NEC Ukrenergo and the European Bank for Reconstruction and Development signed an agreement on a EUR70mn target grant to the company from the bank’s Special Fund provided by the government of the Kingdom of the Netherlands, NEC CEO Volodymyr Kudrytskyy said.

As Kudritsky explained on his Facebook, the funds will be used exclusively to purchase the equipment needed to resume the reliable operation of Ukraine’s energy infrastructure.

“We are grateful to our international partners for such a high level of confidence in our company and strong support in the restoration of Ukraine’s energy system. We are now actively working with manufacturers around the world to deliver the necessary equipment as soon as possible,” said the head of Ukrenergo.

As earlier reported, at the beginning of December, NEC Ukrenergo noted that it had attracted EUR300 mln of credit funds from the EBRD, EUR150 mln of which would be allocated for the purchase of equipment necessary for substations that have been subject to massive Russian missile strikes.

The rest EUR150 mln of the EBRD loan will be used to replenish Ukrenergo’s working capital, in particular, to fulfill the company’s financial obligations in the electricity market amid the non-payments that arose in the market because of the war.

At the same time, there was also talk about attracting EUR72 million in grant funds from the Netherlands to restore networks and improve the financial stability of the company.

Some Ukrainian pork producers and processors plan to start exporting pork to EU next year as they study European regulations and prepare for unofficial audits on the compliance of their products with export requirements.

At the moment, four Ukrainian enterprises of the industry are interested in launching pork exports to Europe, according to the website of the Association of Ukrainian Pork Producers (ASU) on Thursday.

“We have been working with experts and the veterinary service to have “draft” questionnaires ready in advance for enterprises that want to check whether they meet the requirements of EU regulations. A number of processors interested in exporting pork have gone through these questionnaires to assess what they need to polish to prove their compliance with regulations,” the organization quotes its president Oksana Yurchenko as saying.

According to her data, the EU “has a certain understanding” that next year may be introduced certain indulgences for Ukrainian pork products, which before the full-scale Russian aggression was not even particularly discussed.

“Next year, in cooperation with international organizations, we will start informal audits to support such producers. Now there are four enterprises,” Oksana Yurchenko stressed in a statement.

According to ACU estimates, the European Union will be open to exports of Ukrainian pork for up to two years, and this is not a pessimistic scenario.

In turn, the industry is promoting the official approval of international certificates for the export of pork to Vietnam and Hong Kong, but so far it is not very relevant, because the sea routes are closed due to the aggression of Russia, and other logistics for producers financially unprofitable.

As reported, on May 11, 2022, the European Commission allowed the export of pork, beef and processed meat products produced in Ukraine to third countries via the EU.

As of February 1, 2022, the total number of pigs in Ukraine amounted to 5.56 million, a decrease of 3.4% compared to the same date in 2021. Data for the following months was not published by the State Statistics Committee due to the beginning of full-scale Russian military aggression in Ukraine.

Consumption of pork per capita in Ukraine this year will be 20 kg/year, up slightly from 19.9 kg/year in 2021. A total of 625 thousand tons of meat and meat products will be produced in the country during the year.

The company’s oil price is expected to remain stable on the last working day of the year amid low trading activity, ending the fourth quarter in negative territory, Interfax-Ukraine news agency Interfax reported on Thursday (Dec 2).

Fears that a sharp lifting of quarantine restrictions in China, which has already led to an increase in the incidence of COVID-19, will weaken the country’s economy and, consequently, the demand for oil, put pressure on the market. In addition, investors do not rule out a new wave of coronavirus infection in the world.

Earlier, the Chinese authorities announced that they would resume issuing documents for tourists wishing to travel abroad. The United States and Italy have already announced additional requirements for passengers arriving from China.

Data from the U.S. Department of Energy, released on Thursday, showed an unexpected increase in the country’s oil reserves last week. Reserves rose by 718,000 barrels, while analysts polled by Bloomberg agency forecast an average decline of 1.2 million barrels.

Gasoline inventories decreased by 3.1 million barrels and distillates increased by 283,000 barrels.

The value of March futures on Brent crude oil on London’s ICE Futures Exchange by 7:15 am on Friday stands at $83.8 per barrel, which is $0.34 (0.41%) higher than the price at the close of the previous session. Those contracts fell $0.53 (0.6%) to $83.46 a barrel at the close of trading on Thursday.

The price of WTI futures for February increased by $0.33 (0.42%) up to $78.73 per barrel at electronic trades of NYMEX. By the close of previous trading, those contracts had fallen $0.56 (0.7%) to $78.4 a barrel.

“We have another year ahead of us with serious uncertainty, and the oil market will remain highly volatile,” said Oanda chief analyst Craig Erlam, cited by Bloomberg. – The new year promises many surprises and twists and turns.

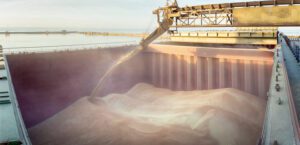

Ukrainian ports from December 20 to 29 left 41 vessels with almost 1.6 million tons of food, the Joint Coordination Center (JCC) reports.

“From December 20 to 28, 38 vessels left Ukrainian ports, they transported a total of 1,552,879 tons of grain and other foodstuffs within the framework of the Black Sea grain initiative,” the report said.

It is noted that on December, 29 three dry cargo vessels with 42,070 tons of food left Ukrainian ports.

Two vessels New Victory (23.5 tons of barley) and Panjali Teymurov (3.3 thousand tons of vegetable oil and 2 970 tons of soybean oil) went to Tunisia. Aileen dry cargo ship will deliver 12.3 thousand tons of sunflower meal to Morocco.

SKZ reported that “61 applications for participation in the initiative have been submitted.

In addition, 10 vessels are waiting for permission to enter Ukrainian ports, 31 loaded vessels are waiting for departure to their destinations.

“As of December 29, the total tonnage of grain and other agricultural products exported from the three Ukrainian ports is 15,959,660 tons. A total of 1,206 vessels have been permitted to move so far: 597 to arrive at Ukrainian ports and 609 to leave them,” the JCC summarized.

The U.S. dollar is weak against the euro in trading on Friday, stable against the pound and getting cheaper against the yen.

The calculated ICE index, which shows the dollar’s movement against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona), is adding 0.14% in trading, while the broader WSJ Dollar Index is stable.

The ICE Dollar Index, which rose in September to its highest level in 20 years, has since declined 10%. Nevertheless, the index ends 2022 up more than 8%.

As of 8:05 a.m. Ksk on Friday, the euro/dollar pair was trading at $1.0650 compared to $1.0664 at the close of the previous session. The exchange rate of the pound to the dollar is $1.2050 against $1.2055 the day before.

The value of the U.S. currency in a pair with the yen dropped to 132.55 yen, compared to 133.03 yen in previous trading.

The Bank of Japan continues unscheduled redemption of government bonds on Friday for the third consecutive day in an effort to curb the growth of bond yields, Bloomberg reported. This month the volume of redemption of government bonds by the Japanese Central Bank has reached a record level of 17 trillion yen ($128 billion).

The Bank of Japan unexpectedly expanded the boundaries of the corridor of permissible fluctuations in yields of ten-year government bonds at the December meeting that was perceived by the market as a step towards easing its policy.

“We believe that the Japanese Central Bank is experiencing difficulties with its policy of yield control and in the end it will have to abandon it – this is a key factor in strengthening the yen,” notes Rodrigo Catherill, a currency market analyst at National Australia Bank Ltd. in Sydney.

The expert expects the dollar to yen to 120 yen in 2023.

EURO, pound, U.S. dollar, yen