Founder and CEO Elon Musk announced the launch of a new project from his company Tesla, Inc. — a modular house that will be manufactured and assembled using a model similar to that used in the production of electric cars. The company has published a video announcement demonstrating the assembly of modules, the installation of “smart” systems, integration with energy infrastructure, and the possibility of quick installation on site.

According to Musk, the Tesla modular home will have a number of key features, namely:

Musk noted that “the housing of the future must be built quickly, efficiently, and with minimal impact on the environment,” and that Tesla “can do for buildings what it has done for transportation.” According to him, the first prototypes will be assembled as early as 2026, and mass production is planned to start in 2027.

The company expects modular homes to be in demand both in the US market and abroad, especially in places with rising real estate prices and housing shortages. Musk emphasized that Tesla is considering partnerships with builders and developers around the world.

Elon Musk is one of the most famous entrepreneurs of our time. Born in 1971 in South Africa, he later moved to Canada and the US. He founded or was one of the key figures in companies such as PayPal, SpaceX, and Tesla. Musk has become a symbol of “21st-century technological entrepreneurship.”

Tesla, Inc. is an American company founded in 2003 that specializes in electric vehicles, renewable energy solutions, and stationary storage. On Musk’s initiative, the company scaled up production, launched Gigafactory, and became one of the leaders in the green tech sector.

The launch of the modular home project demonstrates the expansion of Tesla’s business format — from transportation and energy to residential construction — and may become a new growth vector in the field of “smart homes” and sustainable construction.

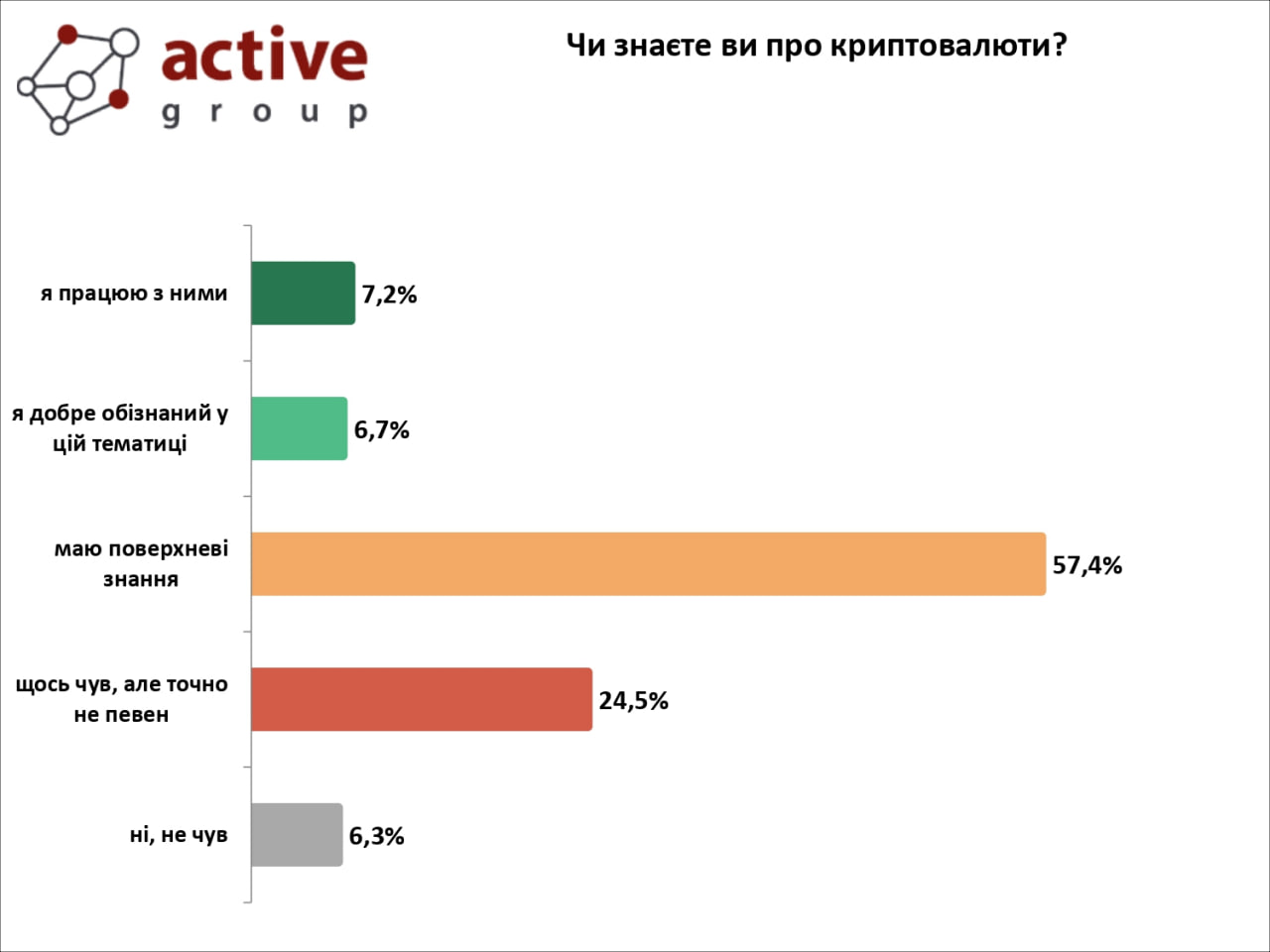

Only 14% of Ukrainians are well versed in cryptocurrencies or work with them

7% work with cryptocurrencies

7% are well informed about digital assets

57% have only superficial knowledge

25% “have heard something, but are not sure”

6% have never heard of cryptocurrencies

Regarding investment security:

25% consider them safe

38% consider them risky

37% cannot decide

So, Ukrainians are still hesitant about cryptocurrencies and their risks

The full study and methodology can be found at this link

Source: https://t.me/pulsweek/1122

In the context of the war, Ukrainian dairy farms are facing an acute shortage of staff. Forced migration, mobilization of workers, and reduced opportunities for professional training have created serious challenges for the development of the industry.

This was stated during the XVII International Dairy Congress by Valery Lototsky, associate professor of the Department of Animal Reproductology at Bila Tserkva National Agrarian University, head and co-founder of the AVM Advisory Center and Veterinary Service Centers, and AgriAcademy expert.

The International Dairy Congress, organized by the Association of Milk Producers (AMP), is the most powerful event of the year in the dairy industry. This year, it brought together hundreds of leading industry representatives: producers, scientists, and businesspeople to exchange experiences and the latest achievements in the dairy business.

“Today, dairy farm managers are forced not only to maintain production, but also to invest in knowledge to compensate for staff shortages and adapt their work to European requirements for animal welfare and product safety,” the expert emphasized.

That is why, in November 2025, the educational platform AgriAcademy will launch a new certified online course, “Best Practices for Cattle Welfare and Responsible Use of Antibiotics to Prevent the Development of Antibiotic Resistance.”

Three key risk periods and how to control them

The author of the course, Valery Lototsky, notes that the training will help farm workers understand where mistakes are most often made when using antimicrobial drugs and how to avoid them.

The course covers three critical stages in cattle breeding:

“During the third module, participants will learn to identify critical points for the onset of mastitis, follow the milking protocol, select the right antibiotics, and develop their own treatment and prevention plan,” said Valery Lototsky.

AgriAcademy is a free platform that is changing agricultural education

AgriAcademy is a modern online platform for agribusiness, created in 2022 by the EBRD. It is a free online training platform for agricultural workers and students of agricultural education institutions, launched by the EBRD in December 2022 as part of a program to support food security in Ukraine. Its goal is to strengthen the competitiveness and sustainable development of agriculture, which has suffered significant losses due to the war.

Today, the platform offers 28 online courses – over 300 hours of practical training in agronomy, management, technology, processing, storage, and more. Each course includes a test of the students’ knowledge.

The creation and management of the platform (including course development, training tours, etc.) is supported and funded by the EBRD, as well as:

Today, the platform offers:

AgriAcademy is not just about learning. It is a response to the challenge facing the Ukrainian agricultural sector: how to preserve and develop human capital in times of war. Choose a course and grow with us!

On October 27, a new course, “Rearing and Fattening Young Cattle,” by Yevgen Shatokhin, an international expert on animal husbandry at the Food and Agriculture Organization of the United Nations (FAO) and the EBRD, became available on the AgriAcademy platform. The course was announced on October 18 during the International Dairy Congress, writes SEEDS.

The course “Raising and Fattening Young Cattle” is designed for owners, managers, and employees of farms who want to develop cattle breeding and fattening or start a business in this segment.

“Today, Ukrainian farmers are looking for proven solutions that will help reduce risks, increase production efficiency, and achieve stable profitability. That is why we have prepared a course that brings together the practical experience gained over 25 years of work in animal husbandry,” said Yevgen Shatokhin.

Education that helps you earn money

The course “Raising and Fattening Young Cattle” is a new training program that will soon be available on the AgriAcademy.org platform, which brings together dozens of free practical courses for Ukrainian agribusiness.

AgriAcademy is a free online learning platform created on the initiative of the EBRD as part of its program to support food security in Ukraine. Its goal is to strengthen the competitiveness and sustainable development of agriculture, which has suffered significant losses due to the war.

The platform’s creation and management (including course development, training tours, etc.) is supported and funded by the EBRD, as well as:

The course covers key business organization issues:

“We wanted to create not a theoretical lecture, but a step-by-step guide that farmers can immediately apply in practice. All modules were filmed on real farms, demonstrating technological solutions that have already proven their effectiveness,” explains the course author.

Course structure

The program consists of six modules covering the entire production cycle:

After each video module, participants take a short test to reinforce what they have learned.

The total duration of the course is 4 hours.

Who can take the course

The course will be useful for:

The course is available free of charge on the AgriAcademy.org platform.

Upon completion, participants receive a certificate and access to other training programs, ranging from agricultural enterprise management to product processing and sustainable production.

AgriAcademy provides practical education that helps farmers develop their businesses and move forward.

Practical knowledge, modern technologies, and a systematic approach to livestock development

Today, the platform already offers more than 30 certified courses for managers and specialists of agricultural companies, farmers, veterinarians, agronomists, students, and teachers.

The main areas of the courses are:

By the end of 2026, AgriAcademy will launch 20 new courses that address the most pressing challenges facing agribusiness.

Studying with AgriAcademy is easy, interesting, and useful

Go to training and get a certificate at AgriAcademy.org

Turkish shoe retailer FLO is reducing its presence in the Ukrainian market: as of October 2025, it has only one store left in Ukraine — in the Fontan Sky shopping center (Odessa), whereas the company had previously planned to open up to 50 retail outlets.

According to publications, the closure of the company’s stores was influenced by extremely low sales: for example, the FLO hall in the Nikolsky shopping center in Kharkiv had an area of about 1,200 m², but its turnover was 4-5 times lower than expected.

According to data from the state register, in January-June 2025, the Ukrainian division’s revenue amounted to 53.3 million hryvnia, a decrease of 39.3% compared to the same period last year; the company’s loss during this period amounted to about 43 million hryvnia.

FLO is a Turkish footwear chain founded in the 1960s, with more than 850 stores in over 30 countries. It is one of the leading footwear retailers in the Middle East, African, and Eastern European markets. In 2020, FLO entered the Ukrainian market, opening its first stores in Lviv and Kyiv.

Ukraine may export an additional 46,000 tons of sugar to the EU as early as 2025, according to a statement by the National Association of Sugar Producers of Ukraine “Ukrtsukor” on its Telegram channel.

The industry association recalled that on October 29, 2025, an updated trade agreement between Ukraine and the European Union came into force, which provides for a 400% increase in the tariff quota for white sugar to 100,000 tons. As part of the agreements reached, the quota for the current year has also been revised, which will allow Ukrainian sugar producers to export an additional 46,625.8 tons of white sugar to the EU by the end of 2025.

According to Cabinet of Ministers Resolution No. 1368 of October 29, 2025, this volume will be distributed among exporters in proportion to the volume of exports of the specified products to the EU during January-May 2025.

Ukrtsukor specified that in October 2025, Ukraine exported 44.4 thousand tons of sugar worth over $20 million, of which only 2% was supplied to EU markets. Lebanon was the leader in terms of export volume, receiving 48% of all sugar. Syria and North Macedonia were also among the top three importers of Ukrainian sugar in October.