Electricity, communications, water and heat supply have been almost completely restored in the Ukrainian capital as of Sunday morning, the press service of the Kiev city military administration said.

“Repair work on the power grid system is in its final stages. As of this morning, most residents of the city are not only with light, but also without emergency and even stabilization shutdowns,” the report said.

It specifies that all this is due to “restored, stable power supply and low power consumption by subscribers.”

“On the scale of the capital water supply, heat supply, communications – everything is working in a normal mode. Only local emergency situations are likely,” the administration concluded.

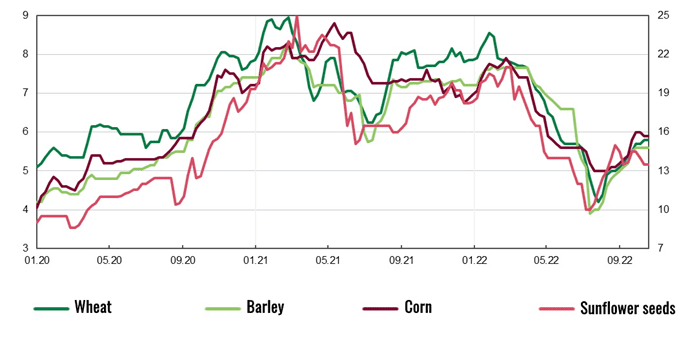

Dynamics of prices for main agricultural products in structure of Ukraine’s export in 2020-2022

NBU

Poland will allocate 20 million euros to support the “Graine from Ukraine” program, which will deliver food from Ukraine to poor countries in Asia and Africa, said Prime Minister Mateusz Morawiecki.

“We want to support this initiative, so we are allocating 20 million euros to support President Zelenski’s initiative … We must continue supporting such initiatives of the Ukrainian president because Ukraine is suffering – and at the same time Zelenski is preparing this very generous initiative to help countries in Africa, Asia, the Middle East,” Moravetski said at a press conference following the international summit on food security in Kiev on Saturday.

Also, he said, over the past few months Poland has been preparing special ways of solidarity for comprehensive support for Ukraine, including support regarding exports of goods, food, etc.

“We have prepared special ways of solidarity over the last few months, because Ukraine requires not only military support or financial support, but comprehensive support. Support in terms of exports of goods, food products,” he said.

The Polish prime minister also noted that his country “cannot go back to business as usual with Russia, because that would mean that Poland would not pay attention to Russian attacks on civilian infrastructure in Ukraine.

In addition, he stressed that Poland would continue to support Ukrainians in their heroic struggle against the Russian aggressor.

“We will never lay down our arms, we will not stop helping Ukraine’s heroic struggle, its struggle against the barbaric regime. Ukraine must be successful. I am confident of Ukraine’s victory. And let 2023 be the year of victory and restoration of Ukraine,” Moravetsky concluded.

City One Development together with Valeriy Kodetsky’s charitable fund UNITA delivered and handed over 80 tons of humanitarian aid to the front-line de-occupied communities of Kherson Oblast.

According to the Foundation’s press service, residents of the liberated territories of Kherson received 4,500 food packages, as well as personal hygiene products for adults and children.

Eight ambulances were sent for the needs of Kherson region, one of which was sent to Bilozersk district hospital. Generators and 1,000 sets of medicines for primary care were also handed over to medics.

Humanitarian aid was delivered to de-occupied settlements: Aleksandrovka, Belozerka, Dniprovske, Chornobaivka, Stanislav, Shirokaya Balka, Mirolyubovka and others.

As was reported, UNITA Charitable Foundation in cooperation with the City One Development Company delivered more than 300 tons of humanitarian aid to Kyiv, Bucha, Irpen, Berezan, Bilogorodka, Boyarka, Akhtyrka, Poltava and Bakhmut communities from March to June. More than 30 thousand families have received targeted help.

The charitable Civil Solidarity Fund “UNITA” was founded in 2015 by Valeriy Kodetsky, a Ukrainian entrepreneur, owner, and president of City One Development Group. During the four months of Russia’s full-scale military aggression against Ukraine, the fund and City One Development allocated more than 40 million hryvnias for charitable purposes.

Founded in 2010, the investment and development company City One Development provides a range of services in the creation and development of real estate. The company’s projects include Novopecherskie Lipki, Fountain Boulevard and Svyatobor. The real estate portfolio amounts to over 900 thousand sqm, with 600 thousand sqm under construction.

CITY ONE DEVELOPMENT, HUMANITARIAN AID, KHERSON REGION, УНИТА

Hungary will allocate funds for the transportation of food products from Ukraine within the “Grain from Ukraine” initiative, as well as provide logistical support, said the President of Hungary Katalin Novak.

“We support Ukraine at the bilateral level. We have allocated more than 172 million euros, and today Hungary has committed to provide $3.5 million to ensure the transportation of 10 thousand tons of wheat and food products,” – said Novak at the summit on food security.

She also called for the use of the Ukrainian-Hungarian border as an additional food transportation channel.

“We support not only financially, we also support logistically. Our special terminal on the border between Hungary and Ukraine should increase and speed up the transportation of necessary goods,” the president said.

“And, of course, this is all happening because of the war in Ukraine. And democratic channels must be restored. In the end, there must be a just peace, a peace for all of us,” she stressed.

Ista Center (Dnipro), a producer of starter batteries, intends to use its net profit for 2021 in the amount of 154.85 mln hryvnia to cover the losses of the previous periods.

According to the draft decision of the general meeting of the company shareholders, scheduled for December 26, published in the NKTSBM disclosure system, Ista-Center does not plan to accrue and pay dividends.

According to the company’s information, net profit per one common share in 2021 was UAH 60.4 mln, whereas a year earlier it amounted to almost UAH 2.9 mln. Net profit in 2020 was 7.37 million hryvnias.

As of January 1, 2022, the company had retained earnings of 12.81 million hryvnias against an uncovered loss of 143.25 million hryvnias on the same date in 2021.

The shareholders also plan to approve the reports of the management bodies at the meeting, approve the main directions of development for 2022 and re-elect the supervisory board.

“Ista-Center”, operating since 1995, is one of the plants producing starter batteries in Dnipro (the other is DOZ “Energoavtomatika”).

According to the latest financial statement of the company, which was made public by the NCSSM, its net income in 2020 was 206.6 million hryvnias. By the beginning of 2021, the plant employed 135 people.

According to the NCSSM, as of the fourth quarter of 2021, Oberon-Center LLC (Dnipro) owns 40% of the shares in which, according to Opendatabot, over 75% belongs to Scotwind Limited, whose beneficiary is named Oleg Zimin; 23.0476% is owned by Battery Investment Corp. registered in Panama and 6.23% belongs to the Ista International Corporation (Belize).

Another 21.55% is owned by the state. As reported, the Ista Center was included in the list of facilities transferred by the Cabinet of Ministers to the State Property Fund for privatization, which was made public in August 2022.