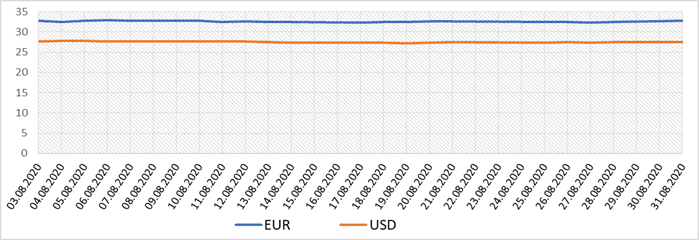

Quotes of interbank currency market of Ukraine (UAH for 1USD and 1 EURO, IN 03.08.2020-31.08.2020).

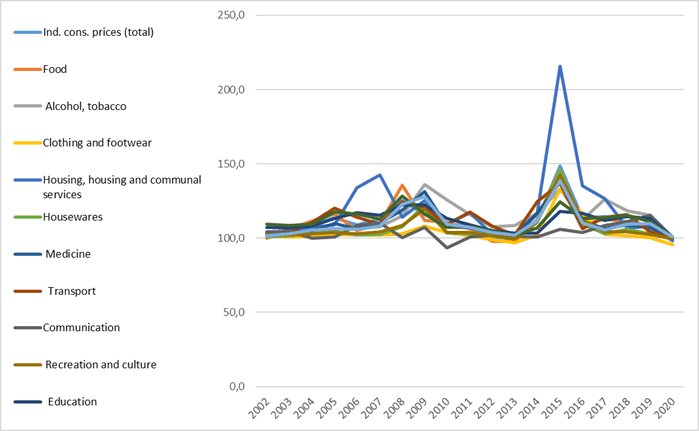

Dynamics of the consumer price index in 2002-2020, in %.

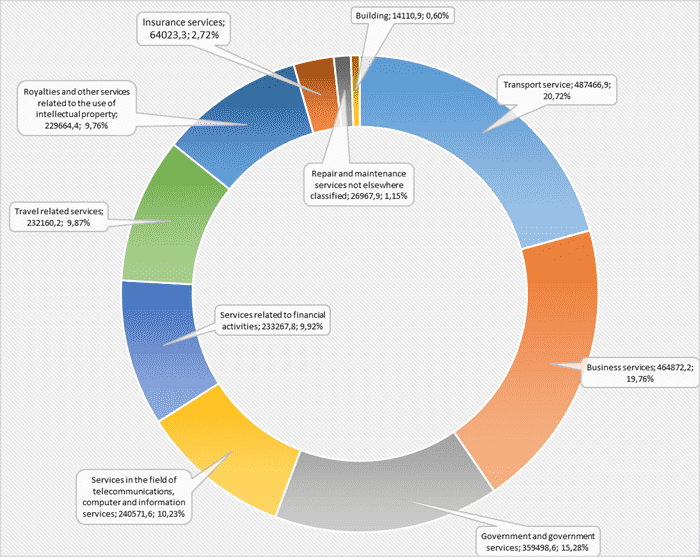

Structure of export of services in 1st quarter of 2020 (graphically)

SkyUp Airlines (Kyiv) will perform an irregular flight to Tashkent (Uzbekistan) on October 1, ticket prices start at UAH 9,031 one way.

According to the press service of the company, the PQ7979 aircraft will depart from Kyiv on October 1 at 04:10 and arrive in Tashkent at 11:20. Flight PQ7980 will return to Ukraine from Tashkent on the same day at 12:20 and arrive in Kyiv at 16:00.

Tickets can be purchased on the airline’s website in the All Flights – Special Flights section.

SkyUp notes that from October 1, to enter Uzbekistan, one needs to have a negative PCR test done no later than 72 hours before arriving in the country.

According to the Ministry of Health of Ukraine’s data of September 25, Uzbekistan is included in the “green” zone, therefore, after entering Ukraine, self-isolation or taking a PCR test is not required.

Prices for apples in Ukraine are now the highest in the last three years, so the average wholesale prices for apples in Ukraine range within UAH 11-13/kg, the Ukrainian Horticultural Association has reported.

According to a report on the association’s website, the season of local apples is gaining momentum in Ukraine. Ukrainian producers are actively engaged in harvesting autumn varieties of apples, respectively, the supply on the market is increasing every day. Today, the average wholesale prices for apples in Ukraine fluctuate within the range of UAH 11-13/kg. For comparison, at the beginning of September, apple producers were selling their products at 15-20% higher prices.

“Today, prices for apples in Ukraine are the highest, at least in the last three years. In the same period of 2019, local apples were sold on average UAH 1-1.5 cheaper than today, and at the end of September 2018, Ukrainian gardeners were shipping dessert apples at an average of UAH 7-8 per kg,” the union noted.

The price situation that has developed today, according to the association, was significantly influenced by the record high prices for apples at the beginning of the season: in mid-July, Ukrainian gardeners sold the first consignments of apples for UAH 20-22/kg. Another factor that affected the price situation on the apple market is the delay in the apple season by an average of 7-10 days due to unfavorable weather conditions in the country.

“Also, we note that in April and May in Ukraine several waves of frosts were recorded at once, which affected the gross yield of early varieties. Of course, losses in the segment of apples are not as significant as in the segment of apricots and cherries, nevertheless, Ukrainian producers from the central and western regions reported that crop losses reach 20-30%,” the report says.