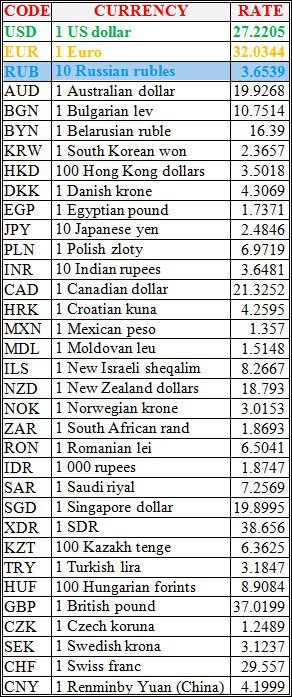

National bank of Ukraine’s official rates as of 21/07/21

Source: National Bank of Ukraine

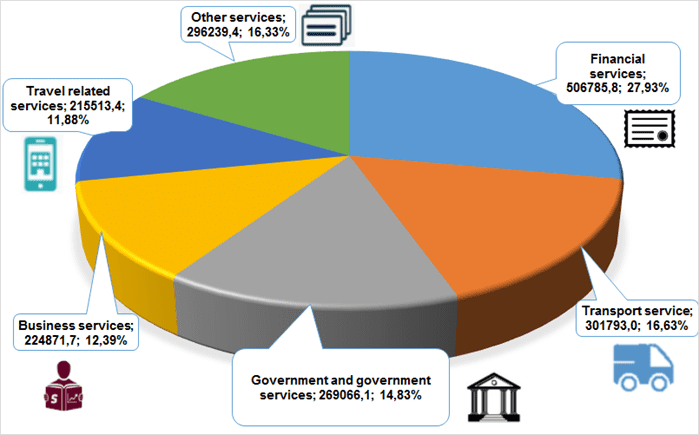

STRUCTURE OF IMPORT OF SERVICES IN JAN-MARCH 2021 (GRAPHICALLY)

The political parties Servant of the People, Opposition Platform – For Life, European Solidarity and Batkivschyna would overcome the five percent barrier if elections to the Verkhovna Rada were held on Sunday, according to the results of a survey conducted by the NGO Kyiv Institute of Sociology of Civil Society from July 15 to July 19, 2021.

According to the poll, which was presented at the Interfax-Ukraine agency on Wednesday by chairman of Kyiv Institute of Sociology of Civil Society, MP Oleksandr Kovtunenko, among those who will vote and have made their choice, 23.1% are ready to support the Servant of the People party, 17.5% – Opposition Platform – For Life, 15.4% – European Solidarity, and 11.8% – Batkivschyna.

At the same time, there are still chances of getting into parliament for the political force of Strength and Honor, which would receive the support of 4.9% of Ukrainians, Oleh Liashko’s Radical Party (4.1%) and Groysman’s Ukrainian Strategy (3.8%).

Civic Position would have won 2.8% of the votes cast, Shariy Party – 2.1%, Holos – 1.5%, Svoboda – 1.2%, Opposition Bloc and National Corps – 0.8% each, For Maybutnie group (For the Future) – 0.3%, People’s Front and Samopomich – 0.1% each. Two percent of respondents would vote for another party, and 7.7% of respondents would spoil the ballot or cross out all candidates.

The poll was conducted by Kyiv Institute of Sociology of Civil Society, commissioned by the American company West Market Industrial LLC (U.S.). Some 3,000 respondents were interviewed using the CATI method (computer-assisted telephone interview). The audience is the population over the age of 18, living in all regions of Ukraine, except for the temporarily uncontrolled territories of Donetsk and Luhansk regions and Crimea. The error in the representativeness of the study does not exceed 2.8%.

UA: PERSHYI TV channel will broadcast the Summer Olympic Games in Tokyo 2021 from July 23 to August 8, the press service of the TV channel reports.

“The broadcast of the opening ceremony of the Games begins at 13:50 and lasts until 18:00. The Ukrainian team at these Olympic Games will be represented by 157 athletes,” the message says.

The first competition starts on July 24.

The broadcast of the morning sessions of the competition starts at 3:00 daily, the afternoon sessions starts at 11:00. From 18:30 to 21:00, replays of the morning session are to be broadcast, from 22:00 – reruns of the evening sessions.

Due to the intensification of inbound tourism, the occupancy rate of hotels in Kiev in June 2021 increased to 66%, which is 23% higher than in May, Head of the Hotel Matrix project Yelyzaveta Rudeleva has told Interfax-Ukraine.

“We see positive trends in all indicators in all major cities of Ukraine,” she added.

According to Rudeleva, Odesa is in second place in terms of hotel occupancy: an increase from 53% in May to 63% in June. This is followed by Lviv from 41% in May to 60% in June, Dnipro from 45% in May to 58% in June, and Kharkiv from 45% in May to 50% in June.

As she said, usually hotels, anticipating the high demand for the coming period, increase the price. Price and Average Daily Room Rate (ADR) certainly have different meanings, therefore, an increase in price, accordingly, affects an increase in ADR.

Compared to May, ADR indicators of all Ukrainian cities grew from 2.4% to 18.4%. ADR of Dnipro increased to UAH 3782 from UAH 3289 in May, Lviv – to UAH 2,439 from UAH 2,060, Odesa – to UAH 2,284 from UAH 2,067, Kiev – to UAH 2,031 from UAH 1,836 in May.

RevPar (Revenue Per Available Room per day) almost doubled in Lviv – from UAH 850 in May to UAH 1,557 in June. A strong breakthrough in hotels in Odesa – from UAH 1,089 in May to UAH 1,476 in June and Kyiv – from UAH 780 in May to UAH 1,345 in June. In Dnipro, this figure rose to UAH 2,174 from UAH 1,550 in May, in Kharkiv to UAH 1,058 in June from UAH 938 in May.

Statistical data for Dnipro is presented by the hotel market of four-star and five-star hotels, in Kharkiv – two-star, four-star and five-star hotels. The statistics of Kiev, Odesa and Lviv are presented by three-star, four-star and five-star hotels.