Ukrainian President Vladimir Zelensky has called on the Georgian leadership to release Ukrainian citizen and former Georgian President Mikhail Saakashvili.

“Right now a Ukrainian citizen, former Georgian President Mikhail Saakashvili is being slowly killed. The very fact that we still have to fight such an attempt to de facto publicly execute a man in Europe in the XXI century – it’s a shame!”, – wrote Zelensky in his twitter.

In this regard, he called on the Georgian authorities to implement the obligations under European norms of human rights protection and to release Saakashvili.

“Given the threat to his life, I call on the Georgian authorities to remember their obligations under the European norms of human rights protection, stop the abuses and release Mikhail! Ukraine has offered solutions. I call on the world to help save Mikhail’s life and prevent his execution,” the president wrote.

Earlier in Kiev, during a press conference with the head of Austria Alexander Von der Bellen, Zielenski showed journalists the photos of the emaciated former president of Georgia, which he had been given and expressed his confidence that the Georgian leadership intends to kill Mikheil Saakashvili.

As it was reported, Saakashvili secretly arrived in Georgia on September 29, 2021. On October 1, he was detained in Tbilisi, after which he was placed in a prison in the city of Rustavi, where he went on hunger strike. On November 8, he was transferred from the Rustavi prison to the prison hospital in Tbilisi (Gldani district) without the consent of his relatives and lawyers. On November 20, Saakashvili was transferred to a military hospital in the city of Gori, where he ended his hunger strike. On May 12 last year, Saakashvili was admitted to the Vivamed civilian clinic in Tbilisi, where he remains today.

On February 1, at a trial on the possible postponement of his prison sentence, Saakashvili said via video link that he was in extremely serious condition and required the necessary treatment. After he tried to take off his shirt and show them his emaciated body, the video link was cut.

In Georgia, the ex-president is being prosecuted in several criminal cases. He considers his detention illegal and the accusations against him trumped up.

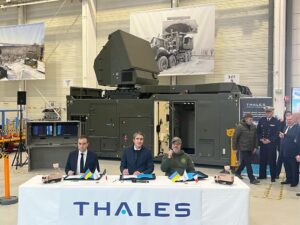

Ukrainian Defense Minister Alexey Reznikov and French Defense Minister Sébastien Lecorniou signed a memorandum with Thales Group on the supply of GM 200 radar systems for Ukraine’s air defense.

“Together with my French colleague Sébastien Lecorniou, we signed a memorandum with Thales Group for the supply of MG-200 radars for Ukraine’s air defense. This equipment will help us detect enemy drones and missiles, including ballistic missiles. Our skies will be protected from Russia’s deadly attacks,” he wrote on Twitter on Wednesday.

Seaports in 2022 transshipped 59 million tons of cargo, providing 54% of exports from the country, compared to the indicator in 2021 – 153.7 million tons – a drop of 2.6 times, the Administration of Ukrainian Sea Ports (AMPU) said in a message on Facebook.

According to it, 47.8 million tons of cargo was shipped for export, which is almost 2.5 times less than in pre-war 2021, while imports were almost 4 times less – 6.2 million tons.

It is specified that the turnover of cargo of the Odessa port in comparison with indicators of 2021 decreased from 22.56 million tons to 7.69 million tons, port “Pivdenniy” – from 53.47 million tons to 15.28 million tons, “Chernomorsk” – from 25.63 million tons to 11.8 million tons. – from 25.63 million tons to 11.76 million tons.

Ukrainian ports mostly transshipped grain cargoes, which provided almost half of the total volume – 28.8 million tons, bulk cargoes amounted to 4.8 million tons.

AMPU emphasized the great importance of the agreement on the “grain initiative”, which allowed to unblock the work of ports “Big Odessa”, and if it were not for the actions of Russia, which blocks the “grain corridor”, the performance of the agreement could have been higher, the report said.

Administration specified that 614 vessels with 16 million tons of agricultural products for 40 countries have been sent for export within the framework of “grain initiative” since August 1. From the port of Odessa – 188 ships with 4.2 million tons, from the port of Chernomorsk – 261 vessels with 6.4 million tons, from Pivdenniy port – 165 vessels with 5.5 million tons.

One third of the vessels – 281 with 7.2 million tons of cargo was bound for Asia, and slightly less – 246 vessels with 6.8 million tons – for Europe, while 87 vessels with 2.1 million tons headed for Africa.

AMPU said that 2022 was planned as the year of the port infrastructure development, but the war has radically changed plans, and with the blocking of most Ukrainian ports, the administration focused on the development of transport logistics of the Danube region.

As a result, the volume of cargo handling in the port of Reni has grown to 6.82 million tons from 1.37 million tons in 2021, port Izmail – to 8.89 million tons from 4 million tons, Ust-Dunaysk – to 785 thousand tons from 64 thousand tons, which were the best results for all the years of Independence.

It was possible to achieve better results due to the development of public-private partnership and maximum business deregulation, the report says, as well as due to the dredging works, which were carried out for the first time in many years near the deep-water berths of Izmail and Reni. The total volume of operational dredging in port Izmail was 710 thousand cubic meters, in port Reni – 130 thousand cubic meters with a total volume of 280 thousand cubic meters, which is planned to be done until the end of II quarter of 2023. Dredging works were carried out by AMPU’s own forces with the participation of branch “Dredging fleet”.

AMPU noted that despite the fact that the Danube ports attracted all the available facilities for cargo handling, there is a potential for development in 2023. It will be realized by modernization of port infrastructure, construction of new terminals, continuation of dredging works and attraction of investments.

The Dobrobut medical network will build a rehabilitation center supported by the U.S. International Development Finance Corporation (DFC).

According to the network’s press release, a letter of intent with Dobrobut was signed by DFC head Scott Nathan at a meeting of Ukrainian business representatives with U.S. Ambassador Bridgette Brink at the American Chamber of Commerce.

“Dobrobut has become the first private medical company in Ukraine to receive financial support from DFC,” the nurse said, without specifying the amount of investment or timing of the project.

As reported, Vadim Shekman, chief operating officer of the Dobrobut medical network, told Interfax-Ukraine in 2021 about plans to build a crpu rehabilitation center.

“Dobrobut” is one of the largest private medical networks in Ukraine. In company portfolio there are 17 medical centers in Kiev and Kiev region, first-aid service, dentistry and drugstores. Medical centers of network provide services for children and adults on more than 75 directions. Annually Dobrobut`s specialists carry out more than 7 thousand operations. The network has more than 2,800 employees.

Since the beginning of the war thanks to the cooperation with the international charitable organizations Direct Relief International, Children of War Foundation, International Medical Corps and University of Miami Global Institute, and thanks to the work of Dobrobut Foundation network clinics that continued their work even during the war, a significant part of medical services for months were free of charge.

The agricultural holding A.G.R. Group and the grain trading company MK Merchants S.A. of businessman Misak Khidiryan, with the start of a full-scale Russian invasion, reoriented the logistics of agricultural products from Ukrainian seaports to road and rail transportation across the border with the EU, as well as to the Ukrainian river ports of Reni and Izmail.

However, even after the end of the war, the de-occupation of the territory of Ukraine and the complete removal of the trade blockade from its seaports, the companies will continue to export part of the grain to the European direction, their owner Misak Khidiryan said in an interview with Interfax-Ukraine.

He also clarified that his holding is looking for opportunities to reduce the logistics shoulder and more convenient export of agricultural products to the EU, and therefore is interested in buying granaries and agricultural enterprises in western Ukraine. At the same time, Khidiryan stressed that at present, the logistics of agricultural products from Ukraine are hindered by the insufficient capacity of the European railway infrastructure and artificial delays in the operation of the maritime “grain corridor” by Russian inspectors.

“After all, the European railway is not capable of transporting the volumes of grain needed by Ukraine, and not only grain. In order to fully use the European infrastructure for export, it is necessary to open additional railway and road border crossings on the border with Ukraine, and, of course, build a European gauge in our country,” the owner of A.G.R. Group emphasized.

“We are also actively exporting along the grain corridor. Frankly, this is a risky option due to long queues, delays in grain truck inspections from the Russian side, and generally very slow operation. But, given the current situation with the cost of logistics during the war, I think grain corridor is a good opportunity,” he stated.

In addition, Khidiryan noted the dubious economic feasibility of exporting agricultural products to Asian and African countries through EU seaports, to which it is transported from Ukraine by road and rail. According to him, the cost of transshipment and reloading of products along this route reaches 50-60% of the total cost of grain, which makes this method of export unprofitable for farmers. Thus, the export of agricultural products to the EU can only be beneficial for export to end consumers in the EU.

In turn, CEO of A.G.R. Group Ihor Shestopalov noted that since the beginning of the war, his holding company has exported almost 55,000 tonnes of agricultural products, while the grain trader MK Merchants ships an average of 8-10 ships with agricultural products through the river ports of Izmail and Reni every month.

“Soybean, rapeseed, barley, wheat, corn, sunflower, buckwheat – we are considering all possible markets for products in the EU, Turkey, Egypt, and Nepal. Since the beginning of a full-scale invasion, we have exported almost 55,000 tonnes. Our partners from MK Merchants are transporting grain through river ports of Izmail and Reni, shipping an average of 8-10 vessels per month,” he said.

In the holding A.G.R. Group includes more than 20 companies. The main direction of its activity is the trade in agricultural products, the cultivation and storage of grain crops, as well as animal husbandry.

A.G.R. Group cultivates land in Poltava, Kyiv, Chernihiv, Mykolaiv and Sumy regions. All grown products are sold on foreign markets.

The holding’s president and head of its supervisory board is businessman Misak Khidiryan.

Sales of medicines in 2022 amounted to 46 billion UAH.

According to the company SMD, according to their study, in particular, in the retail segment in the category of pharmaceuticals market decline was 37% in volume and 28% in money terms.

At the same time in public procurement the fall in drug sales was 26% in volume and 21% in monetary terms.

“Despite the difficult situation, the state has even increased budgetary support and already one third of the entire drug market has state funding. Also the share of reimbursement has increased significantly due to the expansion of the program “Affordable Medicines” in such categories as diabetes (insulin), mental and behavioral disorders”, – the company said.

As reported, the Ukrainian pharmaceutical market in 2022 decreased by 42% in volume terms and by 23% in monetary terms, the cumulative sales in the pharmaceutical market in 2022 amounted to about 61 billion UAH in pharmacy entrance prices.