The founder of mobile izibank Anna Tihipko-Baikovska has joined the supervisory board of Dniprovagonmash (DVM, Kamenskoye, Dnipropetrovsk Region), which is controlled by her father, businessman Serhiy Tihipko, a financial and industrial group TAS.

According to the publication of the company in the information disclosure system of the National Commission on Securities and Stock Market (NSCM), the relevant information from the shareholder T.A.S. OVERSEAS INVESTMENT LIMITED (owns 99.9988% of share capital) on the replacement of his representative in the Supervisory Board from December 16 DVM received on Thursday.

According to the shareholder’s report, this terminated the authority of Sergei Mandra, who had been a member of the DVM JSC’s supervisory board since April 2013.

According to DVM, Tigipko-Baykovska currently holds the position of director of business development at izibank and deputy director for control of strategic assets at TAS Asset Management LLC, previously she was an advisor at TAScombank JSC. She does not own any shares of DVM JSC.

“Dneprovagonmash is one of Ukraine’s leading companies in the design and manufacture of freight cars.

In January-September 2022, it earned UAH 6.15 mln in net profit compared to a UAH 97.7 mln loss for the same period in 2021, and its net income increased 2.2 times, to UAH 849.86 mln.

The board of directors of DVM has four members and has been chaired by Serhiy Tihipko since 2005.

izibank is a fintech project created jointly with the TAS Group and launched in beta mode in the fall of 2020.

TAS Group was founded in 1998. Its business interests cover the financial sector (banking and insurance segments), industry, real estate, and venture projects.

The U.S. dollar is steadily strengthening against major world currencies in trading on Thursday, the pound is getting cheaper after the publication of the results of the Bank of England meeting.

The ICE-calculated index that shows the trend of the U.S. dollar against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and the Swedish krona) rose 0.5% in trading, while the broader WSJ Dollar Index gained 0.7%.

The pound-dollar exchange rate was down to $1.2317 by 2:35 p.m., compared with $1.2425 at the close of the previous session.

The Bank of England raised its benchmark interest rate by 50 basis points (bps) to 3.5% at the end of Thursday’s meeting, as most analysts had expected. The rate was increased at the end of the ninth consecutive meeting and reached its highest value in 14 years.

The British Central Bank slowed the pace of rate hikes, with its leaders divided on the steps needed. Seven of the nine members of the Monetary Policy Committee (MPC) voted to raise the rate, with six, including Bank of England governor Andrew Bailey, in favor of a 50bp increase, while one vote was cast for a 75bp increase. Two MPC members voted to keep the rate at 3% per annum.

The European Central Bank (ECB) will announce the results of Thursday’s meeting at 16:15 Moscow time, and at 16:45 Moscow time it will hold a press conference with President Christine Lagarde.

The ECB may also slow the pace of key rate hikes to 50bp after their increase by 75bp in October and September, experts expect. In addition, the European regulator on Thursday is to present a plan to reduce the amount of assets on its balance sheet, which reached 5 trillion euros after years of bond purchases by the Central Bank.

The euro/dollar pair is trading at $1.0619 on Thursday compared to $1.0682 at the close of the previous session.

The dollar rose to 136.56 yen, compared to 135.47 yen in previous trading.

The day before the Federal Reserve System (FRS) raised its key interest rate by 50 basis points and made it clear that it is going to continue its rise. The rate was raised to 4.25-4.5% per annum – the maximum since 2007.

The head of the Federal Reserve Jerome Powell said during a news conference after the meeting that the U.S. Central Bank will stick to the course of tightening monetary policy until it returns inflation to the target level of 2%.

The Fed leaders’ median forecast is that the rate will reach 5.1% by the end of 2023 and fall to 4.1% by the end of 2024 and then to 3.1% by the end of 2025.

The dollar/yuan exchange rate rose to 6.9678 yuan on Thursday versus 6.9506 yuan the day before.

Commodities will become the most successful asset class in 2023, providing investors with returns of over 40%, analysts predicted Goldman Sachs Group.

According to their forecasts, the Standard & Poor’s GSCI Total Return Index, which takes into account the price dynamics of 24 types of commodities, will grow by 43% next year. The indicator is up 24% since the beginning of this year, while the S&P 500 stock index is down 16%.

“While individual commodity prices have nearly doubled, the amount of capex in the commodities complex as a whole is disappointing,” wrote Goldman analysts led by Jeff Curry and Samantha Dart. – “This has been a major revelation of 2022: Even extremely high prices can’t create enough capital inflows and trigger supply growth to address long-term deficits.

The price of Brent crude oil will reach $105 a barrel in the fourth quarter of next year, copper will cost $10,500 a ton, and liquefied natural gas on the spot market in Asia will rise to $53.1 per million British thermal units (BTU), Goldman forecasts.

As of Wednesday, Brent is trading near $82 a barrel, copper is at $8,400 a tonne and LNG is at $33 per 1 million BTU.

Ukrzaliznytsia reported delays of four trains due to enemy shelling near Nikopol and damage to the contact network.

At the same time, according to the railway company’s Telegram channel on Wednesday, Ukrzaliznytsia deployed reserve diesel locomotives to safely pull out of the region.

At the moment, such flights are delayed:

No. 62 Odessa-Kharkov – delayed by 4 hours;

#276 Kyiv-Zaporizhzhia – delayed for 4 h 30 min;

#119 Lviv-Zaporizhzhya – for 2 hours;

#120 Zaporizhzhya-Lviv – by 30 min.

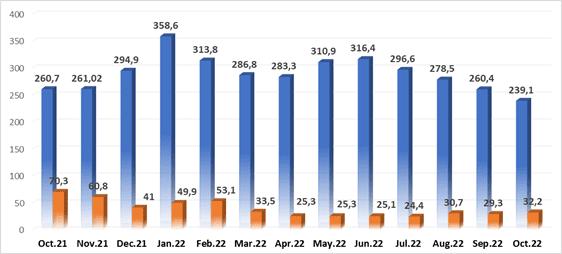

Number of unemployed in Ukraine and job opportunities, Sep 21 – Sep 22

State employment center

Willis Towers Watson (WTW), a leading global advisory and brokerage firm, expects deal-making to remain active in 2023 despite continued uncertainty and major obstacles, and recession fears will cause a “small object effect” as larger deals lose popularity, the WTW website notes.

It also notes that the global M&A market remains remarkably resilient during a year of unprecedented uncertainty. Mergers and acquisitions in 2022 have been affected by a host of factors – geopolitical turmoil, soaring inflation, rising interest rates and fears of a global recession – that will continue into next year. In such a difficult economic environment, it’s harder for buyers, especially those who go beyond their borders, to confidently predict the profitability of potential targets.

“An unprecedented number of disruptive forces have created barriers to deals, but they also create opportunities. The fundamentals behind deal making are still in place, and with valuations dropping after the historic levels reached in 2021, both strategic and financial buyers will take advantage of better growth opportunities,” notes Duncan Smithson, senior director of mergers and acquisitions, WTW.

WTW has identified five major M&A trends for 2023. The first trend is the return of the “small item effect,” which will result in buyers increasingly focusing on smaller deals.

The second is opportunities in distressed M&A, as a challenging operating environment will lead to more companies getting rid of non-core assets in pursuit of long-term value creation. Some deals will be strategic – energy companies, for example, will continue to get rid of carbon-intensive assets – while continued economic uncertainty will force other companies to sell assets – the retail and leisure sectors often have higher operating leverage. This can create opportunities for buyers to expand product lines, services or supply chains at a reduced cost.

The third is technological mergers and acquisitions: from defense to offense. The need for the speed of digital transformation across all industries, accelerated by an era of volatility, will keep deal-making in the spotlight, and a wave of acquisitions in the artificial intelligence and machine learning markets is expected in 2023. Whether it’s introducing new technology and talent or reaching new markets, mergers and acquisitions continue to be the fastest way to transform businesses to remain relevant and sustainable in today’s fast-changing world.

The fourth is geopolitical impact. Because of the many supply chain disruptions during the pandemic, which is expected to continue into 2023, companies will consider M&A deals to improve their operational resilience. The vulnerabilities that continue to lead to problematic deal flows in the hardest-hit sectors will also be catalysts for companies to reinvent their own supply chain networks. By attracting or locating suppliers closer to production, businesses will seek greater security and resiliency.

Fifth, the focus will remain on environmental, social and governance (ESG) issues. As more investors view ESG as fundamental to financial success, businesses will face increasing scrutiny and pressure on climate risk transparency, social justice, sustainability and corporate governance. “Green” due diligence is undoubtedly on the rise.

“As we approach 2023, economic uncertainty will continue to define and challenge mergers and acquisitions, but there will also be opportunities. That same volatility will provide its own incentive for deals, as strategic buyers look to capitalize on lower-priced deals to confront current market challenges and realize transformational growth,” Smithson notes.