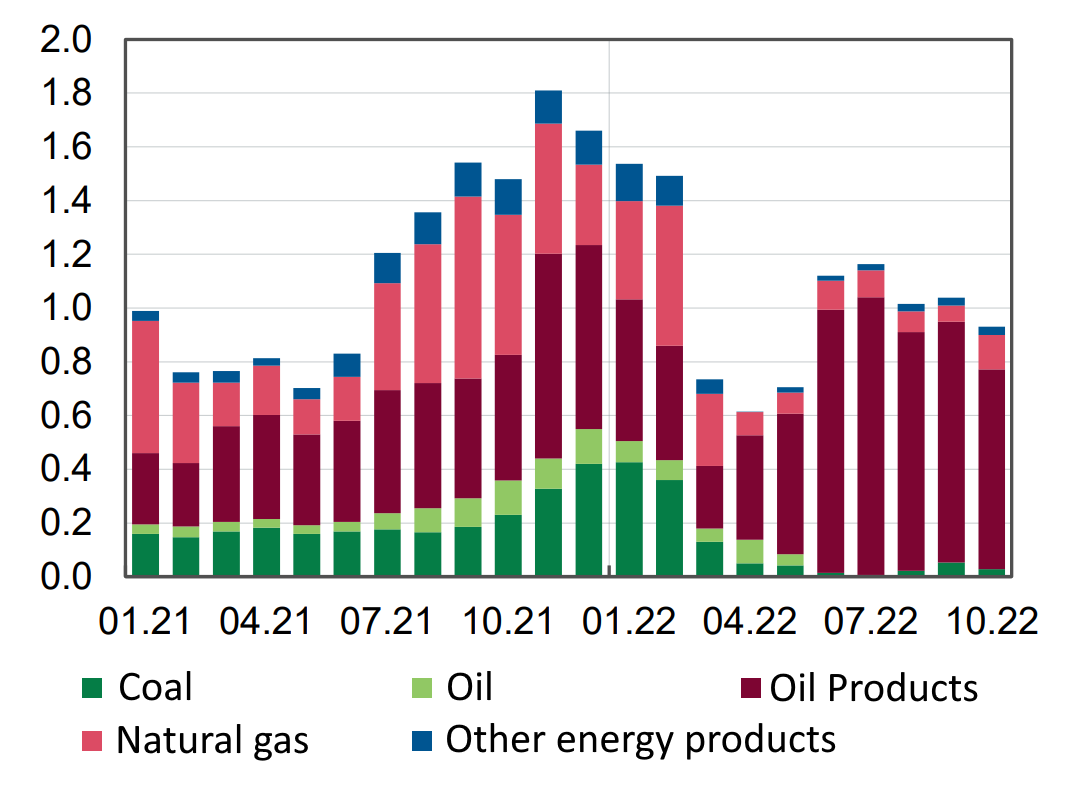

Energy imports to Ukraine in 2021-2022

Source: Open4Business.com.ua and experts.news

Fiona MacAulay, a non-executive director of British mining company Ferrexpo plc with assets in Ukraine, due to her appointment as also a non-executive director of Dowlais Group Plc, which became a public company, will leave the group after the 2023 annual shareholders meeting scheduled for May 2.

“Pursuant to Listing Rule 9.6.14R(2), Ferrexpo plc (LSE: FXPO) makes the following notice with respect to Fiona McAuley, senior independent director and non-executive director of the company. In connection with her current appointment as a non-executive director of Dowlais Group Plc, Ms. McAuley has informed the company that Dowlais Group Plc has become a publicly listed company on the London Stock Exchange effective April 20, 2023,” Ferrexpo stated in an announcement on the London Stock Exchange Thursday.

As stated in Ferrexpo’s 2023 annual general meeting notice, Fiona McAuley will step down as non-executive chairman and chairman of the compensation committee following the 2023 annual general meeting scheduled for May 2, 2023.

Earlier, Ferrexpo’s independent non-executive director, Ann-Christin Andersen, declined to run for the company’s next board of directors in May 2023.

“Independent non-executive director Ann-Christin Andersen has notified the board that she will not run for re-election at the company’s next annual general meeting in May 2023,” Ferrexpo’s annual report reported.

Ferrexpo is an iron ore company with assets in Ukraine.

Ferrexpo owns 100% of Yeristovsky GOK LLC and 99.9% of Belanovsky GOK LLC. Before the court ruling in September 2022, Ferrexpo also owned 100% of Poltava Mining and Processing Division PJSC.

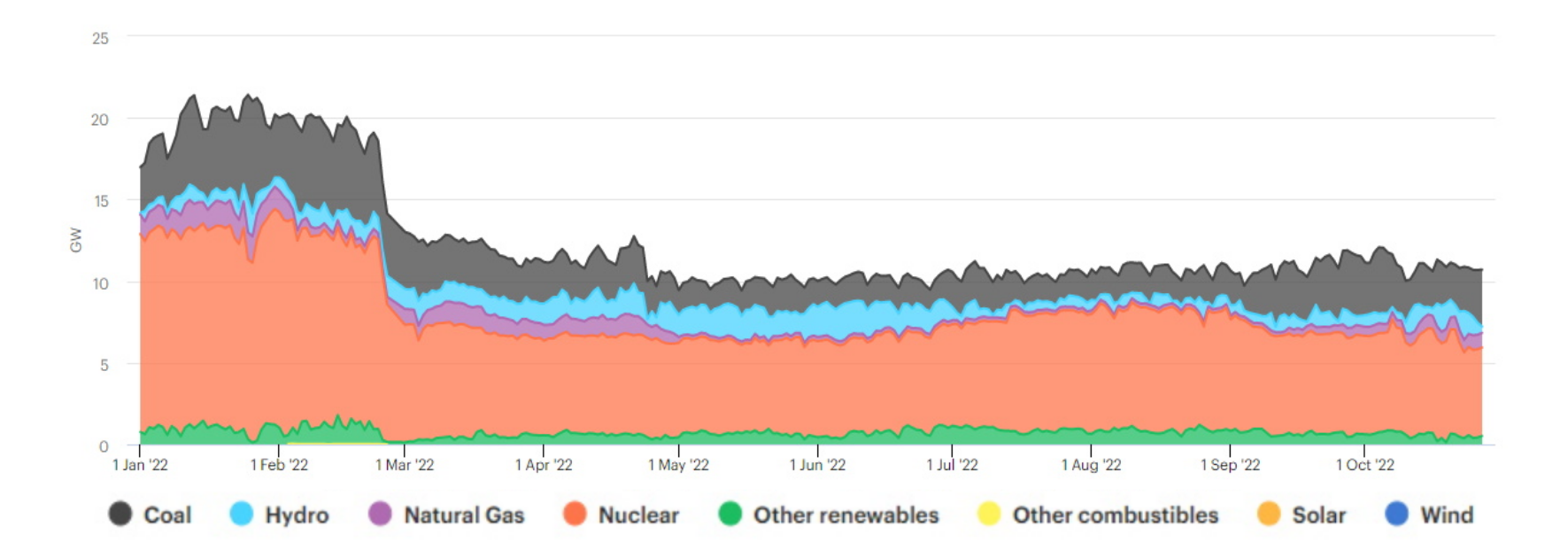

Generation distribution in power system of Ukraine in 2022

Source: Open4Business.com.ua and experts.news

The Lithuanian government may help Ukraine export up to 1 million tons of grain by rail after Poland temporarily banned grain imports from Ukraine, said Lithuanian Economy and Innovation Minister Ausrini Armonaitė.

“The port of Klaipeda and Lithuanian Railways can play an important role in creating momentum to help Poland resolve the situation and guarantee grain exports outside the EU. Lithuania could help safely transport up to 1 million tons of grain from Ukraine by rail. This would be a real solution for Ukraine and a benefit for Poland,” Verslo zinios quoted the minister as saying.

In turn, the president of the Association of Lithuanian Sea Cargo Companies Vaidotas Shileyko noted that the port of Klaipeda is able to process more than 1 million tons of grain a year, but because of the difficult logistics, it is impossible to import more.

“Lithuanian railroads started transporting small volumes of Ukrainian grain through Poland to the port of Klaipeda last May. The main problem here is different railway gauges: Ukraine and Lithuania still use Russian gauges, while Poland uses European ones, which means that rolling stock has to be changed at the border,” he explained.

European stock indexes declined on Thursday for the second day in a row as investors assessed statistical data and company reports.

The Stoxx Europe 600 composite index of the region’s biggest companies was down 0.37% at 1:02 p.m., trading at 466.41 points.

The French CAC 40 was down 0.4% during the session, the British FTSE 100 – 0.2%, the German DAX – 0.7%, the Italian FTSE MIB – 0.9% and the Spanish IBEX 35 – 0.5%.

The index of business confidence in the French economy in April fell to 101 points from 104 points the previous month, said the national statistics office Insee. This is the lowest level in the last five months. The result was worse than analysts’ average forecast of 103 points.

Renault SA share price collapsed by more than 7%. The French carmaker boosted revenue in the first quarter by 30% year-over-year, while exceeding forecasts. However, the company said it continues to face logistical difficulties.

German carmakers are also down, including Porsche down 3.4%, Volkswagen down 2.8%, Bayerische Motoren Werke AG down 2.7% and Mercedes-Benz down 2.6%.

Stellantis shares dropped 5% on news of the unexpected resignation of its chief financial officer Richard Palmer, who will be replaced by Natalie Knight, according to Trading Economics.

In addition, securities of Pirelli & Co. and Ferrari are becoming cheaper – by 1.7% and 2.2%, respectively.

Britain’s Deliveroo Plc, a food delivery service operator, increased its revenue by 7% in the first quarter and confirmed its outlook for the current year. Nevertheless, the stock is down 0.6% as the number of orders and monthly number of active customers fell.

Finnish telecommunications equipment maker Nokia Corp. boosted revenue 9.6% in the first quarter, but net income was worse than the consensus forecast. The company’s market value is down 6.3 percent.

Autoliv, a Swedish-American maker of safety systems for cars, said it will build an airbag factory in Vietnam that will be operational by the end of 2025. The company’s stock is down 0.4%.

Following the fall in oil prices, securities of oil companies, including TotalEnergies – by 0.5%, BP Plc – 0.9%, Shell – 0.7%.

Meanwhile, the capitalization of the Swedish Volvo AB grows by 1.7%. In January-March, the car concern recorded a record for the first quarter deliveries of trucks and its order book grew by 32%.

Shares of French L’Oreal SA are up 0.3%. Growth in comparable sales of one of the world’s largest cosmetics manufacturers in the past quarter exceeded analysts’ expectations.

Italian oilfield services company Saipem SpA is up 2.1 percent, also thanks to good quarterly reports.

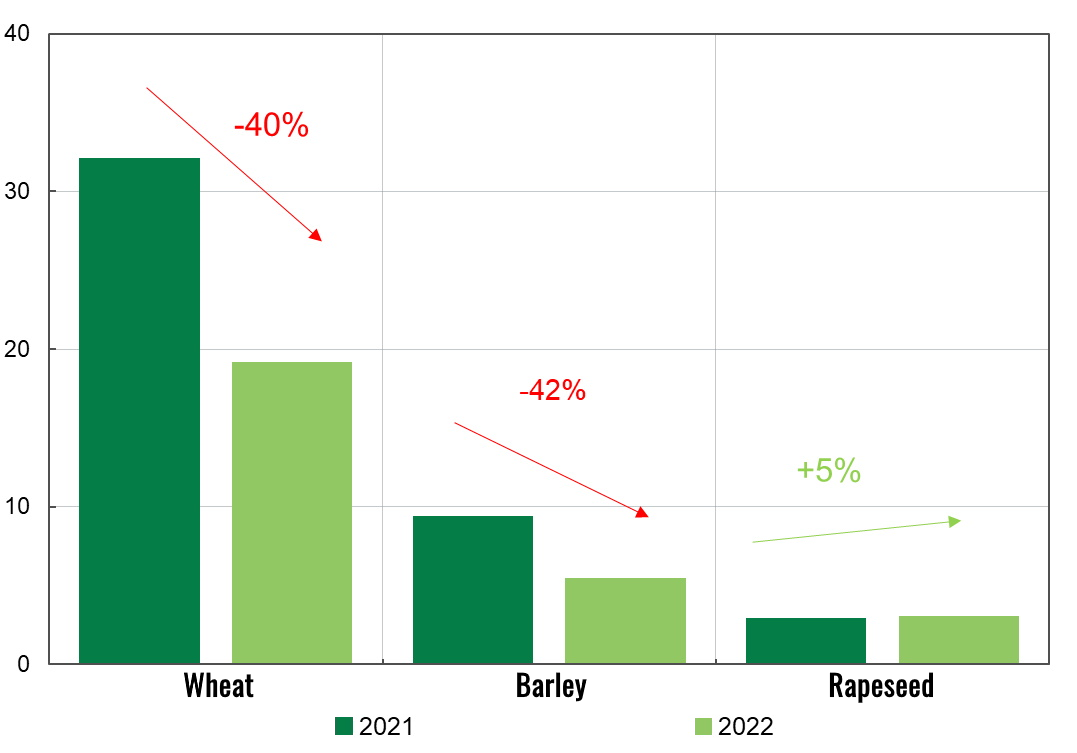

Yield of main crop crops in 2021-2022 (million tons)

Source: Open4Business.com.ua and experts.news