On December 15-16, 2022, the IV International Charitable Scientific and Practical Conference “Viticulture and winemaking of Ukraine under martial law: learning to win!” will be held in Uzhhorod, in the premises of the Transcarpathian Regional Philharmonic. Picturesque Transcarpathia, which has long been a wine region, will welcome everyone who wants to develop the wine industry and show that Ukrainian winemaking is worthy of world recognition. The participants of the event will discuss the effective care of vineyards, modern technologies in winemaking and production of cognacs, grappa, chacha and other drinks and products from grapes. The conference will include a charity auction of goods and services for viticulture and winemaking, the proceeds from which will be used to support the Armed Forces of Ukraine, in particular, to purchase winter ammunition and medicines.

The organizer of the conference is the media group “Technologies and Innovations”.

The conference will be held with the support of the Transcarpathian Regional State Administration, the Association of Winegrowers, Winemakers and Distillers of Transcarpathia, the PU “UKRSADVINPROM”, the Association “Ukrsadprom”, the “Ukrvinprom” Corporation.

Scientific patronage is provided by the Odesa National Technological University, Uzhhorod National University (Department of Horticulture and Viticulture), the National Scientific Center “Institute of Viticulture and Winemaking named after V.E. Tairov” of the NAAS of Ukraine.

The charity auction will be held with the support of the Charitable Foundation “Strong and Free”.

The key idea of the conference is to demonstrate to Ukrainian producers of wines and other beverages how to create and develop a successful viticulture and winemaking business even in wartime, to popularize the latest technologies of growing and processing of grapes from the ground to the finished product – wine and other beverages made from grapes.

The conference program is designed for 2 days:

December 15 – conference day, during which Ukrainian and foreign experts, representatives of leading wine technology companies, scientists, winegrowers and winemakers will speak. Speakers will share successful experience in growing technical and table grapes, talk about the situation in Ukrainian viticulture, outline the main problems and ways to solve them.

At the beginning of the conference day there will be a round table discussion on the key topic “Ukrainian viticulture and winemaking under martial law: learning to win!”. The discussion will be attended by heads of wineries and vineyards, representatives of industry associations, scientists.

Along with the plenary session, there will be an exhibition of equipment and materials for the production of wines and cognacs, as well as technologies for growing table and industrial grapes, presentation of new grape varieties. Also during the event, there will be an exhibition of products of viticultural and winemaking enterprises.

During the conference day there will be a presentation of wines and other drinks from Ukrainian producers. Conference participants will be able to discover new quality wines and taste them.

December 16 – business tour to winegrowing and winemaking enterprises of Transcarpathia with tasting and presentation of new technologies for winemaking and viticulture.

We invite owners and managers, technologists, agronomists of large wineries, small and medium-sized growers of table and industrial grapes, winemakers, producers of spirits made from grapes and all those who are interested in establishing the production of high quality products through modern technologies, implementation of best practices presented by leading international and Ukrainian companies at the conference.

Picturesque Transcarpathia with a deep history of winemaking, with the beauty of the mountains, thermal waters and other highlights is waiting for you!

We all now live in a time when we need to unite and support the Ukrainian army, the Ukrainian economy and each other. Only then we will remain unbreakable! We are waiting for you!

Registration of participants and partners – by contacts:

Larysa Tovkach, tel.: +38 097 96 89 516

Anna Pankratenkova, tel.: +38 097 759 25 83

Iryna Petroniuk, tel.: +38 096 49 166 92

General Information Partner – international specialized magazine “Drinks. Technologies and Innovations” (Drinks.Technologies) www.techdrinks.info

Media partners of the conference – specialized magazines “Horticulture and Vegetable growing. Technologies and Innovations” www.techhorticulture.com, “Yagidnyk”, www.jagodnik.info (Ukraine), Wine of Ukraine (www.wineofukraine.com), Interfax-Ukraine news agency, “Heart of Wine” project (https://theheartofwine.com/).

Open4business is a partner of the international conference

Naftogaz of Ukraine CEO Alexei Chernyshev and Norwegian Equinor CEO Anders Opedal met Friday to discuss gas purchases and potential development of Ukrainian production, the NJSC press service said.

“We have the first agreements with Equinor on the purchase of additional gas volume to pass the most difficult heating season in our history. We hope for special terms of purchase and further reservation of the volume we need,” Chernyshev said in a statement.

In addition, the head of Naftogaz on December 1 discussed with Norwegian Ambassador Erik Svedal the involvement of technology Norwegian oil and gas business and financing the purchase of additional volume of gas needed for Ukraine to pass the winter, given the constant Russian rocket terror.

“At a time when Russia is using the destruction of energy infrastructure as a weapon, support for Ukraine’s energy sector is as important as military support. We look forward to Norway’s continued assistance in this context,” Chernyshev said.

According to the press service, the ambassador said that he expects to increase the announced amount of aid to his state, and future funding will also be allocated to ensure energy security of Ukraine.

As reported, Norway will provide Ukraine with funding of NOK 2 billion (about $195 million) for the purchase of natural gas in winter 2022. Norway plans to use the European Bank for Reconstruction and Development (EBRD) as a channel to support gas purchases in Ukraine, while Naftogaz will be a formal recipient of the fuel.

Previously, the Norwegian prime minister said that the kingdom would provide Ukraine with an aid package worth 1bn euros.

Natural gas supply to Ukraine from EU countries in November 2022 amounted to 228 mln. cubic meters, 27.7% less than in October (315.4 mln. cubic meters), operational data of GTS Operator of Ukraine show.

In particular, the supply of gas to the “customs warehouse” UGS in November made 191.1 million cubic meters against 261.9 million cubic meters in October.

In November, Romania with a modest volume of 0.3 million cubic meters was added to the gas supply to the Ukrainian GTS from Poland, Slovakia and Hungary. At the same time, in the morning of December 2, 8.7 million cubic meters of the total volume was received at the entrance from Romania out of a total of 18.1 million cubic meters. Romanian volumes bypassed the “customs warehouse”.

According to the analytical publication ICIS, Moldova imports gas from Romania through the Trans-Balkan pipeline. Volumes delivered through the Greece-Bulgaria interconnector (IGB) were physically sent north to Moldova via the Trans-Balkan line via Romania and Ukraine.

Once the volumes enter Moldova through the southern border crossing of Causeni, they can be subtracted from the volumes entering Moldova from Ukraine through the Grebeninki border crossing in the north, a regional source told ICIS.

“It took almost six years to unblock the network in the region and start physical gas supplies from alternative directions,” former UGTSU head Sergei Makogon said in a comment to ICIS.

As reported, in September 2022, from the territory of Poland, Slovakia and Hungary to Ukraine received 29.4 million cubic meters (TC – 17.4 million cubic meters), August – 142.1 million cubic meters (120.7 million cubic meters), July – 119 million cubic meters (82.6 million cubic meters). The Trans-Balkan Gas Pipeline is located in the northern part of the Russian Federation, in July – 119 million cubic meters (82.6 million cubic meters), June – 46.1 million cubic meters (6.6 million cubic meters), May – 24 million cubic meters (4.9 million cubic meters), April – 3.2 million cubic meters (3.2 million cubic meters), March – 282.3 million cubic meters (10 million cubic meters), February – 349.7 million cubic meters (11 million cubic meters), January – 47 million cubic meters (0.0 million cubic meters).

The Trans-Balkan pipeline is a trunk gas pipeline crossing the territory of Ukraine, Moldova, Romania, Bulgaria and Turkey.

If the insurance industry is to survive the war and return to life, and thus provide insurance protection to Ukrainians, it is necessary to introduce system solutions at the state level, so we now need to develop and begin to implement a kind of “Marshall Plan” for the insurance industry.

This is the opinion of the general director of “Insurance Business” Association Vyacheslav Chernyakhovsky at the XIV International Scientific Conference “December Readings”, traditionally organized by the Kiev National Taras Shevchenko University. Taras Shevchenko.

According to him, the insurers have formulated a strategic vision and the key points of the plan, which include, in particular, temporary easing of regulatory requirements, revision and reduction of standards, namely the revision of requirements for reserve calculation, primarily the reserve of unearned premiums, reducing the tax burden on insurance companies by initiating the abolition of double taxation in insurance, abolishing the 3% of all insurance payments, leaving only the usual for all legal entities in the country.

In addition, we are talking about the diversification and structure of assets, in particular, the temporary establishment of other values for receivables, reduced restrictions on the placement of insurer reserves in some banking institutions and increase the index of reinsurance in one reinsurer. It is also necessary to develop and implement a mechanism of reverse financial assistance to insurance companies with the involvement of international financial institutions, to stimulate domestic reinsurance, the introduction of new types of insurance.

“It is necessary to implement strategic, systemic solutions, aimed primarily at creating conditions for the post-war development of the industry through deregulation, eliminating any discrimination in the insurance market and measures that promote the growth in demand for insurance services,” he said.

Chernyakhovsky also stressed that assistance from the state at the level of regulatory decisions is primarily needed by small and medium-sized insurance companies, companies significantly affected by hostilities, and national business.

Krivoy Rog iron ore complex (KZHRK) in January-November this year reduced the production of marketable iron ore underground mining by 28.9% compared to the same period last year – up to 2.804 million tons.

According to the company, in November, the mine “Pokrovskaya” produced 20 thousand tons of iron ore products, “Krivoy Rog” – 27 thousand tons, “Kozatskaya” – 28 thousand tons and “Ternovskaya” – 30 thousand tons.

The total output of the plant last month was 105 thous. tons, while in October – 150 thous. tons, in September – 200 thous. tons, in August – 270 thous. tons, in July – 280 thous. tons.

As reported, KZHRK in 2021 increased the production of iron ore from underground mining by 12.7% compared to 2020 – up to 4.298 million tons.

KZHRK specializes in underground mining of iron ore. KZHRK has four mines: “Pokrovska” (formerly “October”), mine “Krivorizka” (“Rodina”), “Kozatska” (formerly “Gvardeyskaya”) and “Ternovskaya” (formerly the Ordzhonikidze mine, then named after Lenin).

Starmill Limited owns 99.88% of the company.

KZHRK is owned by Metinvest Group and Privat Group. The company’s operational management is carried out by Privat Group.

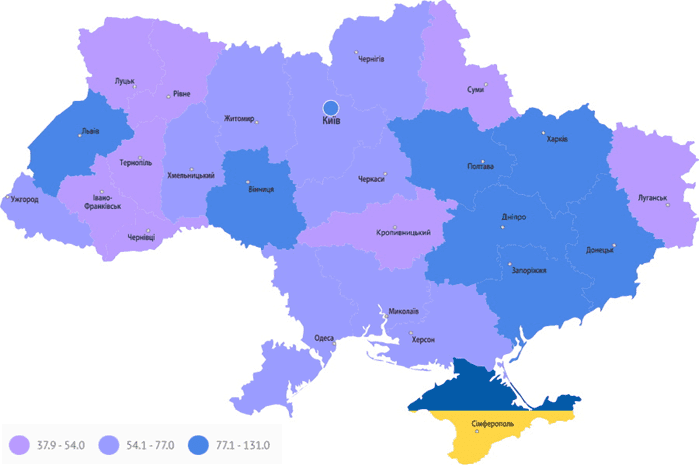

Ratio of the number of unemployed in different regions of Ukraine in 2021 (thush people)

State employment center