Electricity imports on January 21 will amount to almost 7 thou MWh – it is 290-291 MWh every hour, according to data on the website of the Continental Europe System Operators Network ENTSO-E.

According to the information, the electricity is supplied from Slovakia.

As reported on January 21, the interstate section of 290MW for every hour of the day was booked by “D.Trading”, 5MW for all hours of “ERU Trading”, as well as 1MW for three hours from 16:00 to 19:00″ August.

For Jan. 22, D. Trading and ERU Trading booked the same capacity plus 1 MW each for the two nightly hours of NAP Community.

A total of 300-350 MW was auctioned, depending on the hour of the day, with a buyout price of 0 UAH/MWh.

According to DaM Europe in the established JSC “Market Operator” Telegram channel, the average price for electricity on the Slovak Republic on January 21 – 130.83 EUR / MWh, in Ukraine, the price of electricity BASE period on the DAM – 83.71 EUR / MWh.

The import supply on January 21 is the third in January reflected on the ENTSO-E website. The first was on January 15 – a total of 655 MWh: three hours of 50 MW (from 02:00 – 05:00), the following hours of 125 MW, 170 MW and 150 MW, and from 21:00-22:00 another 20 MW. D. Trading (130 MW each for all hours), ERU Trading (20 MW each for all hours), and Nextrade (20-30 MW depending on the hour) booked the section for that day. The second was for January 20, 220 MW in the last hour of the day, the cross-section for which was bought by D.Trading.

The Cabinet of Ministers of Ukraine in early January approved a regulation on the peculiarities of electricity imports during the autumn-winter period of 2022/2023, which as an incentive for businesses to import more expensive European resource gave guarantees of non-disconnection on the volume of imported electricity. According to Energy Minister Herman Galushchenko at a briefing on 20 January, in order to receive guarantees of non-disconnection, businesses must import a significant amount of electric power in accordance with their consumption, indicating that “it cannot be 1 MW”.

Prepared for the second reading of the bill on compensation for damaged and destroyed housing (#7198) takes into account the position of the Ministry of Reconstruction that compensation for destroyed housing, recorded in the “Diya”, will be provided with money in the form of housing certificates, not square meters, said Deputy Minister Alexandra Azarkhina.

“A person will have the opportunity to choose how he uses the housing certificate – either in the secondary housing market or primary housing. There is also an opportunity, in case of loss of a private house, to receive compensation for building materials and work on the site of the destroyed house,” – she said at the signing ceremony of the Memorandum of Cooperation between the Ministry of Reconstruction and Public Organization “Office of Transformation”.

Azarkhina specified that the housing certificate would be issued for the amount, which reflects the value of the destroyed housing, and it can be used when buying real estate.

The Deputy Minister stressed that the ministry and the team of authors of the bill № 7198 were categorically against the state itself to build housing to replace the destroyed and settle people there.

“We were against it, and we are glad that our approach was supported,” said Azarkhina.

“Housing certificate” can be used for five years to buy an apartment, private, garden or summer house on the primary or secondary markets. You can choose any region, except temporarily occupied territories and those where military operations are conducted. If funds from the housing certificate are not enough to buy the desired property, a person can add the missing amount, she added.

The basic source of compensation should be seized Russian assets.

As reported, more than 2.4 million Ukrainians live in housing damaged as a result of Russian aggression. Diya has already received more than 316 thousand applications for destroyed and damaged property. The Verkhovna Rada approved the draft law No. 7198 in the first reading in April 2022.

Deputy Minister of Community Development, Territories and Infrastructure has been unmasked for taking $400,000 bribe, at the moment the issue of his suspicion is being solved, the press service of the SAPU reports.

“On January 21, 2023, with the procedural guidance of the ACP prosecutors, NABU detectives exposed the deputy minister of development of communities, territories and infrastructure of Ukraine and other members of an organized criminal group for receiving $400 thousand in improper benefit for assistance in the conclusion of contracts for the purchase of equipment and machinery,” – said in the message.

It specifies that the preliminary legal qualification of the detainee’s actions is part. 4 of Art. 368, part 5 of Article 191 of the Criminal Code of Ukraine.

“At the moment the persons are detained in accordance with article 208 of the CPC of Ukraine. The question of reporting on suspicion and, accordingly, the choice of preventive measures”, – emphasize in the prosecutor’s office.

They note that in the summer of 2022, the Cabinet allocated 1.68 billion UAH to restore the critical infrastructure and ensure the population in the winter period of light, heat and water supply. However, the investigation revealed that a number of officials of the central and regional executive authorities decided to embezzle part of the state funds.

“Thus, in collusion with others, the officials ensured the conclusion of procurement contracts at inflated costs with predetermined business entities. At the same time, entrepreneurs were supposed to pay officials for “winning” tenders 280 million UAH, which was the difference between the actual and the purchase price of services,” law enforcement officials say.

They specify that during the search in the office of entrepreneurs there were found and withdrawn 920 thousand UAH and $38,7 thousand.

“Disclosure of the criminal organization, which included the Deputy Minister, was due to operational penetration of detectives in the organized criminal group. Investigative actions continue, all persons involved in the commission of this crime are established,” – summed up in the SAP.

As reported, on January 21, the National Anti-Corruption Bureau of Ukraine carried out searches and detained Deputy Minister of Development of Communities, Territories and Infrastructure Vasyl Lozinsky for embezzlement of budgetary funds. The detainee will be dismissed from his post, the Ministry of Development of Communities, Territories and Infrastructure of Ukraine said.

Electricity consumption on Sunday slightly increased compared with Saturday due to a cold snap, and the capacity deficit remains significant, but limits were slightly increased, Ukrenergo said on Sunday.

“Thanks to the weekend, despite the cold snap, all oblenergos were given slightly higher consumption limits than yesterday for the entire day,” the company points out in a telegram message.

“Ukrenergo reminded that Russian missile and drone attacks damaged power plants (generating facilities) and the high voltage network, and the last attack on January 14 caused significant damage to several power units of thermal power plants. In addition, heat is being replaced by frost across the country, the company pointed out.

The night before, operators of six power distribution systems reported that Ukrenergo had raised its Sunday limits for Sunday: daytime limits by about 6% and nighttime limits by 2%.

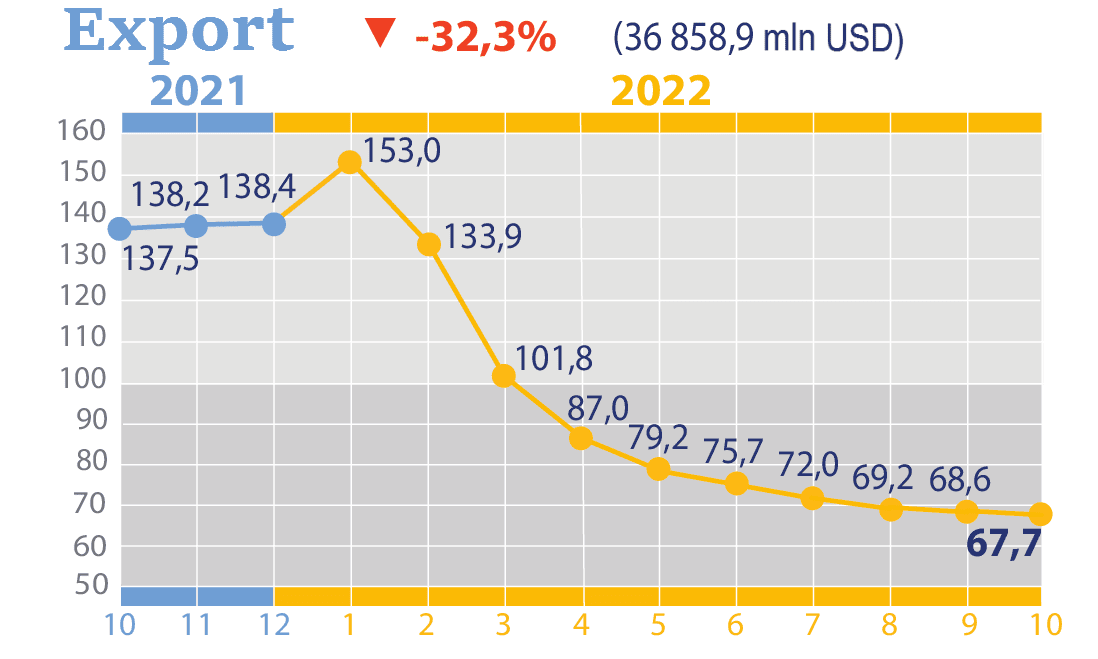

Export changes in % to previous period in 2021-2022

Source: Open4Business.com.ua and experts.news