Global communications group SEC Newgate has opened an office in Ukraine that will specialize in crisis and reputation management, corporate communications, advocacy, and GR.

“The opening of the office of a global corporation ranked 19th in the world rankings was planned a year ago, and all this time preparations for investments, determination of approaches and main directions were underway,” wrote Artem Bidenko, a member of the board of SEC Newgate Ukraine.

He added that significant progress in the group’s work in Ukraine and the visit to its opening in Kiev these days by the head and founder of the SEC Newgate group, Fiorenzo Tagliabue, was achieved at the conference on the restoration of Ukraine in Rome, URC2025.

It is noted that Andriy Rudenko became the director of the Ukrainian company, and Serhiy Bidenko, founder of Reputation Antistress (Bayka.agency), became an advisor.

SEC Newgate has offices in 32 countries. The Ukrainian office will support local companies in entering international markets, advise foreign clients on investments in Ukraine, and be involved in the country’s recovery processes.

Experts warn that automatic hand dryers, despite their convenience, can be a source of bacteria and germs. Studies show that the hot air blown by dryers can draw germs from the air in restrooms and spray them around—onto hands, surfaces, and into the room itself.

In one experiment cited by the Harvard Medical Portal, Petri dishes placed under a working dryer for 30 seconds showed growth of up to 254 bacterial colonies, while control dishes exposed only to the air in the restroom without a dryer showed only one colony.

When researchers installed HEPA filters on the dryers, the number of bacteria decreased by 75%, suggesting that a significant portion of the contamination comes from the indoor air rather than from the internal parts of the device.

Another study, published in the journal Aerosols and Bacteria From Hand Washing and Drying in Indoor Air, compared dryers with paper towels. The results: aerosol and bacteria concentrations after drying hands indoors increase regardless of the method used — dryers or towels.

Another study, Assessment of the bacterial contamination of hand air dryers, showed that dryers produce more “ballistic droplets” that travel further into the room and may contain skin microbes. The authors note that in some cases, dryers can deposit pathogenic bacteria on users’ hands and clothing, especially if the device is located close to the sink or when the air humidity is high.

In addition, the American publication “Automatic Hand Dryers Can Be a Source of Microbial Contamination” states that the internal parts of dryers — the body and nozzles — may contain staphylococci and coliform bacteria. When the device is turned on, these microbes can be transferred to the user’s hands. According to researchers’ estimates, in men’s and women’s restrooms, the internal surfaces of dryers contain an average of 300 microorganisms per 5 cm² in the lower part of the body.

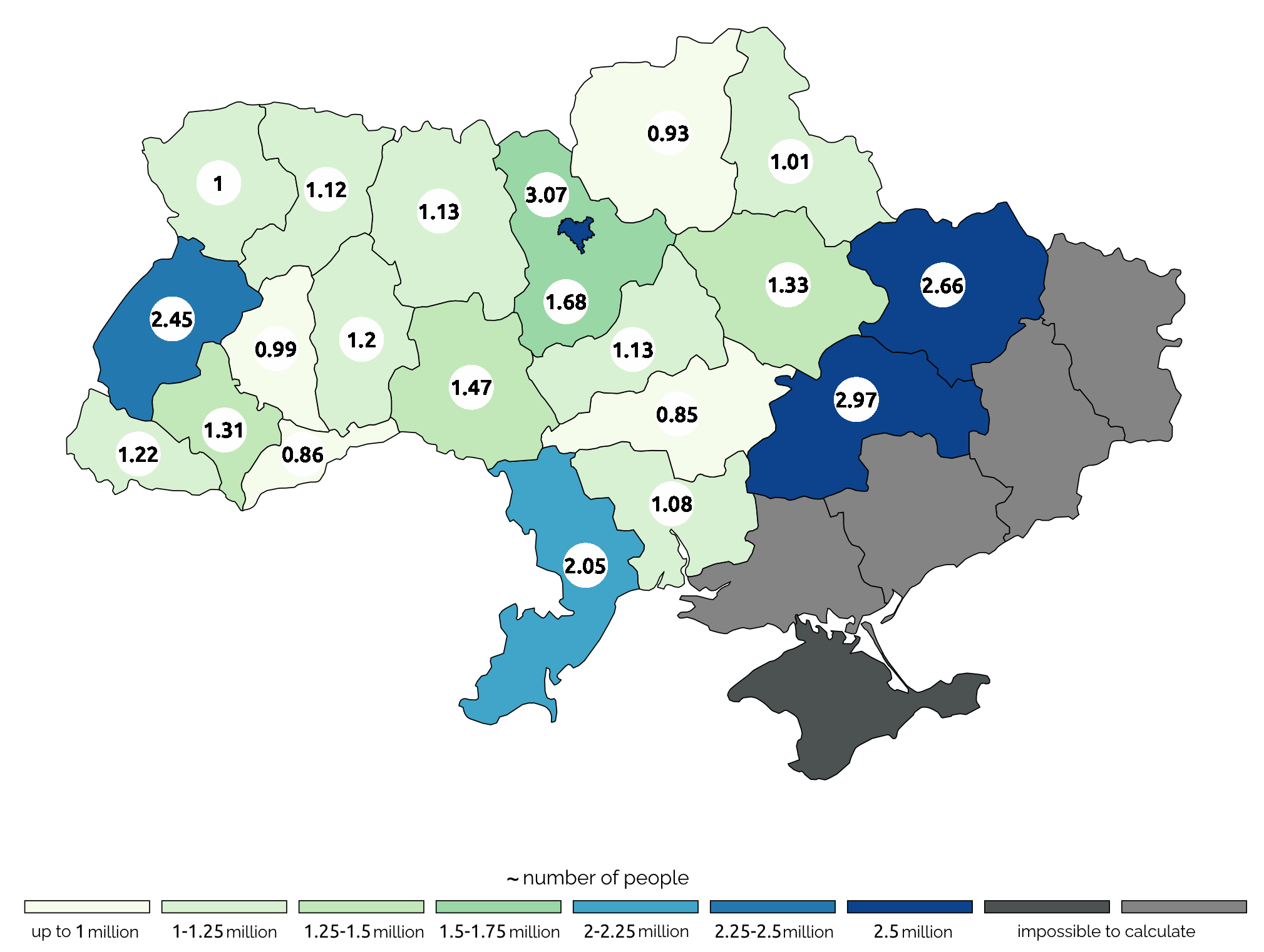

Estimated number of population in regions of Ukraine based on number of active mobile sim cards (mln)

Source: Open4Business.com.ua

The international chain JYSK is opening its 110th store in Ukraine and eighth in Odesa on Thursday, according to the company’s press service.

“Despite the challenges of recent years, we continue to invest in the Ukrainian market. The opening of the 110th store is another step in our strategy of sustainable growth,” commented Yevgen Ivanitsa, Country Director of JYSK in Ukraine.

The new store, with a retail space of 950 square meters, is located on the second floor of the Mayak A1 shopping center (107/1 Polkovnika Gulyayeva Ave.). It has an adapted Jysk Compact format, which allows a full range of products to be placed in a smaller area, while maintaining Scandinavian aesthetics and a quality shopping experience.

There are currently 110 stores and the jysk.ua online store operating in Ukraine. JYSK has over 900 employees in the country.

JYSK is part of the family-owned Lars Larsen Group, which has over 3,500 stores in 48 countries.

JYSK’s revenue in the 2024/25 financial year was EUR6.2 billion.

PJSC Zaporizhkox, one of Ukraine’s largest producers of coke and chemical products and a member of the Metinvest Group, increased its blast furnace coke production by 2.2% in January-September this year compared to the same period last year, from 655,300 tons to 669,700 tons.

According to the company, 77.1 thousand tons of coke were produced in September, compared to 79.6 thousand tons in the previous month.

As reported, in 2024, Zaporizhkox increased its production of blast furnace coke by 2.1% compared to 2023, to 874.7 thousand tons from 856.8 thousand tons.

In 2023, Zaporizhkox increased its output of blast furnace coke by 16% compared to 2022, to 856,800 tons from 737,400 tons.

Zaporizhkox has a complete technological cycle for processing coke chemical products.

Metinvest is a vertically integrated mining group of companies. Its main shareholders are SCM Group (71.24%) and Smart Holding (23.76%). Metinvest Holding LLC is the managing company of the Metinvest Group.

The Israeli residential real estate market in 2024–2025 is showing mixed dynamics: after a period of price growth and increased activity in the post-COVID years, the market has seen a drop in the number of transactions and a decline in interest from foreign buyers.

According to data from Israel’s Central Bureau of Statistics, in June 2025, the number of housing transactions fell to its lowest level in 20 years.

The decline in foreign investor activity was particularly noticeable, falling 37% compared to the same period last year, while net purchases fell 42%.

The average cost of housing in the second quarter of 2025 was 2.27 million shekels (about $672,000), which is 2.5% lower than a year earlier. Taking inflation into account, the decline was 5.6%, the largest since 2007. At the same time, prices rose by an average of 5.1% on an annual basis. Some major centers saw declines: Tel Aviv by 4.2% and Jerusalem by 0.5%.

Despite their relatively small share of the total volume of transactions, foreign buyers continue to have a noticeable impact on the market. In 2024, they purchased about 1,900 residential properties, which is 50% more than a year earlier. At the same time, foreigners contributed about 432 million shekels in the form of tax on investment properties, which accounted for 15% of all revenues from this tax, with their share in transactions at about 10%.

The most active groups of foreign buyers remain citizens of the United States, France, Russia, and Ukraine, with interest also noted from investors from Canada and the United Kingdom. Most foreign transactions are recorded in Jerusalem, which accounts for about 55% of purchases, as well as in Tel Aviv and coastal areas. Experts note that foreigners mainly purchase expensive real estate, which supports the premium segment of the market. At the same time, the mass segment continues to adjust under the influence of high housing costs and reduced affordability for the local population.

According to forecasts, by the end of 2025, the share of foreign buyers will be 6-8% of all transactions, and further price dynamics will depend on the balance of supply and demand in the country’s key markets.

“Although overall interest in the Israeli market remains high, many foreigners are now holding back due to high interest rates and instability — some of the transactions observed are not immediate, but rather serve as a safety ‘reserve’,” says real estate agent Kim Bash.