Futures for US stock indices fluctuate between growth and decline in trading on Thursday after the publication of data from the Ministry of Labor, which showed the maximum increase since June this year in the number of applications for unemployment benefits in the US.

The number of Americans who applied for unemployment benefits for the first time increased by 29 thousand last week and amounted to 219 thousand people.

According to revised data, a week earlier the number of applications was 190 thousand, and not 193 thousand, as previously reported. Analysts polled by Bloomberg expected the figure to rise to 204,000, on average.

Traders take a cautious stance ahead of the publication of September data on the number of jobs and unemployment in the US. The Department of Labor will release them on Friday at 3:30 pm ET.

The consensus forecast of experts polled by Market Watch suggests that the number of jobs in the US last month increased by 275 thousand (315 thousand in August), while maintaining unemployment at 3.7%.

The situation in the US labor market is a key factor influencing the policy of the Federal Reserve System (Fed), and the upcoming publication of unemployment data makes traders take a wait-and-see attitude, experts say.

Another report from the Department of Labor, published earlier this week, showed a sharp decline in the number of open vacancies in the States in August. The indicator fell by 10% – the fastest pace since the start of the pandemic in 2020, to 10.1 million vacancies.

These data were perceived by investors as a signal of “cooling” of the US labor market, which may hold back further tightening of the Fed’s policy.

However, industry organization ADP said on Wednesday that the number of jobs in the US private sector in September rose by 208 thousand compared to August – more than expected. Analysts polled by Dow Jones had forecast a 200,000 increase after rising 185,000 in August.

Shares of Peloton Interactive Inc. adding 0.2% in price during preliminary trading on Thursday. The US fitness equipment manufacturer plans a fourth round of layoffs that will affect 500 jobs.

Conagra Brands rose 0.4%. The prepared food manufacturer ended the first quarter of fiscal 2023 with a loss, but the company’s adjusted figure and revenue exceeded experts’ expectations.

Share price of International Business Machines fell 0.4%. The company has announced plans to invest $20 billion in business development in the Hudson River Valley over the next decade.

The value of the December E-mini futures on the S&P 500 fell by 0.01% to 3793.75 points by 15:55 Moscow time on Thursday. The quotation of the December E-mini futures on the Dow Jones index decreased by this time by 0.06%, to 30293 points. Futures on the Nasdaq 100 for December rose 0.19% to 11646.25 points.

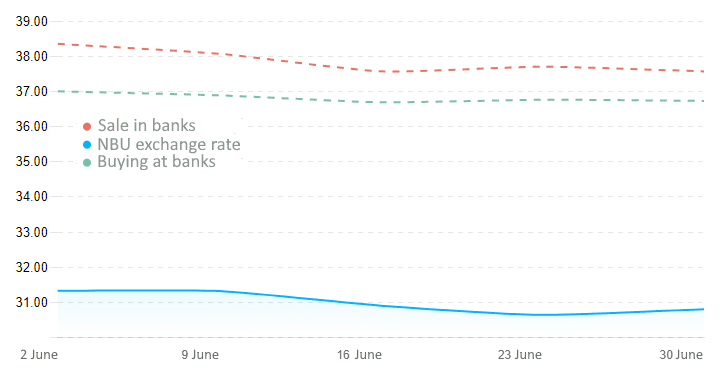

Quotes of interbank currency market of Ukraine (UAH for €1, IN 01.08.2022-31.08.2022)

graphics of the Club of Experts

The stock indexes of the largest countries in the Asia-Pacific region (APR) mostly rose in trading on Thursday, with the exception of the Hong Kong indicator.

Optimistic statistics on the increase in the number of jobs in the United States, published yesterday, dampened hopes that the US Federal Reserve may slow down the pace of tightening interest rates, writes MarketWatch. This put some pressure on stock markets.

The number of jobs in the US private sector in September increased by 208 thousand compared to August, according to the ADP Research Institute. Analysts polled by Dow Jones estimated an increase of 200,000. In August, the number of jobs increased by 185,000, and not by 132,000, as previously reported.

Traders are now waiting for the US Department of Labor September labor market report, which will be released on Friday at 3:30 pm. Experts estimate the unemployment rate in the country last month at 3.7%, the same as in August, and the increase in the number of new jobs in the economy as a whole at 250,000, writes Trading Economics.

Market participants also evaluated the OPEC + decision.

Ministers of the OPEC+ countries at a meeting on Wednesday decided to reduce the alliance’s total oil production quota in November by 2 million bpd.

The Japanese Nikkei 225 rose 0.7% by the close of trading.

The Bank of Japan confirmed its view that most regions of the country are showing moderate economic growth. The regulator left unchanged the assessment of eight out of nine regions and improved the assessment for one region.

The growth leaders among the components of the index are the shares of the IT company Rakuten Group Inc. (+4.6%), Credit Saison Co. Ltd. (+3.3%), a credit card company, and pharmaceutical company Eisai Co. Ltd. (+2.9%).

Hong Kong’s Hang Seng fell 0.4%.

The drop leaders in the index are the shares of the pharmaceutical company Hansoh Pharmaceutical Group Co. Ltd. (-7.6%), automaker Geely Automobile Holdings Ltd. (-3.8%) and developer Country Garden Holdings Co. Ltd. (-3.6%).

Shares of Chinese lithium battery manufacturer CALB Co. completed the debut auction in Hong Kong, practically unchanged in price. The papers started trading at the level of the placement price, and then went into the red, where they were for the main part of the session, but by the close of trading they again returned to the level of 38 Hong Kong dollars ($4.84) per share.

Exchanges in mainland China are closed due to the National Day holidays.

The South Korean Kospi index rose by 1%.

The market value of one of the world’s largest chip manufacturers Samsung Electronics Co. increased by 0.5%, automaker Hyundai Motor – by 0.6%.

The Australian S&P/ASX 200 added 0.03%.

Shares of the world’s largest mining companies BHP and Rio Tinto increased by 0.6% and 0.2%, respectively.

Ukraine and North Macedonia have agreed to expand the free trade zone, Prime Minister Denys Shmygal said.

“Today, as part of our visit to the Czech Republic to participate in the first session of the European Political Community, we met with Prime Minister of North Macedonia Dimitar Kovachevsky. An updated annex to the Free Trade Agreement was signed, which integrates the markets of Ukraine and North Macedonia with the markets of the EU, Turkey, Moldova , Georgia, Norway, Switzerland and Israel through a common system of rules of origin for PanEuroMed,” Shmyhal wrote on the Telegram channel.

According to him, the agreement will help reduce prices for Macedonian goods, which are raw materials for processing enterprises.

“This is the main advantage for the industry of Ukraine. After all, now Ukrainian manufacturers can use components produced in North Macedonia for products that will be sold in the EU,” he wrote.

In addition, the agreement liberalizes agricultural tariffs.

“Ukraine will gain access to the market for products of animal origin and finished products, which will help increase the export of Ukrainian agricultural products,” the prime minister said.

The US dollar is moderately declining against major world currencies on Thursday morning, investors evaluate the statements of the Federal Reserve Board and statistical data.

The ICE-calculated index, which shows the dynamics of the US dollar against six currencies (the euro, the Swiss franc, the yen, the Canadian dollar, the pound sterling and the Swedish krona), is down 0.2%, the broader WSJ Dollar is down 0.25%.

The euro/dollar pair is trading at $0.9920 by 9:08 Moscow time compared to $0.9885 at the close of the session on Wednesday, the euro adds about 0.35%.

The exchange rate of the American currency against the yen is reduced by 0.1% and amounts to 144.53 yen compared to 144.69 yen the day before.

The pound rose 0.1% to $1.1335 compared to $1.1327 at the close of the previous session.

The day before, the head of the Federal Reserve Bank of Atlanta, Rafael Bostic, said that he supports raising the key interest rate in the US by another 125 basis points by the end of the year, to 4.5%.

Meanwhile, San Francisco Fed colleague Mary Daly told CNN that the central bank should raise borrowing costs even higher and keep them high until inflation starts approaching 2%.

It became known yesterday that the index of business activity in the US services sector (ISM Non-Manufacturing) in September decreased to 56.7 points compared to 56.9 points a month earlier, data from the Institute of Supply Management (ISM) showed. Analysts, on average, assumed a more significant drop, to 56 points, according to Trading Economics.

Now all the attention of market participants is directed to data on the US labor market, which will be published on Friday. Experts believe that the unemployment rate in the country in September remained at the August mark of 3.7%, and the number of new jobs increased by 315 thousand people.

YouTube will be 20 years old in 2025. Today it remains one of the most promising and fastest growing digital platforms and firmly holds the world leadership in the video hosting segment. In recent years, the service has increasingly focused on customer support in video marketing and integration of the platform with other advertising services such as GoogleAds. At the same time, the requirements for channel owners in the field of compliance with the rules for posting content are also expanding, and quickly getting a wide audience of subscribers for novice bloggers or brands is a rather difficult task.

The first step to finding and expanding the audience that will benefit from your knowledge and information is to understand where these abilities and ideas intersect with promising topics.

In promoting certain channels in recommendations and trends, YouTube mainly uses data analysis based on a system of complex and intricate algorithms and providing the viewer with the content that interests him most.

To be successful on YouTube in 2022, you need to understand the essence of these algorithms to some extent and delve deeply into the dynamics of the platform. Ultimately, this will help determine what works for other similar channels and where you can make a difference in your favor. Here are some tips to help you grow your YouTube channel with the latest changes on the platform.

1. Creating a full-fledged channel trailer (welcome video)

Your channel can get a lot of visitors that you don’t even know about, but if you don’t have a proper and informative trailer, they might not understand what your content is about and just won’t subscribe and go somewhere else. A trailer is essentially a summary of your channel, and the constant influx of new subscribers directly depends on how interesting it will be for the viewer.

2. Setting audience targeting and keywords.

For YouTube, keywords are crucial, as most of the platform’s algorithms target them. Choosing the right keywords and using them well in the title and description of a video can make a big difference in how it performs. This is because YouTube, like Google in general, is a huge search engine. Creators who recognize this and take action accordingly have an easier way to grow their YouTube channel.

3. SEO optimization of video for YouTube.

Having dealt with the keywords, you can begin to fine-tune the content for the audience. To do this, you need to use a few simple but effective techniques, such as optimizing the title and saturating it with relevant key phrases, creating a description adapted to the search for the video, using effective tags, etc. At the same time, you should try to strike a balance between clickbait and readability of titles and descriptions, so how your main audience is still not robots, but real people, in whom overloading with key phrases can cause rejection.

4. Creating a quality intro for a video.

To do this, you will need a little creativity and knowledge in graphic design. It is recommended to use color options first of all, except for black, red and white. This will create enough variety to keep people interested and eventually keep watching your video. At the same time, the length of the intro playback should not exceed 5-10 seconds, since too long an introduction can scare off part of the potential audience.

Track your video viewing time and viewer retention.

YouTube is committed to ensuring that users stay on the platform for a longer period of time. The longer a user stays, the more ads they will see. Therefore, YouTube’s search algorithms favor videos with longer watch times.

5. View YouTube Analytics statistics

Analyzing each video and audience reaction to it is a critical element in the promotion of any YouTube channel. As you keep posting videos, it’s time to evaluate their success and look for additional ways to improve the content.

6. Chat and collaborate with other YouTube creators

Partnership with other YouTubers greatly simplifies the development of the channel, as it allows you to learn from experience and avoid many mistakes. Also, a powerful promotion tool is the recommendation of partner channels to subscribe to your content.

7. Subscribe to reminders and encourage viewers.

Some people may often watch your videos, but remain unsubscribed to the channel. Since they often watch your videos, your content automatically appears in their feed every time you upload something new. However, there is a good chance that they forgot to subscribe to your channel. Therefore, it is always a good idea to remind your audience to subscribe to your channel and even ask for likes and comments to attract the audience. One easy way to do this is to ask them an interactive question and request answers in the comments below.

This makes it clear that growing your YouTube platform will require patience and hard work, and it is important that you also understand your viewers, notice what they like and want, and what can be useful for them.

You can get more detailed information about the promotion of a YouTube channel on our website.