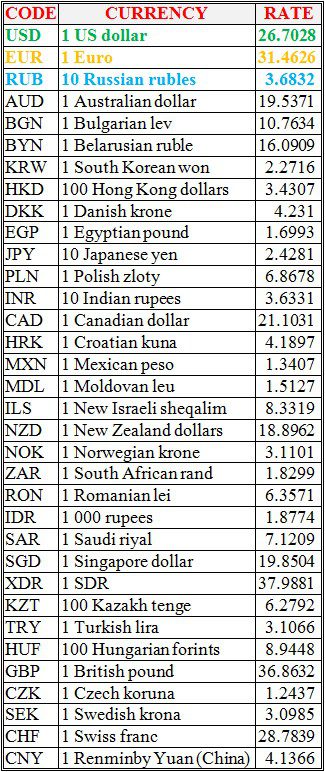

National bank of Ukraine’s official rates as of 20/09/21

Source: National Bank of Ukraine

During the 76th session of the United Nations General Assembly (UNGA), the presidents of Ukraine, Poland, Moldova and the Prime Minister of Georgia will meet, according to the official website of the President of Poland.

According to the published schedule, President of Poland Andrzej Duda and his wife will visit the United States on September 21-24, 2021.

On the first day of the visit, September 21 at 20:00, Duda is scheduled to meet with President of Ukraine Volodymyr Zelensky, President of the Republic of Moldova Maia Sandu and Prime Minister of Georgia Irakli Garibashvili.

The decree of President Volodymyr Zelensky on planting 1 billion trees within three years will be implemented, it will be implemented on 170,000 hectares, the total cost of the project is about UAH 2 billion, Head of the State Forest Resources Agency of Ukraine Yuriy Bolokhovets has said in an exclusive interview with Interfax-Ukraine. “For planting 1 billion trees, about 170,000 hectares are needed. We have already found up to 100,000 hectares of our own territories that require afforestation. These are sites of fire, areas where forests have been destroyed as a result of various factors. Another 70,000 hectares are land of local authorities, the head of the agency said.

He said that the State Forest Resources Agency proposed that the territorial communities, which land plots were in the zone of implementation of the Green Country presidential program, either plant a forest on its territory, or transfer these plots to the agency for afforestation. According to Bolokhovets, today, more than 20,000 hectares are in the process of being transferred from the communities to the enterprises of the State Forest Resources Agency.

“The second question is financing. We need UAH 2 billion for three years. I am absolutely sure that the forest industry, due to going from the shadows and more efficient work, is able to earn this money itself. And we will do it,” the head of the agency said.

Bolokhovets said that planting 1 billion trees is necessary to minimize the effects of global climate change, create protective belts of trees to protect against dust storms, as well as increase the country’s forest cover from the current 15.9% to the minimum required 20%.

The head of the State Forest Resources Agency also noted the increase in the procurement of seed material for forest reproduction several times. His agency is also creating infrastructure for large-scale seeding and building nurseries for growing quality planting material.

“This year we have already significantly increased the planting in comparison with previous years. Next year, we will at least double the planting. I am absolutely convinced that we will implement the President’s task,” Bolokhovets said.

PRESIDENT OF UKRAINE, PRESIDENT ZELENSKY, STATE FOREST RESOURCES AGENCY, TREES