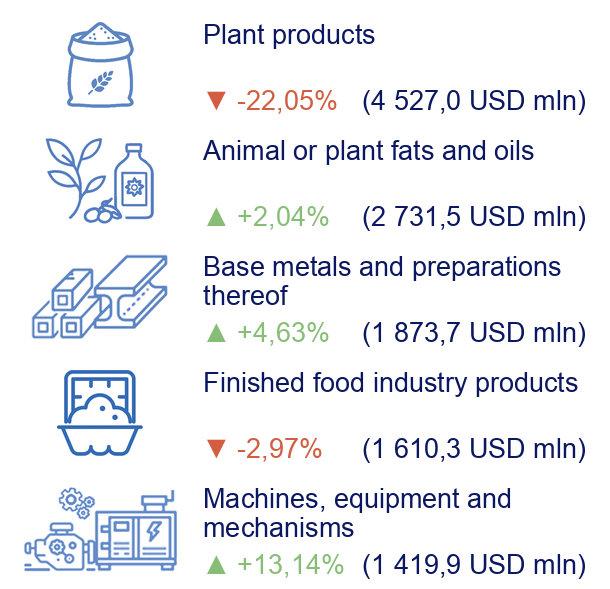

Dynamics of export of goods in january-may 2025 by most important items in relation to same period of 2024, %

Source: Open4Business.com.ua

Two large elevator complexes located in the Berezivka district of the Odesa region are being offered for sale on the OpenMarket electronic trading system (SE “SETAM” of the Ministry of Justice of Ukraine).

The first lot (No. 586642) is a mortgage complex of buildings with a total area of 18,270.7 square meters located at: Berezivka, Pristanichna Street.

The property includes administrative buildings, six grain warehouses, a weighing station, a grain dryer, a silo elevator, production facilities, and auxiliary infrastructure.

The auction date is October 31, and the starting price is UAH 85,086,000.

For more details about the lot and registration for the auction, follow the link

The second lot (No. 586647) is an elevator building with an area of 20,565.5 square meters with 106 items of movable property located in the village of Novoselivka, Berezivka district.

The auction date is November 3, and the starting price is UAH 19,580,000.

For more details about the lot and to register for the auction, follow this link

The sale is being conducted by a private executor within the framework of a single enforcement proceeding. The sale of such assets creates an opportunity to attract new investors to the development of the region’s agricultural infrastructure.

The OpenMarket auction (SE “SETAM” of the Ministry of Justice of Ukraine) is a simple and effective means of selling and purchasing property online. The online auction has been operating throughout Ukraine since 2014.

As part of its 19th package of sanctions, the European Union will impose a ban on transactions with five Russian credit institutions from November 12: Alfa Bank, MTS Bank, Absolut Bank, Zemsky Bank, and NKO Istina, according to an EU statement.

In addition, Belarusian Alfa Bank, Sberbank, VTB, Belgazprombank, BelVEB, as well as VTB’s subsidiary in Kazakhstan and VTB’s branch in Shanghai have been added to the EU sanctions list.

BAN, BANK, BELARUS, EUROPEAN UNION, RUSSIAN FEDERATION, SANCTION, TRANSACTION

Every year on October 23, the world celebrates International Snow Leopard Day, a day dedicated to the protection of this rare and mysterious predator.

The snow leopard is a member of the cat family that lives in the high mountains of Central and Central Asia. It is the only modern predator of the cat family that permanently lives in the harsh conditions of the cold climate of the high mountains. Due to its ability to adapt to extreme environments, it is often called the “ghost of the mountains” because it is rarely seen by humans.

Currently, the population numbers between 4,000 and 7,500 individuals in the wild in 12 countries, including China, India, Mongolia, Pakistan, and Kazakhstan. The main threats to its survival are habitat loss, poaching, and the decline in the number of wild animals that snow leopards prey on.

International Snow Leopard Day aims to raise awareness about the protection of this rare species, remind people of the importance of preserving the biodiversity of mountain ecosystems, and support measures to protect the natural environment of these majestic predators.

Ukraine may purchase up to 150 Gripen fighter jets from Sweden, paying for them with frozen Russian assets, according to The Guardian newspaper.

“Swedish Prime Minister Ulf Kristersson said that the purchase could be financed by frozen Russian assets held in Western countries, as well as by allied states from the ‘Coalition of the Willing,’” the publication wrote on Thursday.

It is noted that Ukraine already has American-made F-16 fighter jets and French-made Mirage 2000 fighter jets. Gripen has long been considered more practical for Ukrainian combat conditions — for example, it is designed to take off and land on civilian roads as well as runways so that it can conduct combat operations from dispersed locations, not just airfields.

Justin Bronk, an air warfare expert at the Royal United Services Institute in London, said that the Gripen E “hypothetically be a much more powerful medium-weight fighter” than Ukraine’s existing fleet, thanks to its radar, internal electronic warfare systems, and ability to carry and launch long-range Meteor air-to-air missiles.

Sweden has reportedly ordered 60 of the latest Gripen E aircraft, and Saab is expanding capacity at its factory in Linköping, aiming to produce 20 to 30 aircraft per year, as well as building them in Brazil.

“We fully understand that there is a long way to go… But starting today, we are committed to exploring all possibilities to provide Ukraine with a large number of Gripen fighters in the future,” the publication quotes the Swedish prime minister as saying.

The Sukha Balka mine (Kryvyi Rih, Dnipropetrovsk region), part of Alexander Yaroslavsky’s DCH group, has started work on a new horizon of the Druzhba iron ore deposit at the Frunze mine.

According to a report in the DCH Steel corporate newspaper on Thursday, work on the block began on October 16.

It is specified that block 45-51 is located in the sub-levels of horizons -1210m and -1227m of the Druzhba deposit. It is noted that this is the first block of the new horizon to be developed using modern technology.

The block’s reserves amount to about 49,000 tons of high-quality raw materials. The average iron content is 61.22%.

It is expected that the block’s reserves will be sufficient for three months of stable operation.

The Sukha Balka mine is one of the leading enterprises in the mining industry in Ukraine. It extracts iron ore using underground methods. The mine includes the Yuvileina and Frunze mines.

The DCH Group acquired the mine from the Evraz Group in May 2017.