destruction of confiscated products and equipment.

It is specified that the event was attended by the member companies of the Chamber’s special platform on hard excisable goods, which in 2022 paid over UAH 78 billion in taxes: “Philip Morris Ukraine, V.A.T.-Pryluky, J.T. International Company Ukraine, and Imperial Tobacco Ukraine.

As reported, in June 2020, Kantar estimated the share of the illegal tobacco market at only 5%, but by August 2022, it reached 21.9%. At the same time, smuggling decreased from 3% to 1.8%, while counterfeit products increased from 1% to 8%, and duty-free labeled products from 2% to 12.2%.

The Shevchenkivskyi District Court of Kyiv has changed the bail measure for Ihor Kolomoiskyi in the case of embezzlement of UAH 5.8 billion, setting it at UAH 3 billion 891 million, Suspilne reported on Friday evening.

Earlier it was reported that on the first suspicion Kolomoisky was granted bail in the amount of UAH 509 million, but yesterday Kolomoisky was informed of an additional suspicion of misappropriation of UAH 5.8 billion.

The Security Service of Ukraine (SBU), the Bureau of Economic Security (BES) and the Prosecutor General’s Office have uncovered new facts of criminal activity by the owner of a large financial and industrial group, Ihor Kolomoisky. Based on the SBU materials, Kolomoisky was served an additional notice of suspicion under the following articles of the Criminal Code of Ukraine

– Part 3 of Art. 27, Part 3 of Art. 28, Part 2 of Art. 200 (illegal actions with documents for transferring payment cards and other means of access to bank accounts, electronic money, equipment for their production)

– Art. 27(3), Art. 191(5) (misappropriation of property by abuse of office committed by an organized group on a particularly large scale);

– Part 3 of Art. 27, Part 3 of Art. 209 (legalization of the proceeds of crime).

According to the investigation, in the period from 2013 to 2014. Kolomoisky illegally seized UAH 5.8 billion. To do this, he created a criminal group consisting of employees of the bank in which he was a founder and shareholder.

During this period, members of this group allowed Kolomoisky to allegedly make systematic fictitious “cash deposits to the bank’s cash desk”, although in fact the bank did not receive any deposits.

According to the investigation, in total, this scheme allowed the defendant to receive UAH 5.8 billion, which was equivalent to more than $700 million at the time.

These fake “contributions” were then credited to Kolomoisky’s personal account and became real non-cash funds.

To legalize the virtual assets, Kolomoisky paid with them in his business activities. In particular, he gave them as loans and used them to pay off loans to companies under his control, withdrew them abroad, cashed them out and withdrew them from bank branches.

The pre-trial investigation is ongoing.

A set of measures is being taken to establish all the circumstances of the illegal activity and bring the perpetrators to justice.

Exports of major commodities in 2022-2023, million tonnes

Source: Open4Business.com.ua and experts.news

In January-June this year, payment systems transferred $1.306 billion to Ukraine, with Western Union (USA) receiving the largest amount of funds – 48.6% of all transfers, the National Bank of Ukraine reported on Friday.

According to the report, MoneyGram (USA) took the second place in the market, increasing its share by 4.3 percentage points to 21.6% compared to May-December last year and overtaking PrivatMoney, whose share dropped from 20% to 13.5%.

In addition, the share of RIAs increased from 9.7% to 12.35%, and the share of Intelexpress increased from 2.7% to 3.04%.

According to the National Bank, a total of 5.72 million cross-border transfers were made, with the largest amount of funds coming to Ukraine from Italy (20.85%), the United States (17.74%), Israel (15.59%), Germany (8.61%) and Ireland (5.2%). The average amount of one such transfer to Ukraine was $228.

In May-December last year, 10.4 million transfers were made for $2.149 billion, with Western Union’s share at that time amounting to 49.5%, the NBU reminded.

The NovaPay payment system remained the leader in domestic money transfers in terms of systems, but the share of transfers made through it decreased from 45% in May-December 2022 to 35% in the first half of this year.

The Financial World system of Ukrainian Payment System LLC came in second place with a share of 15.6% (12.72% in 2022), while the LEO payment system, which held the top spot last year, had its registration revoked by the National Bank in March of this year.

The Moneycom payment system of Swift Guarantor LLC rose from 7th place in the ranking in May-December 2022 (2.51%) to the top three in the first half of 2023 with a share of 12.4%.

The positions in the ranking of the next three market participants have not changed: Ukrposhta is in fourth place in terms of the amount of transfers – 10.3% (12.22%), City 24 FC Phoenix – 7.93% (3.39%) and PrivatMoney PrivatBank – 5.65% (2.61%), followed by Platiservice – 5.15% (1.74%).

In terms of participants in the first half of the year, the share of NovaPay decreased to 35.58% (45.46%), Ukrposhta – to 10.29% (12.22%), while FC “Kontraktovyi Dom” increased to 13.26% (9.92%), and “Swift Guarantor” – to 18.71% (3.79%). The National Bank reminded that in early March it withdrew from the market Aibox Bank, which held 11.57% of the market in May-December last year.

According to the NBU, 390.2 million domestic transfers amounting to UAH 300.6 billion (or $8.221 billion in equivalent) were made in the first half of the year, with the average amount of one transfer within Ukraine amounting to UAH 770.

In May-December last year, transfers amounted to 446.35 million for UAH 292.6 billion.

It is noted that as of July 1 of this year, 35 money transfer systems were operating in the country, including 26 resident and 9 non-resident ones.

Zaporozhogneupor, Ukraine’s largest refractory products manufacturer and part of Metinvest Group, has put a modern overhead crane into operation.

According to the company’s press release, the modern lifting unit manufactured in Zaporizhzhia was put into operation at the finished goods warehouse of Zaporozhogneupor’s aluminosilicate shop. After static and dynamic tests, which confirmed the full compliance of the overhead crane with all requirements, it was put into operation.

Zaporozhogneupor spent approximately UAH 3 million to purchase the new crane. It is specified that the modern crane will significantly reduce the risk of damage to finished products.

“Zaporozhogneupor is Ukraine’s largest enterprise producing high-quality refractory products and materials. The company produces chamotte, mullite, mullite-silica, mullite-corundum, periclase, periclase-chromite products, silicon carbide electric heaters, and unmolded refractory materials. The company’s products are widely used in Ukraine, as well as in the CIS, Europe, Asia and Africa.