The Ukrainian Agro Connection agricultural service cooperative (ASCO) and the Ukrainian Ministry of Agrarian Policy and Food agreed on cooperation in the cooperation of private farms, small and medium agricultural enterprises. They also discussed a number of key issues in the agricultural sector.

The day before the meeting with the First Deputy Minister of Agrarian Policy Taras Vysotsky the head of Ukrainian Agro Connection Bohdan Kupriyanov informed “Interfax-Ukraine” agency about the meeting.

“The result of the communication has really pleased us, because we have agreed on further cooperation and support from the government in the cooperation of farms, small and medium agricultural enterprises,” he told the agency.

According to Kupriyanov, the sides also discussed de-mining of land plots, fields and reclamation systems liberated from the Russian occupation, restoration of destroyed agricultural enterprises, as well as opportunities for international funding and support for farmers to maintain global food security.

The head of the agricultural cooperative stressed that the joint activities of the agrarians will enable its members to sell their products in new international markets at world market prices. It is also possible to jointly solve the problem of storage of the harvested crops, organization of their own processing of agricultural products, getting access to the best equipment and additional sources of funding.

“We see the future of the Ukrainian farmer in combining and focusing on the aspect of processing, which will provide a stable flow of additional profits, as well as the formation of the purchase of joint wholesale lots of fuel, fertilizers, crop protection products, seeds. Our approach is based on technologies and ideas which will serve the needs of agrarians and save them money, time and resources which they can use for other projects,” Kupriyanov explained.

Kupriyanov also emphasized that Ukrainian Agro Connection will hold a meeting of Ukrainian agrarians with state representatives, agribusiness experts and cooperators “360° cooperation” on March 10, 2023, to identify the main problems of the industry and together find ways to solve them.

The head of the SOC also reminded that the agricultural cooperative was created at the end of 2021 by the owner of the agroholding A.G.R.. Group owner Misak Khidiryan, and now it includes farmers with a total land bank of 17 thousand hectares.

The holding A.G.R. Group Holding includes more than 20 companies. The main fields of its activities are trade of agricultural products, cultivation and storage of crops, as well as cattle breeding.

A.G.R. Group cultivates land in Poltava, Kiev, Chernigov, Nikolaev and Sumy regions. All grown products are sold on foreign markets.

The president of the holding and head of its supervisory board is businessman Misak Khidirian.

Hackers attacked the web portal of the Bureau of Economic Security (BES), the agency said Thursday.

“The web portal of Ukraine’s Economic Security Bureau has been hacked and is inaccessible for now. Access and operation of the site will be restored in the near future,” the press release said.

The BEB asks to use its official resources in social networks – Facebook, Telegram, Twitter and Instagram.

Ukrainian Agro Connection, an agricultural service cooperative (ASC) founded by the owner of A.G.R. Group owner Misak Khidiryan, is working to create a water user organization (WUO) in the Nikolayev region.

The project is planned to be implemented on a part of Inguletskaya irrigation system in Mykolaiv region, the Chairman of the cooperative Bogdan Kupriyanov told Interfax-Ukraine.

According to him, OVP as a legal entity is created by owners or users of agricultural land for the use and maintenance of engineering infrastructure of state land reclamation systems. The purpose of its creation is to provide irrigation services for land plots in the WUA service area.

In addition, the establishment of the WUA on the Inguletskaya irrigation system as one of the largest irrigation systems in Ukraine will contribute to strengthening the economy, ensuring food security of Ukraine and preventing the negative effects of climate change.

Kupriyanov specified that now there are three OVPs operating in Ukraine – on the territory of Trushevskaya (Cherkasy region), Suvorovskaya (Odessa region) and Kilchenskaya (Dnepropetrovsk region) irrigation systems. They were registered in December 2022. Thus, the OVP created by the Ukrainian Agro Connection cooperative may well become the largest in the country.

The chairman of the cooperative explained that one of the initiators of the OVP on the Inguletskiy irrigation system was A.G.R. Group LLC “Agro-Dilo” (Partizanske village, Mykolaiv oblast), which in cooperation with other land users will form an initiative group to address organizational issues related to the creation of the WUA. In addition, the initiative group will establish communications with allied water users, address technical, legal and financial issues of the organization.

Head of the Ukrainian Agro Connection noted in his comment that the day before members of the cooperative had met with Taras Kot, First Deputy Head of the State Agency for Land Reclamation and Fishery and got the agency’s support, discussed prospects and advantages of creating WUAs in the region as well as opportunities and ways to attract international investors and grants for development and operation of the land reclamation system.

He said that Inguletskaya irrigation system provides irrigation services on the territory of 121,5 thousand hectares, 103,3 thousand hectares of which are in Nikolaev region and 18,2 thousand hectares – in Kherson region. The system consists of two pumping stations with total capacity of 58.6 thousand kW and a capacity of 62.4 cubic meters of water per second. The total length of the main and distribution channels is 343 km, and there are 621 hydraulic structures.

Kupriyanov also underlined, that on the 10th of March this year the cooperative organizes the meeting of Ukrainian agrarians with government representatives, agribusiness experts and cooperators, in order to determine the main problems of the branch and to find the ways of their solution together.

As it was reported, on August, 27, 2022 the Cabinet of Ministers of Ukraine has approved the model statute of OVP that regulates the main aspects of such organizations, their legal status, the order of creation of such legal entities, OVP managing bodies and their authorities, main directions of OVP activity, the order of business activity and OVP termination. Already in December of the same year there were created 3 TCCs.

The cooperative Ukrainian Agro Connection was created at the end of 2021. It consists of farmers with a total land bank of 17 thousand hectares.

The members of the cooperative have an opportunity to sell general grain lots under direct export contracts, rent and lease agricultural machinery without disrupting the harvesting period. The cooperative helps them with the additional processing and storage of grain. It also gives them the opportunity to get discounts and preferential rates for the services of a network of partners, including banks, leasing and transport companies, suppliers of agricultural machinery, spare parts, fuel and fertilizers.

A.G.R. Agroholding. Group includes more than 20 companies. The main fields of its activities are trading of agricultural products, cultivation and storage of grain crops, and livestock breeding.

A.G.R. Group cultivates land in Poltava, Kiev, Chernigov, Nikolaev and Sumy regions. The grown products are sold on foreign markets.

The president of the holding and head of its supervisory board is businessman Misak Khidirian.

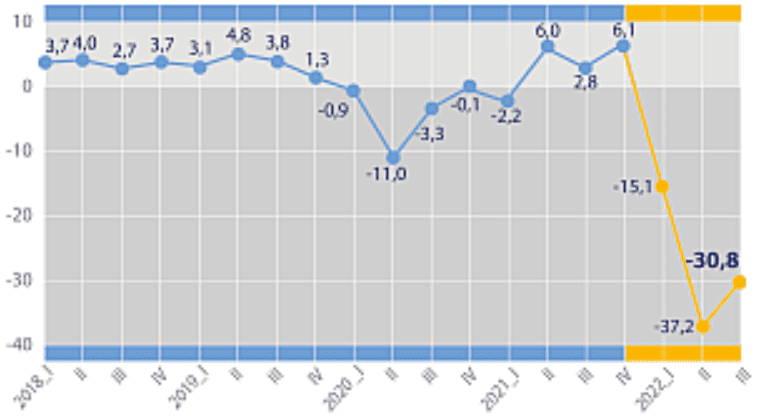

A drop in sales of more than 30% due to Russian aggression was experienced by 47% of Ukrainian companies, including 19% with a drop exceeding 50%, agriculture, retail, mining and metals industries suffered the most, these are the results of a new business resilience survey presented by the American Chamber of Commerce (AmCham).

“The war has taken a huge toll on Ukrainian businesses, but companies have shown extraordinary resilience and some have even found opportunities for growth,” the report said.

According to a study conducted jointly with McKinsey & Company Ukraine on the eve of the first anniversary of the war, in 2022, 3% of companies increased sales, while 10% either maintained them or kept the decline within 10%. Opportunities for growth were noted by representatives of the banking and financial sectors and IT.

Only 4% reduced the number of employees by more than 30%, while 29% of the companies had the figure in the 10-30% range and 2% even increased the number of staff.

It is indicated that 4% of companies have stopped operations and do not know when they can resume them, while 30% stopped, but have already resumed.

According to respondents, in 2023 the pressure of war on business will remain or even increase. Also among the discouraging forecasts is the reduction of aggregate demand, as GDP growth remains uncertain and the purchasing power of consumers may decline due to depletion of savings, rising unemployment and reduced wages.

As stated in the survey results, 90% of companies have developed internal “contingency plans,” but more than 40% of respondents believe they are not effective enough.

As part of these plans, 61% created pre-war special task forces (multifunctional teams or with a specialization in the risk management function), 33% developed such plans with business units, and 6% enlisted professional outside help to prepare plans. Also, 40% of companies admitted the plan did not work as expected, including 29% who did not foresee the extent of failure and 7% who did not have the necessary resources to implement the plan.

According to the published information, the main military challenge for 25% of respondents was decrease in demand for products or services (60% in machine building, 42% in retail), for 23% – physical damage to facilities (67% in FMCG, 50% in transport/machinery), 19% – disruption of supply chains (pharma – 50%, machine building – 40%).

The problem of energy supply was named as the main problem by 10% of respondents (IT – 30%, banks – 25%), but among the top three problems it is in the lead with 66%, ahead of supply chain disruption 60% and reduced demand 52%.

Among the key priorities for effective contingency planning, companies highlighted an agile operating model and a strong corporate culture.

“While an agile operating model is seen as the most useful factor for overcoming the ongoing crisis, among the priorities companies see for their future development, respondents cited diversification, better contingency planning and building resilient teams,” the survey noted.

In the future to overcome the crisis 46% of companies will pay attention to the strategy and diversification of business, which requires rethinking investment plans, 29% more effectively plan their actions, 18% will attract and maintain a sustainable team and workforce.

The American Chamber of Commerce in Ukraine is the most influential international business association serving over 600 member companies in Ukraine since 1992, bringing the united voice of American, international and Ukrainian companies that have invested over $50 billion in Ukraine and remain committed to the country.

Real GDP percentage changes over previous period in 2018-2022

Source: Open4Business.com.ua and experts.news

Metallurgical enterprises in Ukraine in January this year reduced steel production 6.5 times compared to the same period in 2022 – to 284 thousand tons from 1.851 in January-2022, but increased smelting compared to December-2022, when 106 thousand tons were smelted.

As a result, Ukraine took 34th place in the ranking of 64 major global producers of these products, compiled by the Worldsteel Association (Worldsteel), while in December it was 38th.

According to Worldsteel, in January-2023 there was a decline in steelmaking against January-2022 in most of the top ten countries, except China and Iran.

The top ten steel-producing countries in January are as follows: China (79.450 million tons, up 2.3% over January-2022), India (10.930 million tons, down 0.2%), Japan (7.222 million tons, down 6.9%), USA (6.497 million tons, down 6.8%), Russia (5.750 million tons, down 8.9%), South Korea (5.477 million tons, minus 9.8%), Germany (2.925 million tons, minus 10.2%), Brazil (2.783 million tons, minus 4.9%), Iran (2.7 million tons, up 27.7%) and Turkey (2.605 million tons, down 17.6%).

Overall, global steelmaking fell 3.3% to 145.252 million tons in January 2023 from the same period in 2022, compared to a 10.8% decline in December 2022, with an absolute figure of 140.695 million tons.

The country produced 313 thousand tons of steel in November 2022, 318 thousand tons in October, 340 thousand tons in September, 366 thousand tons in August, 281 thousand tons in July, 295 thousand tons in June, 308 thousand tons in May, 281 thousand tons in April, 200 thousand tons in March, 1.374 million tons in February and 1.851 million tons in January.

As reported, metallurgical enterprises in Ukraine reduced steel production in December last year by 16.4 times, or 93.9%, compared to the same period in 2021 – up to 106 thousand tons.

For the 12 months of 2022, the top ten steel producing countries were as follows: China (1.013 billion tons, down 2.1%), India (124.720 million tons, up 5.5%), Japan (89.235 million tons, down 7.4%), USA (80.715 million tons, “minus” 5.9%), Russia (71.5 million tons, down 7.2%), South Korea (65.865 mt, minus 6.5%), Germany (36.849 mt, minus 8.4%), Turkey (35.134 mt, down 12.9%), Brazil (33.972 mt, down 5.8%) and Iran (30.593 mt, up 8%).

Ukraine in 12 months of 2022 was in 23rd place with the melting of 6.263 million tons of steel (“minus” 70.7%).

In total, 64 countries produced 1 billion 831.467 million tons of steel in 2022, which is 4.3% less than in 2021.