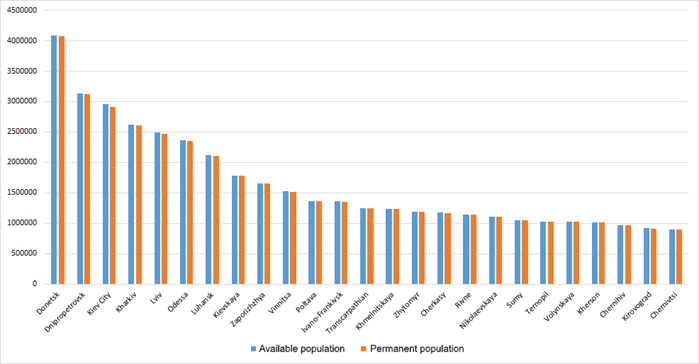

Ukrainian population by regions as of May 1, 2020 (graphically)

The Normady Four summit at the level of heads of state of Ukraine, Germany, France and Russia on the implementation of the project “Key clusters for the implementation of the Minsk agreements” may take place in the near future, said head of the President’s Office of Ukraine Andriy Yermak.

“The main task for all of us remains the restoration of peace [in Donbas] … One of the mechanisms for achieving peace should be the project ‘Key clusters for the implementation of the Minsk agreements’, prepared by Germany and France, which Ukraine supported. The next step should be the N4 summit, which will take place in the near future,” Yermak wrote on his Facebook page following a working visit with President of Ukraine Volodymyr Zelensky to Germany.

He also noted that “security has become a key issue in negotiations with German colleagues.” “Nord Stream 2 is a security challenge that escalates threats to the entire region. Nord Stream 2 violates the principles of the Energy Union and EU antitrust laws, “Yermak said.

Yermak expressed hope that Germany would contribute to the formation of a common position of the European Union on European integration and Ukraine’s membership in NATO, and also stressed that “following the visit to Germany, it became obvious that no one, without taking into account the interests of Ukraine and guarantees of their observance, will decide anything.”

According to the head of the President’s Office, Germany also raised issues of threats to Ukraine due to the concentration of Russian troops near its borders, the implementation of key reforms in Ukraine, the attraction of European investors to Ukraine and the development of “green energy” in Ukraine.

Some 67.1% of Ukrainians are confident that a personal meeting between President of Ukraine Volodymyr Zelensky and President of Russia Vladimir Putin will contribute to resolving the situation in Donbas, according to a sociological survey conducted by the Social Monitoring Center from June 29 to July 9 and presented at the Interfax-Ukraine news agency on Wednesday.

At the same time, 30.3% of respondents are sure that the meeting of Zelensky and Putin will not contribute to the restoration of peace in Ukraine, the return of Donbas and the establishment of good-neighborly relations with Russia, and 2.6% found it difficult to answer.

At the same time, 49.3% of respondents believe that Zelensky should hold a personal meeting with representatives of the self-proclaimed republics in order to return Donbas and peace to Ukraine, 41.1% expressed doubts about the effectiveness of such a meeting, and 9.6% found it difficult to answer.

Also, 51% of Ukrainians believe that the implementation of the Minsk Agreements on the settlement of the conflict in Donbas is in the interests of Ukraine, 39.6% are against such a statement, and 9.4% refused to answer.

The sociological survey was carried out throughout Ukraine, with the exception of the temporarily occupied territories of Donetsk and Luhansk regions and the Autonomous Republic of Crimea, among people over 18 years old by the method of personal interviews at the place of residence of the respondents. The sample is 3,011 respondents.

On July, 17 and 18 Ancient Kiev in the Principality of Kievan Rus (“The Kievan Rus Park”) invites you to join the weekend tour “The Mystery of Genghis Khan”. Horse stunt performances, horseback riding, delicious meals from the fire, extreme attractions, museums, expositions and lots of interesting activities will be waiting for you. And all this in a real, living medieval city!

Horseback archery competitions will be a pleasant surprise for the guests on July, 17 and18. Experienced horse stuntmen will compete in the accuracy of shooting using traditional (historical) bows on horseback at full gallop. It is an incredibly difficult task for the participants in the competitions, but at the same time, a thrilling and exciting show for the spectators!

The visit to Ancient Kyiv is subject to the requirements of the quarantine regime.

Ancient Kyiv opens at 10:00. The program starts at 14:00.

* The program may be changed.

The entry ticket price:

• for adults (full price) – 200 UAH.,

• for pensioners and students – 150 UAH.,

• for schoolchildren – 80 UAH.,

• for preschool children – for free,

Ancient Kyiv in the «Kyivan Rus Park» is located in Kyiv region, Obukhiv district, the vill. Kopachiv.

Details on the website www.parkkyivrus.com

The Interfax subscribers can save money with the “openbusiness-20” promo code for a 20%-discount for a full price adult ticket to the Principality of Kyivan Rus:

– by previous order by tel.: +38 044 461-99-37, +38 050 385-20-35

– or at the cash desk at the entrance to the «Kyivan Rus Park».

The European Council confirms that the ambassadors of the EU member states have decided to recommend including Ukraine in the list of countries for which restrictive measures imposed on travel to the EU due to coronavirus (COVID-19) pandemic can be lifted.

The press service of the European institution said it confirms that the relevant decision was made today by the ambassadors. Further, by the end of the week, it will be formalized in a written procedure.

The list of countries for which it is recommended to be allowed to travel to the EU is reviewed every two weeks and updated as the case may be. Previously, Armenia, Moldova and Azerbaijan were included in it.

The share of land plots cultivated by the 25 largest agricultural holdings is 9% (3.88 million hectares) of the total area of agricultural land in Ukraine, the investment company Concorde Capital (Kyiv) said during the presentation of the agricultural online platform KupiPai.

According to it, the land bank of Kernel agricultural holding (the main beneficiary is Andriy Verevsky) is 510,000 hectares, Ukrlandfarming (Oleh Bakhmatiuk) 475,000 hectares, MHP (Yuriy Kosiuk) 370,000 hectares, Agroprosperis (George Rohr and Maurice Tabasinik) 300,000 hectares, Astarta (Viktor Ivanchik) 243,000 hectares.

Continental Farmers cultivates 195,000 hectares, Epicentr Agro 160,000 hectares, Harveast 127,000 hectares, Ukrprominvest-Agro 120,000 hectares, Agroton and Agrain 110,000 hectares, Vitagro and Privat-agro 85,000 hectares.

Concorde Capital said the land bank TAS-Agro and Nibulon are 83,000 hectares each, Agrovisty, Svitanka and LNZ 80,000 hectares each, Agrotrade 71,000 hectares, Ristone Holdings 67,000 hectares, Grain Alliance 57,000 hectares, AgroGeneration 56,000 hectares.

The investment company said the total area of Ukraine is 60.3 million hectares, including 42,700 hectares are suitable for agriculture (of which 31.1 million hectares are privately owned, 10.4 million hectares are state-owned, 1.2 million hectares of another form of ownership). At the same time, 89% of the 31.1 million hectares of land plots in private ownership are private shares of citizens.

Concorde Capital said that according to data for 2019, 56% of land plots were cultivated by individual tenants, 29% were individual owners, 8% of the land was leased from the state, and 7% were not cultivated at all.