Gazprom’s bid for gas transit through Ukraine has increased to the maximum for the last month (since January 15).

“The operator of Ukraine’s gas transmission system (OGTSU) said it had accepted a transit request from Gazprom for Wednesday in the amount of 35.8 million cubic meters. The figure on Tuesday was 30.8 million cubic meters. The capacity is claimed for only one of the two entry points into the country’s GTS, the Suja gas metering station. No application has been accepted for the corridor through the Sohranovka gas metering station.

The current level of gas reserves in Europe has fallen to 65.66 percent, 20 percentage points above the average for the same date in the last five years, according to the Gas Infrastructure Europe (GIE) association. During the Feb. 13 gas day, inventories were down 0.45 percentage points.

Warm weather in October, November and January as well as austerity measures have resulted in UGS reserve levels now at their highest ever recorded. This strengthens confidence of the authorities in the successful passing of the winter.

Europe’s LNG receiving terminals operated at 62 percent capacity in January, nearly the same in the first days of February. At the same time the level of LNG inventories in the tanks of receiving terminals is decreasing more and more. This suggests that the inflow of new LNG cargoes to the region is falling amid low prices and competition from Asia.

The day-ahead contract at the TTF hub in the Netherlands added just over a percent in the past 24 hours, closing at $592 per thousand cubic meters.

The “Asian premium” is stable. – gap between gas prices in Asia and the price of LNG supplies to Europe. March futures for JKM Platts (Japan Korea Marker, reflecting the spot market price for cargoes supplied to Japan, South Korea, China and Taiwan) traded at $639; futures for LNG supplied to North West Europe (LNG North West Europe Marker) traded at $582.

The state of U.S. UGS reserves is becoming increasingly important to the global market as the country is actively ramping up exports.

In the regular reporting week (ended Feb. 3), reserves fell by 6.1 bcm. For the first time since the beginning of the year, weekly withdrawals exceeded the average for the last five years.

The current reserve level is 49%, 5 percentage points above the five-year average, according to the U.S. Department of Energy’s Energy Information Administration (EIA).

February promises to be a cold month in the country, which will lead to an increase in energy spending for heating. On the other hand – America’s largest LNG plant, Freeport LNG, is still delaying its restart after an accident, leaving gas that was supposed to go to exports in the domestic market.

So far, the EIA has projected that storage inventories will fall by 60 billion cubic meters this winter (the average for the last five years). At the end of March, natural gas volumes in storage are projected to be 40 billion cubic meters. This is 8% below the five-year average.

Ukraine’s anti-corruption bodies have notified 10 more individuals involved in the Ukrhazbank case on suspicion of illegal activities of officials, the Specialized Anti-Corruption Prosecutor’s Office said.

“Under the procedural guidance of the prosecutors of the SAP, NABU detectives notified the suspicion of 10 more participants of the organized group, led by the ex-chairman of the board of JSB “Ukrgasbank” which illegally withdrew from the financial institution 206 million UAH”, – said in a message of the SAP in the telegram channel on Tuesday.

In the SAP emphasize that according to the investigation, the bank’s employees exactly with these figures, who allegedly were “agents” of the bank and attracted large customers to him, provided the conclusion of contracts to receive from the bank “remuneration”.

“It turned out that most of these subjects (individual entrepreneurs, self-employed and legal entities) were registered solely to participate in this scheme and after receiving funds stopped their activities,” the report says.

The prosecutor’s office specifies that five of the defendants are abroad, their suspicion was reported under article 278, article 135 of the Code of Criminal Procedure of Ukraine.

“To date, the total number of participants in the scheme is 15 people, including the ex-chairman of the board of “Ukrgasbank”, – is indicated in the message.

The SAP reminds that the management of the bank, having information about the agreements concluded with major clients on the placement of funds, used it to steal funds.

The investigation found that during 2014-2019 under this scheme, 52 such agents unreasonably transferred funds of the state bank in the amount of more than 206 million hryvnia.

On October 6, 2022 in the mentioned criminal proceedings 5 main figures of this crime, including the former head of the board of “Ukrgasbank”, former and current officials of banking institutions were reported on suspicion.

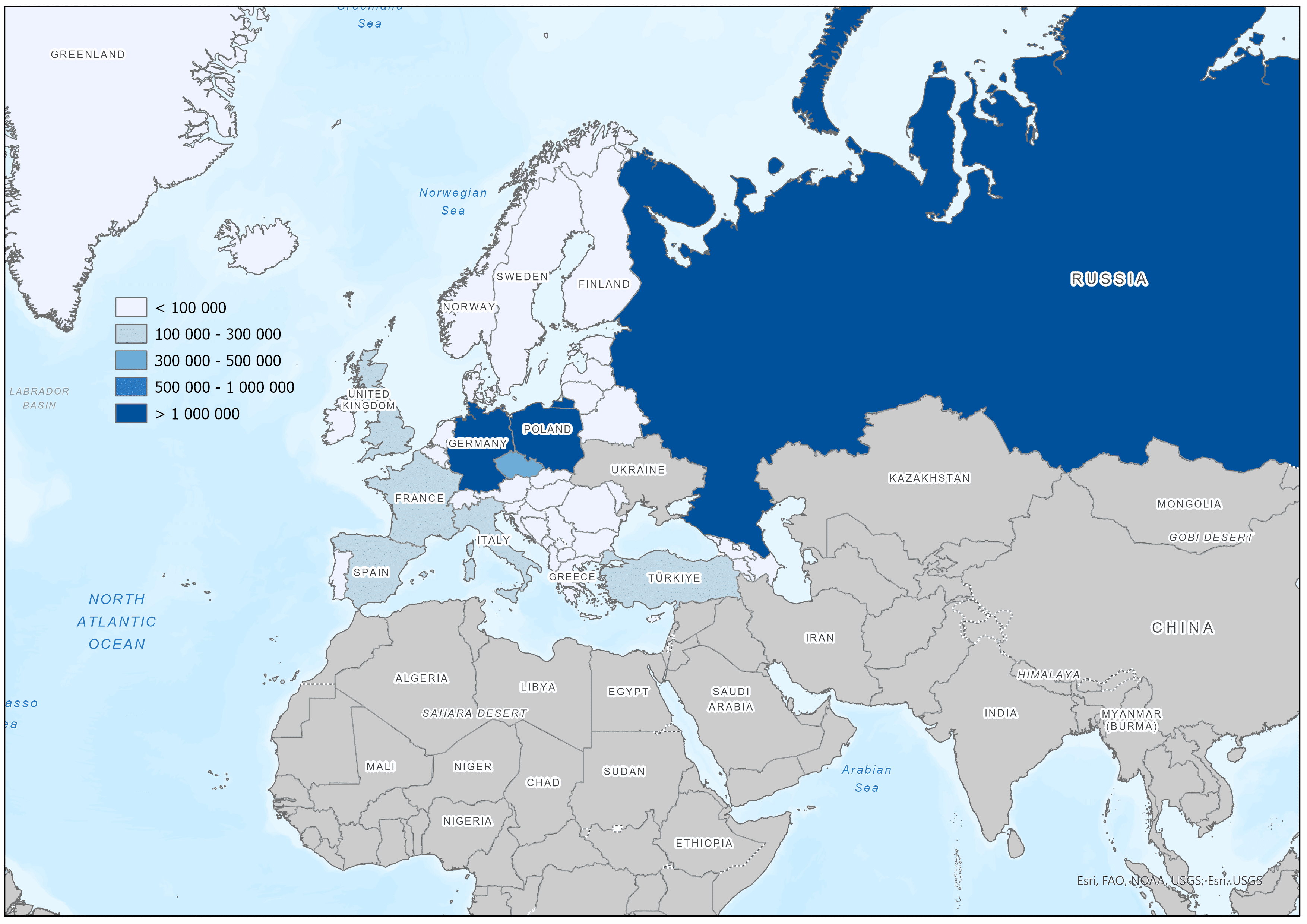

Number of refugees from Ukraine in selected countries as of 30.10.2022

Source: Open4Business.com.ua and experts.news

Benchmark crude oil prices are falling on Wednesday morning, continuing to react negatively to reports on the sale of oil from the US strategic reserve.

April Brent futures on London’s ICE Futures exchange stood at $84.8 a barrel by 7:08 a.m., down $0.78 (0.91%) from the previous session’s close. Those contracts fell $1.03 (1.2%) to $85.58 a barrel at the close of trading on Tuesday.

The price of WTI futures for March at electronic trades on the New York Mercantile Exchange (NYMEX) is $78.31 per barrel by that time, down $0.75 (0.95%) from the previous session. The day before the contract dropped $1.08 (1.4%) to $79.09 per barrel.

The day before the US Department of Energy announced about its plans to sell 26 mln barrels of oil from strategic reserve (SPR) on the market this year. Sales will be carried out within the period from April 1 to June 30.

The fuel release from the reserves will come as part of agreements reached back in 2015 and is related to the execution of the state budget, Sevens Report Research editor Tyler Ritchie told MarketWatch.

“But when traders see a news headline on the screen about releasing oil from the strategic reserve, the first thing they think of is an increase in supply in the market, then they hit the ‘sell’ button first and only then ask questions,” he added.

Meanwhile, OPEC the day before raised its estimate of the demand for oil in 2023 by 100 thousand barrels per day – up to 101.87 million bpd. Oil consumption growth in OECD countries is expected to be 0.35 million bpd in 2023 and 1.96 million bpd in non-OECD countries.

The estimate of oil demand in the first quarter of 2023 is increased by 220,000 bpd from the previous forecast, to 101.26 million bpd; in the second quarter, it is increased by 50,000 bpd, to 100.7 million bpd. The forecast for the third quarter was increased by 90,000 bpd to 101.99 million bpd.

In addition, American Petroleum Institute (API) data released on Tuesday night, Wednesday, indicated a 10.5 million barrel increase in U.S. inventories for the week ended February 10.

The official report on U.S. energy reserves will be released Wednesday at 5:30 p.m. Analysts polled by Trading Economics expect the average increase in oil reserves by about 1.2 million barrels.

Ukraine’s negative balance of foreign trade in goods in 2022 increased 2.3 times compared to 2021 – to $11.125 billion from $4.771 billion, the State Statistics Service (Gosstat) said on Tuesday.

According to its data, exports of goods from Ukraine for the year compared to the previous year decreased by 35.1% – to $44.149 billion, imports – by 24.1%, to $55.274 billion.

State Statistics said that in December 2022, compared to November of that year, seasonally adjusted exports decreased by 2.4% – to $3.376 billion, while imports rose by 9.8% – to $5.347 billion.

The seasonally adjusted foreign trade balance in December 2022 was negative at $1.971 billion, while in November of that year it was also negative at $1.409 billion.

The ratio of exports to imports in 2022 was 0.80 (0.93 in 2021).

The State Statistics Committee specifies that foreign trade transactions were carried out with partners from 233 countries.

Earlier the Club of Experts analyzed in detail the macroeconomic indicators of Ukraine and other countries.

See more details in the video:

Cyprus T.A.S. Overseas Investments Limited from Sergiy Tigipko’s TAS Group intends to acquire over 25% in Austrian TransAnt GmbH (Linz), a joint venture (JV) established by Austrian ÖBB Rail Cargo Group and voestalpine Stahl GmbH to produce innovative and cost-effective railway freight cars.

According to a message of the Antimonopoly Committee of Ukraine (AMCU) on its website, the agency has already provided T.A.S. Overseas Investments Limited with appropriate authorization based on its application and applications from TransAnt and voestalpine Stahl.

In addition, the Cypriot Competition Authority also announced that it had received a notification in connection with the proposed acquisition by TAS Overseas Investments Limited of a share in a charter capital of TransAnt GmbH on January 24 this year.

TransAnt GmbH is a joint venture established at the end of 2020 between Rail Cargo Austria Aktiengesellschaft and voestalpine Stahl GmbH with the aim of operating in the rail freight sector. At this stage, TransAnt is not engaged in commercial activities. However, after the completion of this transaction, it is expected to be actively engaged in production, development, supply, sale and lease of “flex” wagons and superstructures for the transport of goods in the industrial sector.

Rail Cargo Group originally announced plans for parity ownership in the JV with voestalpine, but currently holds a 19.8% share, according to the Austrian register, while voestalpine holds 80.2%.

In this regard, the AMCU classifies TransAnt GmbH and voestalpine Stahl GmbH and their related companies as a single business entity – VAS Group. It is a global steel and technology group operating in the automotive, consumer, aerospace, oil and gas, and rail industries, which is listed on the Vienna Stock Exchange and has no ultimate beneficial owners.

TAS Group was founded in 1998 by businessman Sergiy Tigipko. Its business interests cover the financial sector (banking and insurance segments) and pharmacy, as well as industry, real estate, and venture projects.