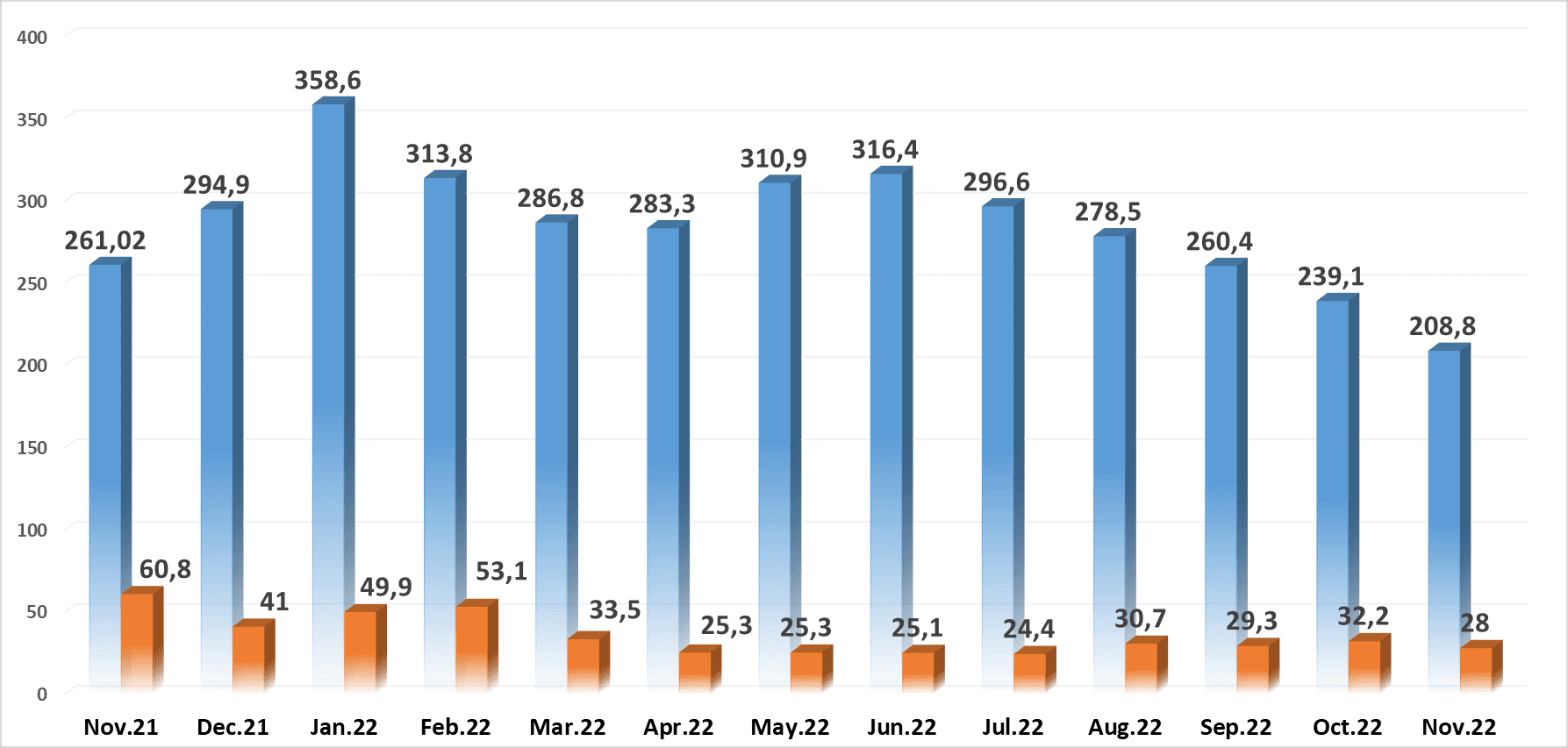

Number of unemployed in Ukraine and job opportunities, Sep 21 – Nov 22

Source: Open4Business.com.ua and experts.news

Oil prices are falling on Friday as signals of crude glut in the U.S. outweigh expectations of demand growth in China, Bloomberg writes.

The cost of April futures for Brent crude oil on London’s ICE Futures exchange is $84.27 a barrel by 7:15 a.m. on Friday, down $0.87 (1.02%) from the previous session’s closing price. Those contracts fell $0.24 (0.3%) to $85.14 a barrel on Thursday.

March futures on WTI crude oil at electronic trades of NYMEX fell by that time by $0.85, to $77.64 per barrel. The previous session’s contract value was down $0.1 (0.1%) to $78.49 a barrel.

“Investors are trying to assess which of the major oil market drivers will prove the most influential in the next few months,” said CIBC Private Wealth senior trader Rebecca Babin.

Major Chinese air carriers announced a significant increase in flight loadings, indicating an upturn in tourist activity, Bloomberg notes.

Meanwhile, oil refining companies in China are increasing their purchases of raw materials. According to the agency’s sources, the trading “subsidiary” Sinopec bought 10 million barrels of oil in the UAE with delivery in April. A number of other Chinese refiners, including China National Chemical Corp. and Rongsheng Petrochemical Co. are also increasing their oil purchases, including from the United States.

At the same time, the U.S. Energy Department said Wednesday that the country’s oil inventories jumped 16.28 million barrels last week. Experts predicted an average increase of 2 million barrels.

U.S. Energy Department data this year “consistently give bearish signals to the market, pointing to weak consumer demand, low refinery activity and rising oil inventories,” analysts say Sevens Report Research.

The U.S. dollar goes up against the euro, yen and pound sterling in trading on Friday on hawkish statements of Federal Reserve (Fed) executives, which strengthened traders’ opinion that the U.S. Central Bank is not going to stop the rate hike cycle yet.

Federal Reserve Bank (FRB) Cleveland President Loretta Mester said the day before that she had seen a “compelling case” for a 50 basis points (bps) rate hike at the January 31-February 1 Fed meeting.

The Federal Open Market Committee (FOMC) unanimously decided at that meeting to raise the rate by 25 bps, to 4.5-4.75% per year.

Mester still believes the Fed needs to raise the benchmark rate to more than 5% and keep it above that mark for a while to get inflation back under control.

St. Louis Fed Chairman James Ballard said Thursday that, like Mester, he supported a 50-bp rate hike at the last meeting. Neither Ballard nor Mester have a vote on the FOMC this year.

Ballard said he thinks the Fed should raise the rate to 5.25-5.5% and do it “as soon as possible. Thus, Ballard believes it is necessary to raise the rate by 75 bps from current levels, Market Watch notes.

“A further rate hike could help solidify the disinflationary trend in 2023 even as the economy continues to grow and the labor market is strong,” Ballard said.

The ICE-calculated index, which shows the dollar’s performance against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona), added 0.53% Friday, while the broader WSJ Dollar Index gained 0.38%.

The euro/dollar pair was trading at $1.0638 as of 7:45 a.m., compared with $1.0672 at market close Thursday.

The pound was down to $1.1948 from $1.1988 the day before.

The value of the American currency against the yen rose to 134.71 yen against 133.94 yen by the previous trading results.

The dollar/yuan pair is trading at 6.8755 yuan, compared to 6.8607 yuan on the previous day.

EURO, pound, U.S. dollar, yen

Stock indices of the largest countries in the Asia-Pacific Region (APR) are down in trading on Friday, following the U.S. stock market.

The pressure on stock markets is being put by renewed fears over further interest rate hikes amid a resilient U.S. economy, which was indicated by fresh statistical data, and hawkish comments from U.S. Federal Reserve (Fed) management.

Federal Reserve Bank of Cleveland (FRB) President Loretta Mester said she thought it was premature to conclude that US inflation was on a steady path toward the US central bank’s 2% target.

Although inflation has slowed somewhat since last summer, it is still too high, Mester said during an event at the University of South Florida on Thursday. Last week’s January Consumer Price Report showed that core inflation is slowing little, she said.

St. Louis Fed Chairman James Ballard said during a speech in Tennessee that he called for a sharper rate hike at the last Fed meeting and did not rule out a sweeping move further down the road.

Japan’s Nikkei 225 Index was down 0.7 percent by 7:13 a.m.

Shares of Internet company Rakuten Group Inc. (-5.5%), Recruit Holdings Co. Ltd., which owns job search sites, (-3.9%) and industrial equipment manufacturer Keyence Corp. (-2.6%).

In addition, investment technology stocks of SoftBank Group (-2.1%), consumer electronics maker Sony (-2.3%) and Asia’s largest clothing retailer Fast Retailing (-0.7%) were getting cheaper.

China’s Shanghai Composite Index was down 0.1% by 7:23 a.m. Hong Kong’s Hang Seng lost 0.7%.

Shares of computer maker Lenovo Group Ltd. were down the most on the Hong Kong Stock Exchange. – by 4 percent, jewelry company Chow Tai Fook Jewellery Group Ltd. – by 3.8 percent and Internet company Baidu Inc. – Ltd. by 2.8 percent.

Shares of Internet giant Alibaba dropped 1.4 percent and consumer electronics maker Xiaomi Corp. – 2.4% and Internet company Meituan – 2.6%.

South Korea’s Kospi was down 0.9% by 7:23 a.m.

One of the world’s biggest chip and electronics maker Samsung Electronics Co. was down 1.7%, automaker Hyundai Motor down 0.5%.

The Australian S&P/ASX 200 index fell 0.86% in trading.

The capitalization of the world’s largest mining companies BHP and Rio Tinto decreased by 0.25% and increased by 0.5% respectively.

TAS Insurance Group paid UAH 99.74 mln in compensations under the concluded insurance contracts in January 2023, which is 8% more than it was paid by the company in January last year.

According to the insurer’s web-site, over a quarter of all payments in January or 27.94% accounted to CASCO: under contracts of ground transport insurance the company paid UAH 27,86 mln.

The share of MTPL in January portfolio of payments of the company amounted to 35,14%, or 35,05 mln UAH.

The company also reports that in the current year Green Card payments increased 3.8 times up to UAH 23.41 mln, which is 23.47% of the total amount of payments.

At the same time TAS IG paid 10.46 mln UAH according to the voluntary health insurance contracts: this way the share of voluntary health insurance in the Company’s portfolio of payouts for the month was 10,48%.

TAS IG paid UAH 2,96 mln on other insurance contracts in January.