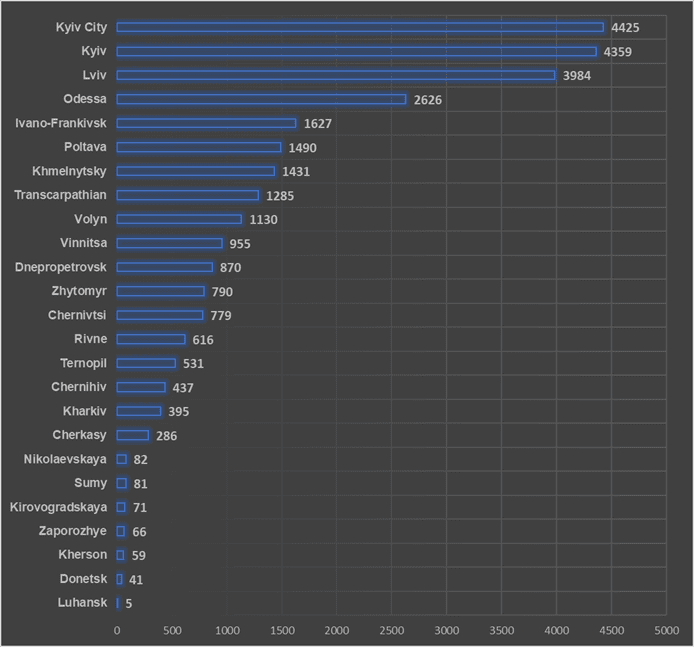

Number of dwellings in residential buildings, putting into service, by type by region in Jan-June 2022

graphics of the Club of Experts

In the Kyiv region, air defense shot down 6 missiles, but there is a hit in a thermal power plant, Deputy Head of the President’s Office Kyrylo Tymoshenko wrote on a telegram channel.

“Under the gun are power facilities from Lviv to Zaporozhye, Kiev region, Khmelnytsky, Dnipro and Vinnytsia, Frankivsk, Sumy, Kharkiv, Zhytormyr, Kirovohrad regions, in general, the entire south. This may affect the stability of the energy supply, so you need to be prepared for the consequences of such shelling, up to rolling blackouts,” he wrote.

For example, Tymoshenko noted, “only in the Kyiv region, air defense shot down six missiles, but there is a hit in a thermal power plant. The specialized services are making every effort to eliminate the consequences of shelling as quickly as possible. There is no rocket that will make us leave”

Minister of Education and Science Serhiy Shkarlet instructed local authorities to make a decision on distance learning by the end of this week.

“Dear teachers, pupils, parents, students! Today, the enemy again dealt crushing blows to parts of the regions and the capital. I appeal to the leaders of the OVA and heads of educational institutions! Our task is to protect all participants in the educational process as much as possible. Therefore, I ask you to make a decision to study in a remote format until the end of the current week (until 10/14/2022),” Shkarlet wrote in the Telegram channel.

The minister emphasized that safety is above all.

“Please do not neglect the rules of conduct during the air raid signal, go down to the shelter. Take care of yourself,” he summed up.

Prime Minister Denys Shmyhal says that as of 11:00 am, 11 important infrastructure facilities in 8 regions and Kyiv have been damaged. The prime minister noted that the main goal of Russia is to sow panic, scare, leave Ukrainians without light and heat.

“All services are working on the ground, we are promptly restoring our infrastructure. We will do everything to restore all facilities as quickly as possible. Thanks to our rescuers and doctors who are now saving people’s lives in the epicenters of shelling. Thanks to our power engineers who are resuming the power supply of cities under shelling” he wrote.

Shmyhal also said that the air defense managed to shoot down more than 40 missiles out of 70.

The Telegram app in Ukraine is malfunctioning, including in Europe, due to platform overload.

“Analyzing sensors on the network, there is a complication of communication through the Telegram application. This is due to the overload of the Telegram digital platform itself. The remaining numbers of the platform work without overload,” the deputy head of the parliamentary committee on digital transformation said in his Telegram channel on Monday Oleksandr Fediyenko (Servant of the People faction).

He advises for a while to switch to communication through other instant messengers and applications.

Messages about failures in the work of Telegram appeared in the social networks of Ukrainians starting from Sunday.

The US dollar continues to strengthen on Monday after a confident rise on Friday on the data on the US labor market.

The ICE-calculated index showing the dynamics of the dollar against six currencies (the euro, the Swiss franc, the yen, the Canadian dollar, the pound sterling and the Swedish krona) adds 0.1%, the broader WSJ Dollar Index – 0.15%.

Statistical data, published on Friday, showed that the US labor market is still strong, despite a significant tightening of monetary policy by the Federal Reserve System (Fed). This was taken by traders as a signal that the Fed will continue to rapidly raise its benchmark interest rate.

The number of jobs in the US economy in September increased by 263 thousand, the Ministry of Labor reported. The growth rate was the lowest since April 2021, but surpassed the consensus forecast of analysts surveyed by Bloomberg, at 255 thousand. Unemployment in the country unexpectedly fell to 3.5% from 3.7% in August.

The next Fed meeting will be held on November 1-2, and experts expect the US Central Bank to raise rates again by 75 basis points, Dow Jones notes.

The euro/dollar pair is trading at $0.9722 on Monday, compared to $0.9740 at the close of the previous session. The pound fell to $1.1065 from $1.1093 the day before.

The rate of the American currency against the yen is 145.37 yen against 145.32 yen at the close of the previous trading session.

On Friday, the dollar rose 0.63% against the euro, 0.67% against the pound and 0.41% against the yen.