On Wednesday, October 13, Prime Minister of Ukraine Denys Shmyhal and Prime Minister of Slovakia Eduard Heger met within a working visit to Malmö(Kingdom of Sweden), where they discussed relevant issues of bilateral relations.

According to the Cabinet of Ministers press service, during the meeting, Shmyhal said that Ukraine highly appreciates the support provided by Slovakia in matters of protecting sovereignty and territorial integrity.

“We count on the support of Slovakia in countering the Nord Stream 2 operator in an attempt to bypass the standard certification requirements of the European Union,” the head of the Ukrainian government said.

The sides also discussed issues of gas transportation, development of electricity and hydropower, renewable energy sources and others.

“Denys Shmyhal also said that Ukraine is looking forward to holding the fifth meeting of the Ukrainian-Slovak joint commission on economic, industrial and scientific-technical cooperation and other intergovernmental commissions by the end of the year, as this will give new incentives to strengthen partnership between the countries,” the Cabinet of Ministers said.

The sides also agreed to hold the next meeting in Uzhgorod soon.

In 2022, the construction of the Ice Arena, a sports complex within the framework of the Big Construction program and the restoration of three castles under the Big Restoration program will start in Cherkasy region, President of Ukraine Volodymyr Zelensky said.

“There is our program – these are large sports unique multi-complexes. One of them will be built in Cherkasy region, several more swimming pools. The Ice Arena will be built separately. These are all programs that will begin next year. There are three castles within the Big Restoration, which are included in the program,” Zelensky told media representatives while on a working visit to Kaniv, Cherkasy region.

He also said that within the framework of the Big Restoration program, documents are also being prepared for the restoration of Kaniv center.

In addition, according to him, in 2022, a school with a playground for children and a swimming pool will appear in the city.

Speaking about roads, the President said that about 250 km of roads are planned to be repaired within the current year.

“I think that in a couple of years we will finish all the main roads in Cherkasy region,” he said.

“I believe that they have everything in Cherkasy region. There are people, there are hands, there are unique places and history. We need to bring all this into a normal high-quality form,” Zelensky said.

The lack of production facilities in Ukraine and the import of its confectionery products into the country allows Mars Corporation to successfully conduct its business amid a crisis in the industry caused by the rise in prices for raw materials and energy resources, Chief Financial Officer (CFO) of Mars Ukraine LLC (Brovary, Kyiv region) Svitlana Hrukhal has said. “In the field of confectionery, we have everything under control. We import products, and this makes it possible to distribute the raw material base and production resources in several countries and thus compensate [for crises],” she told Interfax-Ukraine on the sidelines of the Ukrainian CFO Forum on Wednesday.

According to her, the key trend in the industry is the growth in demand in Ukraine and neighboring countries, which is most pronounced in the segment of chocolate and chewing gum. Hrukhal said that in order to meet this demand, it is necessary to increase production of confectionery products in the region, which is hindered by the rise in prices for raw materials, their shortage, as well as the lack of labor resources.

“If we talk about assessing the development of confectionery products specifically for Mars Corporation, then we have everything under control, and we hope to successfully close this year,” the company’s CFO said.

During the forum, she also said that in 2007 the company planned to build a plant in Boryspil district (Kyiv region) for production of animal feed, but due to unstable business conditions in Ukraine, it abandoned this idea. According to her, for large international companies, the presence of clear and understandable “rules of the game” in the country is a more important factor for investment than well-developed measures of state support for business.

Mars Ukraine LLC is a Ukrainian division of the large international confectionery company Mars. The company sells food and pet care products in Ukraine, produced in Russia and Hungary. Its major brands are Snickers, MARS, Twix, Bounty, Milky Way, M&M’s, Maltesers, Dove, Pedigree, Chappi, Whiskas, Kitekat, Sheba and others.

The single counterparty exposure limit (H7, shall be no more than 25%) as of October 1, was violated by Prominvestbank (88.3%) and Industrialbank (44.08%), according to the website of the National Bank of Ukraine (NBU).

The limit on bank total long open FX position (L13-1, shall be no more than 10%) was violated by Oschadbank (135.7%), Prominvestbank (106.93%), PrivatBank (80.25%) and Industrialbank (19.56%).

The limit on bank total short open FX position (L13-2, shall be no more than 10%) was violated by Prominvestbank (131.27%).

As reported, the prudential requirement on Net Stable Funding Ratio (NSFR) was set at 90% by the NBU for banks starting October 1 (earlier it was 80%). In accordance with the schedule, the NBU will increase the NSFR requirement for banks to 100% from April 1, 2022.

According to the data of the National Bank, all operating banks as of October 1 exceed the level of the NSFR standard of 90%.

The NSFR regulation is intended to encourage banks to rely on more stable and long-term funding sources and reduce their dependence on short-term financing.

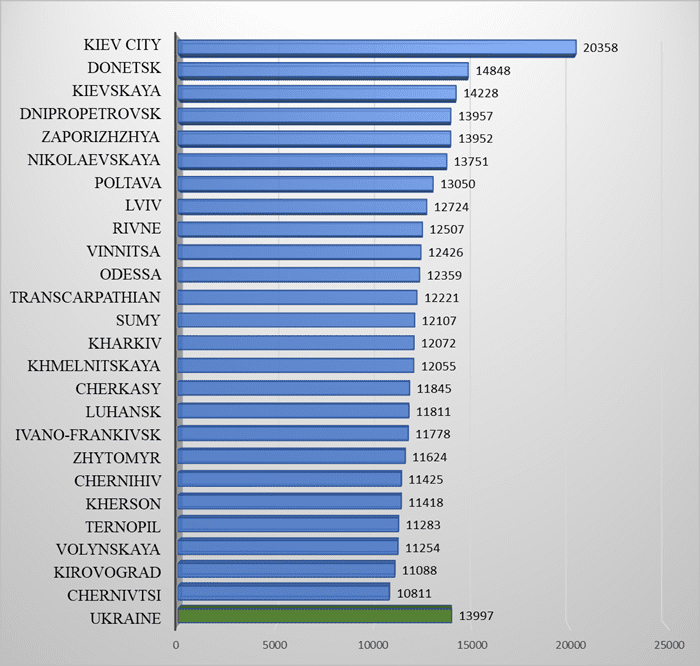

AVERAGE MONTHLY WAGE BY REGION IN AUGUST 2021, UAH