The municipal enterprise Kyivteploenergo (KTE) has added high-power generators ranging from 600 kW to 2 MW, which can be used in the capital’s boiler rooms as backup power sources in case of emergencies.

“Today, 136 generators are installed at heat sources. This means that all boiler rooms where it is technically possible have an emergency power supply,” KTE reported on its Telegram channel.

According to the company’s quote from the deputy head of the Kyiv City State Administration (KCSA), Petro Panteleev, high-power generators have significantly enhanced the capabilities of heat sources in the absence of electricity.

“Earlier, we doubled the number of mobile modular boiler rooms, of which the city now has 51. Boiler rooms in emergency mode can provide heat to hospitals or other critical facilities for the period of repair of damage to the power facility,” he said.

According to Panteleev, the number of residential buildings equipped with alternative power generation equipment is growing in Kyiv.

“Backup power supply routes, alternative connection options, rehearsals of various basic and backup scenarios and instructions, interaction algorithms – these are an integral part of winter preparedness,” KTE concluded.

According to him, over the past month, the city has conducted training for civil protection forces in Kyiv and the region to practice actions in the event of hypothetical damage to large energy facilities. Similar test exercises will continue to be conducted before the start of the heating season.

Henriette Tøgsø, CEO of Danish company Terma A/S, announced the opening of a representative office in Ukraine at a meeting at the Ukrainian Ministry of Defense.

According to the press service of the Ukrainian Defense Ministry, Deputy Minister of Defense for Aviation Development Oleksandr Kozenko held a meeting with a delegation from the Danish company TERMA A/S, led by its CEO. The talks focused on strengthening the aviation capabilities of the Armed Forces of Ukraine.

During the talks, the parties focused on key areas of cooperation, in particular: the experience and prospects of integrating Terma A/S equipment into the existing fleet of the Ukrainian Air Force, improving aviation systems and means of detection, warning, and counteraction using solutions from the Danish company.

During the discussion, the Deputy Minister also invited Terma A/S management to consider participating in promising projects in the domestic military and civil aircraft industry.

In turn, Tyugesen informed the Ukrainian side about the opening of the company’s representative office in Ukraine, which demonstrated Terma A/S’s serious intentions to develop its business in the country.

Terma A/S is Denmark’s largest manufacturer of defense and aerospace products, with more than 2,000 employees worldwide. The company offers radar systems, avionics, and space electronics. Terma’s headquarters are located in Lystrup, Denmark.

Lawyers, finance experts and attorneys have united to form the National Association of Lobbyists of Ukraine (NALU) to promote investments and protect business interests, said Oleksiy Shevchuk, a lawyer, chairman of the board of NALU, chairman of the Information Policy Committee of the National Association of Lawyers of Ukraine (NALU).

“Lobbyist is a new profession in Ukraine, now created by NALU. It means that a great profession is now open to everyone, it means that now a lot of businesses have support. A lobbyist performs business and investment support functions. Today it means that large companies that are going to enter the reconstruction of Ukraine have guides, have support and have managers who will develop these companies and accompany investments,” he said at a press conference at the Interfax-Ukraine agency.

Shevchuk said that NALU now includes 20 people, while the transparency register of lobbyists – the only official State register of lobbyists – includes more than 30 people, and the holder of the transparency register is the National Agency for the Prevention of Corruption (NAPC). At the same time, the NALU can unite only individual lobbyists.

“The NAPC checks the representatives of the lobbying profession to ensure that they meet the requirements of decency and good business integrity and that they do not violate lobbying laws. Lobbyists who are members of NALA meet the standards of quality and requirements of the lobbying profession. This means that these representatives can and should be chosen to accompany major investment projects. This means that today we are moving towards the creation of a civilized society,” he said.

Shevchuk also noted that “recently, law enforcement agencies have been abusing a lot when some investment projects were presented by a state body, when people’s deputies received bills that business needs.”

“Today no one will no longer say that this is a violation of law or abuse of influence. Lobbyists are official managers who represent business,” he said.

According to Shevchuk, Ukrainian lobbyists can be registered in the United States as individual members of the profession and will be able to have a corresponding contract with a European or U.S. organization.

“If today there will be an order either from some lobbyist from the US or from some separate organization – for example, it can be an investment bank, a fund, or a small business that needs to be promoted – a lobbying contract must be concluded and this contract must be registered in the appropriate registry in the US. On their own, no lobbyist has the right to act in the U.S., every lobbyist from Ukraine must interact with a U.S. company. It is the same as with lawyers: a lawyer from America cannot work independently in Ukraine, a lawyer from Ukraine cannot work independently in the U.S.,” he explained.

For her part, NALU executive director Vitalia Globa noted that among the key areas of the association’s activities are the development of lobbyism as an important component of a democratic society, the creation of a system of self-regulation and professional standards for lobbyists, as well as the protection of the rights of association members.

“Any lobbyist in our country can become a member of our association of lobbyists by submitting a free-form application with certain documents, which are specified on the official website of our organization,” she said.

In turn, NALU board member, managing partner of the Leshchenko and Partners law firm Oleksandr Leshchenko said that experts are preparing a large report on the status, system and procedure of lobbying in Ukraine. It will be presented in the European Parliament, as well as in the United States, where a round table with international participation with lobbyists from the US is planned.

“Lobbyism is an activity that in the civilized world is legally regulated. Unfortunately, in most cases, including among elites, journalists, there is a negative attitude to the activities of lobbyists. This opinion is erroneous, because, since 1946, in the United States for the first time an act regulating the activities of lobbyists has been in force. Today Ukraine has created such a legislative act at the legislative level and now there is a process of establishing legal regulation of lobbyist activity”, – he said.

As the vice-president of NALU, head of the representation of the Ukrainian Bar in the UK Oleksandr Chernykh noted, what is now happening very often around draft laws in Ukraine cannot be called professional activity not by the level of preparation, not by the level of analysis.

“Absolutely wrong thing in Ukraine, when public activists spend millions on youtubes and social networks, actually putting pressure on state bodies to make decisions, while they do not report. If we look at the tax and public reporting, it is really millions of dollars, which then disappear on some FOPs, for some incomprehensible services. And it is not clear where these millions of dollars come from, who is the customer and what the end result of this actual lobbying activity is. I very sincerely welcome the adoption of this law, because now we can talk about legitimate legal lobbying activities,” he said.

For his part, NALU representative in Brussels, President of European Facilitation Platform Oleksandr Kamenets emphasized the need to research the lobbying field in Ukraine.

“This is a necessary condition for both in Ukraine and abroad, in Europe and in the world to understand who is now on this market, on this field in Ukraine,” he said.

Chernykh, Kamenets, Leshchenko, lobbyists, UKRAINE, Глоба, НАЛУ, ШЕВЧУК

PJSC “Pharmaceutical firm ”Darnitsa” (Kiev) has suspended production due to overcrowding of warehouses, which arose due to a conflict with pharmacy chains.

As the Economic Pravda newspaper reported, the company’s warehouses are “filled to overflowing due to the unwillingness of the largest pharmacy chains to sell the company’s products”.

The Interfax-Ukraine agency contacted the company to comment on the situation, but has not yet received a response.

Darnitsa Pharmaceutical Company is the leader of the Ukrainian pharmaceutical market in physical terms. The company has been on the market for over 90 years and produces 180 brands of medicines in 15 different forms. The strategic directions of portfolio development are cardiology, neurology, pain management.

The ultimate beneficiary of the company is Gleb Zagoriy.

The Ukrainian Cabinet of Ministers will grant internally displaced persons who have worked continuously for six months an additional one-time payment of UAH 2,000 for living expenses, Prime Minister Yulia Svyrydenko announced.

“Support for the employment of internally displaced persons. The government will grant internally displaced persons who have worked continuously for six months an additional one-time payment of UAH 2,000 for living expenses,” Svyrydenko wrote on a Telegram channel after a government meeting on Wednesday.

In addition, it is noted that internally displaced persons who are recipients of social benefits or housing allowances throughout Ukraine and have not received funds from international organizations will also be able to purchase solid fuels for the winter in the frontline areas.

“The average amount of payments will reach UAH 8,000. A total of 32,000 households are eligible for additional support. The payments will be made by the Pension Fund of Ukraine after the payments from international organizations are completed in November-December,” the prime minister said.

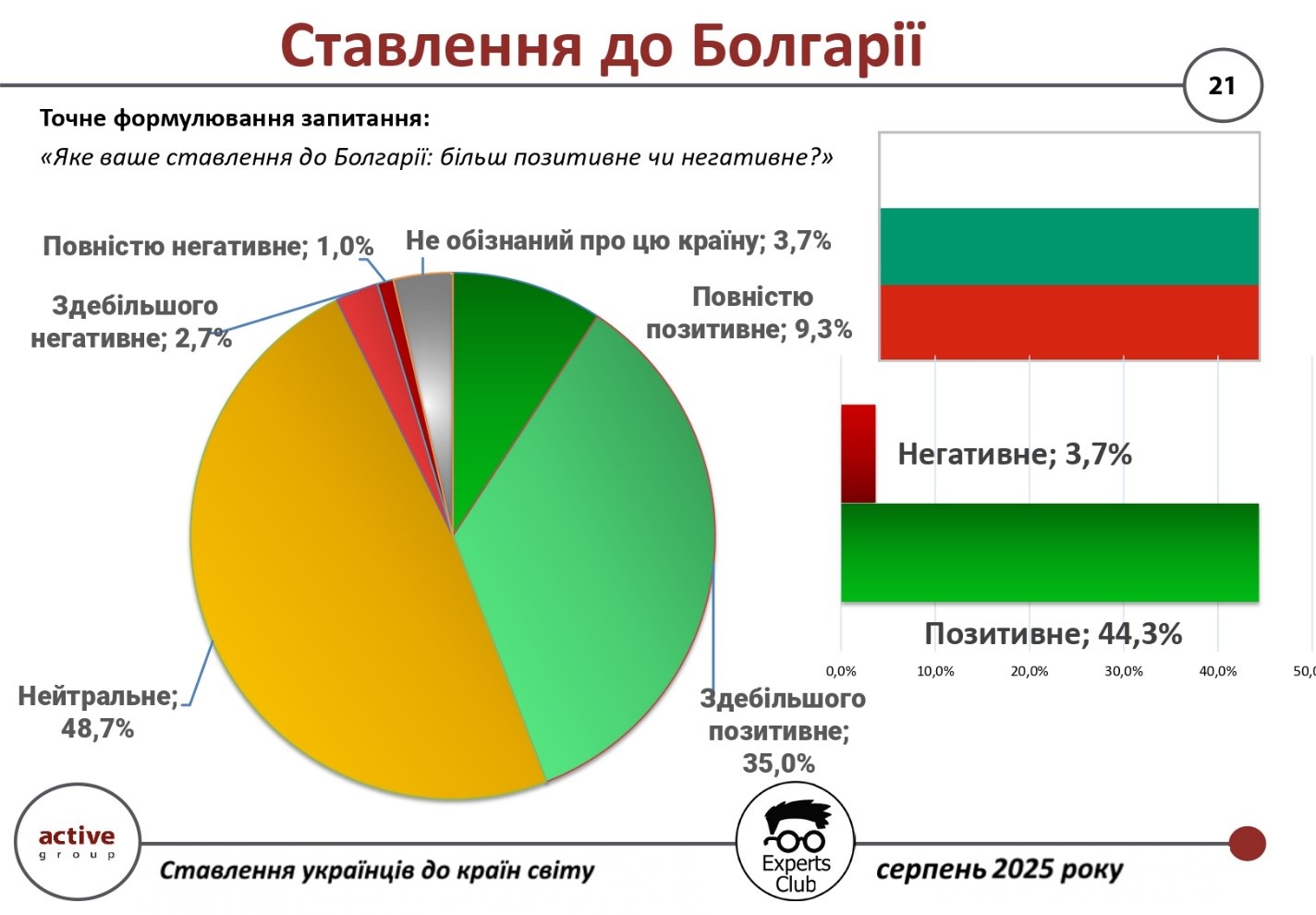

Bulgaria is perceived by Ukrainians mostly positively, although a significant number of citizens remain neutral. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 44.3% of Ukrainians have a positive attitude towards Bulgaria (35.0% – mostly positive, 9.3% – completely positive). Only 3.7% of respondents expressed a negative attitude (2.7% – mostly negative, 1.0% – completely negative). At the same time, 48.7% of citizens are neutral, and 3.7% admitted that they do not know enough about this country.

“For Ukrainians, Bulgaria is not only an EU member state but also a significant economic partner. In the first half of 2025, the volume of bilateral trade amounted to more than $1.53 billion, of which Ukrainian exports amounted to $558.6 million and imports from Bulgaria amounted to almost $980 million. The negative balance of $421.5 million demonstrates an asymmetry in relations, but against the background of the total volume, it confirms the importance and sustainability of economic ties,” said Maxim Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, drew attention to the fact that the sociological picture shows a friendly but at the same time restrained attitude of Ukrainians.

“Almost half of the citizens have a neutral position on Bulgaria, and this is due to the relatively limited presence of this country in the public and information space of Ukraine. At the same time, positive assessments outnumber negative ones by almost ten to one, which indicates the existence of trust and good potential for further development of relations,” he added.

The survey was part of a broader study analyzing international sympathies and antipathies of Ukrainians in the current geopolitical environment.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, BULGARIA, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, URAKIN