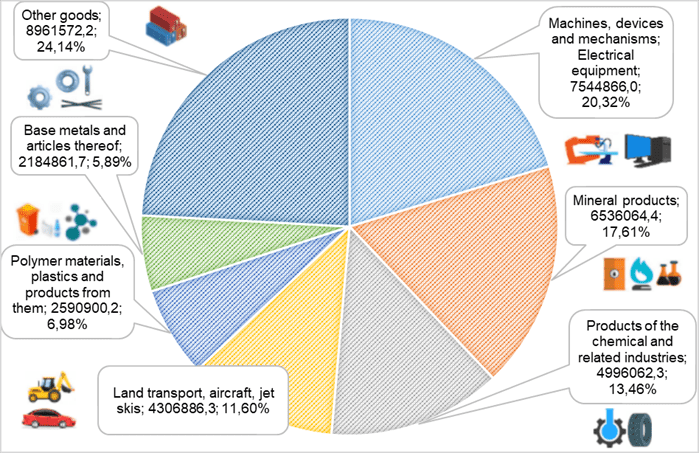

FOREIGN TRADE TURNOVER BY THE MOST IMPORTANT POSITIONS JAN-JULY 2021 (IMPORT)

In the very heart of Kyiv, at 8a Lva Tolstoho Street, a multi-brand showroom Dim Brendiv has opened.

The showroom presents various collections of Ukrainian brands. Buyers got the opportunity to immerse in the world of fashion, beauty and style, and designers – to present their collections and find new fans of their brand.

The showroom collected various products by style, texture and age criterion. There are also daily casual blouses and skirts, suits, evening dresses and outerwear.

It also presents various accessories that women of fashion will be able to effectively complement their image.

The showroom is bright and spacious, shopping lovers will be able to view themselves and their friends in magnificent large mirrors, and the staff will prepare a cup of fragrant tea with sweets so that customers can rest after trying on their outfits.

The assortment and brands presented can be viewed on the Dim Brendiv Instagram page. New collections and models of clothes are presented every day.

“In my showroom there are a lot of cool and exclusive items of famous Ukrainian brands that are not presented anywhere else in Kyiv. I fell in love with these things from the first collection, and with each new look book, you can find models that you really want to buy. The assortment is constantly updated, and we immediately post the most stylish items on our Instagram page. We are open to both buyers and Ukrainian designers who want to present their collections in our stylish premium class showroom. Come to us, our doors are always open!” the owner of the showroom, a girl with a great taste, Maryna Kharetonchuk, who chooses clothes from Ukrainian designers, told Open4Business.com.ua .

It is worth noting that the showroom is located near the Lva Tolstoho metro station in the very center of Kyiv, at 8a Lva Tolstoho Street, opening hours are from 11:00 to 20:00 daily.

Kharkiv Heating Networks have already connected over 90% of houses to heating, director of the municipal company Vasyl Skopenko said.

“Since October 6, we have connected the entire social sphere. Since October 14, we have begun to connect residential buildings. As of today [October 21], we have already supplied heat to 91% of houses. It is clear that there are problems with air removal and defects, but I think that 3-4 days – and we will fully provide everyone with heat,” he said during a press conference at the Interfax-Ukraine agency.

Skopenko specified that the company provided an advance payment for natural gas for October and will be able to pay for November gas. At the same time, he predicted that due to low payments from the population, the company will not be able to accumulate the necessary funds to pay for gas in December-January, its accounts will be seized and the money will be automatically debited.

“I think everyone will have such a situation. Whatever memorandums we sign, given the gas price that exists, with a cash gap and the population’s ability to pay, it will be like this,” he said.

According to him, the difference in tariffs between the cost of heat supply and bills for the upcoming heating season for Kharkiv will be about UAH 2.4 billion, since tariffs for the population were not revised, and the price of gas increased.

The head of the company also said that in preparation for the heating season, the enterprise this year has replaced more than 100 km of heating networks, installed about 300 individual heating points with weather regulation in residential buildings, overhauled 24 boilers with a capacity of 30 to 100 Gcal.

In addition, within the framework of the program with the World Bank, 11 frequency-controlled pumps were put into operation.

“By the way, it is very economically profitable. In winter mode, one such pump gives energy savings in the range of UAH 1 million,” Skopenko said.

Also, within the framework of the program with the World Bank, six new small boiler houses were installed instead of the demolished 60-70-year old ones.

A source:

Minister of Health of Ukraine Viktor Liashko believes that with 70% of the population vaccinated, Ukraine will be able to cancel quarantine restrictions following the example of Great Britain and the Scandinavian countries.

“At least 70% of vaccinated adults will allow us to prevent the spread of coronavirus disease and reduce the number of hospitalizations … If we vaccinate more than 70% of the population with a full course of vaccinations today, we can go the way of the UK, as well as the Scandinavian countries, which are lifting quarantine restrictions now,” Liashko told reporters on the sidelines of the Verkhovna Rada on Friday.

He admitted that the next peak of the disease is possible at the beginning of next year.

“But we cannot wait for it … come to the vaccination center, get vaccinated and reduce the number of hospitalizations,” the minister stressed.

Agroholding KSG Agro in January-September 2021 increased the volume of sales of pigs in live weight by 17.4% compared to the same period last year, to 6,650 tonnes, the growth was mainly due to the renewal of livestock and changes structure of compound feed, according to a press release from the group of companies.

“We managed to significantly improve the quality of feed thanks to a comprehensive partnership program with Cargill. As part of the program, we not only improved the qualifications of our personnel, but also modernized equipment, created modern laboratories,” Board Chairman of KSG Agro Serhiy Kasianov said.

In addition, this year, KSG Agro purchased 1,000 sows of the Danish Dunbred breed as part of the livestock renewal, which increased the birth rate of piglets.

The livestock segment of the agricultural holding provides its own feed from the mill with a monthly capacity of 2,500 tonnes, which uses its own raw materials and additives-premixes purchased from Cargill.

According to Oleksandr Dolzhenko, the head of the meat department of KSG Agro, the group is currently preparing for the modernization of the pig breeding complex in the village of Nyva Trudova (Dnipropetrovsk region), the project documentation for future work has already been approved.

The vertically integrated holding KSG Agro is engaged in pig breeding, as well as in the production, storage, processing and sale of grain and oilseeds. Its land bank is about 21,000 hectares.

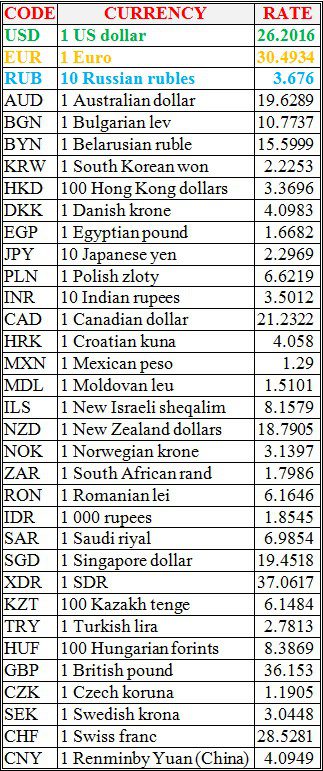

National bank of Ukraine’s official rates as of 22/10/21

Source: National Bank of Ukraine