A petition on the website of Kiev City Council urging to reduce curfew in Kiev and set it from 00:00 to 5:00 has collected the necessary 6 thousand votes for consideration.

According to the petition platform on the website of the Kiev City Council, this petition was filed on January 23 and as of March 8 had collected the necessary 6 thousand votes for consideration.

“Reduce the curfew from 00:00 to 5:00. Since most wage earners have no way to get home on time, or extend public transportation,” the text of the petition reads.

As of today, the curfew in Kiev lasts from 23:00 to 5:00 every day.

The petition must be considered by the responsible persons within ten working days from the date of publication of the information about the beginning of its consideration and, if possible, executed.

Guided by the legal requirements and taking into account the proposal of the Deposit Guarantee Fund (FGVFL), the National Bank of Ukraine adopted its decision #90 of March 7 to withdraw the banking license and liquidate JSC Bank Forward starting March 8, 2023.

In a Wednesday press release, the NBU reminded that its board had decided on Feb. 7 to categorize Forward Bank as insolvent due to its failure to bring its activities into compliance with Ukrainian legislation, including the regulations of the National Bank, after categorizing it as a problem bank.

From March, 1 FGVFL started paying out the guaranteed compensations to the depositors of the bank “Forward” according to the contracts, which term expired till February, 7, 2023 and the contracts of bank settlement. The first part of the general register of depositors includes information on more than 48 thousand accounts with a total guaranteed amount of almost 326 million UAH.

The ultimate beneficial owner of the bank is Russian citizen Rustam Tariko. The Decree of the President of Ukraine in October 2022 enacted a decision of the National Security and Defence Council of Ukraine, which imposed personal sanctions on Tariko.

According to the NBU, as of January 1, 2023, the bank ranked 46th by assets (UAH 2.36 billion) out of 67 then-existing banks.

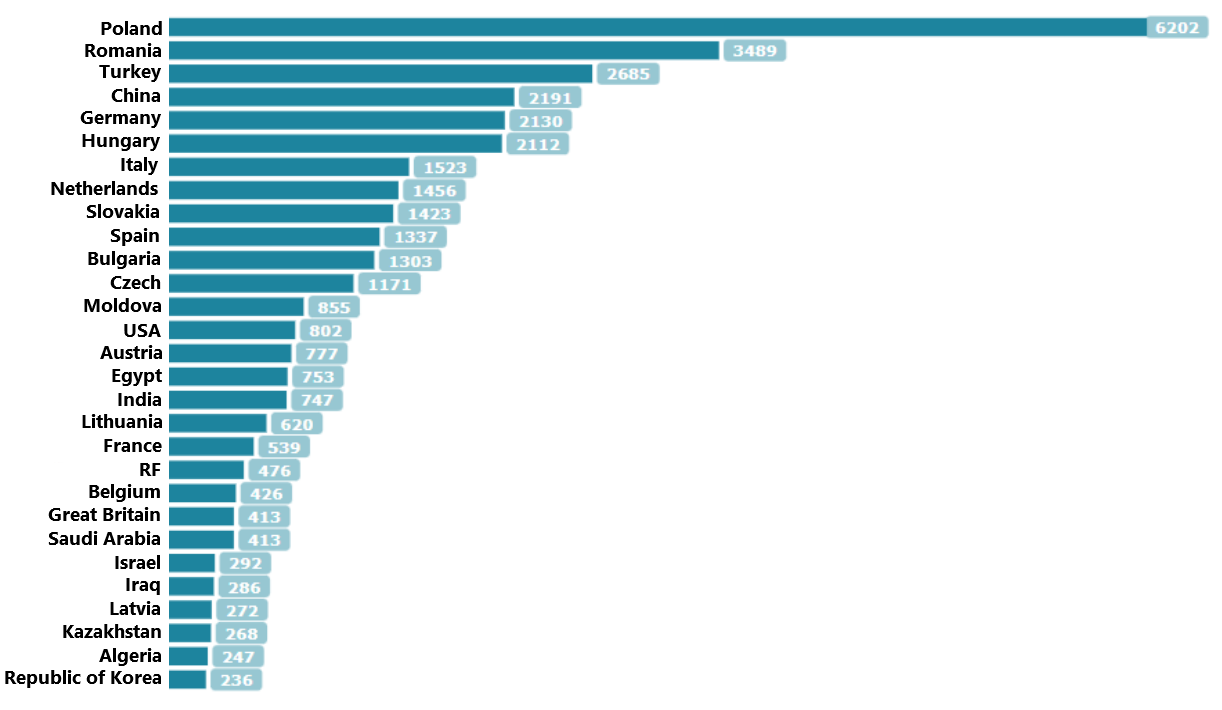

Export of Ukraine by countries in Jan-Nov 2022

Source: Open4Business.com.ua and experts.news

The Board of the National Bank of Ukraine has decided to revoke the banking license and liquidate Ayboks Bank, the 37th largest bank in terms of assets out of 66 Ukrainian banks, starting from March 7, 2023, due to a number of violations, including assistance in holding a sports poker tournament and insufficient financial monitoring of clients even after the regulator’s warning.

“The share of the financial institution amounted to 0.1% of the assets of solvent banks, so its withdrawal from the market will not affect the stability of the Ukrainian banking sector,” the NBU said in a statement on its website.

In particular, during the on-site supervision, the regulator found that seven legal entities, for which the bank has established a high level of risk, received funds for the provision of services through the payment acceptance point, in particular for organizing and holding esports and sports poker tournaments, in the total amount of more than UAH 3.5 billion from February 21 to December 1, 2022.

The NBU pointed out that the clients were newly established and only started carrying out relevant activities in 2022, their websites were launched a few days later or on the day of establishing relations with the bank, there were no expenses/information on the clients’ advertising activities to attract tournament participants, but the volume of transactions in the first days amounted to millions of hryvnias.

In addition, the clients had signs of being related to each other, but Ayboks Bank did not detect them, and identified the risk criteria only partially, generally failing to take the necessary enhanced due diligence measures.

“According to the information provided by the Commission for Regulation of Gambling and Lotteries, as well as the Federation of Esports of Ukraine, which has the status of a national sports federation in the sport of esports, the clients’ activities include all elements of organizing and conducting gambling, in particular poker, on the Internet and/or bookmaking activities,” the NBU said.

The regulator also reminded that it has already fined Ayboks Bank UAH 10 million for violating the requirements of the legislation in the field of prevention and counteraction to legalization (laundering) of proceeds from crime, terrorist financing and financing of the proliferation of weapons of mass destruction, but these violations continued. In addition, the NBU has twice suspended certain types of transactions conducted by the bank and removed a bank official from office.

The NBU assured that each depositor of the bank will receive compensation from the Deposit Guarantee Fund in the full amount of the deposit, including interest accrued as of the end of the day preceding the day of the start of the bank’s withdrawal from the market.

As reported, in early February, Deputy Chairman of the Verkhovna Rada Committee on Finance, Taxation and Customs Policy Yaroslav Zheleznyak accused nine banks, including Ukrgasbank and Ayboks Bank, of helping the gambling business conceal up to UAH 10 billion in turnover per month. He claimed that these banks provided a service for misdirection (change of payment purpose – IF) and withdrawal of this money: they transferred money from a player to a casino account under the guise of payment for “advertising services” or similar services.

“In other words, it was a fairly open service for the market, when the bank was well aware of what it was doing and the damage it was causing to the budget. And, of course, it charged good fees for this (3-3.5% for acquiring). Plus various offers of withdrawal to cash, USDT, etc.”, Zheleznyak said.

The MP appealed to the National Bank to impose large fines on Ukrgasbank and apply the most severe measures to Ayboks Bank. In early March, the NBU fined state-owned Ukrgasbank UAH 64.6 million.

JSC Ayboks Bank (formerly Agrocombank) was founded in 1993. As of January 31, 2023, the bank’s largest shareholders were Vladimir Drobot (73.93%) and Alena Shevtsova (24.98%).

According to the NBU, as of January 1, 2023, in terms of total assets, Ayboks Bank ranked 44th (UAH 4.467 billion) among 67 banks operating in the country. The bank ended the previous year with a net profit of UAH 598.3 million and planned to allocate 92.6% of it to increase its authorized capital.

IC “Brokbusiness” (Kyiv) collected UAH 258.9 mln of gross premiums in 2022, which is 1.76% less than during the same period a year earlier, Expert-Rating said in its information about confirmation of insurer financial strength rating at the level uaAA+ on national scale.

According to the agency, the part of insurance premiums, which belongs to reinsurers, for the mentioned mentioned period decreased by 37,47%, and their share in the structure of gross premiums of the company decreased by 1,98 p.p. and made 3,46%.

The company carried out 63,967 mln UAH of insurance payments and indemnities in 2022, which is 29,42% less than in 2021, while the level of payments has reduced by 9,69 p.p. and has amounted to 24,71% following the results of 2022.

In 2022 the shareholders’ equity of the company has grown by 74.32% up to UAH 164,53 million, and its gross liabilities have reduced by 1,69% down to UAH 155,54 million. The Agency notes that an essential growth of the insurer’s shareholders’ equity in the analyzed period has occurred due to the increase in retained profit (by UAH 64,1 mln) in its structure, which has become possible due to the profitable activity of the company in 2022. In this regard, there was an increase in the level of shareholders’ equity coverage of the insurer’s liabilities on 46,12 p.p. – to 105,78 %. Consequently, at the beginning of 2023 shareholders’ equity exceeded the volume of the company’s liabilities by 5,78%.

The volume of cash and cash equivalents as of December, 31st, 2022 has grown in 1,55 times and has amounted to UAH 167,73 mln that has resulted in the increase of the level of liabilities coverage by cash means: by 39,33 p.p. up to – up to 107,84 %.

In the analyzed period the activity of PrJSC IC “Brokbusiness” has been characterized by a high efficiency. In particular, according to the results of 2022 the operating profit of the insurer has grown up to UAH 70,37 mln, and its net profit has increased up to UAH 66,98 mln, while following the results of 2021 the company has received net and operating losses.

IC Brokbusiness works in the Ukrainian insurance market for more than 25 years and is presented in all regions of Ukraine. The insurer has 39 licenses for voluntary and obligatory types of insurance.

Source: Open4Business.com.ua and experts.news