In 2022/2023 marketing year, Ukraine increased the production and export of sunflower oil by 25.4% compared to 2021/2022 MY, the press service of the association Ukroliyaprom reports.

“One of the main peculiarities of 2022/23 MY was the significant increase of sunflower seed processing at the domestic facilities starting from 2023, after the ban of its import by some EU countries. This allowed to significantly increase the processing of sunflower seeds within the country and, accordingly, the production of oil and its export by 25.4%, sunflower meal – by 27.3% compared to 2021/22 MY,” the company said in the report.

According to the report, the export of sunflower seeds decreased by 58% in the first eight months of 2023 compared to the same period of 2022. This made it possible to significantly increase its processing at domestic facilities and, accordingly, the production and export of high value-added products.

In 2022/23 MY, the production and export of soybean oil increased by 18%, and soybean meal – by 19.4%.

These figures could have been higher if soybean processing in the country had increased, especially given that exports of soybean products are mainly carried out by road and rail, the association noted.

In addition, in 2023, Ukraine increased the processing of rapeseed, as evidenced by the increase in exports of rapeseed oil in July-August this year by more than 20 times compared to the corresponding period in 2022.

“Ukroliyaprom forecasts that in 2023/2024 MY Ukraine’s production of main types of oilseeds will increase by 18.8%. This will be due to the expansion of production areas by 12.1% and an average yield increase of 5.7%, which was facilitated by favorable weather conditions. The largest increase in production is expected for sunflower seeds – by 15%.

As reported, Ukroliyaprom expects that in the season 2023/2024, Ukraine can produce up to 5 million tons of sunflower oil, while exports can reach 4.7 million tons.

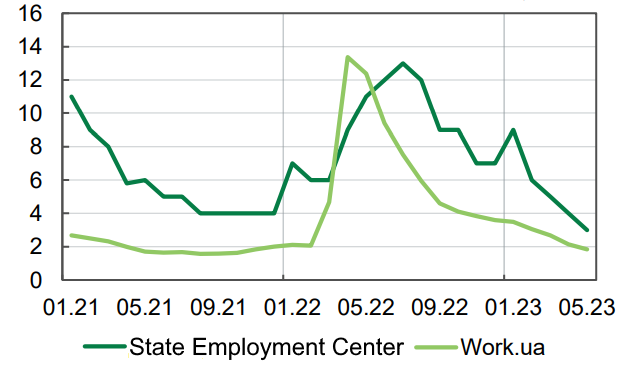

Number of applicants per vacancy (comparison) as of 01.06.2023

Source: Open4Business.com.ua and experts.news

The Minister of Finance of Ukraine Sergii Marchenko has expressed concern about the strengthening of the hryvnia and expects the exchange rate to weaken to 41.4 UAH/$1.

“We are concerned about the strengthening of the hryvnia… For the next year, we expect the exchange rate to be 41.4 UAH/$1,” he said at the European Business Association’s “EBA Global Outlook: Ukraine’s New Economy” in Kyiv on Monday.

The minister clarified that he was referring to the forecast of the Ministry of Economy and other authorized structures, which the Ministry of Finance is guided by.

Marchenko told reporters that it was an average annual rate.

Speaking about concerns about the strengthening of the hryvnia, the Finance Minister emphasized that “there are no fundamental factors for this.” According to him, this is a disadvantage for export-oriented businesses and the country’s economy in general. Marchenko added that “exports are not growing at all,” while the situation with imports is the opposite.

At the same time, the minister clarified that he is not in favor of any sharp devaluation.

The National Bank has kept the official hryvnia exchange rate fixed at 36.57 UAH/$1 since the end of July 2022. On the cash market, the exchange rate has stabilized at around 38 UAH/$1 this year, while last year it was falling to 39 UAH/$1 and even more.

In a September survey, members of the European Business Association predicted an average annual exchange rate of 41 UAH/$1 for 2024, while a year ago they expected 43 UAH/$1 for 2023.

South Korea will provide Ukraine with $2.3 billion for post-war reconstruction: an initial $300 million in 2024 in humanitarian aid and the rest in low-interest loans from 2025, South Korean President Yun Suk-yeol said, South Korea’s Yonhap news agency wrote.

“South Korean President Yun Suk-yeol on Sunday pledged to provide Ukraine with an additional $2.3 billion to help the country restore peace and recover from its war with Russia. Yoon announced the pledge during a session at the G20 summit in New Delhi, saying South Korea will provide an initial $300 million in 2024 in humanitarian aid and the remaining $2 billion in long-term aid – low-interest loans through the Economic Development and Cooperation Fund (EDCF) starting in 2025,” the agency said.

“This will demonstrate our responsible role as a global pivot power in leading assistance to restore peace in Ukraine and lay the foundation for our full participation in Ukraine’s reconstruction,” Yoon Seok-yeol said.

As previously reported, Seoul earlier increased the amount of financial assistance to Ukraine under the state budget to $393 million in 2024.

NAEK Energoatom and the US-based Westinghouse have signed a memorandum of understanding and cooperation on the introduction of SMR 300 small modular reactors in Ukraine, an Interfax-Ukraine correspondent reports.

According to Westinghouse President Patrick Fragman, the SMR 300 will be a good complement to the larger capacity AP 1000 reactors.

Similar memorandums have already been signed by Westinghouse with Slovakia and Finland.

NAEK and Westinghouse also signed a memorandum to extend the exclusivity period of cooperation for the construction of AP1000 units in Ukraine.

“Certain equipment for the construction of AP1000 in Ukraine has already been manufactured in the United States and thus we will accelerate the process of delivery and construction of the unit,” he specified.