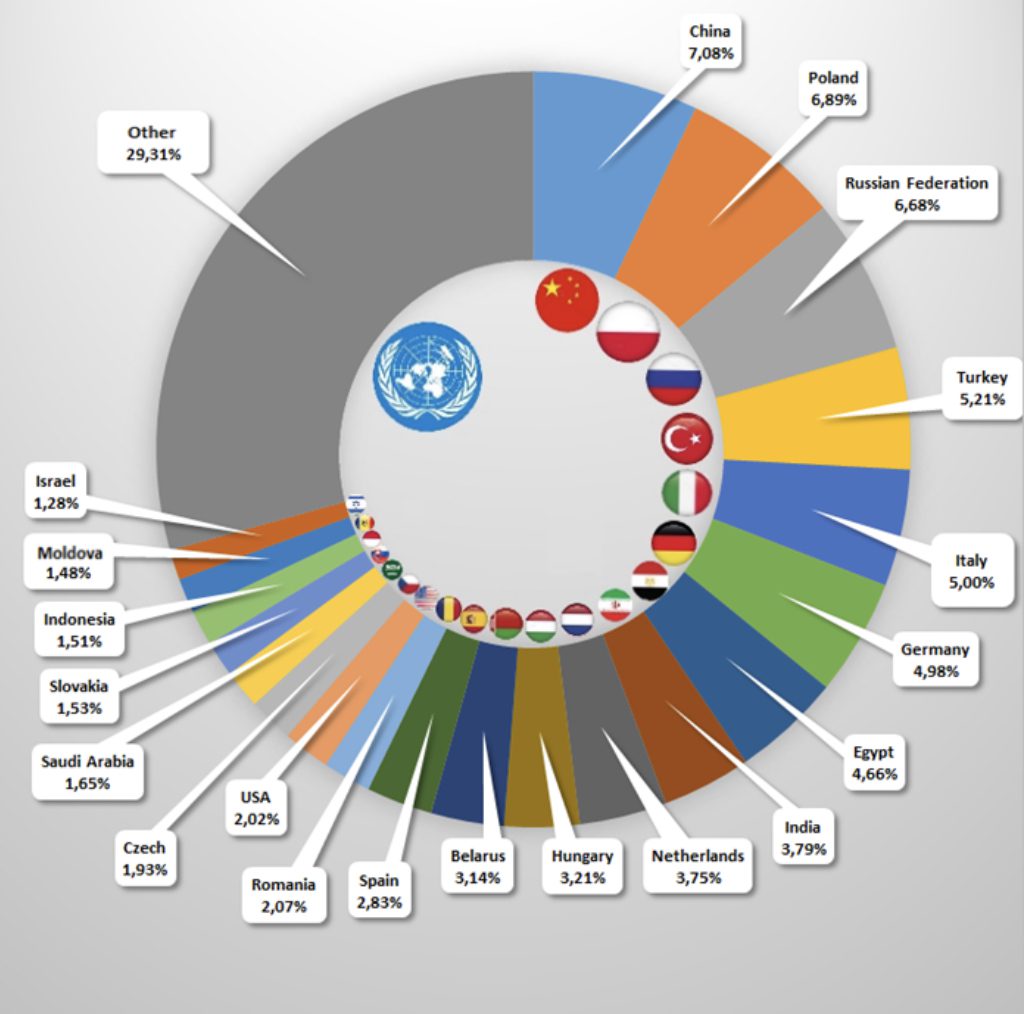

Main trade partners of Ukraine in % from total volume (import from other countries to Ukraine) in Jan-Oct 2019

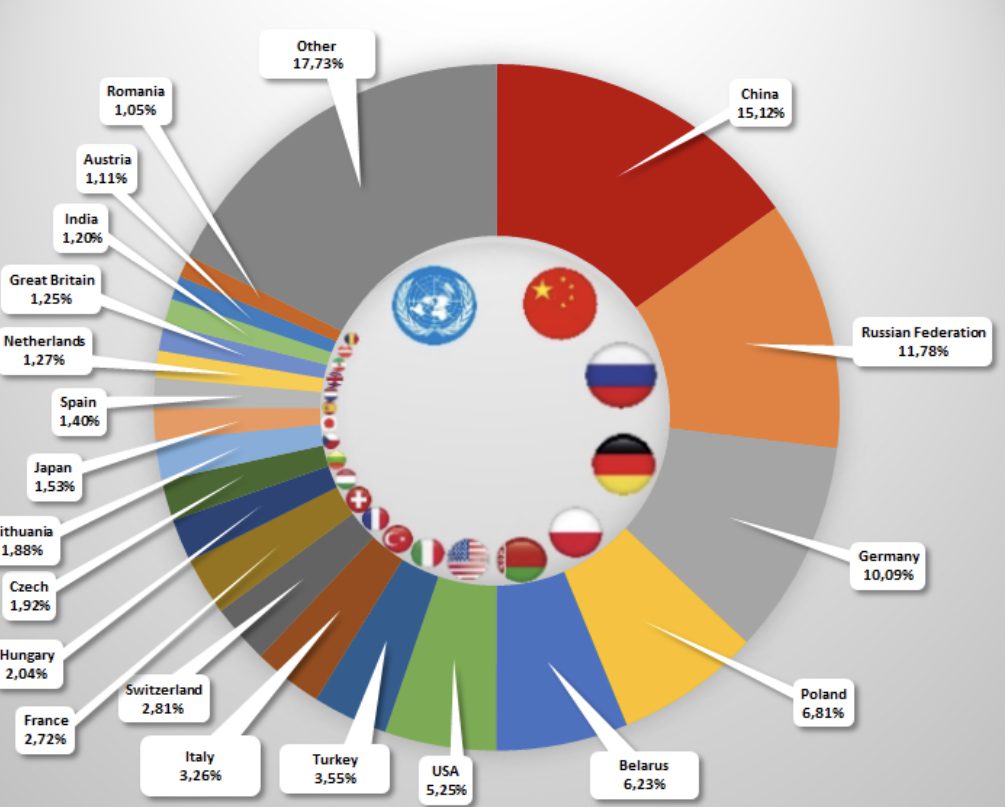

Main trade partners of Ukraine in % from total volume (export from Ukraine to other countries) in Jan-Oct 2019

Ukrainian President Volodymyr Zelensky has declared January 9 a day of mourning for the victims of the January 8 crash of a Ukraine International Airlines (UIA) passenger plane in Tehran, the Office of the Ukrainian President has said.

“In connection with the tragedy that occurred as a result of the catastrophe of JSC Ukraine International Airlines’ passenger plane in the Islamic Republic of Iran on January 8, 2020, leading to multiple human deaths, I order that January 9, 2020 be declared a day of mourning to commemorate the victims,” it said.

Under the presidential decree, state flags will be flown at half-staff on top of buildings housing government agencies, local authorities, state-owned enterprises, institutions, and organizations.

Entertainment events and concerts will also be cancelled and relevant changes will be made to TV and radio listings.

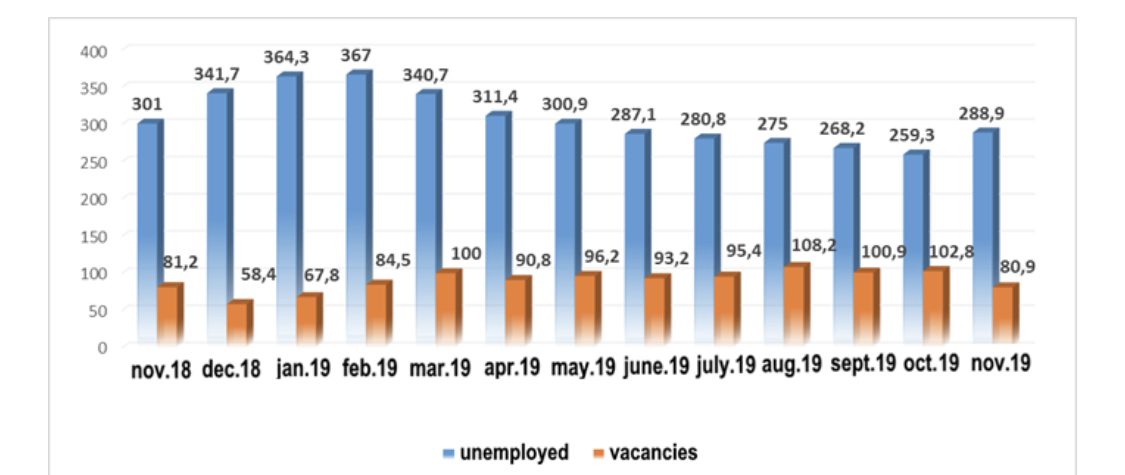

Number of unemployed and number of job opportunities in dynamic (graphic)

The crew of a Ukraine International Airlines (UIA) jetliner that crashed in Iran never reported an emergency on board, Associated Press said on Thursday with reference to an initial report released by Iran’s Civil Aviation Organization. According to the report, the crew also did not make a radio call for help and were trying to turn back for the airport when the plane went down.

In turn, Bloomberg reported that Ukrainian investigation team has arrived in Tehran on Thursday.

According to Bloomberg, the UIA aircraft disappeared from radar detection at 2,440 meters.

UIA’s Boeing 737-800 crashed shortly after take-off from Imam Khomeini International Airport in Tehran on January 8, 2020 in the morning.

Some 167 passengers and nine crew members were on board. All of them died.

The plane, which was carrying out the PS752 flight from Tehran to Kyiv, disappeared off the radars two minutes after takeoff.

State-owned Oschadbank (Kyiv) is selling a straw pellets plant with an annual capacity of 40,000 tonnes on the OpenMarket platform of state-owned enterprise (SOE) SETAM and 34 items of the plant’s equipment at the starting price of UAH 42.95 million.

The press service of SETAM reported on Wednesday that the auction will be held on January 16.

The bid deposit is UAH 2.15 million, and the bid increment is UAH 429,500.

The press service said that the lot was put up for sale by Oschadbank as voluntary sale.

The plant is located in Kirovohrad region.

Oschadbank was founded in 1991. Its sole owner is the state.

According to the National Bank of Ukraine, as of October 1, 2019, Oschadbank ranked second among 76 banks operating in the country in terms of total assets (UAH 274.609 billion).