The bitcoin price collapsed to a 2-year low in trading Tuesday amid the bankruptcy of FTX, one of the world’s largest crypto exchanges.

The bitcoin exchange rate was $15,735,000 as of 1:30 p.m. Tuesday, with the value of the most popular cryptocurrency dropping to $15,480,000 during trading, which is the lowest value since November 11, 2020, according to CoinDesk.

The cryptocurrency market has lost more than $1.4 trillion this year due to a number of problems, including unrealized projects and lack of liquidity due to the global economic downturn. These difficulties have left many cryptocurrency companies facing a string of bankruptcies.

One such company was the owner of the FTX exchange. The company initiated bankruptcy under Article 11 of the U.S. Bankruptcy Code in early October. Before that, another major cryptocurrency exchange – Binance, which was planning to buy the assets of FTX – abandoned the deal after due diligence. The company explained its decision by the identified errors in the management of customer funds, as well as reports about the investigations conducted by U.S. regulators in relation to this site.

In addition, Binance CEO Changpeng Zhao said his company will start selling FTX tokens owned by FTX. This led to the collapse of FTX, whose market valuation once reached $32 billion.

A day earlier, it was revealed that FTX owed the 50 largest lenders $3.1 billion, with a total of 1 million lenders lending to it.

Investors fear that the collapse of FTX could cause a chain reaction in the sector, which further puts pressure on the cryptocurrency market. On Monday, shares of Coinbase Global (SPB: COIN) Inc., another major cryptocurrency exchange operator, plummeted 8.9 percent in U.S. trading, with its market capitalization plunging below $10 billion, the lowest since Coinbase went public.

The US dollar is getting cheaper against the euro, the yen and the pound sterling in trading on Tuesday after the previous session’s strengthening following another Federal Reserve (Fed) statement.

This week, traders will focus on the Federal Reserve’s minutes of November 1-2 meeting at which the U.S. central bank raised its benchmark interest rate by 75 basis points (bps) and hinted at a possible slowdown in the rate hike.

The minutes of the meeting will be released Wednesday at 9 p.m. ET.

On Monday, Federal Reserve Bank (FRB) presidents Loretta Mester and Mary Daly of Cleveland and San Francisco signaled that the U.S. central bank would slow the pace of prime rate hikes next month, while stressing that the need for further policy tightening remains.

“I believe we can slow down the rate hike at the next meeting, I don’t see a problem with that,” Mester told CNBC. – However, I don’t think we’re close to pausing.”

For her part, Daley said the Fed should be mindful of the time lag between Fed decisions and their impact on the real economy. At the same time, she reiterated that she sees the need to raise the rate to at least 5%.

The ICE-calculated index showing the dollar’s performance against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona) lost 0.18% on Tuesday, while the broader WSJ Dollar lost 0.17%.

The euro/dollar pair is trading at $1.0259 as of 8:15 a.m., up from $1.0243 at the close of the previous session.

The dollar traded down to 141.78 yen from 142.14 yen on Monday.

The pound rate rose to $1.1851 compared to $1.1824 the day before.

Canada has issued CAD500 million in bonds in support of Ukraine, the purchase of which Canadians will help the Ukrainian government continue to provide financial support as well as help rebuild critical infrastructure, according to the Canadian government’s website.

“The Canadian government is issuing $500 million in Ukraine sovereignty bonds today, the prime minister first announced last month. These funds will help the Ukrainian government continue to provide essential services to Ukrainians this winter, such as pensions, fuel purchases and the restoration of energy infrastructure,” the report said.

It is noted that the Canadian government has partnered with participating financial institutions to offer Canadians the opportunity to purchase Ukrainian sovereign bonds with a $100 face value. “Canadians interested in purchasing this bond should contact their investment adviser or financial institution between now and November 29, 2022,” the statement said.

“Canadians who buy Ukrainian sovereign bonds will effectively be purchasing a regular five-year Canadian government bond with a current yield of approximately 3.3%, depending on market conditions at the time of issuance. Canadians can be confident in the safety of their investment, which is fully supported by Canada’s ‘AAA’ credit rating,” the agency explained.

Reportedly, after the completion of the bond issue and subject to negotiations with Ukraine, an amount equal to the proceeds of the bond issue will be transferred to Ukraine through the International Monetary Fund (IMF) account for Ukraine.

For his part, Ukrainian Prime Minister Denis Shmygal thanked his colleague Justin Trudeau and Deputy Prime Minister and Finance Minister Chrysta Freeland for their assistance.

“Today Canada issued $500 million in Ukrainian sovereignty bonds. The proceeds will help provide vital payments and services for Ukrainians this winter. Thanks to Justin Trudeau, Hrysta Freeland and all Canadians for supporting Ukraine,” Shmygal wrote on his Twitter microblog.

As reported on November 18, the Government of Canada began collecting applications to buy five-year bonds worth 500 million Canadian dollars (CAD, about 373.4 million at current exchange rates) – Ukraine Sovereignty Bonds – for financial support for Ukraine, offering to submit them until November 29 through participating financial institutions.

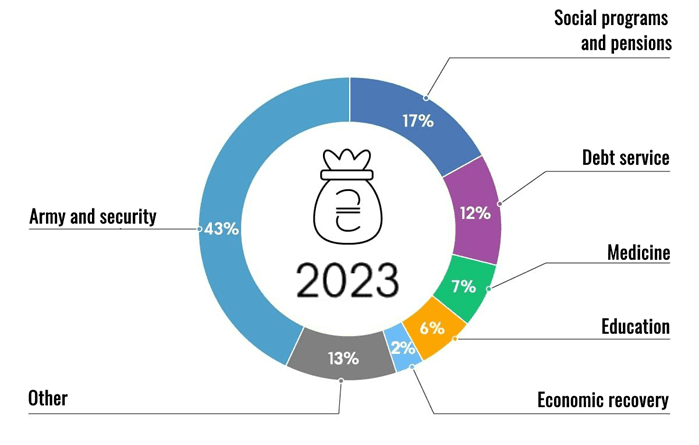

Structure of approved ukrainian state budget expenditures for 2023

CMU

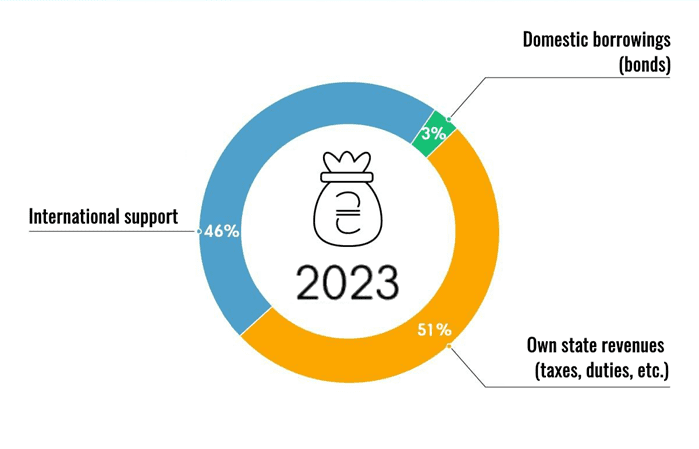

Structure of approved state budget income for 2023

CMU

The Kametstal plant of Metinvest mining and smelting group, based at Dneprovsky Iron and Steel Works (DMK, Kamenskoye, Dnipropetrovsk oblast), has shipped another batch of grinding balls to Polish consumers.

According to the company, the output of metal products for national and international customers is a reliable pillar of Ukraine’s economy.

“In November another batch of grinding balls – five cars – was shipped for Polish enterprises. Kametstal fulfills such orders of European partners systematically”, – is stated in the press release.

It is specified that the balls are niche demand products. They are needed for stable operation of mining and processing plants.

Kametstal operates two ball rolling mills which produce balls of different diameters. This year the production of grinding balls with the diameter of 80 mm was extended due to the special demand.

Before the war these orders were carried out by Azovstal, but now they have been transferred to Kametstal.

This year Polish consumers have already received 48 railcars of the products manufactured at the plant ball rolling mills, which amounts to more than 3 thousand tons of grinding balls of different diameters.

“We supply our products for needs of Metinvest Group mining and processing enterprises and we also fulfill orders of European consumers. This year we shipped more than 3 thousand tons of balls to Polish enterprises. Kametstal rolling workers are working to improve product quality and production efficiency to support the country’s economy in difficult times,” said Sergey Mishurin, deputy chief of the rolling shop at the axle-rolling and ball rolling mills section, who is quoted by the press service.

“Kametstal” was created on the basis of PJSC “Dneprovsky Coke Chemical Plant” (DKHZ) and the CEC of PJSC “Dneprovsky Metallurgical Plant” (DMK).

According to the report of the parent company of Metinvest Group for 2020, Metinvest B.V. (Netherlands) owned 100% of DKHZ.

The main shareholders of Metinvest are SCM Group (71.24%) and Smart Holding (23.76%), which jointly manage the company.

Metinvest Holding LLC is the management company of Metinvest group.