National bank of Ukraine’s official rates as of 02/03/20

Source: National Bank of Ukraine

What factors affecting the pharmaceutical companies in 2020? What important signals and triggers for action does the market show? How to maintain balance in turbulence? Which way to choose – confrontation, opposition or adaptation to external factors?

2020 will be unique year for the healthcare sector of Ukraine. From April 1st, 2020, the National Healthcare Service of Ukraine (NHSU) will start paying for medical services at the secondary and tertiary levels of care. At the moment, it is difficult to predict the progress and implementation of the reform in 2020. Much more information will appear in March, closer to the date of the Ukrainian Pharmaceutical Congress.

The Congress agenda is developed by experts in the field of pharmaceuticals and legal regulation of the industry specifically for top managers of pharmaceutical companies. This is an opportunity to learn about innovations and recent changes in pharmaceuticals and receive practical information for making strategic decisions necessary for the successful operation of pharmaceutical companies in Ukraine.

Get a fresh perspective on:

-MEDICAL REFORM: current state and influence on the pharmaceutical industry in 2020-2021

-PROCUREMENT AND REIMBURSEMENT: what road signs point on – innovations and consequences

-COMPETITION ON THE PHARMACEUTICAL MARKET: the great battle or moderate struggle?

-INDUSTRY INSIGHTS and EXCLUSIVE CASES: challenges and predictions

The Congress is attended by leading experts in the field of pharmaceuticals and legal support, professionals in the field of medicine and healthcare, representatives of state bodies, top managers of leading national and international pharmaceutical companies, representatives of healthcare facilities, professional associations, state authorities in the healthcare sector and parliamentarians.

In particular, representatives of the Verkhovna Rada Committee on National Health, Medical Assistance and Medical Insurance, the Ministry of Health of Ukraine, the State Health Service of Ukraine, Electronic Health state-owned enterprise, State Medical Procurement of Ukraine state-owned enterprise, multidisciplinary hospitals and pharmaceutical companies have been invited to discuss the latest changes and prospects for the industry.

PROGRAM & REGISTRATION

https://www.legalalliance.com.ua/eng/events/ukrainian-pharmaceutical-congress-2020/

Join the important event for key pharmaceutical managers on March 19th and make a successful investment in improving the efficiency of your business!

Organizers:

Legal Alliance Company

ABSC Consulting Company

General Information Partner:

Interfax-Ukraine

Location: Ramada Encore Kiev, Stolychne Hwy 103

Congress working languages: Ukrainian, Russian. Simultaneous interpretation into English

Organizational partner: Pravotoday LLC Info Agency

Event-partner: GB17 – Garden of Brands

Participant registration and mass media accreditation: news@l-a.com.ua

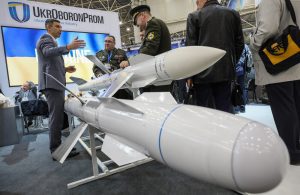

The enterprises of Ukroboronprom concern exported $908 million worth of arms and services abroad in 2019, which is 19% more than a year earlier, said Aivaras Abromavicius, the head of the Ukroboronprom state concern. “Last year, our companies exported arms and services worth $908 million. This is a 19% increase over the previous year,” the head of the concern said on the Real Politics program on Ukraine 24 TV channel on Sunday.

Abromavicius added that Ukraine is not one of the ten largest arms exporters, while U.S. and Russian exports are ten times greater than domestic, but assured that Ukroboronprom’s foreign supply will also increase in 2020.

“We see that in 2020 export growth is planned to reach 30%. And this is a very important figure, especially in anticipation of a slowdown in industrial production growth, which is taking place not only in our country, but throughout the world,” said the head of Ukroboronprom.

Ukrainian metallurgical enterprises in January 2020 reduced steel production by 0.4% compared to the same period in 2019, to 1.843 million tonnes, remaining at the 12th place in the ranking of 64 countries, the major global manufacturers of these products, compiled by the World Steel Association (Worldsteel).

In January, a decrease in steel production from January 2019 was recorded in a half of the countries of the top ten steel producing countries.

The top ten steel producing countries according to January results are as follows: China (84.269 million tonnes, an increase of 7.2%), India (9.288 million tonnes, a decrease of 3.2%), Japan (8.244 million tonnes, an increase of 1.3%), the United States (7.707 million tonnes, an increase of 2.5%), Russia (6 million tonnes, a fall of 4.1%), South Korea (5.753 million tonnes, a decline of 8%), Turkey (3.014 million tonnes, an increase of 17.3%), Iran (2,895 million tonnes, an increase of 46.9%), Germany (2.845 million tonnes, a drop of 17.7%) and Brazil (2.680 million tonnes, a decrease of 11.1%).

They are followed by Italy (1.874 million tonnes, a decline of 4.9%), Ukraine (1.843 million tonnes, a decline of 0.4%), Taiwan (China, 1.7 million tonnes, a decrease of 14.6%), Vietnam (1.53 million tonnes, a decrease of 12.4%) and Mexico (1.375 million tonnes, a decrease of 15.9%).

In January 2020, 64 countries produced 154.436 million tonnes of steel, which is 2.1% more than in January 2019.

The State Agency of Automobile Roads of Ukraine (Ukravtodor) and JSC Ukrzaliznytsia have agreed to coordinate the logistics of construction materials deliveries to facilities being built as part of the government’s Big Construction program, the Ukravtodor Telegram channel reported.

The parties agreed on an optimal model for the information exchange to ensure timely delivery of raw materials to the Big Construction facilities.

“Ukravtodor assumes a coordinating role for the proper planning of freight traffic along the Ukrzaliznytsia routes. Ambitious plans require well-coordinated work of public and private institutions, so with reasonable coordination, we will avoid delays and breakdowns in repairs,” Oleksandr Kubrakov, the head of Ukravtodor, said.

The information exchange on the volumes of raw materials needed to be transported and maintenance of the repair schedule will take place on the basis of Ukravtodor for the purpose of centralized planning of all work.

Remigiusz Paszkiewicz, a member of the board of Ukrzaliznytsia, in turn, said that using Ukrzaliznytsia railways are important for freight transportation, as it unloads roads and reduces transportation cost.