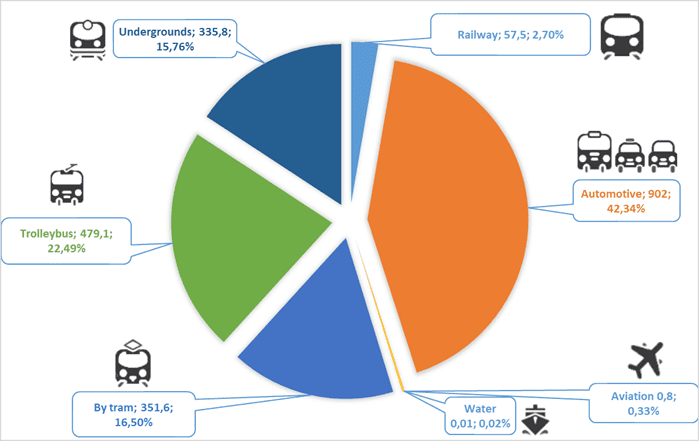

Passengers carried in Jan-Sept of 2020, in MLN.

Nestlé, one of the world’s largest food manufacturers, has announced the launch of a product line in Ukraine in partnership with the Starbucks brand.

“As part of partnership between the two companies, a line of coffee for making at home has been launched on the Ukrainian market,” the company’s press announcement said.

According to the report, on January 15, Nestle will announce the details of partnership with Starbucks and its plans to develop the coffee business in Ukraine as a whole.

Currently, coffee under the Starbucks brand is already present in Ukraine both on the largest marketplaces and in niche online stores, and in large retail chains such as Silpo or Metro, and belongs to the upper segment with a price of about UAH 100 per 100 g.

Illegal import of vaccine against COVID-19 in significant volumes is hardly possible due to strict control over its circulation, senior partner of ABSC Krzysztof Siedlecki believes.

“The demand for the vaccine is huge, the requirements for its logistics are very high. I have very great doubts about the possibility of smuggling the vaccine into Ukraine, although it cannot be ruled out,” he told Interfax-Ukraine, commenting on the statement of businessman Mykhailo Brodsky that a number of Ukrainian government officials, in particular some people’s deputies and top officials, were secretly vaccinated against COVID-19 with the Pfizer vaccine illegally imported to Ukraine from Israel.

He noted that the COVID-19 vaccine is not currently in free circulation.

“This is not a product that you can just call and order from Pfizer. It doesn’t work that way. It’s hard to even imagine that some distributor can illegally import the vaccine, because this vaccine requires special transportation conditions, a very low temperature – 70 degrees below zero, because at higher temperatures the vaccine is stored for only a few days. The possibility of smuggling this vaccine under such conditions is very small,” he said.

The expert stressed that due to the high demand for the COVID-19 vaccine, the distribution of these vaccines around the world is carried out under the strict control of state authorities. At the same time, he admitted that “the doctor can take several doses of the vaccine uncontrollably, but their validity is limited: if they are in the refrigerator, then the shelf life is several days.”

“I’m not saying it’s impossible, but it’s not easy. If we were talking about several hundred doses, then there would be a resonance. I don’t believe that Pfizer would have allowed such a leak,” he said.

In 2020, Ukrtelecom provided 36 Epicenter shopping centers in different regions of the country with optical Internet.

According to the press service of the company, the network was provided with 100 Mbps Internet channels and PRI streams for a certain number of telephone numbers. This package of services meets the business needs of the shopping centers.

At present, Ukrtelecom is working on providing fast Internet for nine online order centers in Kyiv, Zaporizhia, Enerhodar (Zaporizhia region), Kharkiv, Dnipro, Odesa, Lviv, Ternopil, Horodok (Khmelnytsky region).

As the operator notes with reference to Epicenter, the network began to open modern order pick-up centers for the online store epicentrk.ua in 2020 in order to increase the level of customer service.

“The new order pick-up center are technological, with the automation of all processes, an address storage system for goods, a comfortable waiting area for customers with a children’s corner and online showcases. A high level of service in the centers for issuing orders, of course, requires fast and high-quality Internet,” the report says.

Ukrainian shopping and entertainment centers for two weeks of January lockdown will not receive UAH 1.5-2 billion of lease payments, while the loss of their tenants’ turnover will amount to UAH 10-12 billion.

These data were announced by Head of the Ukrainian Council of Shopping Centers, Chief Operation Officer of Budhouse Group Maksym Havriushyn.

“January for most of the tenants of the shopping centers has always been far from the most profitable month. According to our calculations, tenants of the shopping centers as a whole will lose UAH 10-12 billion in turnover in the two weeks of January quarantine. Shopping centers will lose about UAH 1.5-2 billion of rental income,” he told Interfax-Ukraine.

According to Havriushyn, if the lockdown had been introduced at the end of December, the losses would have been doubled.

During the January lockdown, as well as during the spring one in 2020, the shopping and entertainment centers in Ukraine will not charge lease payments for their tenants, whose work is prohibited by a government resolution, the head of council said.

“The market has already gained experience of working in such conditions. The approach will remain the same as during the spring quarantine of 2020. Only maintenance fees will remain. For tenants who will continue to work, conditions will be determined on an individual basis,” Havriushyn said.