The government has given the Ukrainian dairy sector enterprises priority in power supply, now. dairy plants will receive electricity next after critical infrastructure facilities and enterprises of the military-industrial complex

According to the website of the industry association “Union of Dairy Enterprises of Ukraine” (SMPU), giving the industry priority in power supply speaks to the government’s recognition of the importance of dairy processing for the country’s food security.

“UMSU thanks Prime Minister Denis Shmygal for giving dairies priority in determining groups with priority power supply. Milk processing plants are categorized as a business that produces critical goods and products and are included in the third highest priority group, after critical infrastructure groups and facilities that work for national defense,” the organization said in a statement on its website.

The JMPU also asked the government to accelerate the provision of generators to dairy companies on terms that would ensure the availability of this equipment and help the industry maintain uninterrupted operation in conditions of power outage.

As previously reported, the SMPU urged the Ministry of Energy and NEC “Ukrenergo” to agree on the schedule and amount of electricity supplied to the dairy processing enterprises of the industry, in order to maintain the milk production and processing industries and prevent a reduction of livestock.

In early November, the association appealed to the Office of the President, the regional military administrations (RMA), the Ministry of Energy, the Ministry of Economy and the Ministry of Agricultural Policy with a request to provide uninterrupted power supply to the dairy plants. This is necessary because the enterprises, due to regular blackouts, are at risk of spoiling hundreds of tons of raw milk, or they will be forced to stop buying raw milk, which may force the related branch of milk production to reduce the number of cows.

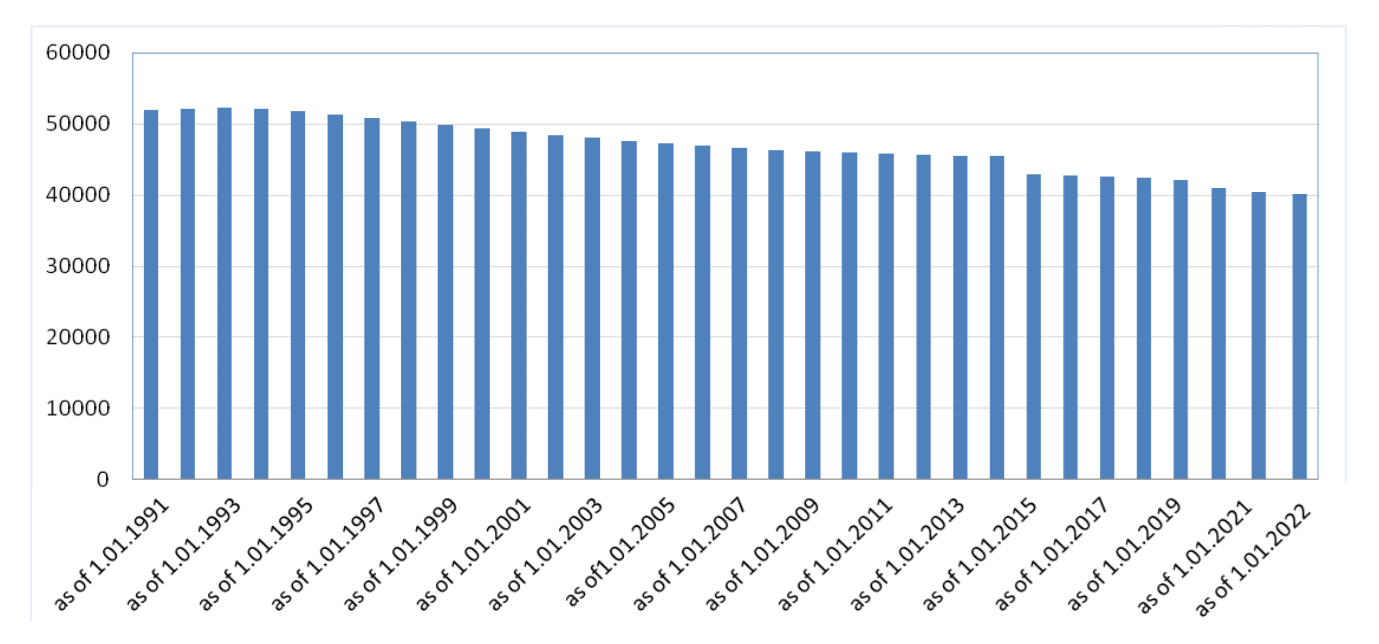

Dynamics of changes in population of Ukraine from 1991-2022

SSC of Ukraine

The US dollar is stable against the euro and the pound sterling in trading on Tuesday, strengthening slightly against the yen.

Traders this week are focusing on meetings of several major global central banks, including the Federal Reserve (Fed), the European Central Bank (ECB), the Bank of England and the Swiss and Norwegian central banks.

The vast majority of experts expect the U.S. Central Bank to slow the rate hike in December after increasing it by 75 basis points (bps) at the end of the previous four meetings. The rate is expected to be raised by 50 bps to 4.25-4.5% at the Dec. 13-14 meeting.

On Tuesday, the U.S. Department of Labor will release November data on the country’s consumer price dynamics, which will allow investors to make predictions about how high the Fed’s rate cap will be in the current hike cycle.

Experts, according to Trading Economics, on average expect the rate of inflation in the United States to slow to an annualized rate of 7.3 percent last month, down from 7.7 percent in October. Core inflation, which excludes food and energy prices, is expected to slow to 6.1% in November from 6.3%.

The inflation data are even more important than the Fed’s decision, said Xi Qiao, managing director of UBS Group AG’s Wealth Management unit.

“The future dynamics of the U.S. central bank rate will depend on the rate of inflation whether or not the Fed slows the rate hike on Wednesday,” Xi Qiao said on Bloomberg TV.

IG Australia experts expect the dollar to decline if Tuesday’s Labor Department report shows a slowdown in U.S. inflation to 7-7.2 percent.

The European Central Bank, which meets on Thursday, may also slow the pace of key rate hikes to 50 bps after raising them by 75 bps in October and September, experts expect.

The euro/dollar pair was trading at $1.0542 as of 7:45 a.m. Ksk on Tuesday, up from $1.0539 at the close of the previous session.

The pound exchange rate by that time is $1.2274 against $.2273 the day before.

The Bank of England, like the ECB, will hold a meeting on December 15. Experts expect the British Central Bank, which raised its benchmark rate by 75 basis points in November to the highest level since 1989, will also hold a meeting. – the most since 1989, will also decide to slow the pace of the increase to 50 bps.

“We believe most Bank of England policymakers view a 75bp rate hike as an emergency move rather than the new normal,” notes BNP Paribas economist Paul Hollingsworth.

The ICE-calculated index showing the dollar’s performance against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona) lost 0.12% on Tuesday, while the broader WSJ Dollar Index lost 0.03%.

The dollar-yen exchange rate rose to 137.71 yen in trading, up from 137.64 yen at the close of the previous session.

Head of the European Commission Ursula von der Leyen has confirmed the allocation of EUR 18 billion to Ukraine in 2023.

“Last night we were able to agree on 18 billion euros for the year, 1.5 billion every month is a constant flow of funds into the budget,” she said on Tuesday, speaking at the conference “Solidarity with the Ukrainian people,” which is being held on Tuesday in Paris, chaired by French President Emmanuel Macron.

On December 12, companies related to the managers of Kernel agro-industrial group bought Eurobonds of the holding with a total par value of $12.4 mln at a price of 45-46% of the nominal value, Kernel said in a statement on the Warsaw Stock Exchange on Monday evening.

According to it, there were four transactions with Eurobonds maturing in 2024 and a coupon of 6.5% per annum: par value of $2.4 million at 45.75% of par value, par value of $2.5 million (at 46%), par value of $5 million (at 45%), par value of $2.5 million (at 45.55%).

It is specified in the message that deals were made at over-the-counter market.

As earlier reported, in the middle of November the companies, related to “Kernel” management, purchased Eurobonds of the holding with a total par value of $29,43 mln at a price of 45-48% of the nominal value.

According to the annual report of “Kernel” in the middle of this year in the market were eurobonds of the company with maturity in 2024 and the nominal value of $297,314 million with maturity in 2027 and $297,724 million.

“Kernel was the world’s number one producer and exporter of sunflower oil before the war (about 7% of world production) and the largest producer and seller of bottled sunflower oil in Ukraine. In addition, the company was engaged in cultivation of other agricultural products and their realization.

The largest co-owner of Kernel, through Namsen Ltd. is Ukrainian businessman Andrei Verevskyi, with a 39.3% stake.

In FY2022 (July-2021 – June-2022), the holding posted net loss of $41 mln against $506 mln net profit in the previous FY. Its revenue decreased by 5% – to $5.332 bln, while EBITDA decreased 3.7 times – to $220 mln.

Insurers of Ukraine from December 13 will be able to make insurance payments under reinsurance contracts entered into with non-residents, the website of the National Bank of Ukraine informs.

In particular, this applies to payments on the basis of: contracts concluded before February 24, 2022 for documents issued before May 31, 2022, contracts concluded from February 24 to May 31, 2022, if their terms provide coverage for military risks.

At the same time there are clear requirements for the implementation of the relevant operations. Firstly, the non-resident reinsurer concluded a contract of reinsurance should have the financial strength rating, which is not lower than “A3” (Moody’s Investors Service), “A-” (Standard & Poor’s ), “A-” (Fitch Ratings), “A-” (A.M. Best) by the classification of international rating agencies.

Secondly, a Ukrainian insurance company, which carries out reinsurance, should meet a number of requirements, among which: no decision of the NBU on the recognition of the ownership structure of the insurer is not transparent; no decision of the NBU on recognizing the business reputation of the insurer, its owners, managers or key persons as insolvent; compliance with the solvency and capital adequacy ratio and the risk ratio of operations by the insurer.

The NBU notes that in order to obtain confirmation of compliance requirements for further transfer to the servicing bank, the insurer must apply to the NBU.

“Providing the ability to pay foreign currency payments under contracts with non-resident reinsurers will ensure that insurers comply with obligations to clients and international partners arising as of May 31, 2022. This is important to maintain the continuity of the insurance market of the country,” – noted in the message.

The NBU has also settled the issue of payment to non-residents of insurance payments under contracts of reinsurance of aviation risks in respect of aircraft, including those in the lease or leasing, clarified the rules for the implementation of transfers to non-resident reinsurers under international contracts of insurance “Green Card”.

The respective amendments were introduced by NBU regulation No.242 dated December 9, 2022 “On Amendments to the resolution of the Board of the National Bank of Ukraine No.18 dated February 24, 2022”, which shall become effective on December 13, 2022.