The Cabinet of Ministers at a meeting on Friday appointed Oleg Tolmachov as acting director general of Ukrhazvydobuvannya instead of Alexander Romaniuk and Roman Malyutin as acting director general of Ukrtranshaz instead of Serhiy Pereloma.

This was reported by the Naftogaz group on Friday evening.

“Roman Malyutin and Oleg Tolmachev are high-class specialists with considerable experience in the oil and gas sector. They are well acquainted with global experience, but have also worked hard in Ukraine and understand the challenges we are currently facing,” said Naftogaz Group head Alexey Chernyshov.

Oleg Tolmachev, who headed Naftogaz Group’s Naftogaz Upstream division, became Ukrhazvydobuvannya’s acting director.

Oleg Tolmachev has more than 20 years of experience in hydrocarbon production in North America. He has held senior positions in gas production companies in the US such as BP America, Chesapeake Energy, EnCana Oil & Gas USA, Eclipse Resources and Montage Resources. In particular, he led high-tech projects to develop large gas and gas condensate fields in North America. Among his responsibilities were increasing the economic efficiency of projects, formation and management of multifunctional teams (geology, development, drilling, production, preparation and processing of hydrocarbons).

Roman Malyutin, who has over 20 years of experience at gas transmission and storage companies, was appointed Acting Head of Ukrtransgas JSC, the operator of all Ukrainian underground gas storages.

Roman Malyutin went all the way from an operator and engineer at Kegichevsk UGS to Deputy Chief Engineer of the eastern region of the Ukrainian Gas Transmission System Operator. For the last year and a half he headed the technical department of Ukrtransgas JSC, where he was responsible for the operation of compressor stations, areas of energy and metrology, and also accompanied projects to develop low-carbon technologies and storage of hydrogen mixtures.

Net sales of dollars by the National Bank of Ukraine (NBU), after jumping to $1 billion 101.79 million in the last week of last year, fell to $674.7 million in the first week of the new year.

According to the National Bank on its website, it bought $7.9 million from Jan. 2 to 6, which corresponds to the usual volume of purchases during the war, while it sold $682.6 million, compared to $1 billion 101.79 million a week earlier.

At the cash market the dollar went up again at the level of about 40.75 UAH/$1, but the spread has narrowed a bit.

As we informed, the volume of the NBU’s interventions in December increased to $3.16 bln from $1.57 bln in November and $2.03 bln in October.

Overall for 2022, the NBU bought $3 billion 268.0 million and EUR111.0 million from the market and sold $26 billion 380.6 million and EUR1 billion 789.1 million.

Including the purchase of foreign currency has reached $2 billion 611.1 million and EUR111.0 million since the war began, while the sale – $23 billion 610.4 million and EUR1 billion 789.1 million.

International reserves of the National Bank increased by 1.9% or $536.4 million in December to $28.491 billion due to currency receipts from international partners, which exceeded the NBU interventions to sell foreign currency to support the fixed rate.

Overall, they fell by 7.9%, or $2.45 bln in 2022.

Ukraine imported 669.4 thousand generators in 2022, MP Yaroslav Zheleznyak (Golos faction) said.

“Of these, 643.8 thousand generators were imported by enterprises, 25.5 thousand were imported by citizens (about 4% of the total),” he wrote in his Telegram Channel on Friday.

According to Zheleznyak, almost half of the generators were imported in December – 309.4 thousand, 52 times more than at the beginning of the year, when just over 6 thousand were imported in January.

The MP noted that demand has steadily increased during the year, although fewer generators were imported in March – 4.6 thou.

A French court on January 5 evening released on bail of EUR 1 million businessman, former MP Konstantin Zhevago, who was arrested on December 29 after being detained in Courchevel at the request of the State Bureau of Investigation (GBI), reports the publication Le Dauphine Libéré.

“I did not do all the things I am accused of. I have always fought corruption. Over the past three years, I have asked for my country’s justice to hear me 15 times and 15 times I have been denied,” the businessman was quoted as saying in the article.

According to it, Zhevago is now living in Dubai and has applied for asylum in Gibraltar.

The former deputy said that he is not an oligarch and has always fought against oligarchs, while his lawyers stressed that the businessman needs to be free to continue running his business.

Earlier, it was reported that the court on the same day postponed a hearing on Zhevago’s extradition to Ukraine until January 19 so that the prosecutor and lawyers could prepare.

The State Bureau of Reconstruction and Development accuses Zhevago and a number of top managers of Finance and Credit Bank of organizing a mechanism for embezzlement of $113 million, thus causing damage to the interests of the state and the bank depositors.

According to the State Border Service of Ukraine, the property of the suspect and his associates has been seized, in particular, “shares of his companies worth hundreds of millions of hryvnias, 26 properties, … 14 property complexes, 21 pieces of property complexes, 30 non-residential premises and 10 apartments”.

Kiev’s Pechersky Court decided to detain Zhevago in late 2019, and he was put on the international wanted list in the summer of 2021, although his lawyers denied this fact.

In 2022 LNZ Group agricultural holding produced 7 thousand tons of frozen berries, fruits and vegetables at its plant for frozen berries, vegetables and vegetables in Shpole (Cherkasy region). They are sold under TM Tevitta – raspberry, sweet corn, seedless cherry, pumpkin, elderberry, currant, blueberry etc.

According to the LNZ website, the Tevitta brand has a closed circle of production and performs all production processes on its own, from growing to direct sales of packaged products.

In particular, the nursery has grown 2 million seedlings of strawberry, 220 thousand of raspberry and blackberry and about 50 thousand of other cultures: dog rose, elderberry, currant and cherry. In addition, in 2022, the company planted two new nurseries for raspberries and strawberries, a nursery for nursery seedlings, and built nearly three dozen tunnels for growing berries on an area of more than 2 hectares.

“Despite the war, the Tevitta brand was able to ramp up production, storage and direct processing capacity. And while the brand was already in operation in 2021, it was 2022 that was the year to fully launch and operate. The brand combined seedling production, berry, vegetable and fruit freezing and market sales. That is, the full-scale military invasion of the Russian Federation, the company actually met at the stage of formation,” the company said.

In addition, in the fields Tevitta planted 60 hectares of land for growing different raw materials for processing – from strawberries to rose hips. The nursery works not only to meet its own needs, but also supplies seedlings to farmers who are engaged in industrial berry production.

“The company is pleased with the result: the plant in 2022 came out to almost 100% utilization. What’s more, it has expanded its export boundaries. Products have already reached the markets of France, Belgium, Germany, Estonia and England. In addition, in early 2023 frozen products of Tevitta brand can be found on the shelves of stores in Ukraine and other European countries”, – summed up the holding.

LNZ Group was established on the basis of Lebedinsky seed plant. It specializes in selling corn, sunflower, wheat and barley seeds, as well as growing agricultural products and livestock. The group cultivates 70 thousand hectares of land, the number of cattle is about 6 thousand heads.

LNZ Group owns two elevator complexes in Sumy and Kirovograd regions with total storage capacity of 170 thousand tons of grain, and also has its own fleet of cars.

In the unified state register of legal entities and individuals the ultimate beneficiary of PJSC Lebedinsky seed plant (Cherkasy region) is Dmytro Kravchenko.

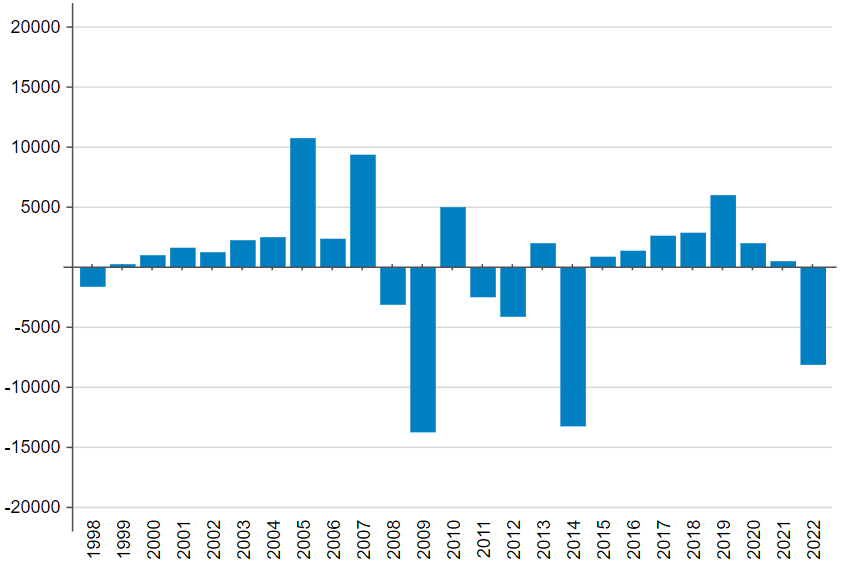

Dynamics of balance of payments of Ukraine in 1998-2022 (USD mln)

http://www.minfin.gov.ua