Western European stock indexes are mainly down during the trading on Friday, following the Asian stock markets.

Investors are waiting for the report on the U.S. labor market for November, which will be released at 15:30 ksec.

The consensus forecast of experts polled by Trading Economics expects the number of jobs in the U.S. economy to increase by 200,000 in November and the unemployment rate to remain at 3.7%.

The November labor market report is important to the Federal Reserve (Fed), which will hold its next meeting on December 13-14. Judging by futures quotations for the prime rate, the market expects the Fed to raise it by 50 bps. – to 4.25-4.5% per annum.

The composite index of the region’s biggest companies Stoxx Europe 600 had shed 0.25 percent to 442.84 points by 11.16 a.m. Ksk.

Germany’s DAX is up 0.16% while Britain’s FTSE 100 is down 0.32%, France’s CAC 40 is down 0.27%, Italy’s FTSE MIB is up 0.22% and Spain’s IBEX 35 is also down 0.22%.

Traders are analyzing the fresh batch of statistics and corporate news.

The total volume of German exports in October, adjusted for calendar and seasonal factors, decreased by 0.6% compared to the previous month to 133.5 billion euros, according to the Federal Statistical Office of Germany (Destatis).

Imports fell 3.7% to 126.6 billion euros. Germany’s foreign trade surplus was €6.9 billion the month before last, down from a revised €2.8 billion in September.

Meanwhile, industrial output in France fell 2.6% month-on-month in October, following a 0.9% decline in September. Economists polled by FactSet had expected a 0.2% decline.

Shares of British retailer ASOS PLC are down 0.3%. Kathy Mecklenberg, the company’s interim CFO, will resign to become the CFO of Softcat PLC, an IT company.

Volvo Car AB papers are down 0.25%. The Swedish car maker increased car sales by 12% year-on-year in November on the back of sustained strong demand.

The share price of Wizz Air Holdings PLC is up 1.9%. The European low-cost carrier carried 3.7 million passengers in November compared to 2.2 million in the same month a year earlier, the company said in a statement. Thus, the index increased by 70%.

The leaders in the decline among the components of the index Stoxx Europe 600 are shares of Swedish investment Kinnevik AB, which fell by 5.3%.

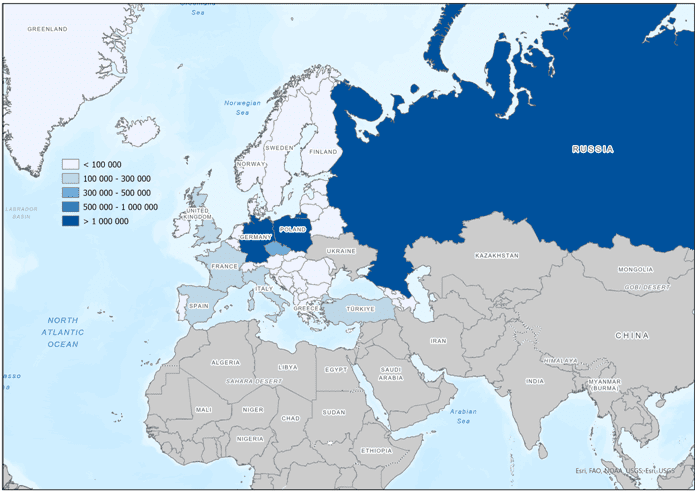

Number of refugees from Ukraine in selected countries as of 30.10.2022

UNHCR

Equity markets in the Asia-Pacific region (APAC) are down in trading on Friday.

Investors are waiting for more clarity from Chinese authorities after Beijing signaled it was easing a series of tough restrictions against the spread of the coronavirus infection, CNBC writes.

Several major Chinese cities have announced easing of anti-covirus measures. Guangzhou, Shijiazhuang and Chengdu relaxed requirements for the regularity of tests for COVID-19 and the movement of citizens, Bloomberg reported. Markets and public transportation began operating in some areas. In Beijing, sick people are allowed to stay at home instead of being isolated in special centers.

Japan’s Nikkei 225 was down 1.7 percent by 7:11 a.m. Ksk. At a certain point in trading the indicator fell to a three-week low, Trading Economics said.

Shares of automaker Mitsubishi Motors Corp. (-5.6%), bearings and cardan shafts maker NTN Corp. (-5.3%) and electric cables maker Fujikura Ltd. (-4.3%) act as leaders in the decline among index components.

Moreover, shares of such big companies as SoftBank Group (-0.3%), Sony Group Corp. (-1.3%), Fast Retailing Co. (-2.3%) also declined.

China’s Shanghai Composite had lost 0.3% by 7:16 a.m. Ksk, Hong Kong’s Hang Seng had lost 0.6%.

Investors fix profits after a confident rally associated with the softening of the PRC’s position on the anti-covids restrictions, writes Trading Economics.

The most significant decline in quotations on the Hong Kong Stock Exchange is shown by shares of developers Country Garden Holdings Co. Ltd. (-6.4%), Country Garden Services Holdings Co. Ltd. (-5.6%) and Longfor Group Holdings Ltd. (-5.4%).

South Korea’s Kospi index was down 1.4 percent by 7:14 a.m. kk.

One of the world’s biggest chip and electronics maker Samsung Electronics Co. was down 2.9 percent, while car maker Hyundai Motor slid 1.5 percent.

Consumer prices in South Korea rose 5 percent year on year in November, the slowest pace since April 2022, after rising 5.7 percent a month earlier, data from the country’s statistics agency showed. Analysts on average had expected inflation in the country to be 5.1 percent, Trading Economics wrote.

On a monthly basis, consumer prices in November fell by 0.1% after rising 0.3% a month earlier.

The Australian S&P/ASX 200 index lost 0.7% in trading on Friday.

Retail sales in Australia fell 0.2% month-on-month in October, compared with an increase of 0.6% a month earlier, official statistics showed.

This is the first decline in the current year. It is due to the fact that price pressures and rising interest rates have begun to have a negative impact on consumer spending, according to Trading Economics.

Share prices of the world’s largest mining companies BHP and Rio Tinto fell by 1.6% and 1.1%, respectively.

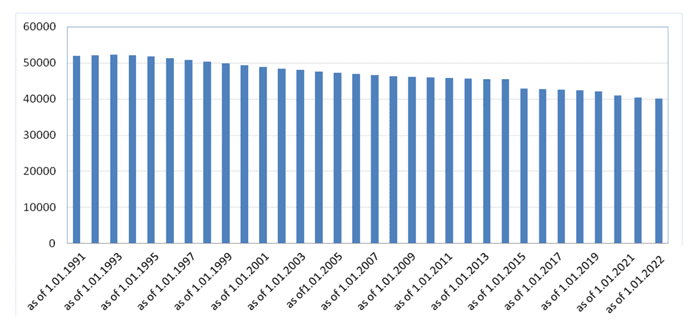

Dynamics of changes in population of Ukraine from 1991-2022

SSC of Ukraine

Oil prices fluctuate slightly but end the week with growth, Brent – $86.99 a barrel

Oil prices fluctuated weakly and multidirectionally in trading on Friday, but finished the week with a strong increase, thanks to signals of gradual easing of quarantine restrictions in China.

Several major Chinese cities announced the easing of quotas, which allows investors to hope for an increase in business activity and, accordingly, demand for oil in the country.

Guangzhou, Shijiazhuang and Chengdu relaxed requirements relating to the regularity of tests for COVID-19 and the movement of citizens, Bloomberg reported. Markets and public transportation began operating in some areas. In Beijing, sick people were allowed to stay at home instead of being isolated in special centers.

The cost of February futures for Brent crude oil on London’s ICE Futures exchange was $86.99 a barrel by 6:15 a.m. KSC on Friday, up $0.11 (0.13%) from the previous session’s close. Those contracts fell $0.09 (0.1%) to $86.88 a barrel at the close of trading on Thursday.

The price of WTI futures for January oil at NYMEX fell by $0.03 (0.04%) to $81.19 per barrel by that time. By closing of previous trades these contracts grew by $0.67 (0.8%) to $81.22 per barrel.

Since the beginning of this week, Brent has risen 4% and WTI more than 6%.

“We should not expect a sharp reversal of Chinese policy, but any easing of covid restrictions is welcome,” said OANDA chief analyst Craig Erlam. – The PRC’s approach to fighting the coronavirus has been devastating for the economy and the trust of citizens, and the protests have shown how public attitudes have changed.”

The focus for traders this week is the next OPEC+ meeting this weekend, and the market largely expects the organization’s states to decide to keep production levels unchanged, Bloomberg notes.

On Monday, an EU embargo on Russian oil purchases comes into effect.

In addition, according to the G7-approved plan, starting from December 5, the EU and British companies will be able to provide shipping and insurance services for transportation of Russian oil, only if it is bought at a price below a certain ceiling.

The Wall Street Journal reported Thursday, citing its sources, that the European Commission, in response to Russia’s continued war against Ukraine, proposed that the 27 EU countries approve a price ceiling on Russian oil of $60 per barrel.

The U.S. dollar is stable against the euro in trading on Friday, getting stronger against the pound and cheaper against the yen.

Traders will focus on the U.S. labor market report for November, which will be released at 3:30 p.m. Ksk.

The consensus forecast of experts polled by Trading Economics expects the number of jobs in the U.S. economy to increase by 200,000 in November and unemployment to remain at 3.7%.

The November labor market report is important to the Federal Reserve (Fed), which will hold its next meeting on December 13-14. Judging by futures quotations for the prime rate, the market expects the Fed to raise it by 50 bps. – to 4.25-4.5% per annum.

A new dot plot of forecasts will also be published at the end of the December meeting, reflecting the individual expectations of the members of the Federal Reserve Board of Governors and the heads of the Federal Reserve Banks with regard to interest rates.

Earlier this week, U.S. Central Bank Chairman Jerome Powell confirmed that the Fed could slow its rate hike as early as December.

Fed Vice Chairman of Banking Supervision Michael Barr on Thursday also argued in favor of a slower rate hike.

“We’ve been moving very, very quickly toward a rate level that would limit economic activity, and now that we’re very close to it, I think it makes sense to slow the pace of the hike,” Market Watch quoted Barr as saying.

The euro/dollar pair was trading at $1.0529 as of 8:20 a.m. Ksk Friday, up from $1.0527 at the close of the previous session. The pound fell to $1.2239, compared to $1.2256 at the close of trading on Thursday.

The dollar-yen exchange rate declined to 135.08 yen in trading, compared to 135.34 yen at the close of the previous session.

The ICE-calculated index showing the dollar’s dynamics against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and the Swedish krona) lost 0.01% on Friday, while the broader WSJ Dollar Index lost 0.04%.