The production of beer in Ukraine (except for non-alcoholic beer with an alcohol content of up to 0.5% by volume) in January-July 2022 decreased by 31.6% compared to January-July 2021, to 71.4 million decalitres.

As reported on the website of the industry organization of brewers “Ukrpivo”, for seven months of 2022, a recovery in beer production is recorded after a fall in the first quarter, when this figure decreased by 50% compared to January-March – from 34.1 million decalitres to 17.1 million gave.

Subsequently, beer production in the country was recovering – in the first four months of this year, the decline was 42.8% compared to the same period last year, in May – 36.4%, June – 32%, July – 31.6%.

According to Ukrpiva, malt production in January-July 2022 decreased by 31.3% compared to January-July 2021, to 93.7 thousand tons. Thus, the recovery of its production is recorded after a fall in the first quarter of 2022 by 40.8%, and a sharp reduction in June, by 50.6%.

As reported, in 2021 Ukraine produced 5% less beer compared to 2020 – 170.5 million decalitres, and in 2020 its production decreased by 0.4% compared to 2019 – to 179.7 million decalitres.

Malt production in 2021 amounted to 218.5 thousand tons, which is 19.5% less than in 2020. At the same time, the year before last, its production decreased by 18% compared to 2019, to 275 thousand tons.

According to the results of January-June this year, Metinvest reduced steel production by 45% compared to the same period last year, to 2.412 million tonnes, according to a press release from the parent company Metinvest B.V. on Wednesday.

According to the report, the production of pig iron decreased 49%, to 2.252 million tonnes, coke fell by 55%, to 1.075 million tonnes.

At the same time, in connection with the start of a large-scale military aggression of the Russian Federation against Ukraine, from February 24, 2022, Metinvest decided to halt the manufacturing activities of its assets in Mariupol, Avdiyivka and Zaporizhia. The group’s Zaporizhia enterprises resumed their production operations later.

The group’s facilities in Mariupol and Avdiyivka have been affected by hostilities.

In the second quarter, iron and steel production amounted to 424,000 tonnes and 450,000 tonnes, respectively, which is 77% lower than in the previous quarter. In general, in the first half of 2022, the production of iron and steel amounted to 2.252 million tonnes and 2.412 million tonnes, respectively, which is 49% and 45% lower than the same period last year. The lack of production from the Mariupol steelmakers since the end of February 2022 was partly compensated by production volumes at Kamet Steel.

In addition, in the second quarter of 2022, the production of merchant semi-finished products decreased by 52% compared to the previous quarter, to 249,000 tonnes, largely due to a slump in hot metal production. In the first half of 2022, the production of merchant semi-finished products decreased by 47%, to 771,000 tonnes. This was partly compensated by the output of merchant billets at Kamet Steel, the effect of which in H1 2022 was 444,000 tonnes.

In the second quarter of 2022, the production of finished products decreased by 72% compared to the previous quarter, to 414,000 tonnes. At the same time, the production of flat products decreased by 946,000 tonnes, to 167,000 tonnes, because of the lack of production from the Mariupol steelmakers since late February 2022 and the shutdown of the Italian re-rolling plants for a scheduled maintenance in May 2022 in the absence of stable slab supplies. Production of long products decreased by 81,000 tonnes to 247,000 tonnes because of a production decline at Kamet Steel, irregular deliveries of billets from Kamet Steel to Promet Steel in Q2 2022, and the lack of production at Azovstal since the end of February 2022.

In the first half of 2022, the production of finished products decreased 46% compared to the same period last year, to 1.884 million tonnes. At the same time, the production of flat products decreased 1.658 million tonnes, to 1.281 million tonnes, the production of long products increased by 125,000 tonnes, to 575,000 tonnes following the acquisition of re-rolling facilities by Kamet Steel, which fully compensated the lack of Azovstal’s volumes since the end of February 2022 and the lower output at Promet Steel given the aforementioned reasons.

The production of rail products fell by 2,000 tonnes to 10,000 tonnes, pipe products – by 62,000 tonnes to 18,000 tonnes.

The output of the group’s coke-making assets has been affected by the war in Ukraine. Thus, in the second quarter of 2022, coke production decreased 63% compared to the previous quarter, to 292,000 tonnes, and in the first half of 2022 it fell by 55% compared to the same period last year, to 1.075 million tonnes.

Law, philology and IT specialties are traditionally in the highest demand among applicants to Ukrainian universities, Minister of Education and Science of Ukraine Serhiy Shkarlet said.

“In 2020-2022, in the structure of the state order, much attention is paid to engineering high-tech specialties, that is, professions of the future. But traditionally, the most active specialties in terms of demand are law, philology and IT specialties,” Shkarlet said on the air of the national telethon on Thursday afternoon .

At the same time, the minister noted that today there is also a significant demand for the specialty “psychology” (11,000 applications have already been submitted) and “pedagogy” (9,000 applications).

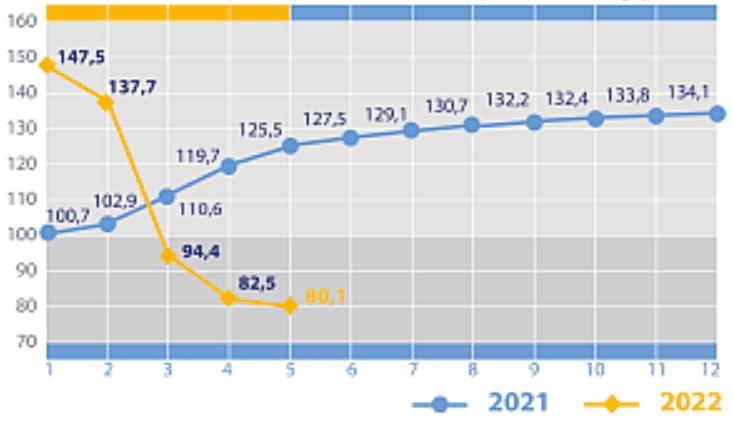

Import of goods to Ukraine in % to the previous period in 2021 and 2022

SSC of Ukraine

Prime Minister of Ukraine Denys Shmyhal has thanked foreign investors for their decision to defer payments on Ukraine’s external debt until 2024.

“Investors in Ukraine’s external debt gave their consent to defer payments until 2024 with a possible extension for another year. Thank you for the step of solidarity. We are also grateful to the G7 countries for supporting this position,” Shmyhal wrote on his Telegram channel on Wednesday.

He said that thanks to this decision, Ukraine will save almost $6 billion on payments over the next two years.

“These funds will help us maintain macro-financial stability, strengthen the stability of the Ukrainian economy and increase the power of our army,” the head of government said.

The prime minister added that the holders of securities of the state-owned Ukrenergo and Ukravtodor also accepted the postponement offer, thanks to which Ukraine could better prepare “for the most difficult heating season in history and more effectively restore infrastructure destroyed by Russian terrorists.”

The international research company Corteva Agriscience has established export supply chains for corn seeds from Ukraine to the EU, and in the context of the Russian military invasion plans to increase its exports to European countries by 16 times by the end of the year compared to last year.

According to a press release from the company, as of early August, it has already shipped 3,000 tonnes of corn seeds grown at its seed complex in Poltava region to the European Union.

The company clarified that, for security reasons, it suspended the operation of the seed plant immediately after the start of the Russian invasion of Ukraine, but at the initiative of the employees themselves, after some time, resumed the operation of the enterprise. The launch of its work made it possible to provide Ukrainian farmers with seed material that is critical for the sowing campaign.

Corteva, in the context of Russian aggression, also for security reasons, refused to supply seeds of Ukrainian production by land to the countries of the Caucasus and Central Asia, but expanded logistics to the EU as much as possible.

“On the production lines of the Corteva plant in Ukraine, high standards of seed production have been introduced, which allow us to produce goods that meet all the quality criteria adopted in the EU. Seeds are controlled by many indicators at all stages of production – from field to bag, and meet the maximum requirements of both Ukrainian, and foreign farmers choosing Corteva genetics,” the company said.

Earlier, in April, the company decided to leave the Russian market due to the military aggression of the Russian Federation against Ukraine.

Corteva Agriscience is a global agricultural company. It offers farmers comprehensive solutions to maximize yields and profitability. It has more than 150 research facilities and more than 65 active ingredients in the portfolio.