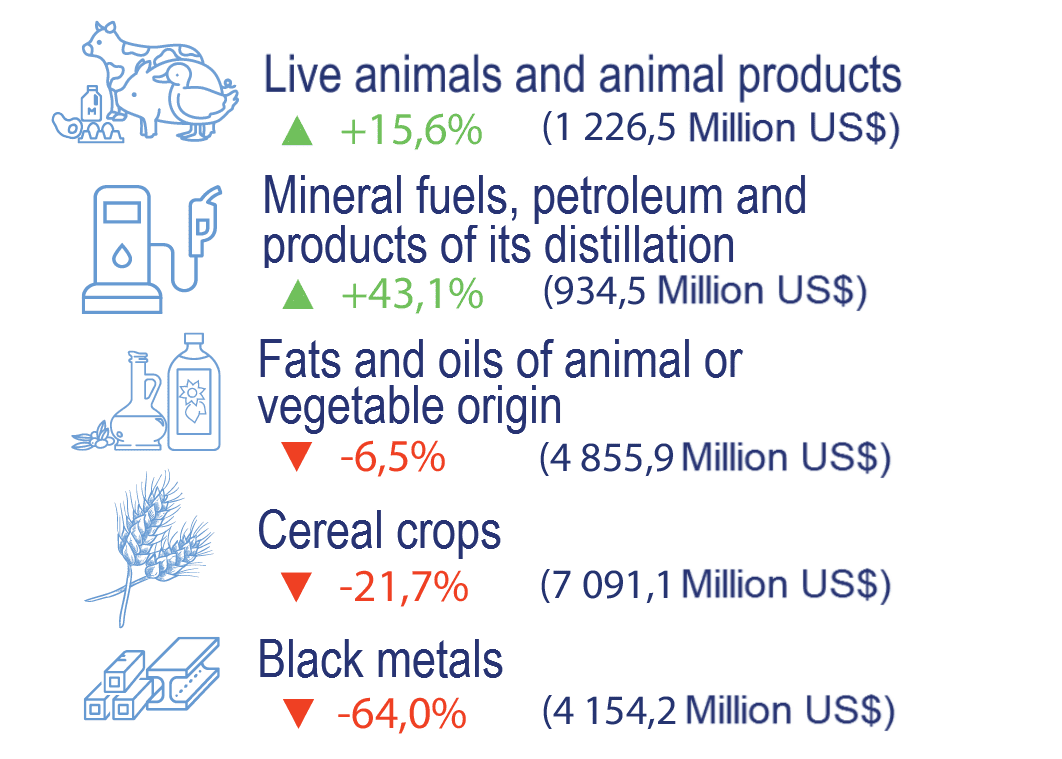

Export of goods in Jan-Oct 2022 to most important positions and in relation to same period of 2021

Source: Open4Business.com.ua and experts.news

Omnichannel retailer of appliances and electronics Eldorado.ua donated a modular house to a family in Chernihiv region within the framework of the “Zeglina for moles” charitable project together with Tera Monada, the retailer’s press service reported.

According to the report, the modular house is connected to all communications and equipped with furniture, appliances and a generator.

“The main goal at Eldorado.ua is to take care of Ukrainian families. That is why we organized this project to help families who have lost their own homes. I very much appreciate the trust of our customers and am grateful for their desire to help those in need. Many of the donations are not one but several “bricks”, there are 50 and 100 each. So this house in Chernihiv region is the “first swallow”, then we are preparing the next ones”, – Mikhail Kozlov, director of the retail department of Eldorado.ua, was quoted in the press release.

Half of the cost of modular home paid the retailer and the other half was collected thanks to customers’ donations. The charity project will last until the end of 2023. According to the company, today collected almost 40 thousand “bricks”, which amounts to about 900 thousand UAH (at the rate of 1 “brick” – 23 UAH).

Eldorado.ua – network of stores of home appliances and electronics in Ukraine, represented in offline and online environment. It was founded in 1999 as a division of the network of the same name. In 2013, the company becomes 100% Ukrainian. At the same time, it merges with the Tekhnopolis network. The beneficiary is Viktor Volischuk.

Today the chain has 95 stores in Ukraine. The staff consists of 3.2 thousand people. Since the beginning of the full-scale invasion, the company has transferred equipment and electronics worth 10 million hryvnias to the Armed Forces and terrorist defense.

Tera Monada is a social startup launched in June 2022 that creates modular, quickly-mounted houses for Ukrainians who lost their homes because of the war.

State Oshchadbank (Kiev) in 2022 issued 2.4 thousand car loans at 1.6 billion UAH, which is three times in number and 2.5 times less in volume compared to the figures in 2021 (7.2 thousand car loans at 4 billion UAH), said the head of the bank Sergey Naumov.

“Car loans in Oshchadbank last year enjoyed significant demand (2,421 loans totaling 1.6 billion UAH): the most popular car brands were Hyundai, Mitsubishi, Skoda and Toyota,” he wrote in Telegram on Friday.

He pointed out that 119 car loans worth 90 million UAH have already been issued in 2023.

Oshchadbank was founded in 1991. Its only owner is the state.

According to statistics from the National Bank of Ukraine (NBU), as of November 1, 2022, Oschadbank ranked second by total assets (UAH 270.806 billion) among 67 operating banks in the country.

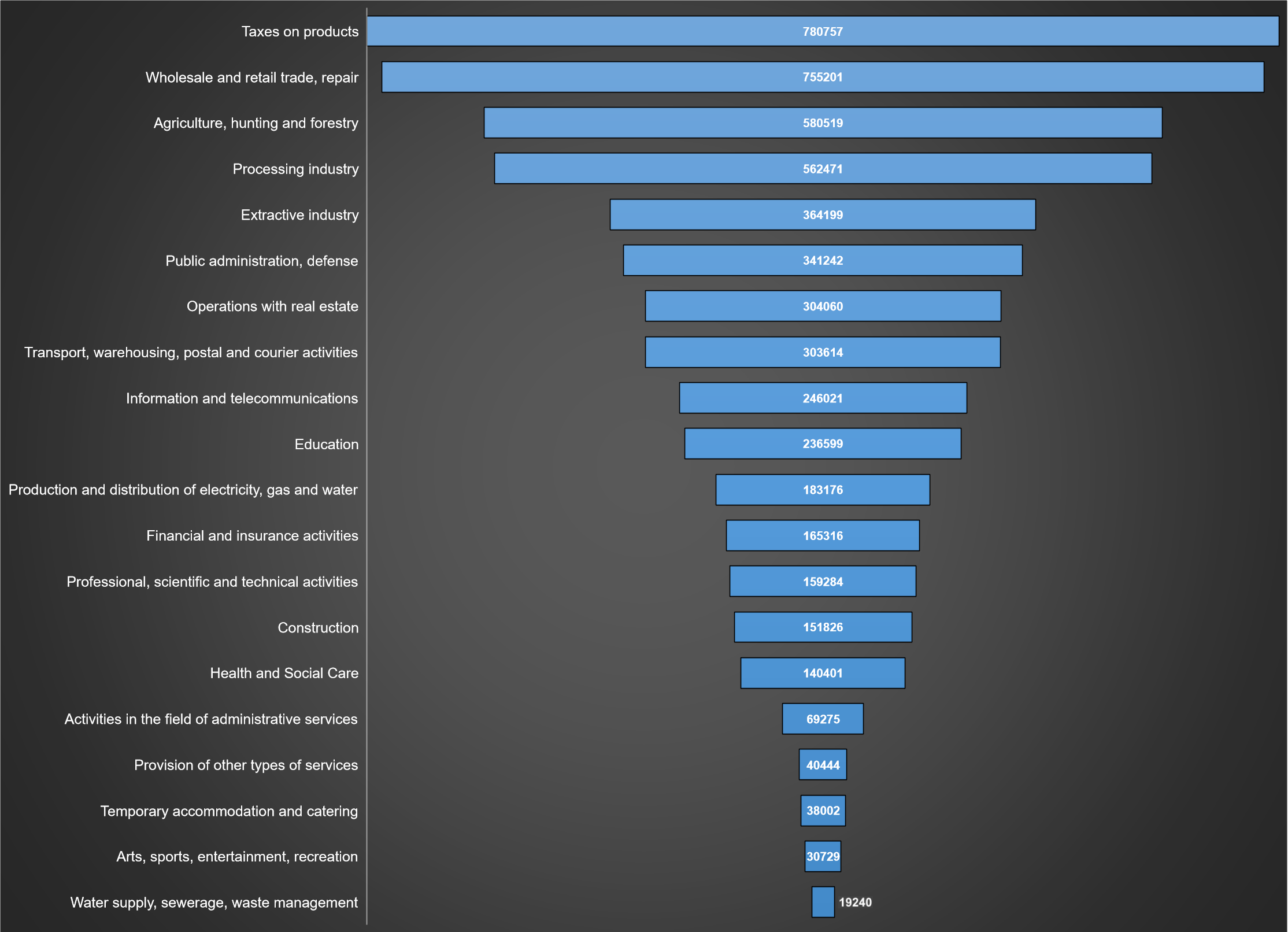

Structure of Ukraine’s GDP in 2021 (production method, graphically)

Source: Open4Business.com.ua and experts.news

Corum Group engineering company (“DTEK Energy”) manufactured and delivered a high capacity scraper conveyor to Metinvest’s Pokrovske mine, the company said on Facebook.

“The scraper conveyor is designed to transport coal, including in conditions of high concentration of dust and gas,” the statement said Friday.

The length of the conveyor – 120 m, power capacity – 2×85/250 kW, the load – from 1320 t/hour.

The company specified that a number of improvements have been made to the conveyor-loader’s design to increase its reliability; in particular, the construction of the chutes, the drive frame and the side group has been improved. The cost of the equipment was not disclosed.

Corum Group is Ukraine’s leading manufacturer of mining equipment and is part of DTEK Energo, the operating company responsible for coal mining and electricity generation from coal within Rinat Akhmetov’s DTEK holding.

As previously reported, as part of the relocation of Corum’s Druzhkivka Machine-Building Plant (Donetsk Region) and Svet Shakhtyora Plant (Kharkiv), production sites were created in Dnipropetrovsk, Volynsk and Khmelnytskyi regions.

In May 2022 the company manufactured its first roadheader after its relocation at the combine assembly plant in Dnipropetrovsk.

As of December 2022 (for 10 months of war) the company produced 133 units of mining equipment, eight combine harvesters and 454 units of spare parts and components.

Net sales of dollars by the National Bank of Ukraine (NBU) increased to $714.9 million in the third week after falling slightly in the second week of the new year to $652.5 million from $674.7 million in the first.

According to the National Bank on its website, it bought $7.5 million from January 16 to 20, the same as usual buying volumes during the war, while it sold $722.4 million, up from $659.0 million a week earlier.

On the cash market, the dollar depreciated by about UAH 0.15 during the week to about UAH 40.35/$1, while the spread remained narrow.

As we informed, the volume of interventions of the National Bank in December increased to $3.16 billion from $1.57 billion in November and $2.03 billion in October.

International reserves of the National Bank in December increased by 1.9%, or $536.4 million to $28.491 billion due to currency receipts from international partners, which exceeded the NBU interventions to sell currency to support a fixed rate. For 2022, they decreased by 7.9%, or $2.45 bln.

Last year, the NBU bought $3 bln 268.0 mln and EUR111.0 mln on the market, and sold $26 bln 380.6 mln and EUR1 bln 789.1 mln.