Main Department of State Service of Ukraine for Food Safety and Consumer Protection in Odessa region on January 19 detected import into Ukraine from Poland party of Egyptian peanuts with exceeding the content of toxic substance aflatoxin-B1.

As reported on the Facebook page of the regional department, this product can be sold in the Ivano-Frankivsk region, and market operators should withdraw these products from circulation and within no more than two working days and in writing to inform Gosprodpotrebluzhba.

“The Main Department of the State Consumer Service in the Odessa region received an information message from the rapid response system for food and feed from January 19, 2023 № 2022.3810-fup 3, regarding the detection of excessive amounts of B1, and G2 in peanuts in shells exported from Egypt (exporter: ASM for advice and export agricultural products, Egypt) through Poland (importer: Atlanta Poland S.A, Poland) to Ukraine, 13-G Vysochana Street, Horodenko town, Ivano-Frankivsk region, 78100,” – stated in the message of the service.

The report specifies that aflatoxin-B1 is a toxic substance for humans and animals, secreted by certain species of microscopic mold fungi. It causes malignant tumors and cirrhosis of the liver, as well as reduces immunity. Severe aflatoxin B1 poisoning can cause cerebral edema and acute liver failure.

Oschadbank’s net profit at the end of 2022 is 690 million UAH compared with 1,054 million UAH in 2021, such preliminary data, which can be clarified by the results of annual adjustments and external audit, said the head of the bank’s management board Sergei Naumov.

“In the super-heavy conditions of martial law Oschadbank was able to maintain profitability. This allows us to keep capital at a sufficient level and gives prospects for the payment of dividends to the state,” he wrote in Telegram on Monday.

Naumov specified that compared to 2021, operating income for 2022 increased by 1.6 billion UAH – to 21.7 billion UAH, interest income increased by 1.1 billion UAH – to 22.4 billion UAH, while interest expenses decreased by 0.4 billion UAH – to 7.5 billion UAH.

He added that there was also an increase in net non-interest income – by UAH 0.8 billion to UAH 7.6 billion.

According to the head of the board, the results of Oschadbank had a positive impact on the revaluation of financial instruments in the amount of UAH 4.8 billion because of the presence of securities in his portfolio with indexed value.

Naumov noted that in assessing the risks the bank always adheres to a conservative position, so the bank formed additional reserves of 12.1 billion UAH, which is 4.3 times more than in 2021, because there were weighted possible losses in the reporting year due to the deterioration of the loan portfolio quality, caused by an active war.

Head of the Board also recalled that in 2022 Oschadbank became a member of the Deposit Guarantee Fund, paying 777 million UAH contributions, which also respectively decreased the annual profit compared with the previous year.

Oschadbank was founded in 1991. Its sole owner is the state. According to statistics from the National Bank of Ukraine (NBU), on December 1, 2022, Oschadbank was in second place (282.828 billion UAH) among the 67 operating banks in the country by total assets.

Ukrainian President Vladimir Zelensky congratulated Petr Pavel on his victory in the Czech presidential election and invited him to visit Ukraine.

“Congratulated Petr Pavel on his victory in the Czech presidential election. Thanked him and the Czech people for their unwavering support. Invited him to visit Ukraine,” Zelensky wrote in his Telegram channel on Sunday.

Earlier it was reported that the former chairman of the NATO Military Committee Petr Pavel on Saturday won the second round of the presidential elections in the Czech Republic. After all ballots were counted, he received more than 58.3 percent of the vote. The inauguration is scheduled for March 9.

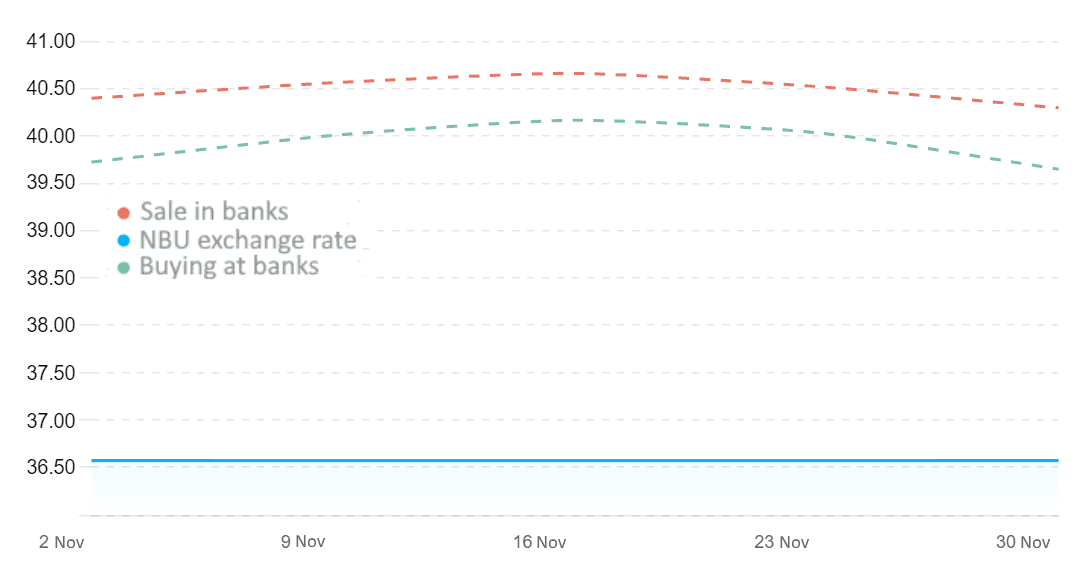

Quotes of interbank currency market of Ukraine (UAH for $1, in 01.11.2022-30.11.2022)

Source: Open4Business.com.ua and experts.news

Japan International Cooperation Agency (JICA) resumes work in Ukraine and will focus on reconstruction issues, Prime Minister Denis Shmygal said.

“The Japan International Cooperation Agency (JICA) resumes work in Ukraine and will focus on reconstruction issues. Good news for the 31st anniversary of the establishment of diplomatic relations between Ukraine and Japan,” Shmygal wrote in his Telegram channel.

The prime minister also said that he discussed with the Japanese ambassador Kuninori Matsuda further support for Ukraine in various areas.

“Priority: energy, housing reconstruction, humanitarian demining and support for small and medium-sized businesses in Ukraine. Touched on the situation at the Zaporizhzhia NPP. Called on Japanese partners to promote sanctions against the Russian nuclear industry”, – he added.

The U.S. dollar is stable against the euro and the pound on Monday morning and is weakly falling against the Japanese yen in anticipation of this year’s first meetings of the Federal Reserve, the European Central Bank and the Bank of England.

The ICE-calculated index showing the U.S. dollar’s performance against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona) is down less than 0.1% in morning trading.

The euro/dollar pair is trading at $1.0866 as of 7:47 a.m., versus $1.0869 at the close of last Friday’s session.

The dollar/yen exchange rate is down 0.1% at 129.70 yen, down from 129.85 yen at the close of trading on Friday.

The pound is trading at $1.2394 versus $1.2396 at the close of last session.

The Fed will release the results of its meeting on Wednesday, February 1. Analysts expect the Fed leadership to raise the key interest rate by 25 basis points, meaning the hike will be more moderate than at previous meetings.

Market participants will also closely follow the speech of Fed Chairman Jerome Powell, hoping to get new signals on the future trajectory of monetary policy.

Last week, it became known that growth in the Core Consumer Price Index (Core PCE), which the Federal Reserve closely monitors when assessing inflation risks, slowed to 4.4% in December from 4.7% in November, marking a fourteen-month low.

The outcome of the ECB and Bank of England meetings will be known on Thursday. Experts expect both central banks to raise interest rates by 50 bps.