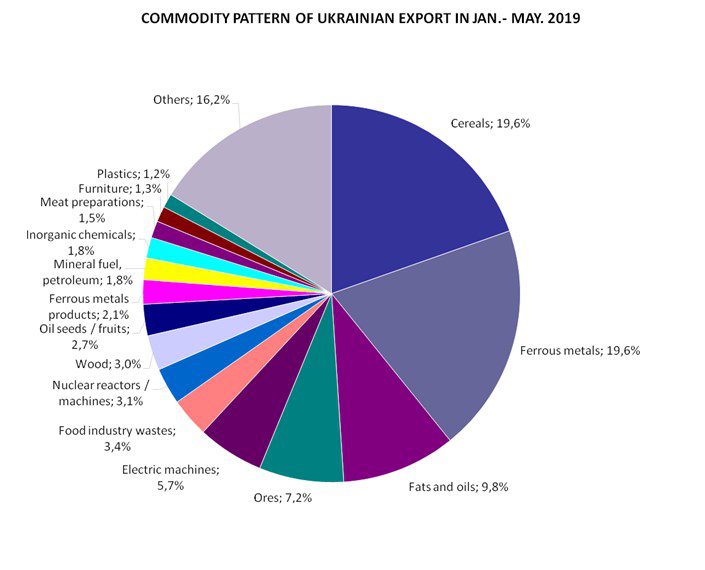

Commodity pattern of Ukrainian export in Jan-May, 2019

The Antimonopoly Committee of Ukraine (AMCU) has provided permission to Canadian Fairfax Financial Holdings Limited to acquire PJSC Universalna insurance company (Kyiv) via subsidiary of FFHL Group Ltd. FFH Ukraine LCC, which would grant over 25% of the votes in the management body of the insurance company. According to a regulator’s posting on its website, the committee also permited Fairfax Financial Holdings Limited to acquire shares in Universalna insurer via newly created FFH Ukraine Holdings LLC, which would grant 50% of the votes in the management body of the insurance company.

Besides, the AMCU permitted to acquire shares in the share capital of FFH Ukraine Holdings LLC by the European Bank for Reconstruction and Development (EBRD), which would grant 25% of the votes in the management body of the company.

In addition, the regulator granted a permit for agreed actions to Fairfax Financial Holdings Limited and Whiteford Limited (Cyprus) in the form of liabilities to refrain from competition and the ban to drain human resources away from the companies for the period of five years.

According to the National Commission on Securities and the Stock Market, Whiteford Limited is a holder of 42.3358% of shares of Universalna as of second quarter of 2019.

For Fairfax, the acquisition of Universalna insurance company will not be the first asset in Ukraine. Earlier in February 2019, the company already bought two of its Ukrainian subsidiaries, AXA Insurance and AXA Life Insurance, from the French AXA Group. Three years earlier, Fairfax acquired 100% of the insurance company QBE Ukraine (and changed its name to Colonnade Ukraine).

Universalna was founded in 1991. The company specializes in providing services in the field of risk insurance, its regional network has more than 300 offices.

According to the results of the first half of 2019, the company collected UAH 490.311 million in gross insurance premiums (17.4% compared to the previous year) and paid UAH 127.2 million (+11.4%) to customers.

The authorized capital of the company is UAH 192.7 million, with liquid assets of UAH 125.006 million (decreased by 32.73%). Deposits in the amount of UAH 293 million are on the company’s accounts.

Production units of Ukrprominvest-Agro vertically integrated agroindustrial company threshed over 155,000 of grain after completion of early crops harvesting on August 12.

According to a company’s press release, the average yield of wheat harvested on 14,500 hectares is 7.07 tonnes/ha, the average yield of barley harvested on 8,700 hectares is 5.94 tonnes/ha.

Ukrprominvest-Agro’s core business includes growing crops, sugar, flour, meat, and dairy farming. The company’s land bank is 122,000 hectares, the total number of cattle is 5,200 head, that of pigs is 21,000.

Ukrprominvest-Agro incorporates Agroprodinvest Group LLC, PrJSC Podillya, Zorya Podillya LLC, Bread Combine No. 2 LLC. The holding is owned by Ukrainian President Petro Poroshenko.

Ukraine’s ore mining enterprises increased exports of iron ore and raw materials (IORM) in physical terms by 8.5% in January-July 2019 year-on-year, to 23.311 million tonnes. Export of IORM for the mentioned period in monetary terms grew by 28.9%, up to $2.92 billion, according to a customs statistics report posted by State Fiscal Service of Ukraine.

The bulk of iron ore was exported to China (27.07% of total imports in monetary terms), Poland (13.69%), and Czech Republic (10.52%).

In January-July 2019, Ukraine imported 108 tonnes of IORM worth $56,000 from the Netherlands(51.79% in monetary terms), Great Britain (39.29%) and Czech Republic (3.57%).

Ukraine reduced coke and semi-coke exports by 61% year-over-year, to 6,891 tonnes in January-April 2019.

According to customs statistics, published by the State Fiscal Service of Ukraine, coke and semi-coke exports were down 65.2% in monetary terms, to $1.652 million.

The majority of deliveries were made to Belarus (22.4% in monetary terms), Romania (20.22%) and Moldova (17.68%).

Imports of coke and semi-coke rose by 12.9%, to 651,259 tonnes in January-July 2019, worth $200.694 million (15% up). The goods were mainly imported from Russia (84.36% in monetary terms), Poland (9.98%) and Egypt (3.74%).

As reported, Ukraine cut coke and semi-coke exports by 88.6% year-over-year to 25,578 tonnes in 2018. Imports of coke and semi-coke fell by 45.8%, to 839,757 tonnes in 2018, worth $251.724 million (44% down).

Some coalmines and coking plants in Ukraine are located in Russia-occupied areas of Donetsk and Luhansk regions in eastern Ukraine.

Turkish Airlines is going to shoot a promo video about Kyiv for their new advertising campaign in order to promote Kyiv and increase tourist flows to Ukrainian capital.

This follows from a report of the press service of Kyiv City State Administration referring its deputy head Maryna Khonda.

“Turkish Airlines is the only one company that has launched such a project in Ukraine: shooting of promo videos about cities, where it has regular flights. Today, the flow of tourists from Turkey has doubled, but we consider it insufficient and want to increase it further. Indeed, for example, 15 million people live in Istanbul, but the flow of tourists from Turkey amounted to only about 60,000 for half a year. Tourism is one of our priority sectors, and these videos will help us in promoting our city,” Khonda said during a meeting with General Manager of Turkish Airlines in Kyiv Dincer Sayici.

Filming will take place at the Zoloti Vorota (Golden Gate), Andriyivsky Uzviz, Besarabska Square, Saint Sophia Cathedral, National Opera, Feofaniya Park, Pyrohiv Museum of Folk Architecture and Life of Ukraine and other famous locations.

As reported, the Turkish air operator brought services to over 800,000 passengers on its flights to/from Ukraine that is 28% more than in 2017.

Turkish Airlines (Türk Hava Yolları, THY) was established in 1933 with a fleet of five aircraft. For today has an air fleet of 329 passenger and cargo aircraft.