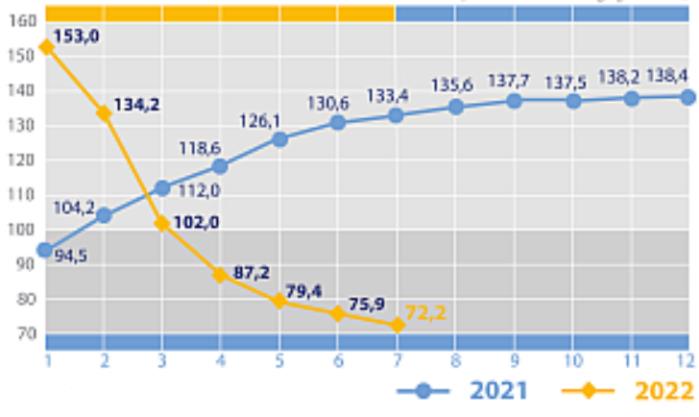

Exports of goods in % to the previous period in 2021 and 2022

SSC of Ukraine

Number of dead and wounded civilians in Ukraine as result of military actions from 24.02.2022 according to un data (per)

Data: UN

The US dollar is getting cheaper against the euro and the pound sterling during the trading session on Tuesday.

The day before, the U.S. currency steadily strengthened on statements by Federal Reserve (Fed) officials that dampened investor optimism that the rate hike cycle may end soon.

Fed Vice Chair Lale Brainard told Bloomberg on Monday that the Fed is likely to slow the pace of rate hikes soon.

“However, I think it’s important to emphasize: we’ve done a lot already, but we still have more work to do,” Brainard said.

Earlier Monday, her colleague Christopher Waller, a member of the Fed’s board of governors, warned investors against overly optimistic about the timing of the end of the policy tightening cycle, noting that the Fed still has much work to do.

“We have a long, very long way to go to slow inflation. The rate will continue to rise, and it will stay high for a while, until we see it get closer to our target level,” Waller said at an event in Sydney hosted by UBS.

The ICE-calculated index, which shows the dollar’s performance against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona), added 0.2% on Tuesday, while the broader WSJ Dollar lost 0.03%.

The euro/dollar pair is trading at $1.0333 as of 9:15 a.m. Ksk, compared to $1.0329 at the close of the previous session. The pound rose to $1.1776, compared to $1.1760 the day before.

The dollar rose to 140.31 yen against 139.88 yen at the close of previous trading.

The exchange rate of the U.S. currency paired with the yuan dropped to 7.0491 yuan against 7.0740 yuan the day before. On Tuesday, the People’s Bank of China (PBOC, the country’s central bank) injected 850 billion yuan ($120.7 billion) into the financial system as part of its medium-term lending program (MLF).

The United Nations General Assembly on Monday adopted a resolution on the need to hold Russia accountable for its violation of international law during the invasion of Ukraine, as well as to create a mechanism for compensating Ukraine for the damage caused by Russian aggressors.

The document was supported by 94 countries, 73 abstained and 14 others opposed.

Among the countries that voted against the resolution were the Russian Federation, Belarus, Syria, Iran, Zimbabwe, Cuba, China, Eritrea, Mali and the Central African Republic.

The resolution states that Russia “should be held accountable for any violations of international law in or against Ukraine, including its aggression in violation of the UN Charter, as well as any violations of international humanitarian law and human rights.

In addition, the states that supported the resolution believe that Russia should bear the legal consequences of all of its internationally wrongful acts, including compensation for the damage suffered as a result of the above-mentioned actions.

They also recognize the necessity of creating an international mechanism for compensation for the damages caused to Ukraine by Russia and recommend creating an international register of the damages received by all concerned individuals and legal entities, as well as the State of Ukraine, for registration of their evidence.

Oil prices continue to decline on Tuesday after a 3% decline the day before following OPEC’s worsening forecast of oil demand.

The oil market is also pressured by weak statistical data from China, which increased traders’ pessimism about demand prospects.

China’s industrial output growth slowed in October while retail sales fell for the first time in five months, China’s State Statistics Office (SSC) reported on Tuesday.

January Brent crude futures on London’s ICE Futures exchange stood at $92.88 a barrel by 8:15 a.m. KSC on Tuesday, down $0.26 (0.28%) from the previous session’s close. Those contracts fell $2.85 (3%) to $93.14 a barrel at the close of trading on Monday.

The price of WTI futures for December at electronic trades of NYMEX fell by that time by $0.52 (0.61%) to $85.35 per barrel. By the close of previous trading, those contracts had fallen $3.09 (3.5%) to $85.87 a barrel.

“Weak statistical data from China only confirms the view that oil demand in the country will remain weak as long as tight quarantine restrictions persist,” notes Vanda Insights founder Vandana Hari in Singapore, cited by Bloomberg.

On the eve of OPEC lowered its estimate of the demand for oil in 2022 by 100 thousand barrels per day – up to 99.57 million bpd, in 2023 – also by 100 thousand bpd, to 101.82 thousand bpd.

Thus, OPEC predicts that global oil consumption in 2022 will increase by 2.55 million bpd, and in 2023 – another 2.24 million bpd, according to a monthly report of the organization.

The International Energy Agency (IEA) will publish its forecasts on Tuesday.

Insurance company Knyazha Life Vienna Insurance Group (Kyiv) collected UAH 42.764 mln of insurance payments in January-September 2022, which is 18.9% less than during the same period a year earlier.

This was reported by Standard-Rating rating agency, which confirmed financial strength rating/credit rating of the insurance company at the level uaAA+ for three quarters of 2022.

According to the message, the indemnities of the insurer during this period amounted to UAH 9,729 mln, that is by 28,90% lower than the indemnities paid out during nine months of 2021. Thus, the payout ratio has fallen by 3,21 p.p. – to 22,75%.

Acquisition expenses of the insurer has decreased by 15,88% down to UAH 7,8 mln.

Net profit of the insurer has amounted to UAH 8,449 mln, assets have increased by 17,36% up to UAH 712,614 mln, shareholders’ equity has increased by 1,93% up to UAH 107,381 mln, liabilities – by 20,59% up to UAH 605,233 mln, cash and cash equivalents – by 37,60% up to UAH 75,486 mln.

Thus, as of the beginning of the fourth quarter of 2022 shareholders’ equity of Knyazha Life Vienna Insurance Group has covered 17,74% of liabilities, and 12,47% of its liabilities have been secured by cash and cash equivalents.

It is noted that on the reporting date the insurer has formed a portfolio of investments into bank deposits in the amount of UAH 71,6 mln, and investments into government bonds in the amount of UAH 528,228 mln.

It is noted that a high level of external support for the company is provided by its shareholder – an international insurance group with headquarters in Austria Vienna Insurance Group Wiener Städtische Versicherung AG, which is represented by 50 companies in 30 countries and is the insurance market leader in Central and Eastern Europe.